Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Germany's secret war preparations have been exposed, aiming to reshape the European military landscape. Poland is deeply concerned, and US-Russia relations may face further uncertainty. A potential power struggle is unfolding.

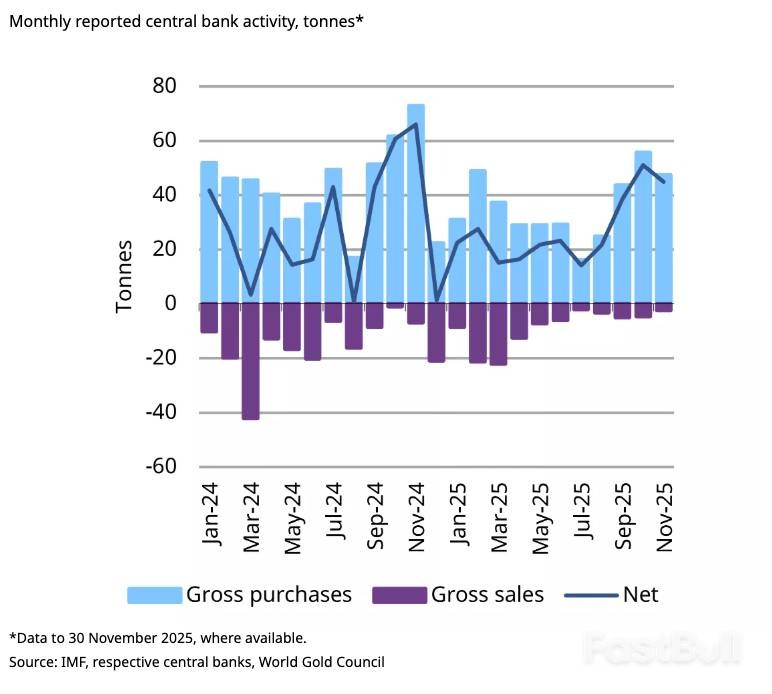

Global central banks extended their gold purchasing streak into November, building on significant momentum that began in September and accelerated through October.

Official data shows central banks collectively added another 45 tonnes of gold to their reserves in November. While this was a slight decrease from the 53 tonnes acquired the previous month, it reflects a sustained and elevated level of buying compared to earlier in 2025.

This activity follows a strong third quarter, during which officially reported net purchases hit 220 tonnes. This figure marked a 28% increase from the second quarter and was 6% above the five-year third-quarter average.

According to the World Gold Council, the recent demand demonstrates that central banks are continuing to "add gold strategically, despite facing higher prices."

For the second consecutive month, Poland was the most significant buyer, adding another 12 tonnes to its reserves. This purchase brought the country's total gold holdings to 543 tonnes, accounting for 28% of its total reserves. The National Bank of Poland has previously stated its intention to increase its gold allocation to 30% of total reserve assets.

Adam Glapiński, Governor of the National Bank of Poland, has described gold as "the only safe investment for state reserves" amid global turmoil. He emphasized that gold is not tied to any single national economy, serves as a safe haven, and maintains its long-term value. "It is a symbol of stability that enhances our credibility," Glapiński noted. To date, Poland is the top central bank gold purchaser, having increased its reserves by 95 tonnes.

Brazil also continued its buying for the third straight month, adding 11 tonnes in November. Over the past three months, the country has increased its gold holdings by 43 tonnes, bringing its official total to 172 tonnes, or about 6% of its reserves.

The People's Bank of China reported another purchase in November, adding one tonne and marking its 13th consecutive month of increasing its official reserves. Over this period, China has officially added 401 tonnes, bringing its stated holdings to over 2,300 tonnes, which represents around 7% of its total reserves.

However, there is widespread analysis suggesting China's actual holdings are substantially larger than its public disclosures. Research from Jan Nieuwenhuijs indicates the People's Bank of China may hold over 5,000 tonnes of monetary gold—more than double the officially admitted figure. This discrepancy has started to gain attention in mainstream financial reporting.

Several other central banks contributed to the net increase in global gold reserves:

• Uzbekistan: The central bank added 10 tonnes in November, following a 9-tonne purchase in October. This follows a period of selling in September, a common pattern for banks that source gold from domestic production.

• Kazakhstan: The National Bank of Kazakhstan was also a buyer, expanding its reserves by 8 tonnes.

• Czech Republic: The Czech National Bank continued its steady accumulation, adding 2 tonnes for its 33rd straight month of purchases. It now holds 71 tonnes and aims to reach 100 tonnes by 2028.

