Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Treasury chief Rachel Reeves was clearly considering becoming the first Chancellor of the Exchequer in 50 years to increase the basic rate of income tax.

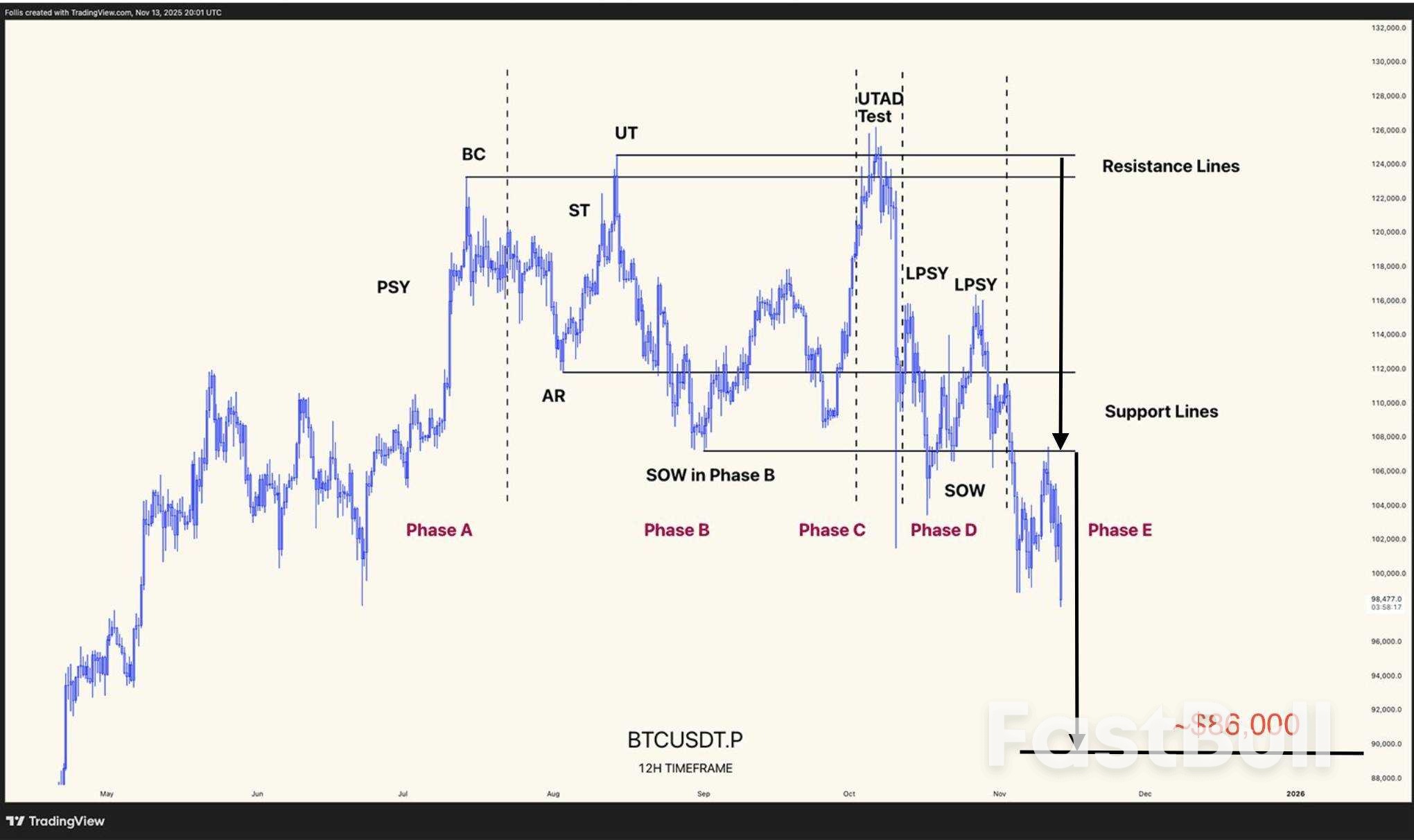

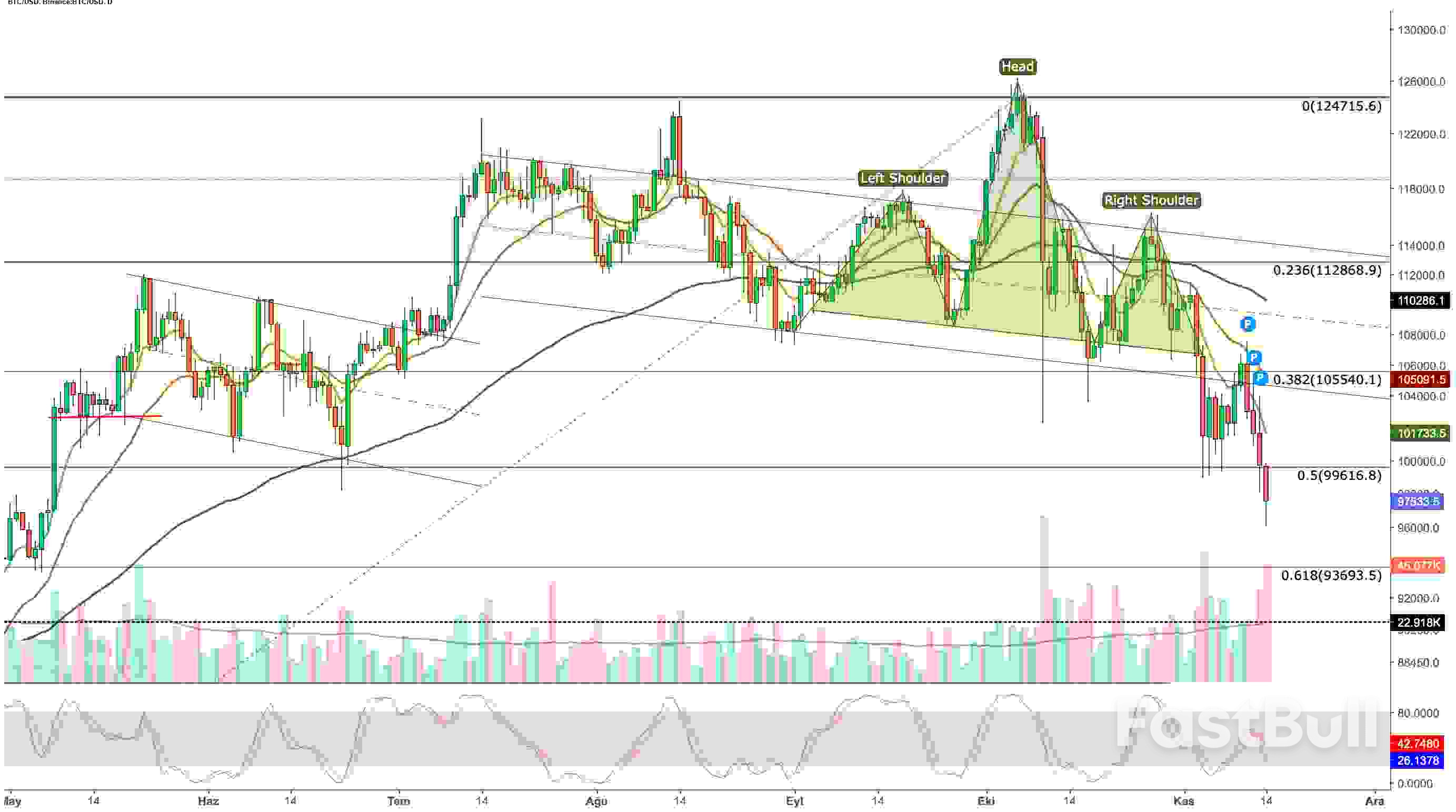

Bitcoin's drop below $100,000 comes as a Wyckoff Distribution pattern points to a potential decline toward $86,000.

Some analysts remain optimistic, arguing that the bull market will hold as long as the $94,000 support level remains intact.

Bitcoin (BTC) has just slipped under the key $100,000 support level, driven by hawkish Federal Reserve prospects and persistent whale selling.

