Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. Treasury yields are set to decline further according to bond strategists who are clinging to expectations the Federal Reserve resumes cutting interest rates after pausing for more than half a year even as dealers are set to underwrite a deluge of new supply.

U.S. Treasury yields are set to decline further according to bond strategists who are clinging to expectations the Federal Reserve resumes cutting interest rates after pausing for more than half a year even as dealers are set to underwrite a deluge of new supply.

A slight majority now expect another sell-off in longer-dated bonds, the maturities most at risk, by the end of this month.

Concerns that President Donald Trump’s tax-cut and spending bill will add trillions of dollars to an already-staggering $36.2 trillion debt pile by 2034, along with tariff brinkmanship already have many holders of U.S. assets scrambling for the exit.

The rising "term premium" – what investors demand as compensation for holding longer-dated debt – leaves the market more vulnerable, particularly among foreign investors, ahead of upcoming Treasury bond auctions.

"The amount of debt we need to issue keeps rising and there doesn't appear to be anyone in Washington on either side that really has a plan to bring down deficits and address our fiscal situation," said Collin Martin, fixed income strategist, Schwab Center for Financial Research.

"That'll weigh on the long end of the curve where we need to see yields rise a bit to attract that marginal buyer."

Global sovereign bond yields have mostly risen in tandem over the past two months. A rapid sell-off in benchmark U.S. 10-year Treasuries in April pushed the yield up around 60 basis points.

That yield, which rises when prices fall, has since steadied, oscillating around 4.50%.

Median forecasts from nearly 50 bond strategists in a June 6-11 Reuters survey, most from dealers and sell-side firms, predicted the 10-year yield would decline a modest 13 bps to 4.35% in three months and to 4.29% in six from its current 4.48%.

Despite predicting a decline, more than half upgraded their forecasts from a May survey with many flagging the risk of yields moving higher.

"The 10-year will probably trade range-bound for a while between 4-4.50% and maybe even rise a little bit further, particularly given deficit concerns. The yield curve should continue to steepen as short-term yields drift gradually lower as the Fed cuts rates one or two more times by year-end," Schwab's Martin added.

The more interest rate-sensitive 2-year yield was forecast to decline a slightly steeper 17 bps to 3.85% in three months and to 3.73% by end-November, the survey showed.

Most economists polled by Reuters predict two or fewer rate cuts this year while rate futures are currently pricing two.

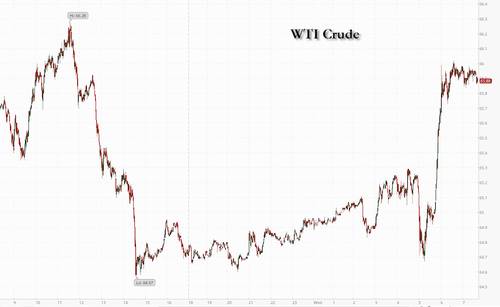

The NY Post has published a new Trump interview focused on apparently stalled Iran nuclear deal efforts which resulted in a surge in oil prices.

The President said in the interview he's getting "less confident" about ongoing nuclear negotiations with Iran, soon after which oil rose as well as benchmark treasury yields and gold, as investors weigh the possibility of US-Iran nuclear talks falling apart.

Trump was asked whether he thinks the Islamic Republic will agree to shut down its nuclear program. "I don’t know. I did think so, and I’m getting more and more — less confident about it," he responded.

"They seem to be delaying, and I think that’s a shame, but I’m less confident now than I would have been a couple of months ago," Trump continued. "Something happened to them, but I am much less confident of a deal being made."

Then the question was raised by the Post, "what happens then?" To which Trump responded:

“Well, if they don’t make a deal, they’re not going to have a nuclear weapon,” Trump answered. “If they do make a deal, they’re not going have a nuclear weapon, too, you know? But they’re not going a have a new nuclear weapon, so it’s not going to matter from that standpoint.

“But it would be nicer to do it without warfare, without people dying, it’s so much nicer to do it. But I don’t think I see the same level of enthusiasm for them to make a deal. I think they would make a mistake, but we’ll see. I guess time will tell.”

On the question of China's influence on Tehran, Trump described, "I just think maybe they don’t want to make a deal. What can I say?” he said. “And maybe they do. So what does that mean? There’s nothing final."

Via AFP

Via AFPOn Tuesday Trump acknowledged in a Fox News interview that Iran is becoming "much more aggressive" in these negotiations. And the day prior he had told reporters that the Iranians are "tough negotiators" and sought to clarify that he would not allow Tehran to enrich uranium on its soil, after some recent contradictory reports suggested the White House had backed off this demand.

Washington is awaiting a formal response from the Islamic Republic, which is expected to submit a counter-proposal in the coming days, just ahead of an expected sixth round of indirect talks with the US in Muscat, Oman, slated for Sunday, June 15.

