Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

JPMorgan allows Bitcoin purchases but excludes custody, affecting market sentiment. Client demand drives JPMorgan's partial entry into Bitcoin. Institutional interest may boost Bitcoin and related assets.

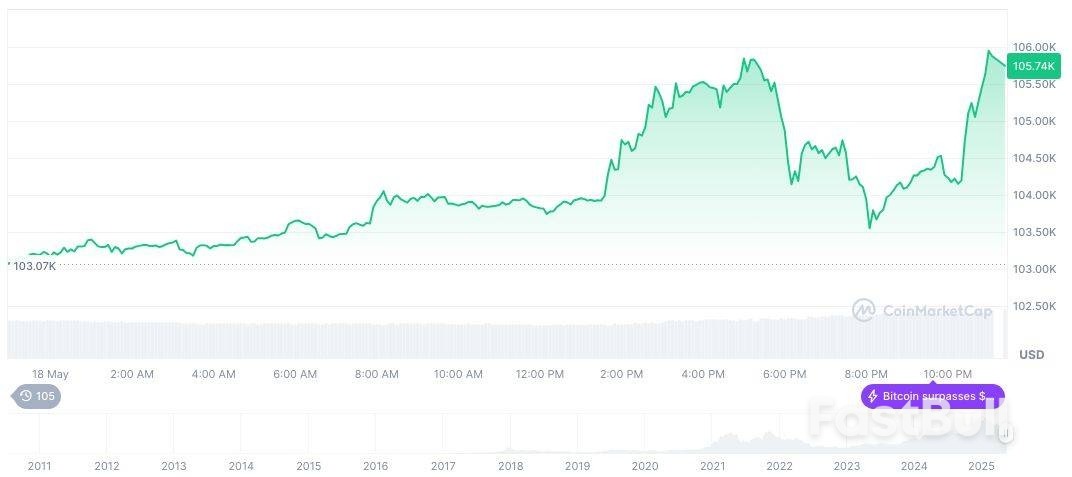

Bitcoin(BTC), daily chart, screenshot at 15:50 UTC on May 19, 2025.

Bitcoin(BTC), daily chart, screenshot at 15:50 UTC on May 19, 2025.

Moody's decision to downgrade the U.S. credit rating may have consequences for your money, experts say.

The debt downgrade put immediate pressure on bond prices, sending yields higher on Monday morning. The 30-year U.S. bond yield traded above 5% and the 10-year yield topped 4.5%, hitting key levels at a time when the economy is already showing signs of strain from President Donald Trump's unfolding tariff policy.

Treasury bonds influence rates for a wide range of consumer loans like 30-year fixed mortgages, and to some extent also affect products including auto loans and credit cards.

"It's really hard to avoid the impact on consumers," said Brian Rehling, head of global fixed income strategy at Wells Fargo Investment Institute.

The major credit rating agency cut the United States' sovereign credit rating on Friday by one notch to Aa1 from Aaa, the highest possible.

In doing so, it cited the increasing burden of the federal government's budget deficit. Republicans' attempts to make President Donald Trump's 2017 tax cuts permanent as part of the reconciliation package threaten to increase the federal debt by trillions of dollars.

More from FA Playbook:

Here's a look at other stories impacting the financial advisor business.

"When our credit rating goes down, the expectation is that the cost of borrowing will increase," said Ivory Johnson, a certified financial planner and founder of Delancey Wealth Management in Washington, D.C.

That's because when "a country represents a bigger credit risk, the creditors will demand to be compensated with higher interest rates," said Johnson, a member of CNBC's Financial Advisor council.

Americans struggling to keep up with sky-high interest charges aren't likely to get much relief any time soon amid Moody's downgrade.

"Economic uncertainty, especially regarding tariff policy, has the Fed — and a lot of businesses — on hold," said Ted Rossman, a senior industry analyst at Bankrate.

Atlanta Fed President Raphael Bostic said on CNBC's "Squawk Box" Monday that he now sees only one rate cut this year as the central bank tries to balance inflationary pressures with worries of a potential recession. Federal Reserve Chair Jerome Powell also recently noted that tariffs may slow growth and boost inflation, making it harder to lower the central bank's benchmark as previously expected.

Douglas Boneparth, another CFP and the president of Bone Fide Wealth in New York, agreed that the downgrade could translate to higher interest rates on consumer loans.

"Downgrades can raise borrowing costs over time," said Boneparth, who is also on CNBC's FA council.

"Think higher rates on mortgages, credit cards, and personal loans, especially if confidence in U.S. credit weakens further," he said.

Some loans could see more direct impacts because their rates are tied to bond prices.

Since mortgage rates are largely tied to Treasury yields and the economy, "30-year mortgages are going to be most closely correlated, and longer-term rates are already moving higher," Rehling said.

The average rate for a 30-year, fixed-rate mortgage was 6.92% as of May 16, while the 15-year, fixed-rate is 6.26%, according to Mortgage News Daily.

Although credit cards and auto loan rates more directly track the federal funds rate, the nation's financial challenges also play a key role in the Federal Reserve's stance on interest rates. "The fed funds rate is higher than it would be if the U.S. was in a better fiscal situation," Rehling said.

Since December 2024, the overnight lending rate has been in a range between 4.25%-4.5%. As a result, the average credit card rate is currently 20.12%, down only slightly from a record 20.79% set last summer, according to Ted Rossman, a senior industry analyst at Bankrate.

Credit card rates tend to mirror Fed actions, so "higher for longer" would keep the average credit card rate around 20% through the rest of the year, Rossman said.

Before its downgrade, Moody's was the last of the major credit rating agencies to have the U.S. at the highest possible rating.

Standard & Poor's downgraded the nation's credit rating in August 2011, and Fitch Ratings cut it in August 2023. "We've been through this before," Rehling said.

Still, the move highlights the country's fiscal challenges, Rehling said: "The U.S. still maintains its dominance as the safe haven economy of the world, but it puts some chinks in the armor."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up