Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Latest news on the Israeli-Palestinian conflict

Remarks of Officials

Middle East Situation

Palestinian-Israeli conflict

Trump's Gaza peace plan hits snag as Israel rejects its new governance board, deepening diplomatic friction.

The Trump administration's plan for post-war Gaza has hit a significant snag, with Israel formally objecting to the composition of a newly announced "Board of Peace" intended to oversee the territory's transitional government. The move signals a major diplomatic rift over the second phase of a US-brokered peace initiative.

On Friday, US President Donald Trump revealed the members of a high-profile body designed to manage the war-torn Palestinian territory following a ceasefire agreement that began in October.

The plan establishes a two-part governance framework. The top body is the seven-member "founding executive board," chaired by President Trump himself. Its members include:

• US Secretary of State Marco Rubio

• Trump's special envoy Steve Witkoff

• Former British Prime Minister Tony Blair

• Trump's son-in-law Jared Kushner

• World Bank President Ajay Banga

Subordinate to this is a "Gaza executive board," which a White House statement said "will help support effective governance and the delivery of best-in-class services."

This second board includes Witkoff, Kushner, and Blair, alongside Turkish Foreign Minister Hakan Fidan and Qatari diplomat Ali Al-Thawadi. The inclusion of officials from Turkey and Qatar is notable, as both nations have been critical of Israel's military operations in Gaza since the attacks of October 7, 2023.

Israel’s response was swift and negative. Prime Minister Benjamin Netanyahu's office declared that the board's composition "was not coordinated with Israel and runs contrary to its policy."

The statement confirmed that Netanyahu has directed Foreign Minister Gideon Saar to communicate Israel's reservations directly to US Secretary of State Marco Rubio. However, the official communication did not specify the exact nature of the prime minister's objections.

The Palestinian militant group Islamic Jihad also criticized the board's makeup. The group, considered a terrorist organization by the US and other countries, argued the body was formed "in accordance with Israeli criteria and to serve the interests of the occupation," signaling what it called "preexisting bad intentions."

This new board is a central element of the second phase of the US peace plan. The first phase was a ceasefire that took effect on October 10. Since then, the agreement has been fragile, with both sides accusing each other of violations.

Key points of contention remain. Israel has continued to restrict aid into the Gaza Strip while conducting attacks. Meanwhile, Hamas—designated a terrorist organization by the US, EU, Germany, and some Arab states—has refused to meet Israel's non-negotiable demand to disarm.

Political

Latest news on the Israeli-Palestinian conflict

Remarks of Officials

Palestinian-Israeli conflict

Middle East Situation

The Muslim World League (MWL) has officially backed the launch of the second phase of a comprehensive peace plan for Gaza, signaling its support for a new framework that includes establishing a Peace Council and a National Committee for the Administration of Gaza.

In a statement released on Saturday, the organization praised the international efforts aimed at ending the war and fostering long-term stability in the Palestinian territories.

The MWL specifically commended the commitments made by US President Donald Trump, citing his pledge to ensure the withdrawal of Israeli forces from Gaza and prevent the annexation of any part of the occupied West Bank.

MWL Secretary-General Mohammed Al-Issa urged all parties to fully comply with the plan's requirements, calling for a "serious and firm response" to any violations. Al-Issa also highlighted two critical conditions for success:

• Humanitarian Access: Ensuring sufficient and unimpeded humanitarian aid reaches Gaza.

• PA's Return: Supporting the Palestinian National Authority's return to its administrative responsibilities in the territory.

He stated these efforts are vital for ending the cycles of conflict and establishing a just and comprehensive peace consistent with international resolutions and the New York Declaration for a two-state solution.

This second phase of the peace initiative builds on a prior ceasefire and introduces a new governance structure. A US-led board is set to oversee Gaza's post-war administration.

Several key figures have been appointed to steer the process. Former British Prime Minister Tony Blair was given a key role, while a US officer has been tapped to lead a developing security force.

The announcement came after a meeting in Cairo attended by Jared Kushner, President Trump's senior Middle East adviser, and a Palestinian committee of technocrats assigned to govern Gaza. A central goal of the plan is to drive economic development in the region, which has sustained extensive damage during more than two years of Israeli bombardment.

