Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

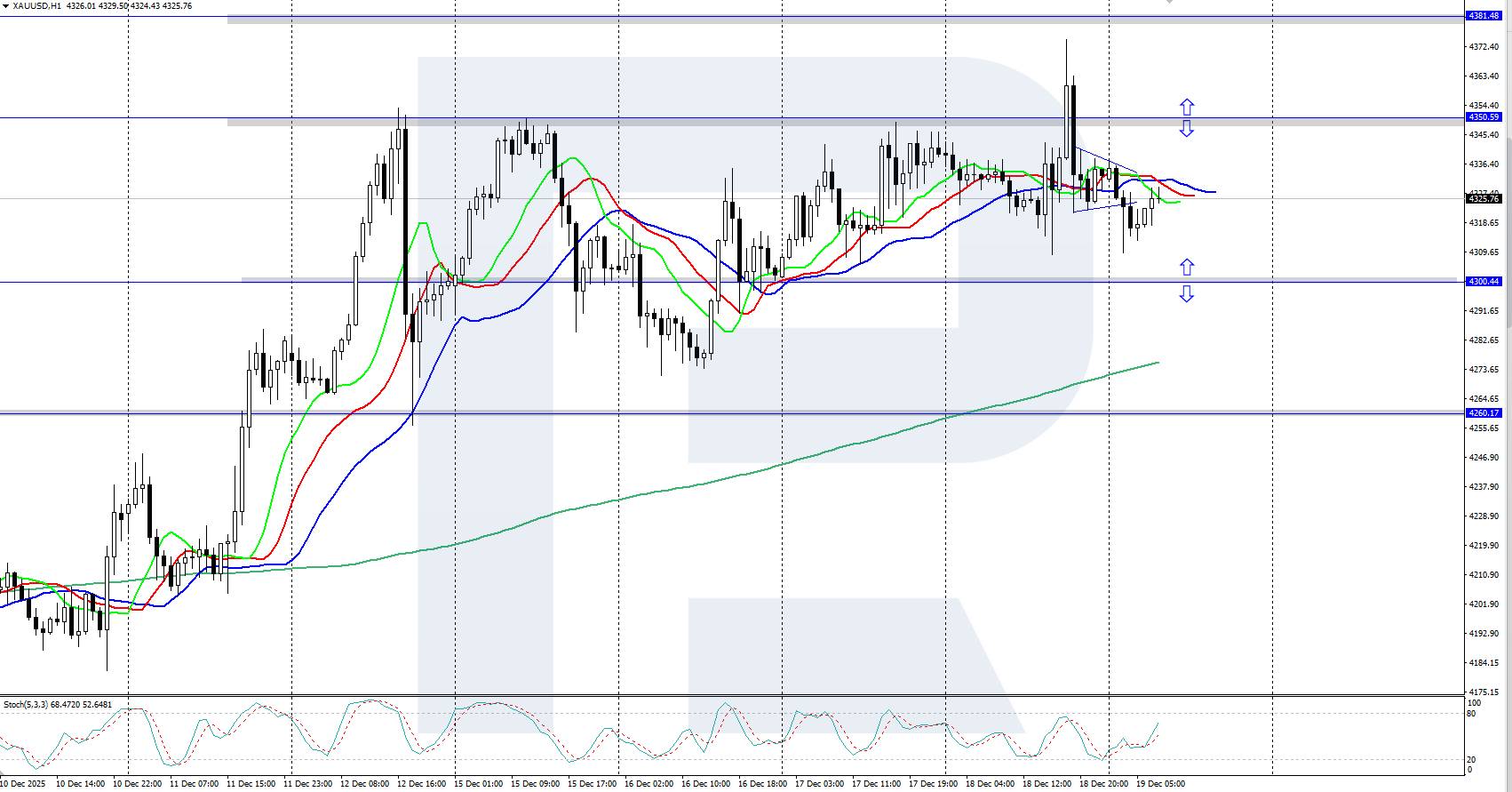

The price of XAUUSD declined toward the 4,300 USD area during a downward correction after an unsuccessful attempt to renew the all-time high, following the release of US inflation data.

The price of XAUUSD declined toward the 4,300 USD area during a downward correction after an unsuccessful attempt to renew the all-time high, following the release of US inflation data.

Gold (XAUUSD) has returned to a consolidation range of 4,260–4,350 USD per ounce, remaining close to record highs. An attempt to renew the all-time high at 4,381 USD after weaker-than-expected US inflation data proved unsuccessful.

