Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices fluctuated as traders evaluated a potential US-Russia truce in Ukraine. While a ceasefire may not ease sanctions, hopes of continued Russian oil flows eased supply concerns amid weakening demand.

Washington and Moscow are understood to be aiming to reach a deal to halt the war in Ukraine that would lock in Russia’s occupation of territory seized during its military invasion.

US and Russian officials are working toward an agreement on territories for a planned summit meeting between Presidents Donald Trump and Vladimir Putin as early as next week, people familiar said.Putin is demanding that Ukraine cede its entire eastern Donbas area to Russia as well as Crimea, which his forces illegally annexed in 2014. Any deal on those terms would hand Russia a victory that its army couldn’t achieve militarily since the start of the full-scale invasion.

Such an outcome would represent a major win for Putin, who has long sought direct negotiations with the US on terms for ending the war that he started, sidelining Ukraine and its European allies. Ukrainian President Volodymyr Zelenskiy risks being presented with a take-it-or-leave-it deal to accept the loss of Ukrainian territory.

Trump said yesterday that he’d be willing to meet with Putin, even if the Russian leader hadn’t agreed to also sit down with Zelenskiy, apparently overriding earlier suggestions of a trilateral meeting.

Germany will halt deliveries to Israel of military equipment that could be used in operations in the Gaza Strip over concern for humanitarian suffering in the territory. The ban on deliveries of spare parts for tanks and other defense-related goods will be in place until further notice, Chancellor Friedrich Merz said today in a statement. The move was prompted by Israeli Prime Minister Benjamin Netanyahu’s move to secure approval for a military takeover of Gaza City.

Bank of England Chief Economist Huw Pill warned the central bank may need to slow its once-a-quarter pace of interest-rate cuts after a resurgence in inflation that risks changing the behavior of households and businesses. Pill — who opposed the BOE’s closely contested decision yesterday to cut rates by a quarter point — said a spike in price pressures may linger for longer than expected, pointing to the impact on household expectations from climbing food bills.

China said its imports of Russian oil are justified, pushing back against US threats of new tariffs after Washington slapped secondary levies on India for buying energy from Moscow. “It is legitimate and lawful for China to conduct normal economic, trade and energy cooperation with all countries around the world, including Russia,” the Chinese Foreign Ministry said Friday in a statement to Bloomberg News. Trump said earlier this week he could punish China with additional tariffs over its purchases of Russian oil.

Trade tariffs are adding to challenges facing the Irish whiskey industry, a sector already beset by oversupply, faltering US demand and soaring costs. A clutch of independent distilleries have closed or cut production in recent months, while giants like Diageo and Pernod Ricard are also impacted. The Killarney Brewing & Distilling closed down last month, the latest casualty of the reversal of a short-lived boom for the industry.

Aircraft maker Pilatus Flugzeugwerke has stopped deliveries to the US one day after the 39% tariff rate on Switzerland went into effect. Trump’s surprise decision has roiled local manufacturers. “Massive additional costs” and the resulting competitive disadvantages with US and European competitors are causing increasing uncertainty among customers, the maker of the PC-12 single-engine utility plane and PC-24 10-passenger business jet said in a statement. That led the company to temporarily interrupt its US business, the statement said. Pilatus said it would work with clients to send the planes to other markets.

Zimbabwe and the UK are rekindling diplomatic ties after almost three decades of tensions, driven by a global surge in demand for critical minerals. The former colonial power is pursuing $1 billion in deals with the resource-rich nation. The British Embassy in Harare said those prospective deals are across key sectors such as agriculture, finance, telecommunications, renewable energy and critical minerals.