More geopolitical headlines via Newsquawk:

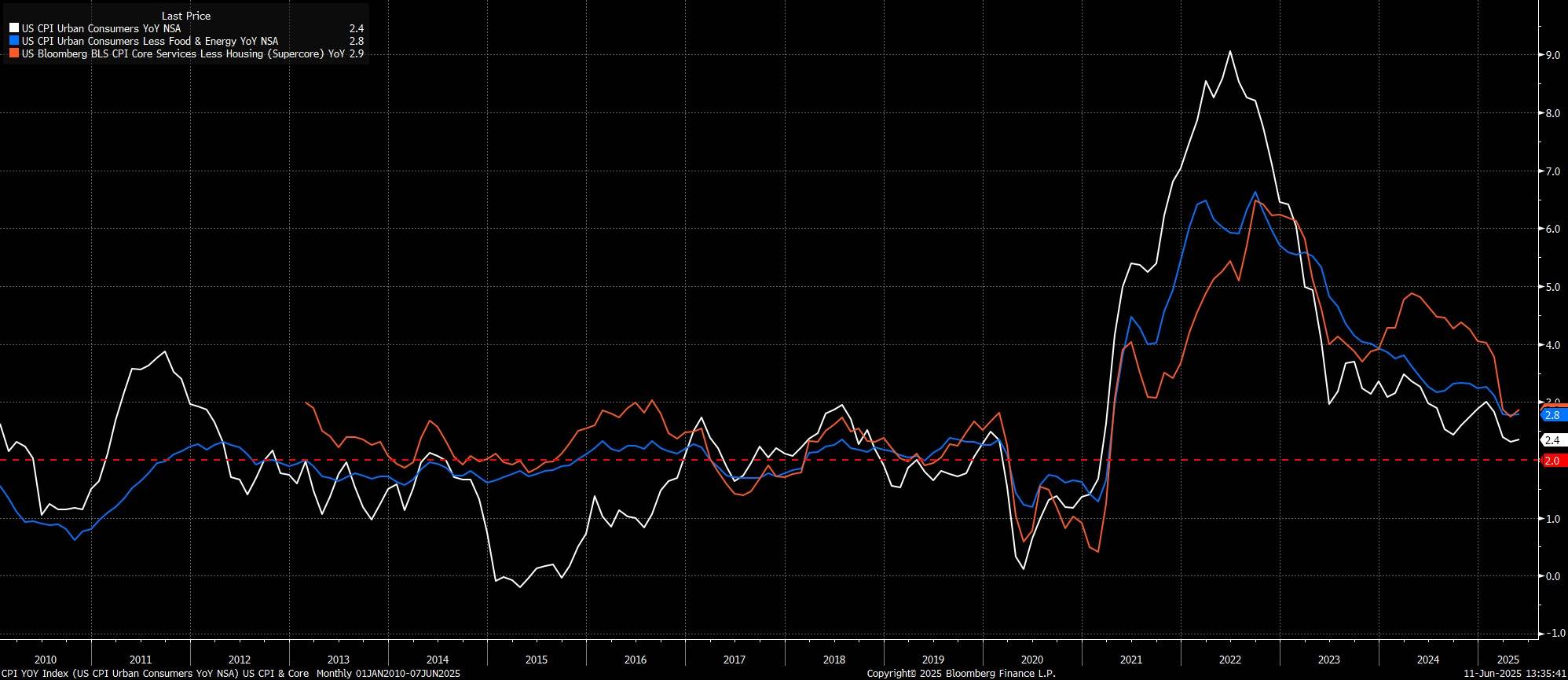

Headline CPI rose 2.4% YoY last month, a modest uptick from April, but in line with expectations, while core prices rose 2.8% YoY over the same period, 0.1pp cooler than consensus, and unchanged from last time out. In addition, the so-called ‘supercore' inflation metric, aka core services less housing, rose 2.9% YoY, a notable rise from the 2.7% YoY prior, bucking the trend of coolness elsewhere.

Meanwhile, on an MoM basis, both headline and core prices rose just 0.1% MoM, both also considerably cooler than had been expected, with the expected price pressures from tariff pass-through thus far elusive.

As is usually the case, annualising this data helps to provide a clearer picture of underlying inflationary trends, and the broader backdrop:

•3-month annualised CPI: 1.0% (prior 1.6%)

•6-month annualised CPI: 2.6% (prior 3.0%)

•3-month annualised core CPI: 1.7% (prior 2.1%)

•6-month annualised core CPI: 2.6% (prior 3.0%)

The details of the CPI report, though, are of considerably more importance this time around than the headline metrics, as participants and policymakers alike continue to try and gauge the degree to which tariffs are being passed on to consumers in the form of higher prices. On that note, and again contrary to expectations, the pace of core goods inflation remained subdued, at just 0.3% YoY, while core services prices rose 3.6% YoY, unchanged from last time out.

As the data was digested, money markets repriced marginally in a dovish direction, once again fully discounting two 25bp cuts by year-end, up from around 44bp pre-release.

Taking a step back, the May CPI figures reinforce the FOMC's ongoing ‘wait and see' approach, and shan't significantly alter the monetary policy outlook. Despite being cooler than consensus, upside inflation risks from tariffs clearly remain.

Policymakers, hence, will remain on the sidelines for the time being, seeking to ‘buy time' in order to assess the impacts of the tariffs which have been imposed, and how this alters the balance of risks to each side of the dual mandate. Concurrently, the Committee are also attempting to ensure that inflation expectations remain well-anchored, despite the trade-induced ‘hump' in inflation that we are now likely to see through to the end of summer.

Overall, Powell & Co. seem highly unlikely to deliver any rate cuts before the fourth quarter, with just one 25bp cut in December my base case, even if the direction of travel for rates clearly remains to the downside. Next week's FOMC is unlikely to ‘rock the boat' especially much, merely being a ‘placeholder' as policymakers continue to stand pat for the time being.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up