• Other Buyers: The National Bank of the Kyrgyz Republic added 2 tonnes, while the Bank of Indonesia increased its holdings by 1 tonne.

Additionally, the Bank of Tanzania reported purchasing 15 tonnes of refined gold in the first year of its Domestic Gold Purchase Program, aimed at strengthening its foreign reserves. The only notable sellers in November were Jordan and Qatar.

While the pace of gold buying slowed slightly in 2025, the strong performance in the latter part of the year underscores a persistent strategic trend. The World Gold Council remains bullish, highlighting its 2025 survey where 95% of central bank respondents expect global gold reserves to rise over the next year.

This trend is part of a larger pattern. In 2024, central banks increased their gold holdings by a net 1,044.6 tonnes, the 15th consecutive year of expansion. This was the third-largest increase on record, just shy of the totals in 2023 and the all-time high of 1,136 tonnes set in 2022. For context, the average annual increase between 2010 and 2021 was just 473 tonnes.

Analysts at the World Gold Council have called central bank purchasing "surprisingly resilient" and expect the buying spree to continue. A key driver identified is diversification, specifically "a reduction of U.S. assets." This move is widely seen as a component of de-dollarization, as nations seek to reduce their reliance on the U.S. dollar amid geopolitical uncertainty.

While President Donald Trump has lauded the recent U.S. military operation in Venezuela as "amazing," new polling data reveals a deeply divided American public. A Reuters/Ipsos poll published Monday shows that U.S. opinion is almost perfectly split on the decision to oust the country's president.

The survey, conducted on January 4 and 5 among more than 1,200 adults, found that:

• 33% of respondents approved of the U.S. military action.

• 34% disapproved of the action.

• 32% remained unsure.

This split sentiment marks a notable change from attitudes prior to the operation. Earlier polls showed clear opposition to intervention. A Quinnipiac University poll in December found 63% of Americans were against military action, while a November CBS News/YouGov survey reported that figure at 70%.

The split in public opinion runs sharply along party lines. The Reuters/Ipsos data shows a near mirror-image reaction between the two major parties:

• Nearly two-thirds of Republicans backed the Trump administration's operation.

• An equal number of Democrats opposed it.

This partisan gap extends to expectations for Venezuela's future. Republicans expressed general optimism that the ousting of Nicolás Maduro would improve the country's stability, quality of life, and election fairness. Democrats, in contrast, were far more skeptical of any positive outcomes.

Despite the partisan divide on the operation itself, there is a broad, cross-party consensus on one key point: the fear of getting stuck in Venezuela. A significant majority of Americans are wary of deep or prolonged U.S. involvement.

"They don't want to get too involved. They don't want U.S. troops in Venezuela," said Alec Tyson, a senior vice president at Ipsos Public Affairs. He described the situation as a "narrow path here for the administration," where the public may hope for positive outcomes but remains cautious about the commitment.

This concern is reflected in the numbers:

• Nearly three-quarters of all respondents worried the U.S. would become "too involved."

• This sentiment was shared by 90% of Democrats and over half of Republicans.

"It's clear that the public wants limited—and I really emphasize limited—engagement there," Tyson added.

The Reuters/Ipsos findings align with other recent surveys. A Washington Post poll also found Americans almost evenly divided, with 40% approving of the attack and 42% disapproving.

The Post's survey further highlighted American reluctance to deepen the commitment. When asked about the U.S. taking control of Venezuela—an idea previously suggested by Trump—only about one-quarter of respondents supported the action, while 45% opposed it.

Perhaps the most definitive finding came on the question of sovereignty. An overwhelming majority of Americans—94%—believe the Venezuelan people should be the ones to determine their country's future leadership.

The White House confirmed on Tuesday that President Donald Trump is considering a range of options, including military action, to gain control of Greenland. The administration views the acquisition of the mineral-rich Arctic island as a critical national security objective.

White House Press Secretary Karoline Leavitt stated that the move is aimed at countering Russian and Chinese influence in the Arctic. "The president and his team are discussing a range of options to pursue this important foreign policy goal," Leavitt said. "Utilizing the US military is always an option at the commander in chief's disposal."

This renewed focus on Greenland comes after the US military's seizure of Venezuelan President Nicolas Maduro. Trump has repeatedly argued that controlling Greenland is a strategic necessity for the United States, which already operates the Pituffik Space Base in the island's northwest.

Despite the White House's assertive stance, the idea of military action has met resistance from US lawmakers on both sides of the aisle.

