Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

This week, market attention turns to the Fed's final rate decision of the year. Updates to the dot plot, adjustments to economic projections, and Powell's remarks could all be key factors influencing gold's year-end trajectory.

This week, market attention turns to the Fed's final rate decision of the year. Updates to the dot plot, adjustments to economic projections, and Powell's remarks could all be key factors influencing gold's year-end trajectory.

Looking at the XAUUSD daily chart, gold has been trading in a tight range between $4,180 and $4,250. Bulls face clear resistance near $4,250, with multiple attempts failing to hold above this level. Although the uptrend formed at the end of October remains intact, buying momentum has been limited, keeping supply and demand relatively balanced.

On Monday morning, gold traded near $4,200. To the upside, $4,250 is a critical level for resuming the uptrend. A sustained break above this level, accompanied by higher volume, could reignite bullish momentum, pushing toward $4,300 and ultimately the record high of $4,381.

To the downside, a drop below last week's $4,180 low would shift focus to the October uptrend line near the 50-day moving average, likely attracting buying interest and prompting a short-term rebound.

Bullish factors remain dominant for gold. In the U.S., the December rate cut is priced at nearly 90%, the dollar is weak, and internal Fed divisions over the path of future easing have grown, all supporting gold. Meanwhile, China's central bank increased its gold holdings for the 13th consecutive month in November, reinforcing price support. Yet, last week's economic data only reinforced existing bullish narratives without providing new momentum.

At the same time, U.S. Treasuries faced continued selling, with yields rising, reflecting cautious expectations for a "hawkish cut," which adds some pressure to the non-yielding asset.

The market's focus is squarely on the Fed's decision this week. Beyond the rate cut itself, traders are watching dot plot updates, Powell's tone, and guidance on the 2026 rate cut path. Unlike Powell's previous emphasis on internal consensus, committee members now differ significantly in both policy direction and magnitude. Even minor adjustments by a few members could lead to notable dot plot shifts and rate path changes.

The baseline scenario for traders is that the U.S. labor market faces downside risks, unemployment forecasts may be slightly revised higher, and Powell may acknowledge internal Fed divisions while using moderately hawkish language on the rate cut. With dot plot uncertainty intact, this policy risk hedging could provide some support to gold.

If the Fed's outcome and comments are clearly dovish, gold's upside momentum could strengthen further. Conversely, if economic forecasts show persistent inflation and some Fed members lean hawkish, delaying 2026 rate cuts, profit-taking could intensify, putting short-term pressure on gold prices.

Overall, gold remains in high-level consolidation, and market confidence in its long-term bullish outlook stays firm. In the short term, "range trading and trend-following" remains the preferred strategy. Until $4,250 is decisively breached, chasing positions carries risk. Any reasonable pullback is likely to attract buying interest and support prices.

Aside from the Fed, the market will also monitor policy meetings from the RBA, Bank of Canada, and Swiss National Bank. The market's main tension has shifted from simply validating economic data to pre-pricing potential divergences in major central bank policies. Greater volatility in interest rates and currencies could further enhance gold's appeal as a safe-haven asset.

On Tuesday, the U.S. will release October JOLTS job openings, expected at 7.15 million. This will be the first data reflecting the true labor market post-government shutdown, potentially shaping expectations for Fed policy.

If the figure falls below consensus, it may reinforce expectations of a weaker labor market, increase the probability of rate cuts, and provide additional support for gold.