BTC/USDT four-hour chart. Source: TradingView

BTC/USDT four-hour chart. Source: TradingViewNow, a classic technical breakdown setup is strengthening the case for prolonged selling in the Bitcoin market.

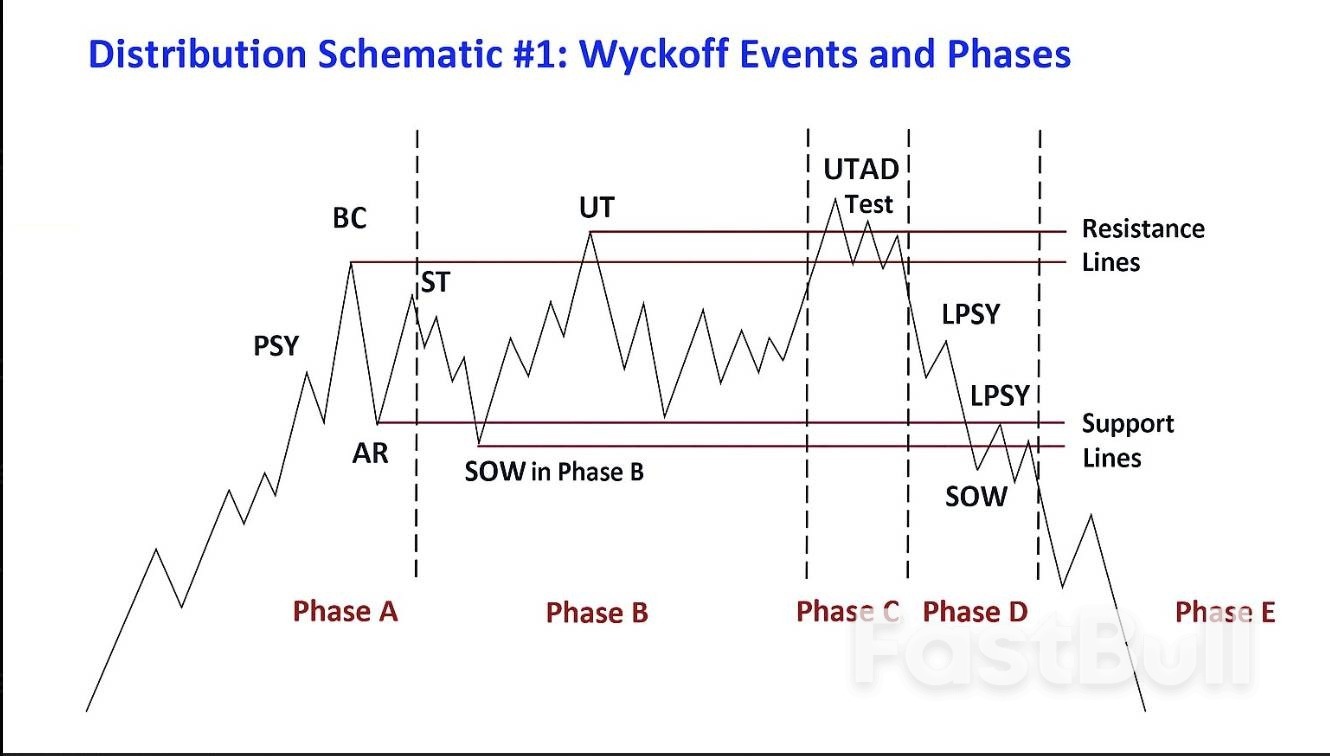

Wyckoff distribution model warns of BTC price drop to $86,000

The schematic, highlighted by analyst @follis_ on X, shows Bitcoin's recent structure tracking the classic five-phase Wyckoff Distribution, a pattern often seen near macro market tops, as shown below.

Wyckoff distribution schematic illustration

Wyckoff distribution schematic illustrationThe alignment is strong enough that the Bitcoin bull market "might actually be over," @follis_ said.

BTC's surge above $122,000 marked the Buying Climax (BC), followed by an Automatic Reaction (AR) and Secondary Tests (ST) that failed to create higher highs.