Secretary of State Marco Rubio informed legislators that Trump's preferred method was to purchase Greenland from Denmark and that discussions did not signal an imminent invasion.

Republican House Speaker Mike Johnson told Politico he did not believe military action in Greenland was "appropriate." Similarly, Democratic Senator Ruben Gallego pledged to block any attempt to invade the territory.

However, White House Deputy Chief of Staff Stephen Miller maintained a hardline position in a Monday interview, insisting that Greenland should be part of the US. "Nobody is going to fight the US militarily over the future of Greenland," Miller said, while also questioning the legitimacy of Denmark's territorial claim.

Greenlandic and Danish officials have firmly rebuffed the idea of a US takeover, calling for immediate talks with Washington to resolve what they term "misunderstandings."

Greenland's Prime Minister Jens-Frederik Nielsen reiterated Tuesday that the island is not for sale and that its future can only be decided by its own people. Greenland, a former Danish colony, has been a self-governing territory within the Kingdom of Denmark since 1953 and holds the right to pursue independence.

Danish Prime Minister Mette Frederiksen issued a stark warning on Monday, stating that a US takeover of Greenland would mean the end of the NATO military alliance.

In a show of support, several European nations—including Britain, France, Germany, Italy, Poland, and Spain—joined Denmark in issuing a joint statement of solidarity with Greenland.

China's central bank has laid out its 2026 roadmap, placing the digital yuan—also known as the e-CNY—at the heart of its strategy to expand the nation's financial influence. Following a policy conference from January 5-6, 2026, the People's Bank of China (PBOC), led by Governor Pan Gongsheng, signaled a decisive shift from domestic testing to promoting the e-CNY for cross-border transactions.

The key priorities for the year ahead include:

• Expanding the international use of the digital yuan.

• Strengthening infrastructure for global yuan payments and settlement.

• Leveraging currency swap agreements to reduce dependence on the U.S. dollar.

• Continuing the development of the e-CNY while maintaining strict supervision of private cryptocurrencies.

After years of pilot programs that began in 2020, the PBOC is officially moving to internationalize its digital currency. The central bank stated it will "steadily advance the development of the digital RMB" and accelerate the creation of infrastructure to support cross-border yuan transactions.

This strategic push is already moving past the theoretical stage. A recent transaction involving Laos was reported as the first cross-border use of the digital yuan, indicating that international applications are becoming a reality. The 2026 agenda confirms a clear transition from domestic experiments in retail and transport toward broader integration into the global financial system.

To support this goal, the PBOC will encourage wider adoption of the yuan for trade and investment settlement and push financial institutions to enhance their cross-border RMB services. The bank is also working with foreign monetary authorities to establish the technical and regulatory standards needed for seamless international e-CNY transactions.

Reducing Dollar Reliance and Boosting the Yuan

A core objective behind the e-CNY's global push is to reduce reliance on the U.S. dollar in international trade. The PBOC plans to expand the use of bilateral currency swap arrangements, which allow countries to settle trade directly in their local currencies and promote the yuan's circulation.

Other initiatives designed to boost the yuan's global appeal include:

• Opening Bond Markets: China will continue to welcome foreign entities to issue "panda bonds"—yuan-denominated bonds sold within China—to deepen its domestic capital markets.

• Integrating Payment Systems: The bank aims to build international links between fast payment systems and promote cross-border cooperation on QR-code payments.

Alongside its digital currency ambitions, the PBOC reaffirmed its plan to maintain a moderately loose monetary policy in 2026. The bank will flexibly use tools like reserve requirement ratio cuts and interest rate adjustments to ensure sufficient liquidity in the financial system.

The conference also highlighted the need to improve financial support for the real economy, targeting five key areas:

• Technology finance

• Green finance

• Inclusive finance

• Pension finance

• Digital economy finance

In 2025 alone, over 700 entities reportedly issued more than 1.5 trillion yuan in science and technology innovation bonds. Further reforms are also planned for market access programs like Bond Connect and Swap Connect, which give international investors entry into China's onshore bond and derivatives markets via Hong Kong.

While championing its state-backed digital currency, the PBOC reiterated its hardline stance on private digital assets. The bank pledged to strengthen supervision of virtual cryptocurrencies, continue its crackdown on illegal activities, and implement tighter anti-money laundering controls.

At the same time, China is positioning itself for a larger role in global finance. The PBOC announced its support for the development of the International Monetary Fund Shanghai Center, a move that underscores its ambition to increase its influence within the international financial architecture.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up