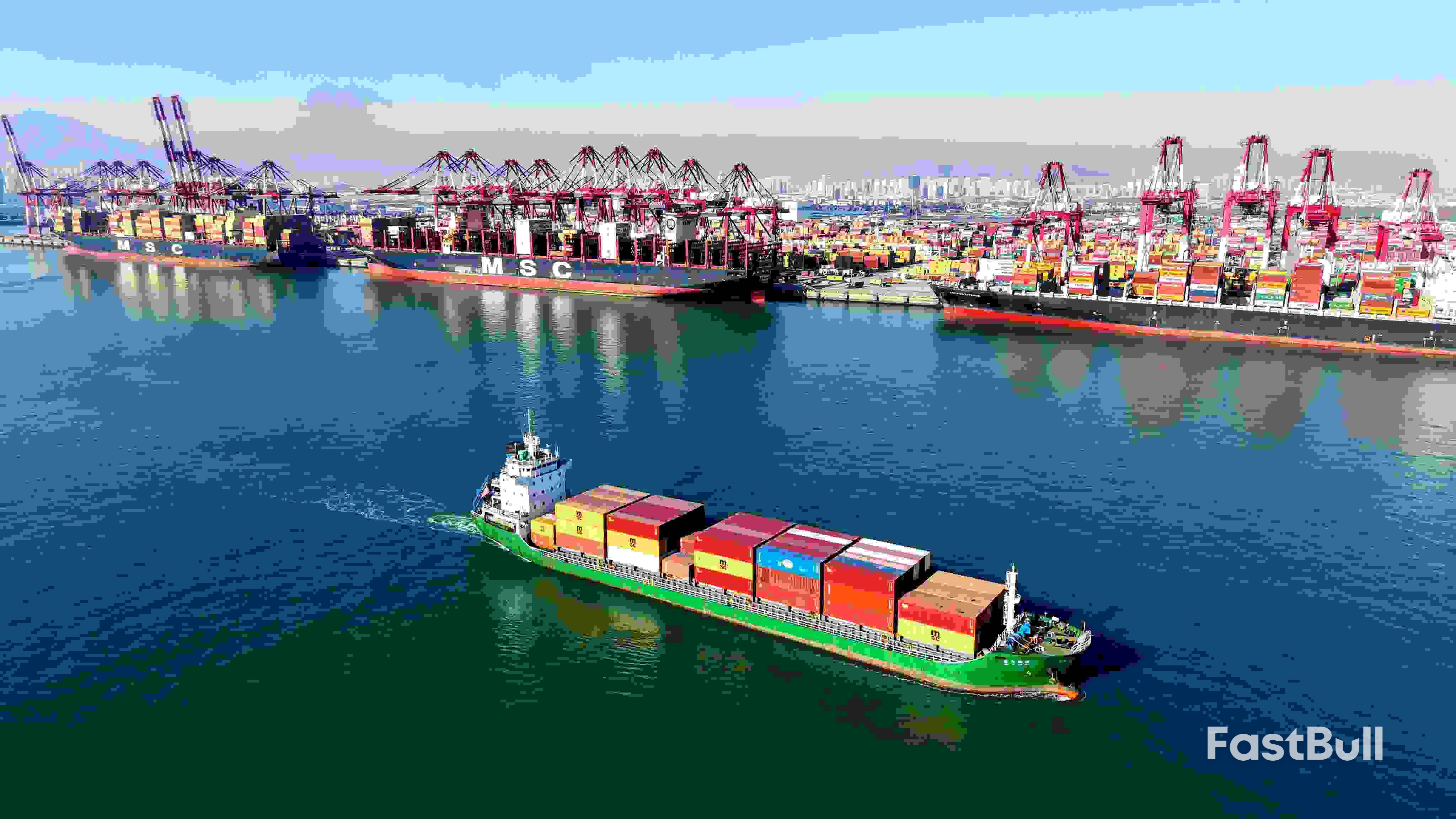

China's exports massively beat market expectations in November as manufacturers rushed to ship out inventory on the back of a trade deal with Washington, following a meeting between the leaders of the world's top two economies.

Outbound shipments surged 5.9% in November in U.S. dollar terms from a year earlier, China's customs data showed Monday, topping economists' forecast for a 3.8% growth in a Reuters poll. That growth marked a rebound from an unexpected 1.1% drop in October — the first contraction since March 2024.

Imports growth of 1.9%, however, missed expectations for a 3% rise, as Beijing renewed pledges to expand imports and work toward balancing trade amid widespread criticism against its aggressive exports.

Imports had grown just 1% in October from a year earlier as a protracted housing downturn and rising job insecurity continued to be drag on domestic consumption.

Chinese manufacturers breathed a sigh of relief after Chinese leader Xi Jinping and U.S. President reached a deal during their meeting in South Korea in late October, putting on hold a raft of restrictive measures for one year.

The two sides agreed to roll back steep tariffs on each other's goods, export controls for critical minerals and advanced technology, with Beijing committing to buying more American soybeans and working with Washington to crack down on fentanyl flows.

Following the truce, the U.S. levies on Chinese goods remain at around 47.5% according to Peterson Institute for International Economics. Beijing tariffs on imports from the U.S. stand at around 32%

China's factory activity shrank for an eighth month in November, an official manufacturing survey showed, with new orders staying in contraction. A private survey focused on exporters showed manufacturing activity unexpectedly fell into contraction.

Chinese policymakers are expected to meet later this month for the annual Central Economic Work Conference, to discuss economic growth target, budget and policy priorities for next year. The specific targets will not be officially announced until the "Two Sessions" meeting in March next year.

Beijing is expected to keep the 2026 growth target unchanged at "around 5%," according to Goldman Sachs, which would require incremental policy easing early next year to ensure a growth acceleration from a likely lackluster reading in the fourth quarter of 2025.

The Wall Street bank expects Chinese authorities to lift the augmented fiscal deficit ceiling by 1 percentage point of GDP, cut policy rates by a total of 20 basis points and step up stimulus measures to rein in the housing slump.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up