Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The FOMC is comprised of Fed governors, who are appointed by the president, and regional Fed presidents, who are appointed by banks in their respective districts.

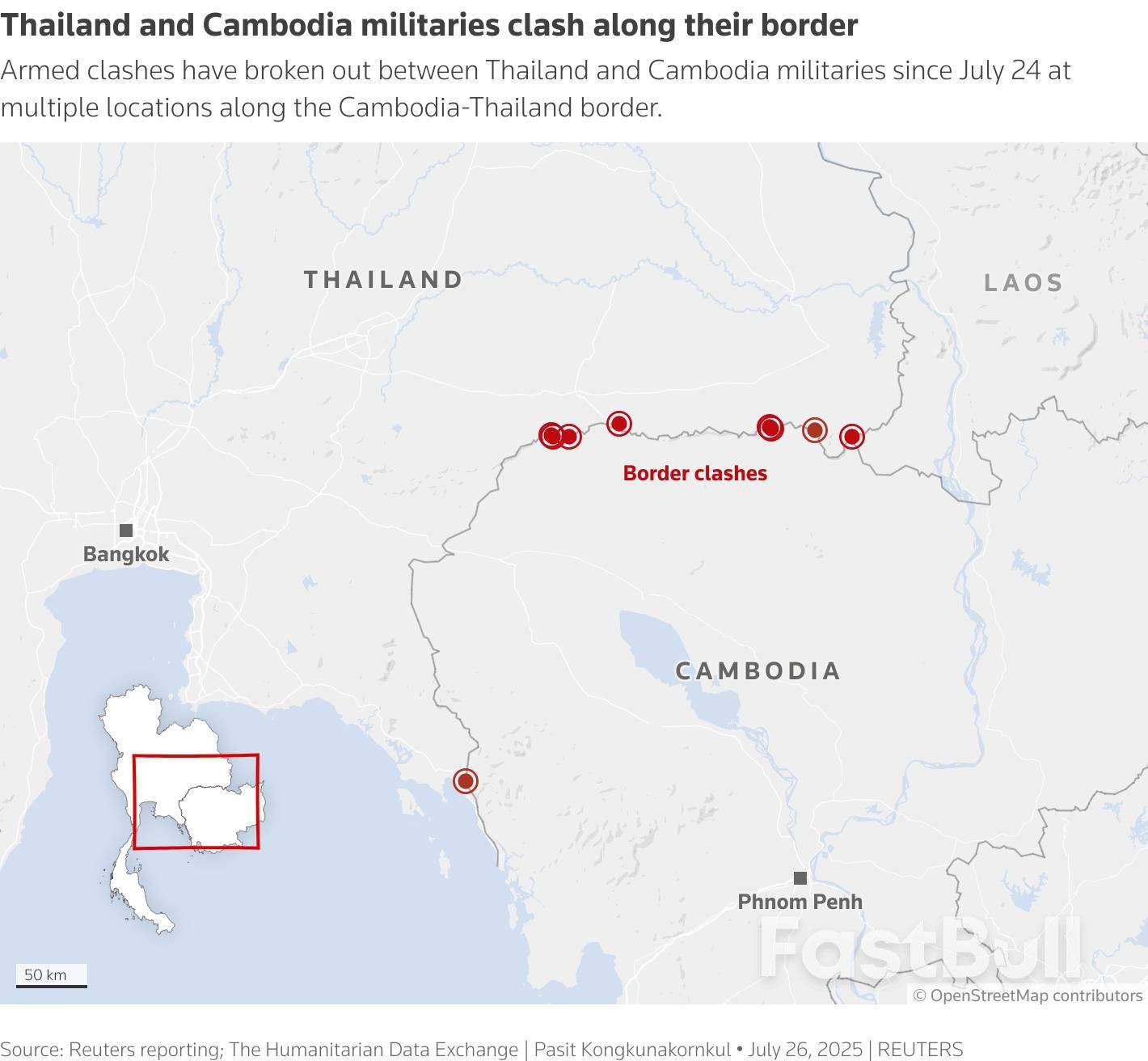

Cambodia and Thailand agreed to an "immediate and unconditional ceasefire" from midnight (1700 GMT) on Monday, to try to halt their deadliest conflict in more than a decade after five days of fighting that displaced more than 300,000 people.