BTC/USDT daily chart. Source: TradingView/follis_

BTC/USDT daily chart. Source: TradingView/follis_The early-October push toward $126,200 resembled an Upthrust After Distribution (UTAD), a final bullish deviation that signals demand exhaustion.

From there, Bitcoin printed multiple Last Points of Supply (LPSY) and lost mid-range support near $110,000, confirming Phase D.

It dropped below the AR/SOW zone at $102,000–$104,000, then shifted BTC into Phase E, the markdown phase, accelerating the decline. By Friday, BTC had dropped below $95,000 on Binance.

Based on Wyckoff's measured-move method, the $122,000–$104,000 distribution band implies an $18,000 downside projection, i.e., $86,000 as the primary target.

BTC/USDT daily chart. Source: TradingView/follis_

BTC/USDT daily chart. Source: TradingView/follis_The bearish shift occurred as global risk appetite deteriorated, driven by fears that the Federal Reserve would not cut interest rates in December.

The US government shutdown, which ended on Thursday, restricted access to key economic data, making policymakers less confident about easing monetary policy. That uncertainty rippled through risk assets, hurting Bitcoin alongside US stocks.

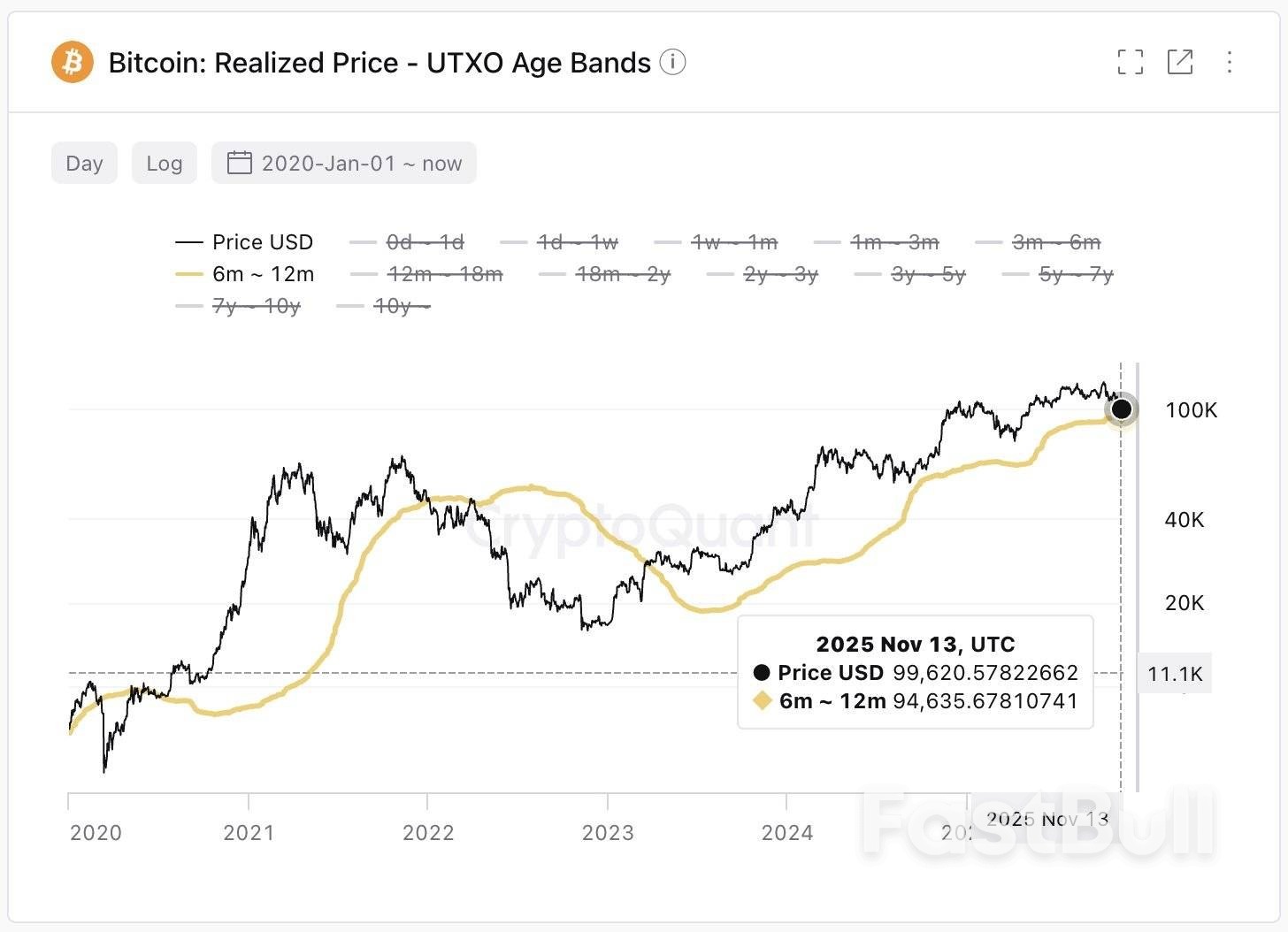

Bitcoin's broader uptrend remains intact unless the price falls below the key $94,000 level, the average cost basis of six- to 12-month holders, according to CryptoQuant CEO Ki Young Ju.

Bitcoin realized price UTXO band chart. Source: CryptoQuant

Bitcoin realized price UTXO band chart. Source: CryptoQuantBitwise CEO Hunter Horsley said Bitcoin "may have been in a bear market for almost six months" and is now nearing the end of it, adding that "the setup for crypto right now has never been stronger."

Treasuries stalled as traders awaited a raft of delayed economic data with the potential to revive expectations for Federal Reserve interest-rate cuts.

Yields were broadly flat across most maturities mid-morning in New York Friday after falling toward their lowest levels of the week earlier in the session. The five-year rate reached 3.65%, the lowest level since Oct. 29, when the Fed cut rates for the second straight time.

Since then, expectations for a third rate cut in December have faded, with derivatives this week pricing in less than 50% chance of a move.

However bond traders are anticipating that the resumption of US government economic data, suspended during the six-week US government shutdown, may support a December cut, even as several Fed officials this week have said they're opposed to one.