US inflation slowed to 2.7% in November, below the 3.1% forecast, while core CPI came in at 2.6% — the lowest reading since March 2021. This has strengthened expectations of a potential Federal Reserve rate cut in 2026.

Geopolitical tensions continue to support the precious metal. Confrontation between the US and Venezuela persists, military action in Ukraine continues, and there has been no clear progress in peace negotiations so far.

XAUUSD quotes corrected toward the 4,300 USD area. The daily trend, confirmed by the Alligator indicator, remains upward, indicating the possibility of a continuation of the bullish move once the current correction is complete.

Within the short-term price forecast for XAUUSD, if bulls manage to regain control, another attempt to break the all-time high at 4,381 USD may follow. If bears succeed in extending the decline and secure prices below 4,300 USD, a deeper correction toward support at 4,260 USD may develop.

Gold is undergoing a moderate correction after failing to renew the all-time high at 4,381 USD. Slowing US inflation and ongoing geopolitical tensions continue to support the precious metal. Once the correction phase is complete, the upward movement may resume.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold's recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Key insights from the week that was.

Australia's key release for the week was the Westpac-MI Consumer Sentiment Index which, after November's 'net positive' read, fell 9% to 94.5 in December – a 'cautiously pessimistic' level. Responses to questions on news recall suggest consumers were shaken by recent inflation results, the tone of related coverage now viewed as decisively negative versus somewhat mixed three months ago. This has sparked one of the sharpest turnarounds in consumers' mortgage rate expectations on record, 86% of those with a view now anticipate mortgage rates to be the same or higher in a year's time.

This has fed into renewed concerns over the economy, the one-year and five-year ahead sub-indexes falling 9.7% and 11.7% respectively. Buyer sentiment also looks to have been crimped, the 'time to buy a major household item' sub-index shedding 11.4% to be well below average. Official data is pointing to a genuine consumer upswing, driven by a recovery in real household disposable incomes; however, higher inflation, interest rates and bracket creep threaten the outturn. As a result, the year-ahead outlook for family finances fell 6.1% to be modestly below average.

The RBA has also taken signal from the recent lift in inflation, with only some of the pressures deemed temporary. As detailed by Chief Economist Luci Ellis earlier this week, Westpac continues to believe inflation will moderate through 2026, but the Monetary Policy Board's more hawkish assessment has pushed back the timing of further policy easing into 2027. There are risks to both sides of our view for policy to remain on hold in 2026 and two cuts in H1 2027. If inflation continues surprising meaningfully to the upside in the near term, a rate hike could become a possibility. But, if the labour market weakens more than expected, the cuts now forecast for 2027 may need to be brought forward.

Fiscal policy developments are also worth monitoring vis a vis inflation and growth. The Federal Government's MYEFO revealed an $8.7bn improvement in the budget's bottom line over the forward estimates due to a tax windfall associated with higher commodity prices and a firmer-than-expected economic upswing. If the government elects to save the bulk of the windfall, it would ease near-term inflationary pressures – at the margin.

Before moving offshore, a final note on the local manufacturing sector. The latest Westpac-ACCI Survey of Industrial Trends revealed that the long-awaited improvement in conditions is finally starting to materialise, the Actual Composite bouncing from a broadly neutral read to a solid 55.1 in Q4. The Expected Composite meanwhile continued to lift to fresh cycle highs. Some of the hallmark challenges facing the sector, such as elevated costs, skilled labour shortages and material constraints, has restricted the ability for some manufacturers to respond to firmer demand. Solid investment intentions and plans for hiring, if realised, should go some way to alleviating capacity constraints.

Over in the UK, the Bank of England cut rates by 25bps to 3.75% in a narrow 5-4 vote. Those voting for a cut emphasised the downside risks to growth; those for a pause that inflation, which came in at 3.2%yr earlier in the week, could show greater persistence. On the outlook, Governor Bailey noted that "judgements around further policy easing will become a closer call" suggesting that the BoE is nearing the end of its easing cycle. With GDP growth expected to be only slightly above 1% in 2026 and inflation trending down, we maintain a view of further gradual BoE easing in H1 2026, by 25bp per quarter. However, the committee may proceed more cautiously, delaying cuts to the second half of next year.