Cuba's long-simmering energy crisis is escalating as a U.S. intervention in Venezuela severs a critical fuel lifeline. With its primary oil supplier now cut off, Havana faces immense pressure to find a solution. While oil-rich neighbors like Mexico are providing short-term relief, Cuba must secure a long-term energy strategy to achieve stability and end years of economic strain.

For months, Cubans have endured near-daily blackouts and gas shortages. The crisis stems from chronic underinvestment in the nation's electrical transmission network, causing power plants to operate well below capacity and leaving supply unable to meet demand.

The situation has forced residents to purchase charcoal stoves, rechargeable batteries, and fans—items many can barely afford. The grid's fragility was laid bare in March of last year when a nationwide collapse left most of the island's 10 million people without electricity. While major tourist hotels switched to generators, much of the population was left in the dark, fueling mass protests demanding government action.

Venezuela has been one of Cuba's most important energy partners. Despite its own declining output, Venezuela’s state-run PDVSA shipped an average of 26,500 barrels per day (bpd) to Cuba last year, covering approximately 50% of the island's oil deficit. In 2025, trade with Venezuela accounted for about 10% of Cuba's total.

However, reports indicate that no oil tankers have departed from Venezuelan ports for Cuba since a U.S. intervention there earlier this month. The U.S. attack also resulted in the deaths of thirty-two members of Cuba's armed forces and intelligence services.

Following the intervention, President Donald Trump issued a stark warning, urging Cuba to negotiate with Washington to secure future oil supplies from Venezuela.

"THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA – ZERO!" Trump posted on his Truth Social platform. "I strongly suggest they make a deal, BEFORE IT IS TOO LATE."

He later added that Cuba had long received oil and money from Venezuela in exchange for providing "Security Services" to its leaders. "But not anymore!" he wrote, stating that Venezuela is now protected by the United States military.

Cuban President Miguel Diaz-Canel countered on X, formerly Twitter: "Cuba is a free, independent and sovereign nation. No one tells us what to do." He noted that Cuba has been attacked by the U.S. for 66 years and is prepared to defend itself. Cuban Foreign Minister Bruno Rodriguez affirmed the country's right to import fuel from any willing supplier.

With Venezuelan oil halted, Mexico has emerged as Cuba's leading supplier. According to a Financial Times report, Mexico surpassed Venezuela in 2025. Mexican President Claudia Sheinbaum stated that her country is not shipping significantly more oil to Cuba than in the past but acknowledged its new role. "Of course, with the current situation in Venezuela, Mexico has obviously become an important supplier," she said. "Before, it was Venezuela."

In 2025, Mexico sent an estimated daily average of 12,284 bpd of crude to Cuba, making up 44% of the island's crude imports. Venezuela's exports for the same period were estimated at 9,528 bpd, or 34% of Cuba's imports.

Mexico's support for Cuba has not gone unnoticed by the Trump administration. With a review of the North American USMCA free trade agreement approaching, pressure is mounting on President Sheinbaum to cut back shipments.

Florida Republican Congressman Carlos Giménez issued a direct threat. "Make no mistake: if the Sheinbaum government continues to give away free oil to the terrorist dictatorship in Havana, there will be serious consequences as we renegotiate the USMCA."

As tensions rise, both Cuba and Mexico find themselves in a difficult position. President Trump is pushing Havana toward a deal to restore its energy supply, while Mexico faces economic repercussions for providing a crucial lifeline to its Caribbean neighbor.

Top officials from the Trump administration are promoting their strategy to lower vehicle costs by rolling back emissions regulations, arguing that affordability is a primary concern for American buyers.

Transportation Secretary Sean Duffy, EPA Administrator Lee Zeldin, and U.S. Trade Representative Jamieson Greer made the case during a tour of the Detroit Auto Show. Their visit was the final stop on a two-day trip through the Midwest that also included visits to a Ford truck factory and a Stellantis Jeep plant in Ohio.

The administration has been systematically reversing electric vehicle policies established under former President Joe Biden.

"These rules will bring car prices down and allow car companies to offer products that Americans want to buy," Duffy stated. "This is not a war on EVs at all... We shouldn't use government policy to encourage EV purchases all the while penalizing combustion engines."

The policy push comes as President Donald Trump confronts economic challenges one year into his term and with midterm elections approaching in November. A key campaign promise was to quickly address rising prices for consumers.

Recent data highlights the affordability challenge. According to research firm Cox Automotive, the average transaction price for a new car reached a record $50,326 in December, driven by strong sales of more expensive trucks and SUVs and a decline in available entry-level models.