Following efforts by Malaysia, chair of the ASEAN regional bloc, the United States and China to bring both sides to the table, the two countries' leaders agreed to end hostilities, resume direct communications and create a mechanism to implement the ceasefire.

"This is a vital first step towards de-escalation and the restoration of peace and security," Malaysian Prime Minister Anwar Ibrahim told a news conference, flanked by the Thai and Cambodian leaders, following more than two hours of negotiations at his residence in Putrajaya.

The truce talks followed a sustained effort by Anwar and U.S. President Donald Trump's phone calls to both leaders at the weekend, where he said he would not conclude trade deals with them if fighting continued. Both sides face a tariff of 36% on their goods in the U.S., their biggest export market.

Trump in a post on Truth Social on Monday congratulated all parties and said he spoken to the leaders of Thailand and Cambodia and instructed his trade team to restart negotiations.

"By ending this War, we have saved thousands of lives ... I have now ended many Wars in just six months — I am proud to be the President of PEACE!," Trump said.

The Southeast Asian neighbours have wrangled for decades over border territory and have been on a conflict footing since the killing of a Cambodian soldier in a skirmish late in May, which led to a troop buildup on both sides. A full-blown diplomatic crisis ensued that brought Thailand's fragile coalition government to the brink of collapse.

They accuse each other of starting the fighting last week that escalated quickly from small arms fire to the use of heavy artillery and rockets at multiple points along their 800-km (500-mile) land border. Thailand unexpectedly sent an F-16 fighter jet to carry out airstrikes hours after the conflict erupted.

At least 38 people have been killed in the fighting, mostly civilians.

Thai acting Prime Minister Phumtham Wechayacha praised Trump for pushing the peace effort and said trade negotiations would start from a good place.

"I thanked him from my heart for what we received from him and helped our country move beyond this crisis," he told reporters on his return from Malaysia after speaking to Trump.

"After today the situation should de-escalate."

Item 1 of 6 Malaysia's Prime Minister Anwar Ibrahim looks on as Cambodia's Prime Minister Hun Manet and Thailand's acting Prime Minister Phumtham Wechayachai take part in mediation talks on the Thailand–Cambodia border conflict, in Putrajaya, Malaysia July 28, 2025. Mohd Rasfan/Pool via REUTERS

[1/6]Malaysia's Prime Minister Anwar Ibrahim looks on as Cambodia's Prime Minister Hun Manet and Thailand's acting Prime Minister Phumtham Wechayachai take part in mediation talks on the Thailand–Cambodia border conflict, in Putrajaya, Malaysia July 28, 2025. Mohd Rasfan/Pool via REUTERS Purchase Licensing Rights, opens new tab

The simmering tensions boiled over last week after Thailand recalled its ambassador to Phnom Penh and expelled Cambodia's envoy, in response to a second Thai soldier losing a limb to a landmine that Bangkok alleged Cambodian troops had laid.

Cambodia has strongly denied the charge, as well as Thai accusations that it has fired at civilian targets including schools and hospitals. It had accused Thailand of "unprovoked and premeditated military aggression".

Cambodian Prime Minister Hun Manet said his Thai counterpart had played a positive role and he deeply appreciated Trump's "decisive mediation" and China's constructive participation.

"We agreed that the fighting will stop immediately," he said, adding both sides could rebuild trust and confidence.

U.S. Secretary of State Marco Rubio in a statement said he and Trump expected all sides to "fully honour their commitments to end this conflict".

This map shows the locations where military clashes have occurred along the disputed border between Thailand and Cambodia.

The fighting has scarred border communities on both sides.

In Thailand's Sisaket province, a house was reduced to splintered wood and twisted beams after it was struck by artillery fire from Cambodia. The roof had caved in, windows hung by the frame and power lines drooped over the structure.

Amid the din of occasional artillery fire, homes and shops remained shut and a four-lane road was deserted except for a few cars and military vehicles.

Dozens of displaced residents lined up quietly for their evening meal at an evacuation centre about 40 km away from the frontlines. A few children played with dogs, others swept the dusty floor.

Fifty-four-year-old Nong Ngarmsri just wanted to go back to her village.

"I want to go to my children who stayed back," she said. "I want them to cease firing so that I can go home."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up