Across the English Channel, the European Central Bank kept rates steady at 2.0% with President Lagarde noting once again that "policy is in a good place". Inflation was revised up for 2026 due to a slower descent in services inflation (core inflation now 2.2%yr), but it is still expected to stabilise at target in 2027/2028 (1.9% and 2.0%). The economic growth projections have also been revised up to 1.4% in 2025, 1.2% in 2026 and 1.4% in 2027, where growth is expected to remain in 2028. The statement made clear the "Governing Council is not pre-committing to a particular rate path", highlighting that policy will be fine-tuned depending on how the risks evolve.

In the US, November's inflation read surprised to the downside, the core measure rising 2.6%yr while headline prices rose 2.7%yr, both down from 3.0%yr in September. However, with the government shutdown precluding an October report and essentially no month-to-month detail provided for November, the FOMC is unlikely to take signal from this inflation read. Earlier in the week, non-farm payrolls rose 64k in November after a 105k decline in October, both released at the same time. Average job gains over the last 3 months are circa 20k, towards the bottom of the range estimated to be consistent with balance between labour demand and supply. It is unsurprising then that the unemployment rate edged up 0.2ppts between September and November to 4.6%.

In Asia meanwhile, Chinese partial data came in softer than expected in November. Retail trade was up just 4%ytd, weighed down by persistent weakness in consumer prices, but more significantly weak sentiment and declining wealth. Equities are now trending higher, but house prices continue to decline. Industrial production grew 6%ytd, however, highlighting that the capacity investment of recent years is earning a return. Fixed asset investment fell 2.6%ytd though, as high-tech manufacturing retraced some of its rapid gains of prior years, and property construction continued to contract. Clearly, pro-active stimulus in scale is necessary to put a floor under activity and, in time, see sentiment move back up.

Further east, the Q4 Tankan survey showed conditions improved by two points to 17pts, supporting views for a rate hike later today by the Bank of Japan. The output prices measure remained broadly steady, with one-year, three-year and five-year ahead projections all consistent with at-target inflation. Investment plans remain high, albeit with a slight downgrade from last quarter's expectations. Software investment is anticipated to increase 12.2%, while R&D investment is expected to rise 4.6%. All this is consistent with reports of firms investing to reduce their demand for labour and in pursuit of productivity. Employment conditions remained consistent with a tight labour market; firms expect to hire more new graduates in the following financial year. Overall, the survey points to a tight labour and historically elevated inflation expectations, which should aid workers case for higher wages in FY26 (ending in March 2027).

Malaysia's trade surplus contracted sharply in November as imports grew faster than exports, according to data released by the Department of Statistics Malaysia (DOSM) on Friday.

During the month under review, the trade surplus declined by 58.8% to RM6.1 billion, compared with RM14.8 billion in the corresponding period a year ago, the DOSM said in a statement.

Imports surged 15.8% year-on-year to RM128.9 billion, a growth rate more than double that of exports, which increased 7% to RM135 billion in November.

Chief statistician Datuk Seri Dr Mohd Uzir Mahidin said the rise in exports in November was supported by higher re-exports and domestic exports.

Re-exports accounted for 22% of total exports and increased 40.3% year-on-year to RM29.8 billion, while domestic exports, which made up 78%, recorded marginal growth of 0.3% to RM105.2 billion.

In terms of products, export growth in November was led by higher shipments of electrical and electronics products, optical and scientific equipment, metalliferous ores and metal scrap, palm oil-based manufactured products, manufactured metal products, and machinery, equipment and parts.

By destination, higher exports were mainly driven by increased shipments to Taiwan, China, Hong Kong, the European Union, Mexico, Singapore and Vietnam, the DOSM said.

Imports-wise, Malaysia saw higher inflows from China, Costa Rica, South Korea, the United Arab Emirates, Taiwan, Oman and the European Union.

Mohd Uzir said the rise in imports reflected higher demand for capital and intermediate goods, with capital goods imports jumping 56.8% year-on-year to RM20.8 billion and intermediate goods imports rising 5% to RM66.4 billion. The imports of consumption goods, however, fell 1.7% to RM9.9 billion.

Compared with October 2025, exports declined 9% while imports rose marginally by 0.7%. Total trade decreased by 4.5%, and the trade surplus fell 70% respectively from October levels.

For the January-November period, Malaysia's total trade expanded 5.8% year-on-year to RM2.8 trillion, supported by a 6.1% increase in exports and a 5.6% rise in imports. The cumulative trade surplus strengthened 10.7% to RM132.6 billion.