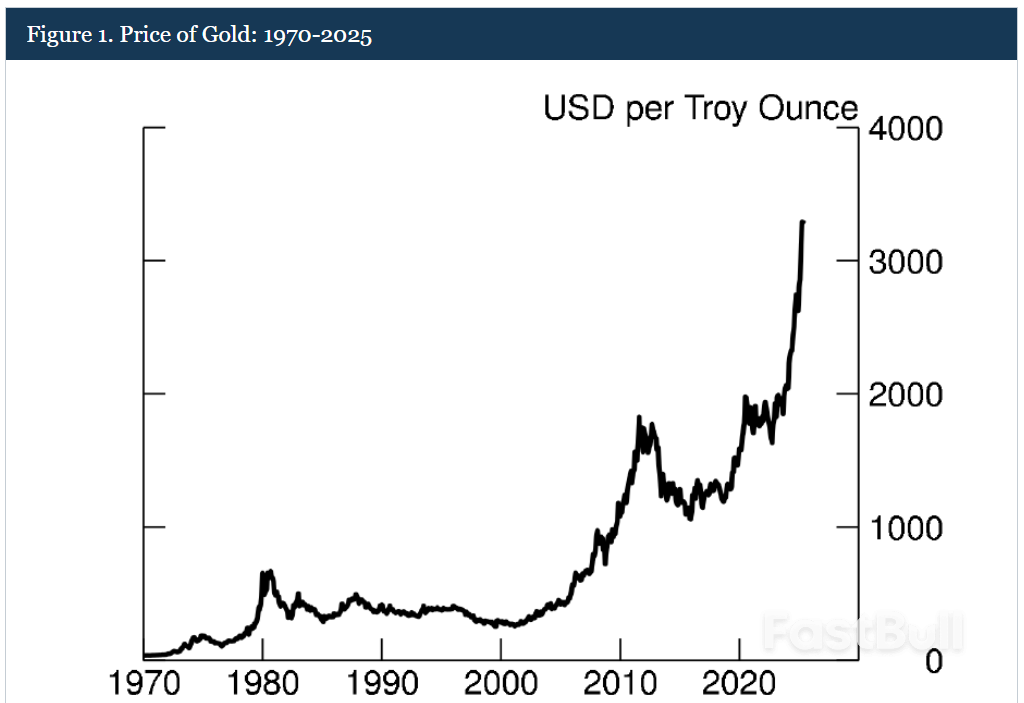

Gold (XAUUSD) prices have rallied over the past week and are near record-high levels after a wave of profit-taking in late July.

Investors have bid up the precious metal amid uncertainty over the outlook for the U.S. economy and expectations that the Federal Reserve will cut interest rates in September, following July’s weaker-than-expected employment report released last Friday. Gold tends to benefit from its reputation as a safe-haven asset during times of economic uncertainty, while lower rates also support the non-yielding asset. Reports that the U.S. will impose tariffs on imports of gold bars have also underpinned gains this week.

The commodity has soared about 30% this year, boosted by concerns over the Trump administration’s unpredictable trade policies—amid uncertainty about how tariffs will affect the economy—and ongoing tensions in the Middle East. Spot gold was trading at just under $3,400 per troy ounce recently.

Below, we take a closer look at the spot gold price chart and use technical analysis to identify key levels that investors will likely be watching.

Since a shooting star pattern marked gold’s high in late April, the commodity has consolidated in an ascending triangle, a bullish chart formation that signals a potential continuation of the longer-term uptrend.

More recently, the price has rallied from the triangle’s lower trendline and reclaimed the respected 50-day moving average (MA), a move that has coincided with the relative strength index crossing back into bullish territory.

Let’s identify two key overhead areas to watch on gold's chart if the recent upward momentum continues and also point out major support levels worth monitoring during possible retracements.

The first overhead area to watch sits around $3,435. This location on the chart would likely provide significant resistance near four distinct peaks that form the ascending triangle’s top trendline.

Investors can forecast a bullish price target above gold’s all-time high by using the measured move technique, a tool that analyzes chart patterns to project future price movements. When applying this analysis, we calculate the distance of the ascending triangle near its widest section and add that amount to the pattern’s top trendline. For instance, we add $300 to $3,435, which projects a target of $3,735, about 10% above the commodity’s current trading levels.

So what is Value at Risk? Value at Risk, abbreviated to VaR, is a statistical measure used to estimate how much a trader, portfolio, or institution could lose over a set period under normal market conditions. It provides a single risk figure, making comparison of different assets, portfolios, or strategies more straightforward.

VaR is defined by three key components:

For example, if a portfolio’s Value at Risk has a one-day 95% risk estimate of £10,000, it means that under normal conditions, there is a 95% chance that losses won’t exceed £10,000 in a single day. However, the remaining 5% represents extreme events where losses could be greater.

VaR is widely used in trading, portfolio management, and regulatory frameworks because it quantifies risk in monetary terms. It helps traders set position limits, assess exposure, and compare risk across different assets. However, while VaR is useful, it does not account for rare but extreme losses, which is why it’s often combined with other risk measures.

There are three main ways to calculate VaR, each with its own approach to estimating potential losses: the historical method, the variance-covariance method, and the Monte Carlo simulation. Each method has strengths and weaknesses, and traders often use a combination to cross-check risk assessments.

1. Historical Method

This approach looks at past market data to estimate future risk. It takes the historical returns of an asset or portfolio over a given period—say, the last 250 trading days—and ranks them from worst to best. The VaR is then set at the percentile corresponding to the chosen confidence level.For example, in a 95% confidence level VaR calculation using 250 days of data, the worst 5% (12.5 worst days) would indicate the expected loss threshold. If the 13th worst loss was £8,000, that would be the VaR estimate. This method is simple and doesn’t assume a normal distribution, but it relies on past data, which may not capture extreme events.