"The market has priced in a weaker labor market story — not terrible but weak," said Ed Al-Hussainy, a portfolio manager at Columbia Threadneedle Investments. "Unless inflation runs away, it's difficult to take out the easing expectations."

The outlook for US economic data that weren't published during the shutdown from Oct. 1 to Nov. 12 remains unclear. Release dates haven't been announced yet, and there's been conflicting guidance on whether some reports will be missed. For example, National Economic Council Director Kevin Hassett Nov. 13 said the October jobs report will be released without the unemployment rate, a day after the White House said the jobs report and consumer price index for October were unlikely to be released.

Hassett also said about 60,000 job losses were possible because of the shutdown. The Fed cut interest rates in September and October in response to signs of weakness in US employment, even as inflation continues to exceed its target.

Accordingly, traders are anticipating that worsening labor-market conditions can win over the several Fed officials who've said cutting rates again in December would be a mistake. Most recently, Kansas City Fed President Jeff Schmid Friday said additional interest-rate cuts could do more to ingrain higher inflation than shore up the labor market.

In the Treasury options market, where wagers on the 10-year note's yield falling below 4% in coming weeks have piled up. The 10-year last traded below 4% on Oct. 29, before Fed Chair Jerome Powell said a December rate cut was far from certain.

Bond traders also are mindful of the potential for a pause in Fed rate cuts to hurt demand for risky assets and stoke demand for safer Treasuries, which might otherwise suffer from a Fed pause. The outlook for lower rates has helped lift US equity benchmarks to record highs in the past month, and stretched valuations for several giant technology companies have drawn warnings from investors and Wall Street CEOs.

"If you tell the markets that there will be no cuts, risk markets will unwind. So it's tough to trade from the short side," Al-Hussainy said.

Treasury yields reached their highest levels of the day before US markets opened, when the UK government bond market was rocked by reports that the government will drop a proposed income tax increase. Long-dated UK yields climbed as much as 14 basis points and remained near session highs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up