Strong external demand and the recent US trade deal are expected to sustain the momentum in manufacturing output and exports. Industrial production is likely to recover in November, as both semiconductors and automotives show significant improvement. Last month's decline in semiconductor output appears to be temporary, and inventory restocking is expected to drive higher chip production. After the US-Korea trade agreement, motor vehicle exports rose in November. This should positively impact overall IP. We expect December exports to rise by 9% year on year, as these two industries continue to improve. Meanwhile, retail sales growth should moderate as the effect of previous cash handouts gradually wanes. Still, events such as the November Sales Festa and an increase in foreign tourists are expected to support continued growth in retail sales.

Also, inflation is expected to decelerate in December despite the recent weakness in the KRW. Fresh food prices stabilized during the winter season while gasoline prices peaked in early December. We expect headline inflation to ease to 2.2% YoY in December from the previous month's 2.4%.

Industrial production in Japan is projected to decline. This should only partially offset the gains of the past two months. Meanwhile, retail sales continue to climb, supported by robust wage growth. We believe that November data won't yet show significant negative effects from the decrease in Chinese tourists.

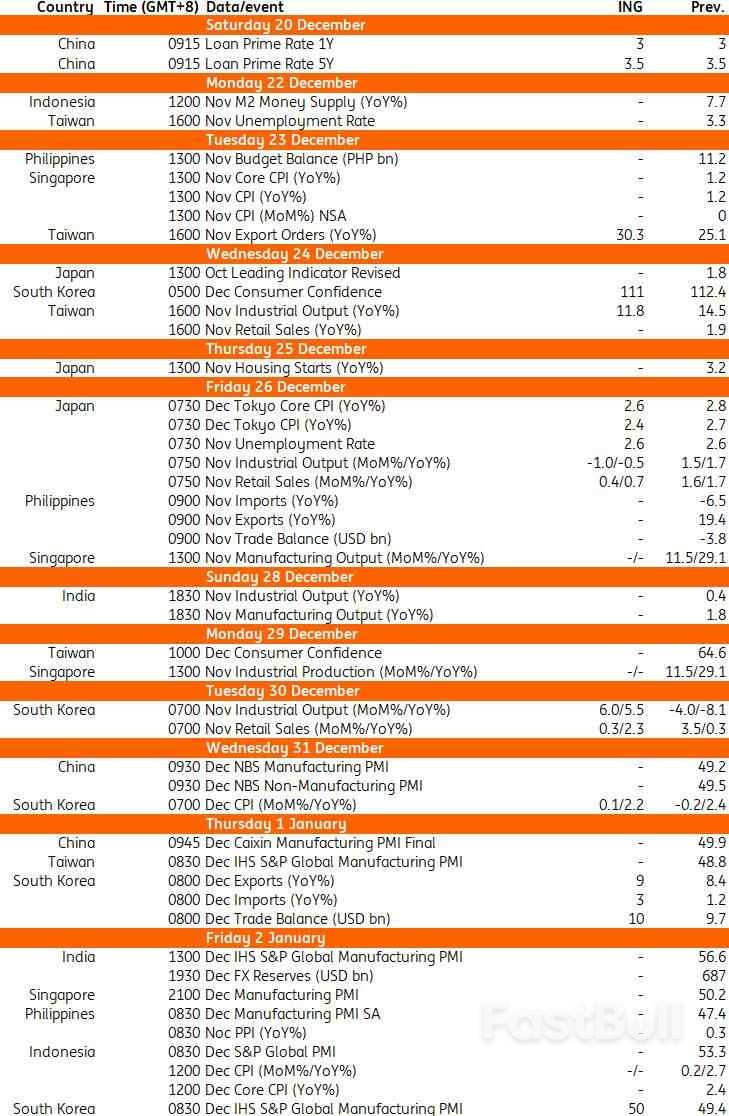

With the last key data releases done for the year, Saturday's Loan Prime Rates decision will dominate next week's economic discussions. We expect this to be a non-event, with 1 and 5 year LPRs held unchanged at 3.0% and 3.5%, respectively.

We are looking for export orders to continue their solid run in November, rising to 30.3% YoY. This gain in the data, out Tuesday, will be driven by continued strength in electronic products and information and communication products. We expect industrial production data for November, out Wednesday, to slow slightly to a growth rate of 11.8% YoY.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up