Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Airline ETFs Rise Over 2.6%, Leading US Sector ETFs; S&P Technology Sector Falls Over 1.8%] On Thursday (January 29), The Global Airline ETF Rose 2.64%, Regional Bank ETFs And Banking ETFs Rose Up To 1.84%, The Energy ETF Rose 0.92%, The Semiconductor ETF Rose 0.21%, The Internet Stock Index ETF And Consumer Discretionary ETF Fell Up To 0.48%, The Technology Sector ETF Fell 1.58%, And The Global Technology Stock Index ETF Fell 1.76%. Among The 11 Sectors Of The S&P 500, The Information Technology/technology Sector Fell 1.86%, The Consumer Discretionary Sector Fell 0.64%, The Energy Sector Rose 1.08%, The Real Estate Sector Rose 1.42%, And The Telecommunications Sector Rose 2.92%

On Thursday (January 29), Spot Silver Fell 0.61% To $116.0075 Per Ounce In Late New York Trading, Trading Between $121.6540 And $106.8954. Comex Silver Futures Rose 2.87% To $116.790 Per Ounce. Comex Copper Futures Rose 0.78% To $6.2855 Per Pound, Having Reached $6.5830 At 22:31 Beijing Time. Spot Platinum Fell 2.65%, And Spot Palladium Fell 2.34%