Last year, President Trump signed legislation that made several key changes to auto industry regulations:

• It eliminated the $7,500 federal tax credit for electric vehicles.

• It rescinded California's authority to set its own EV rules.

• It canceled penalties for automakers that fail to meet fuel efficiency requirements.

Zeldin argued that the government "should not be forcing, requiring, mandating that the market go in a direction other than what the American consumer is demanding."

Despite these policy shifts and steep tariffs imposed by Trump on imported vehicles and parts, new U.S. vehicle sales increased by 2.4% in 2025, reaching 16.2 million units.

Democrats and environmental advocates argue that the administration's policies, including auto tariffs and the removal of EV incentives, will ultimately hurt consumers.

"The oil industry will rake in billions more from cash-strapped Americans who can't afford to spend more to fuel up their car or truck," said Kathy Harris, director of clean vehicles at the environmental group NRDC.

However, Greer countered that car prices are already trending downward and claimed that tariffs are not being passed on to buyers. "Whatever effects those tariffs may have on various parts of the supply chain, they're not really getting down to the consumer," he said.

The administration's own data illustrates the central trade-off of its policy. In December, the U.S. Department of Transportation (USDOT) proposed reversing Biden-era fuel efficiency standards that had pushed automakers toward EVs.

The USDOT estimates its proposal would reduce the average upfront cost of a new vehicle by $930. However, the department also projects that the change would increase national fuel consumption by as much as 100 billion gallons through 2050, potentially costing Americans an additional $185 billion at the pump over that period.

The EPA is also expected to finalize a rule in the coming weeks that will eliminate vehicle tailpipe emissions requirements.

China and Russia are cementing their control over the global nuclear power market, initiating 90% of all new atomic plant construction last year. Through state-led development, Beijing and Moscow are not only building out their domestic power grids but also expanding their international influence by exporting nuclear technology to emerging nations.

Analysis of data from the World Nuclear Association and the International Atomic Energy Agency reveals a stark trend. Of the nine large-scale nuclear power plants that broke ground in the last year, seven are in China, one is in Russia, and just one is in South Korea.

Over the past decade, China and Russia have systematically cornered the nuclear construction industry. Since 2016, more than 90% of the 63 nuclear power plants started worldwide were of Chinese or Russian design. The only exceptions were five projects in South Korea and the United Kingdom.

This two-nation dominance signals a major shift in the global energy and geopolitical landscape, with long-term implications for technology standards and international alliances.

China is aggressively scaling its domestic nuclear capacity, with 27 reactors currently under construction, according to its Ministry of Ecology and Environment. A government-affiliated industry group projects that China's nuclear generation capacity will hit 110 gigawatts by 2030, a move that would see it overtake the United States as the world's top nuclear power producer.

The Chinese government is accelerating this expansion, having approved plans for 10 new reactors across five locations in April of last year. Nuclear power is forecast to supply 10% of the nation's energy mix by 2040, a significant jump from just under 5% in 2024.

With approximately 60 operational reactors and a generating capacity of around 64 gigawatts, China's nuclear fleet is already on par with that of France, the world's second-largest producer. The country's technological self-sufficiency is also growing, with many new reactors being the Hualong One type—a design China claims as its own. Six are already online in China, with two more operating in Pakistan.

Innovating with Small Modular Reactors

Beyond large-scale plants, China is developing small modular reactors (SMRs), which require less initial investment. State-owned China National Nuclear Corporation successfully conducted a cooling test in October for its Linglong One SMR in Hainan province. This 125-megawatt reactor is scheduled to become operational this year.

While building at home, Russia is primarily focused on exporting its nuclear technology to emerging economies. Over the last ten years, state-owned nuclear giant Rosatom has begun constructing 19 Russian-designed plants overseas in countries like Turkey, Bangladesh, and Egypt.

These projects are highly strategic, locking in relationships that can last for nearly a century—spanning design, construction, fuel supply, maintenance, and eventual decommissioning.

However, Moscow's ambitions face headwinds. Economic sanctions imposed following the invasion of Ukraine have caused delays and financial difficulties for projects abroad. A high-profile plant in Turkey, for example, has missed its original 2023 start date due to funding issues.

Like China, Russia is also pursuing SMR technology. President Vladimir Putin stated at a conference in November that small reactors would "move into mass production," emphasizing Russia's independent technological capabilities.

