Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold surged over 40% in 2025, outpacing stocks and bitcoin, driven by Fed rate cut bets, dollar weakness, and central bank buying. Analysts see potential gains toward \$5,000 by 2026 amid global uncertainty.

Reports claiming the Trump administration attempted to remove Fed Governor Jerome Powell have no substantiated basis from primary sources or official announcements as of September 2025.

Potential removal of a Fed Chair could destabilize financial markets, affecting cryptocurrency volatility, but no confirmed legal actions or disruptions have been noted.

Trump Administration Allegedly Appeals Court to Block Fed Chair Removal

Rumors of Trump seeking legal action to remove Fed Chair Jerome Powell circulate without official confirmation.

The circulating rumors about Powell’s potential removal have prompted discussions among analysts and market participants. While no official evidence supports these reports, concerns about leadership uncertainties could influence market sentiment towards both traditional and crypto assets. As of now, neither Trump nor Powell has commented on these alleged legal actions.

Analysts Weigh In on Financial and Crypto Implications

Did you know? The Federal Reserve’s leadership roles have historically faced political pressures, but no sitting or former U.S. president has successfully removed a Fed Chair through emergency legal action.

The European Union is very unlikely to impose crippling tariffs on India or China, the main buyers of Russian oil, as U.S. President Donald Trump has urged the bloc to do, EU sources said.

An EU delegation, including the EU's Russia sanctions chief, flew to Washington this week to discuss how the two sides can coordinate on sanctions against Russia over its full-scale invasion of Ukraine.

Officials said Trump urged the EU to hit India and China with up to 100% tariffs in order to put pressure on Russian President Vladimir Putin, who relies on energy revenues to fund his country's war in Ukraine.

The European Commission did not respond to a request for comment.

The European Union has imposed extensive sanctions on Russia and also listed two Chinese banks as well as a major Indian refinery in its last package in July.

However, the EU treats tariffs in a different way to sanctions and only imposes them after an investigation typically lasting months to establish a legally sound justification, the sources said.

The bloc has so far only imposed tariffs in the context of the Ukraine war on Russian and Belarusian fertilizers and farm products. The justification for the measures was to prevent creating a dependency that could be exploited and to avoid harm to EU fertiliser producers.

"So far, there is no discussion on possible tariffs neither on India...nor with China," an EU diplomat said.

Furthermore, the EU is in the midst of finalising a trade deal with India, which the bloc is unlikely to want to jeopardize.

Trump's position on India also appeared to ease by Wednesday, when he said he was looking to reset trade relations with New Delhi.

Another EU source said such tariffs were risky and could be too broad and it was easier to sanction specific entities and open the door to delist them if they ended their business with Russia.

Up to now, the EU had limited itself to listing small and unknown entities in third countries, which were often shell companies used to funnel military equipment or dual-use goods for use by Russia's military.

The EU is planning to list banks in two central Asian countries in its 19th package of sanctions as well as Chinese refineries, which could be proposed as soon as Friday.

U.S. producer prices unexpectedly fell in August amid a compression in trade services margins and mild increase in the cost of goods, suggesting that domestic businesses were probably absorbing some of the tariffs on imports.

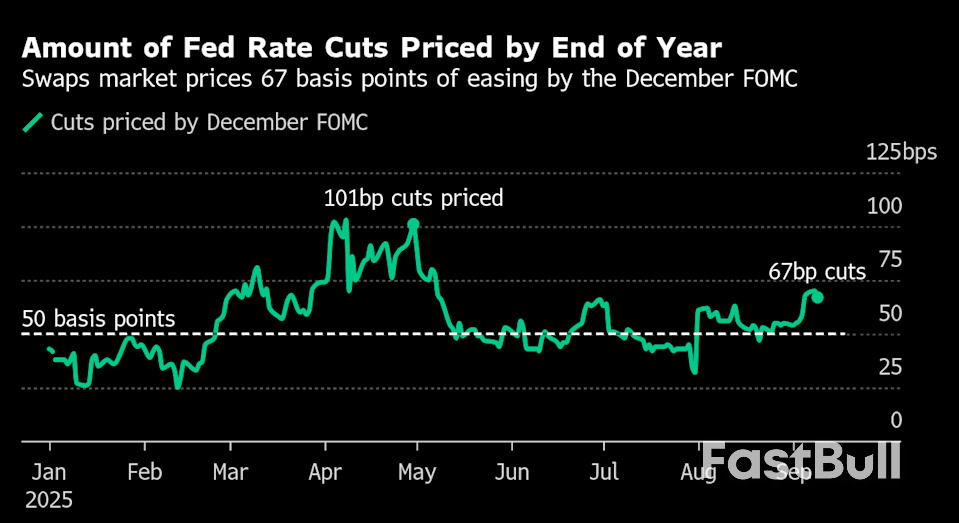

The lack of strong producer price pressures, despite import duties, could also be signaling softening domestic demand against the backdrop of a struggling labor market. The Federal Reserve is expected to cut interest rates next Wednesday, with a quarter-percentage-point reduction fully priced in, after pausing its easing cycle in January because of uncertainty over the impact of President Donald Trump's sweeping tariffs."Inflation barely has a heartbeat at the producer level which shows the tariff effect is not boosting across-the-board price pressures yet," said Christopher Rupkey, chief economist at FWDBONDS. "As time goes on one has to wonder if there are slow-growth reasons and weak economic demand that is keeping inflation in check. There is almost nothing to stop an interest rate cut from coming now."

The Producer Price Index for final demand dipped 0.1% last month after a downwardly revised 0.7% jump in July, the Labor Department's Bureau of Labor Statistics said on Wednesday. Economists polled by Reuters had forecast the PPI would advance 0.3% after a previously reported 0.9% surge in July.A 0.2% drop in the prices of services accounted for the fall in the PPI. That followed a 0.7% rebound in July. Services were last month held down by a 1.7% decline in margins for trade services, reflecting a 3.9% decrease in margins for machinery and vehicle wholesaling.

But the cost of services less trade, transportation and warehousing increased 0.3% while prices for transportation and warehousing services shot up 0.9%.

Portfolio management fees increased 2.0%. Airline fares rose 1.0% while the cost of hotel and motel rooms increased 0.9%. Prices for dental services accelerated 0.6%.

Goods prices edged up 0.1% after increasing 0.6% in the prior month. Food prices gained 0.1%, with declines in the costs of eggs and fresh fruits partially offsetting more expensive beef and coffee because of tariffs. Wholesale beef prices surged 6.0% while those for coffee vaulted 6.9%.

Energy prices fell 0.4%. Excluding the volatile food and energy components, producer goods prices rose 0.3% after climbing 0.4% in July, indicating some pass through from tariffs. In the 12 months through August, the PPI increased 2.6% after climbing 3.1% in July.

Economists are expecting price pressures from tariffs to lift consumer inflation in August.

U.S. stocks opened higher. The dollar eased against a basket of currencies. U.S. Treasury yields fell.

Labor market weakness has raised concerns that the economy was stagnating. The government estimated on Tuesday that the economy likely created 911,000 fewer jobs in the 12 months through March than previously estimated.

That data followed the release last Friday of the monthly employment report, which showed job growth almost stalled in August and the economy shed jobs in June for the first time in four and a half years.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up