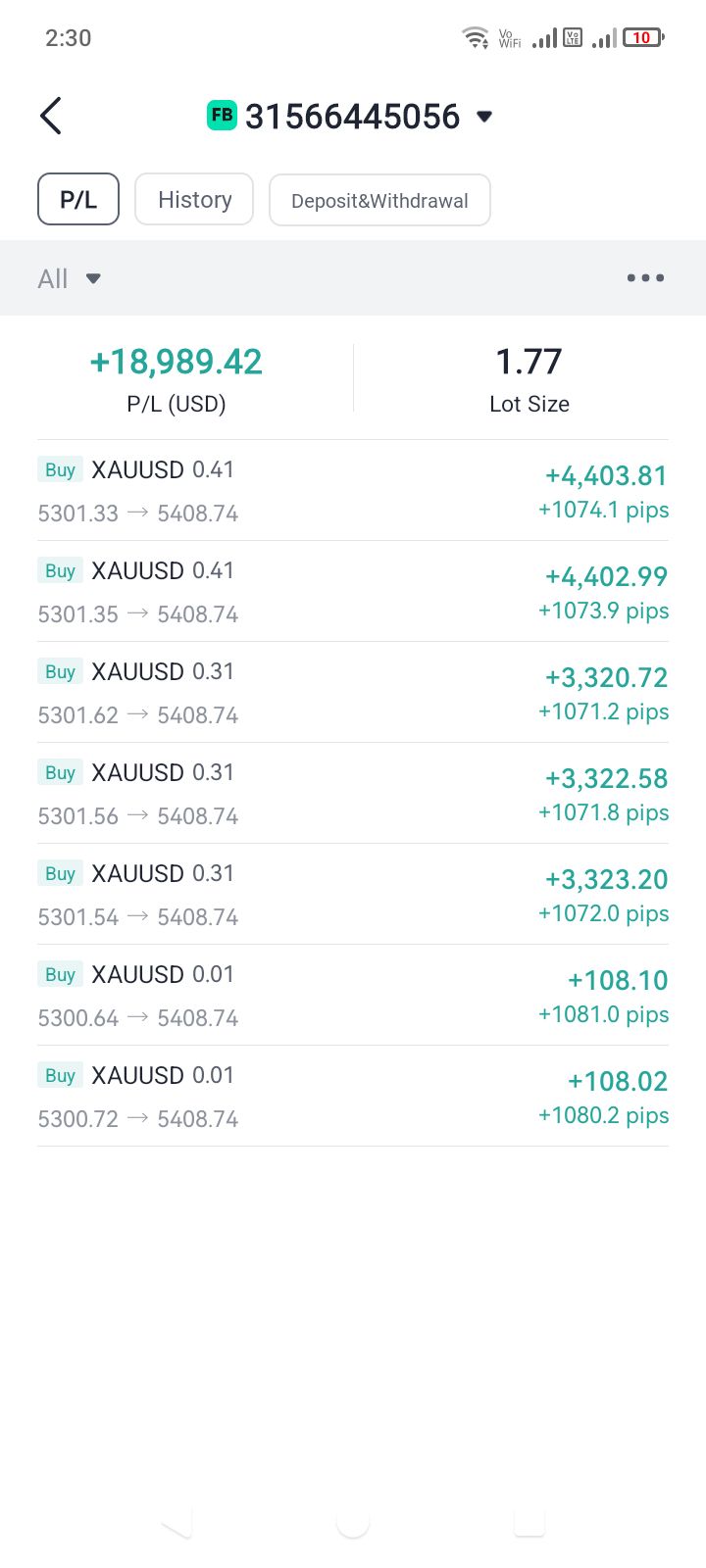

On Thursday (January 29), Spot Gold Rose 0.43% To $5,394.00 Per Ounce In Late New York Trading. At 14:23 Beijing Time, It Reached $5,595.47, Continuing To Set New Historical Highs. A Short-term Plunge Began At 23:00, Hitting A Daily Low Of $5,459.31 At 23:36. Comex Gold Futures Rose 1.97% To $5,408.30 Per Ounce, Having Reached $5,586.20 At 14:22

Stryker: Foreign Exchange Is Expected Slightly Positive Impact On Sales & Adj Net Eps Should Rates Hold Near Year-To-Date Levels For 2026

Bank Of Canada: Canada Government Will Participate In All Fixed-Rate Cmb Syndications Proposed For 2026

Toronto Stock Index .GSPTSE Unofficially Closes Down 159.94 Points, Or 0.48 Percent, At 33016.13

The S&P 500 Initially Closed Down 0.1%, With The Technology Sector Down 2%, Consumer Discretionary Down 0.6%, Energy Up 1.1%, And Telecoms Up 3%. The NASDAQ 100 Initially Closed Down 0.5%, With Atlassian, Microsoft, And Strategy Technology Among The Worst Performers, All Down Approximately 10%. Synopsys Fell 6%, Cadence Fell 5.7%, ASML Rose 2%, And Meta Rose 10.8%. Salesforce Initially Closed Down 6.3%, Boeing Fell 3%, And Microsoft Led The Decline Among Dow Jones Components. JPMorgan Chase Rose 1.6%, Honeywell Rose 4.9%, And IBM Rose Approximately 5%

The Nasdaq Golden Dragon China Index Closed Up 0.3% Initially. Among Popular Chinese Concept Stocks, NIO Closed Up 3.8%, Yum China Rose 1%, Tencent, New Oriental, Li Auto, Xiaomi, And Meituan Rose By More Than 0.9%, Alibaba Fell 0.7%, NetEase Fell 1.3%, WeRide Fell 4.5%, And Pony.ai Fell 7.9%. In The ETF Market, Ashr Rose 0.9%, Kweb Rose 0.5%, And Cqqq Fell 1.5%

ANZ - Roy Morgan New Zealand Consumer Confidence Index 107.2 In January From 101.5 Previous Month

USA Treasury: Thailand Added To Monitoring List Of Trading Partners Whose Currency Practices 'Merit Close Attention' Due To Its Growing Current Account Surplus And Trade Surplus With USA

USA Treasury: No Major Trading Partners Met All Three Criteria For Enhanced Analysis During Review Period

USA Treasury: Now Monitoring More Broadly Whether Countries That Smooth Exchange Rate Movements Do So To Resist Depreciation Pressures

USA Treasury Official Says New Criteria Not Aimed At Any Specific Country On Monitoring List But Will Aid Future Analysis During A Period Of Relative Dollar Depreciation

USA Treasury: Monitoring Trading Partners' Use Of Capital Controls, Macroprudential Measures, Government Investment Vehicles To Influence Foreign Exchange Markets

