Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Goldman Sachs projects gold at \$3,700 by end-2025 and \$4,000 by mid-2026, with potential up to \$4,500–\$5,000 if private investors shift from U.S. assets, citing Fed risks and safe-haven demand.

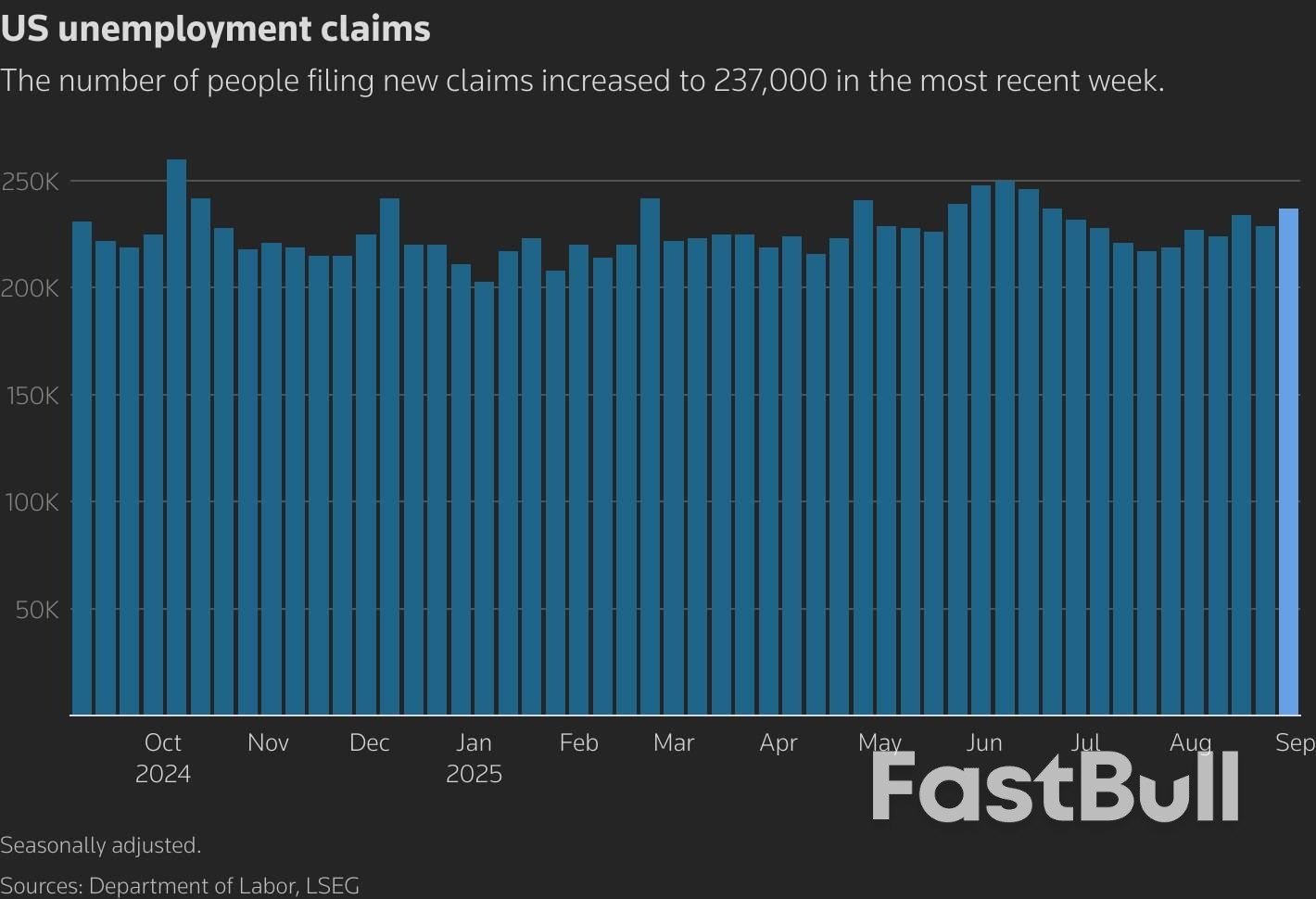

The number of Americans filing new applications for jobless benefits increased more than expected last week, while hiring by private employers slowed in August, offering further evidence that labor market conditions were softening.

The reports on Thursday came on the heels of government data on Wednesday showing there were more unemployed people than positions available in July for the first time since the COVID-19 pandemic. Job growth has shifted into stall-speed, with economists blaming President Donald Trump's sweeping import tariffs and an immigration crackdown that is hampering hiring at construction sites and restaurants.