The United States has been largely dormant in the sector, having built no new commercial nuclear plants since 2013. The Trump administration, however, has signaled a renewed push. In May, President Donald Trump signed an executive order aiming to begin construction on 10 large reactors by 2030, with manufacturers like Westinghouse Electric under consideration.

"Thanks to President Trump, America's nuclear renaissance is here," Energy Secretary Chris Wright posted on social media this month.

AI Boom Fuels Demand for Nuclear Energy

A key driver for this renewed US interest is the recent surge in electricity demand, largely fueled by the artificial intelligence boom. Data centers require a constant, 24/7 power supply that cannot be met by intermittent renewable sources alone.

The US is also heavily invested in SMR development. In early December, the Trump administration announced $400 million in funding for the Tennessee Valley Authority (TVA) and other organizations to advance this technology.

TVA, a government-affiliated utility, plans to adopt an SMR developed by a joint venture between GE Vernova and Hitachi, targeting operation as early as 2032. The utility is also exploring a partnership with US-based NuScale Power to potentially deploy around 70 SMR units with a total capacity of 6 gigawatts. NuScale, which has received investment from Japanese firms like IHI, may use Japanese-made parts in its reactors.

The global energy landscape is pointing toward a "second nuclear renaissance." The first wave in the 2000s and 2010s, driven by decarbonization goals, was largely halted by the 2011 Fukushima Daiichi nuclear accident, which eroded public confidence in nuclear safety.

Today, the combination of geopolitical competition and the massive energy demands of artificial intelligence is once again making a compelling case for nuclear power, setting the stage for a new era of atomic energy development.

