Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Discover the latest trends in gold prices with an easy-to-understand analysis. Learn about gold's short-term price outlook, investment options, and the growing demand for gold in green technology.

Acreage Shift

Acreage Shift

Last week, the markets saw their most volatile week of 2024 as the S&P VIX Index shot up briefly past 60 for the first time since the COVID-19 pandemic on Monday. The S&P 500 also had its biggest daily pullback since late in 2022 during the week, as Japan had its biggest down day since 1987. However, by the end of the week the VIX was back down to 20 and the major indexes only had incurred minor losses for the week.

To me, last week was a significant tremor in front of a larger quake yet to come. During Covid, the Western world instituted an unprecedented global lockdown for months, severely disrupting global logistics and supply chains. The Federal Reserve increased the money supply by 40% over two years, and the government pumped trillions of dollars into the economy via stimulus programs. This caused the CPI in June 2022 to hit 9.1, the highest level of inflation recorded since the early 1980s. This triggered the most aggressive monetary policy by the Federal Reserve since the days of Paul Volcker.

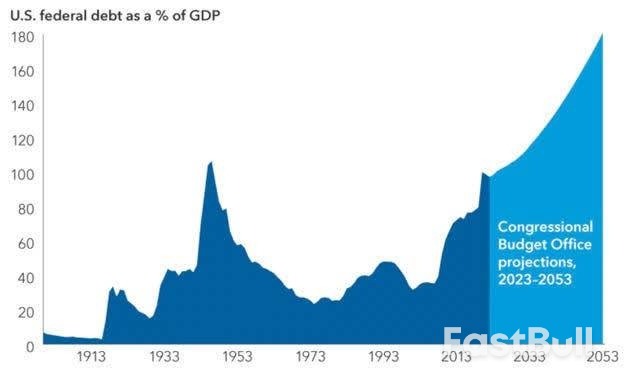

The U.S. federal debt is now over $35 trillion and the federal debt to GDP ratio has reached an all-time high, and both continue to grow. Fiscal deficit spending continues to be north of six percent of annual GDP. To think the central bank is going to engineer a "soft landing" for only the second time during my 57 years on earth (the sole one being achieved in 1995) given this backdrop always struck me as somewhat farcical and the result of investor hope over market history.

The economy and markets simply are not going to get off scot-free from all the monetary and economic dislocations of the last few years. Or as a recent ZeroHedge article put it more succinctly and eloquently:

You simply can't raise rates the most in recent history at the fastest pace in recent history on the most debt outstanding in history and not face consequences."

In today's article, we look at two well-known market sages that are signaling extreme caution right now. Both are globally acknowledged for their risk management prowess over the decades. We will also look at three key economic signals saying a recession is directly ahead.

Warren Buffett, aka The Oracle of Omaha, raised a massive amount of cash during the second quarter through his investment vehicle Berkshire Hathaway Inc. Cash balances swelled by $88 billion during the quarter to $277 billion, a record. Berkshire did so by disposing of massive stakes in Apple and Bank of America on the market during the quarter.

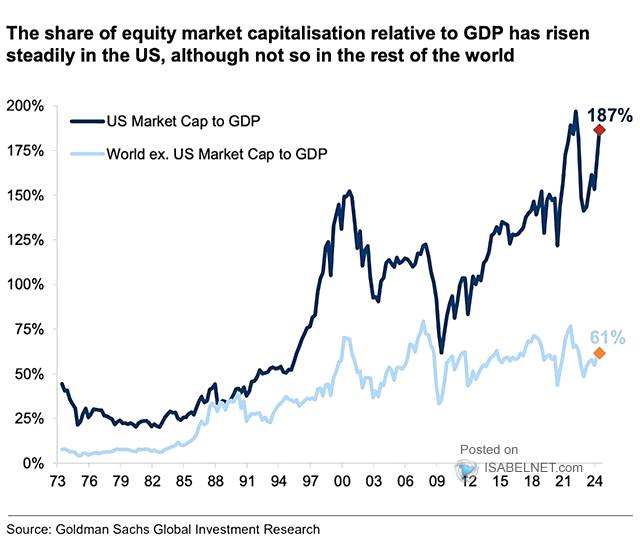

Mr. Buffett is famous for "being greedy when others are fearful, and fearful when others are greedy." He is clearly signaling the latter and is on record of saying he is finding few bargains within a market that is trading at roughly 21.5 times forward earnings on the S&P 500. Equities have never seen a higher valuation based on market cap to U.S. GDP, as they have hit in 2024 as well.

Then we have legendary banker and CEO of JPMorgan Chase & Co. Jamie Dimon, who managed to get that bank through the Great Financial Crisis in much better shape than most of its large financial peers. Mr. Dimon went on record again last week, stating the chances of a much anticipated "soft landing" are significantly lower than what the market is pricing in. He currently sees the chances of that event occurring in the 35% to 40% range. The head of JPM is also quite skeptical about whether the Federal Reserve will be able to achieve their official two percent inflation target.

As far as economic signals go, the U.S. unemployment rate has moved up from 3.5% early in the summer of 2023 to a current 4.3%. This has triggered the so-called Sahm Rule. This rule states, "that the economy is in recession when the unemployment rate's three-month average is a half percentage point above its 12-month low." It has reliably been triggered during all the recessions since the 1950s.

Then we have the normalization of the yield curve. The yield curve has now been inverted continuously since July 2022. Only one other yield curve inversion has had a greater duration. That was one that ended in 1929. Good things did not follow. The normalization of the yield curve following a significant inversion has signaled every economic recession since WWII. There is usually a lag of six to 18 months following yield normalization before a recession is entered, it should be noted. The yield curve has been inverted by more to 100bps at times (the largest divergence in 40 years) during the current inversion period. The current spread between the two and 10-Year Treasury is now down to just over 10bps and could well normalize over the coming weeks or months.

Finally, we have the monthly Leading Economic Indicators or LEI. This has also been a reliable indicator of an approaching economic contraction historically. Albeit, one that has been negative for just over two years now. The only up month over that time was in February of this year. My guess is the massive amounts of fiscal deficit spending and trillions of dollars provided by various legislation like the ironically named Inflation Reduction Act or IRA has temporarily distorted the usefulness of this indicator. Most likely, the recession that almost always follows negative readings from this historical reliable indicator has just been delayed.

So, two Wall Street sages are urging extreme caution, and three reliable recession indicators are signaling an economic contraction is in the offing. Investors should heed these warnings and position their portfolios accordingly. On CNBC this morning, long-time investor David Roche stated he "expects a bear market in 2025 caused by smaller-than-expected rate cuts, a slowing U.S. economy and an artificial intelligence bubble." These factors could trigger a drawdown of 20% and could start before yearend. He does see this downturn being "short-lived" as the Federal Reserve will "adjust" its monetary policy to lower rates further, it should be noted.

That seems to be a pretty solid baseline scenario, as it is unlikely the economy and markets can emerge scot-free from all the monetary and fiscal distortions of the past few years without paying some sort of significant price.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up