The slackening labor market likely positions the Federal Reserve to resume cutting interest rates later this month, though much would depend on August's employment report that is scheduled to be published on Friday.

"We continue to see softness growing in the labor market as tariff policy uncertainty lingers, immigration changes take effect, and AI adoption grows," said Eric Teal, chief investment officer at Comerica Wealth Management. "The silver-lining is the weaker the jobs data, the more cover there is for stimulative interest rate cuts that are on the horizon."

Initial claims for state unemployment benefits rose 8,000 to a seasonally adjusted 237,000 for the week ended August 30, the Labor Department said. Economists polled by Reuters had forecast 230,000 claims for the latest week. There were significant increases in unadjusted claims in Connecticut and Tennessee.

A column chart titled "US unemployment claims" that tracks the metric over a recent period.

The number of people receiving benefits after an initial week of aid slipped 4,000 to 1.940 million during the week ending August 23, the claims report showed.

The still-high so-called continued claims are a reflection of a reluctance by businesses to increase headcount. The Fed's "Beige Book" report on Wednesday noted that "firms were hesitant to hire workers because of weaker demand or uncertainty."

U.S. stocks opened mixed. The dollar rose against a basket of currencies. U.S. Treasury yields fell.

The claims data have no bearing on the closely watched employment report for August scheduled to be released on Friday as they fall outside the survey period.

Economists are bracing for another month of tepid job growth. Those expectations were reinforced by the ADP National Employment Report showing private employment increased by 54,000 jobs last month after advancing 106,000 in July. Economists had forecast private employment increasing by 65,000 jobs.

A Reuters survey of economists expects the employment report will likely show nonfarm payrolls increased by 75,000 jobs in August after rising by 73,000 in July.

Employment gains averaged 35,000 jobs per month over the last three months compared to 123,000 during the same period in 2024, the government reported in August. The unemployment rate is forecast to climb to 4.3% from 4.2% in July.

Fed Chair Jerome Powell last month signaled a possible rate cut at the U.S. central bank's September 16-17 policy meeting, acknowledging the rising labor market risks, but also added that inflation remained a threat.

The Fed has kept its benchmark overnight interest rate in the 4.25%-4.50% range since December.

U.S. Bank is reigniting momentum in digital finance with a bold return to bitcoin custody, integrating ETF support and unlocking powerful institutional pathways into cryptocurrency adoption.US Bank Resumes Bitcoin Custody Services, Signaling Broader Institutional Shift

Institutional investors are increasingly seeking regulated access to digital assets as banks adapt their offerings to meet demand. U.S. Bank announced on Sept. 3 that it has resumed cryptocurrency custody services, initially introduced in 2021, through an early access program for Global Fund Services clients. The bank explained:The services are intended for institutional investment managers with registered or private funds who seek a secure safekeeping solution for bitcoin.

The updated platform also includes support for bitcoin exchange-traded funds (ETFs), with NYDIG, a bitcoin financial services and infrastructure firm, selected as sub-custodian.Executives positioned the relaunch as both a continuation of earlier work and a response to evolving regulation. Stephen Philipson, vice chair of U.S. Bank Wealth, Corporate, Commercial and Institutional Banking, stated: “We’re proud that we were one of the first banks to offer cryptocurrency custody for fund and institutional custody clients back in 2021, and we’re excited to resume the service this year. Following greater regulatory clarity, we’ve expanded our offering to include bitcoin ETFs, which allows us to provide full-service solutions for managers seeking custody and administration services.”

From NYDIG’s side, CEO Tejas Shah commented: “NYDIG is honored to partner with U.S. Bank as its primary provider for bitcoin custody services. Together, we can bridge the gap between traditional finance and the modern economy by facilitating access for Global Fund Services clients to bitcoin as sound money, delivered with the safety and security expected by regulated financial institutions.”

Broader strategic ambitions were also highlighted. Dominic Venturo, senior executive vice president and chief digital officer at U.S. Bank, remarked: “U.S. Bank has been at the forefront of exploring how digital assets can serve our clients. Further expanding our capabilities unlocks new opportunities to deliver innovative solutions to those we serve. U.S. Bank will continue to drive progress and shape the future of what matters for our clients in digital finance.” With $11.7 trillion in assets under custody and administration as of June 30, 2025, the bank’s return to bitcoin custody signals growing institutional readiness to engage with cryptocurrencies. While critics highlight risks from market volatility and custodial complexity, advocates contend that regulated partnerships improve security and broaden access for institutional investors seeking exposure to the asset class.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up