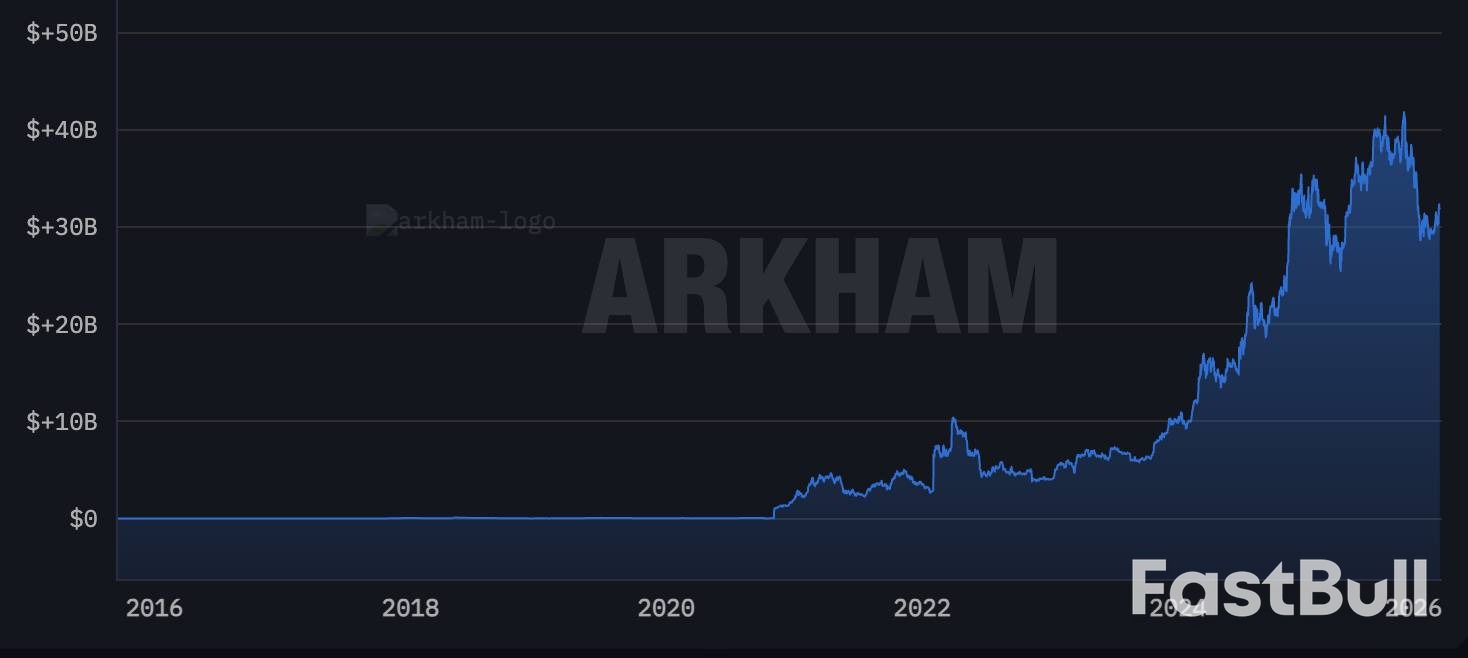

The United States is facing "obscure" legal hurdles in its plan to establish a strategic Bitcoin reserve, according to Patrick Witt, director of the White House Crypto Council. The initiative, designed to create a national stockpile of digital assets, is currently navigating a complex regulatory landscape.

Speaking on the Crypto in America podcast, Witt confirmed that multiple government agencies, including the Department of Justice (DOJ) and the Office of Legal Counsel (OLC), are actively discussing the legal framework for the reserve.

"It seems straightforward, but then you get into some obscure legal provisions, and why this agency can't do it, but actually, this other agency could," Witt explained. "We're continuing to push on that. It is certainly still on the priority list right now."

The push for a national crypto reserve gained momentum in March 2025 when President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve and a broader "Digital Asset Stockpile" that includes various altcoins.

While the move was seen as a landmark moment, its practical limitations quickly drew criticism. The order stipulated that the U.S. government would not sell its existing Bitcoin holdings. Crucially, it only allows the reserve to grow through BTC seized in asset forfeiture cases, prohibiting the government from purchasing Bitcoin or other digital assets on the open market.

The restrictions outlined in the executive order led many in the Bitcoin community to feel that the Trump administration had underdelivered on its promises. The inability to actively acquire BTC was seen as a major flaw.

Bitcoin maximalist Justin Bechler dismissed the effort, stating, "The belief that the federal government will one day build a Strategic Bitcoin Reserve requires a complete detachment from reality."

He added, "There is no movement toward a Bitcoin reserve. There is no intention to acquire a fixed-supply asset in good faith. There are only empty speeches, vague references and opportunistic pandering from Washington politicians."

Further backlash followed in July 2025 when the Trump administration released a long-awaited report on digital asset policy that failed to provide any new details about the strategic BTC reserve.

Despite the setbacks and criticism, discussions about growing the reserve continue. In August 2025, U.S. Treasury Secretary Scott Bessent renewed hope by suggesting the government could acquire BTC through "budget-neutral strategies" that would not increase the annual budget deficit.

This proposal opened the door to the possibility of the U.S. government actively buying Bitcoin on the open market. Potential strategies include converting portions of other reserve assets into BTC or using gains from revaluing the nation's precious metals holdings to fund Bitcoin acquisitions.

Former U.S. President Donald Trump has threatened to impose escalating tariffs on several key European allies unless Denmark agrees to sell Greenland to the United States. The ultimatum sharply intensifies a dispute over the Arctic territory and has already sparked protests in both Denmark and Greenland, with demonstrators demanding the island retain its right to self-determination.

In a post on Truth Social, Trump detailed his plan to levy an additional 10% import tariff starting February 1 on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Great Britain. These nations are already subject to tariffs previously imposed by his administration.

He added that the new tariffs would increase to 25% on June 1 and would not be lifted until the U.S. is able to purchase Greenland.

Trump has consistently framed the acquisition of Greenland as a matter of U.S. national security, pointing to its strategic Arctic location and significant mineral resources. He has not ruled out using force to achieve this goal.

Tensions have been rising, underscored by the recent deployment of European military personnel to the island at Denmark's request.

"These Countries, who are playing this very dangerous game, have put a level of risk in play that is not tenable or sustainable," Trump wrote. He stated that the U.S. was "immediately open to negotiation," citing America's decades-long role in providing security for Europe.

Analysts at Bernstein offered another perspective in a recent note. "Greenland was probably never really about just buying land or oil," they wrote. "We think it is about control of the Western Hemisphere."

In separate statements, Trump addressed reports concerning JPMorgan CEO Jamie Dimon. He forcefully denied a Wall Street Journal story claiming he had offered Dimon the position of Federal Reserve chair.

Trump also announced his intention to sue JPMorgan within the next two weeks. He accused the bank of "debanking" him after the January 6, 2021, attack on the U.S. Capitol.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up