2. Variance-Covariance Method

The Variance-Covariance (VCV) method assumes that potential returns follow a normal distribution and estimates risk using standard deviation (volatility).One of the main advantages of the VCV method is its simplicity and efficiency, particularly for portfolios with multiple assets. However, its accuracy depends on the assumption that potential returns are normally distributed, which may not always hold, especially during extreme market conditions.

3. Monte Carlo Simulation

Monte Carlo simulations generate thousands of hypothetical market scenarios based on random price movements. It models different potential outcomes by simulating how prices might evolve based on past volatility and correlations. The resulting dataset is then analysed to determine the percentile-based VaR estimate.This method is more flexible and can handle complex portfolios but is computationally intensive and requires strong assumptions about price behaviour.

Traders use Value-at-Risk models to measure potential losses, manage exposure, and make decisions about position sizing. Since VaR quantifies risk in monetary terms, it provides a clear benchmark for setting risk limits on individual trades or entire portfolios.One of the most practical applications of VaR is in position sizing. A trader managing a £500,000 portfolio might have a risk tolerance of 1% per trade, meaning they are comfortable with a potential £5,000 loss per trade. By calculating VaR, they can assess whether a given trade aligns with this limit and adjust the position size accordingly.

Hedge funds, proprietary trading firms, and institutional investors use VaR to allocate capital efficiently. If two trades have the same expected returns but one has a higher VaR, a trader may adjust exposure to avoid exceeding risk limits. Large institutions also use portfolio-wide VaR to monitor overall exposure and assess whether they need to hedge positions.

Another key use is stress testing. Traders often compare historical VaR to actual market moves, especially during volatile periods, to gauge whether their risk model holds up. If markets experience larger-than-expected losses, traders may refine their approach by incorporating additional risk measures like Conditional VaR (CVaR) or adjusting exposure to tail risks.Ultimately, VaR is a risk filter—it doesn’t dictate decisions but helps traders identify when exposure might be higher than expected, so they can adjust accordingly.

Value at Risk is widely used in trading and portfolio management because it provides a single, quantifiable measure of potential loss. However, while it’s useful for assessing risk, it has limitations that traders need to be aware of.

Strengths of VaR

Limitations of VaR

Because of these limitations, traders often combine VaR with other risk measures, such as Conditional VaR (CVaR), drawdowns, and volatility analysis, for a more comprehensive risk assessment.

Value at Risk is used by traders, hedge funds, and financial institutions to assess market exposure and manage risk. It plays a key role in everything from daily trading operations to large-scale regulatory compliance.

VaR gained prominence in the 1990s when J.P. Morgan developed its RiskMetrics system, which set a standard for institutional risk measurement. The firm used VaR to estimate potential losses across its trading desks, providing a consistent risk measure for its global operations. This approach became so influential that it was later adopted by regulators and central banks.

It’s believed that the reliance of the hedge fund Long-Term Capital Management (LTCM) on VaR to manage its highly leveraged positions in the late 1990s led to the fund’s collapse. While its models suggested limited downside risk, LTCM’s reliance on normal market conditions led to catastrophic losses when a position in Russian debt unravelled. The fund’s VaR calculations underestimated extreme market moves, contributing to a collapse that required a $3.6 billion bailout from major banks.

During the 2008 financial crisis, Goldman Sachs relied on VaR to monitor trading risk. At the peak of market volatility in late 2008, its daily VaR jumped significantly, highlighting the increased risk in its portfolio. The firm adjusted exposure accordingly, reducing positions in high-risk assets to manage potential losses.

FAQ

What Is VaR?

The Value at Risk, or VaR, meaning refers to a statistical measure used to estimate the potential loss of an asset, portfolio, or trading strategy over a specific timeframe with a given confidence level. It helps traders and institutions assess market exposure and manage risk.

What Does VaR Mean in Trading?

In trading, VaR quantifies the potential downside of a position or portfolio. It provides a single number that represents the maximum expected loss over a set period, such as one day or one week, under normal market conditions.

How to Calculate Value at Risk?

VaR is typically calculated using three methods: historical simulation, which uses past market data; the variance-covariance method, which assumes a normal distribution of potential returns; and Monte Carlo simulation, which generates potential future price movements to estimate risk.

What Is a VaR Strategy?

A VaR strategy involves using VaR to set position limits, manage exposure, and allocate capital efficiently. Traders and institutions often integrate VaR into broader risk management frameworks to balance potential risk and returns.

What Does 95% VaR Mean?

A 95% VaR means there is a 95% probability that losses will not exceed the calculated VaR amount over the chosen period. The remaining 5% represents extreme market events where losses could be higher.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up