On Thursday (January 29), The Bloomberg Electric Vehicle Price Return Index Fell 1.76% To 3646.11 Points In Late Trading. The Index Was Down Throughout The Day, Trading Around 3680 Points For More Than Half The Time, And Its Decline Accelerated After 10:00 PM Beijing Time

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)A:--

F: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)A:--

F: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)A:--

F: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)A:--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)A:--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)A:--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)A:--

F: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)A:--

F: --

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Fed held rates, cautious on inflation. Markets now scrutinize economic data, leaving crypto to struggle for momentum.

The Federal Reserve is holding interest rates steady, signaling that policymakers aren't ready to declare victory over inflation. For traders and investors, this means the focus is shifting away from Fed announcements and squarely onto hard economic data for market direction.

Analysts suggest the Fed's decision reflects a cautious confidence. While restrictive policy has successfully cooled demand without causing significant job losses, the progress on inflation isn't yet enough to warrant a rate cut.

Iliya Kalchev of Nexo Dispatch noted that officials seem comfortable maintaining tight financial conditions until the economy shows more definitive signs of slowing. He pointed to steady jobless claims and resilient consumer spending as evidence that the current policy is moderating demand "without triggering meaningful job losses," aligning with the central bank's goal of a soft landing.

This wait-and-see approach means markets will likely react more to major economic data releases—like inflation and employment reports—than to the Fed's own guidance in the coming months.

For the digital asset market, the Fed's decision to hold rates was widely anticipated and already priced in. As a result, market sentiment now hinges on clues about when easier financial conditions might finally arrive.

Javed Khattak, co-founder of cheqd.io, explained that attention has moved beyond the decision itself to the message behind it. "The Fed holding rates was expected and fully priced in," he said, adding that investors are now seeking clarity on whether policymakers are leaning toward looser conditions later this year.

Ryan Lee of Bitget Research added that steady rates help maintain supportive liquidity conditions for risk assets, which sustains appetite for equities, commodities, and crypto.

Bitcoin Struggles for Momentum

Despite the stable policy environment, market dynamics remain cautious. A report from Bitfinex Alpha highlighted that Bitcoin (BTC) and the wider crypto market have struggled to break higher. The primary obstacles are weakening spot demand and outflows from exchange-traded funds (ETFs), which are limiting upward momentum.

The report notes that Bitcoin remains range-bound as institutional flows have slowed. This situation leaves prices dependent on fresh demand catalysts before a sustained rally can materialize and helps explain the muted market reaction to the Fed's announcement.

Speaking after the decision, Fed Chair Jerome Powell remarked that recent economic performance makes it difficult to label the current policy as clearly restrictive.

"It's hard to look at the incoming data and say that policy is significantly restrictive at this time," Powell stated. He suggested that the Fed's policy might now be "sort of loosely neutral or it may be somewhat restrictive."

Powell pointed to several key indicators:

• Economic growth remains resilient.

• Labor market conditions appear to be stabilizing, with unemployment at 4.4% in December.

• Core PCE inflation, while down from its 2022 peak, is still running at 3.0% annually—above the Fed's 2% target.

This backdrop reinforces the view that investors should watch the data, as the Fed will be waiting for clearer economic signals before making its next move.

U.S. President Donald Trump announced Thursday that he secured a one-week pause in Russian attacks on Kyiv and other Ukrainian cities from President Vladimir Putin, citing the region's severe cold temperatures. The Kremlin has yet to confirm any such agreement.

The announcement comes as Russia continues its campaign of targeting Ukraine's critical infrastructure, a strategy designed to weaken public resolve by cutting off heat and power during the coldest months of winter.

Speaking at a White House Cabinet meeting, Trump said he personally requested the pause from the Russian leader.

"I personally asked President Putin not to fire on Kyiv and the cities and towns for a week during this ... extraordinary cold," Trump stated, adding that Putin "agreed to that."

The Republican president expressed satisfaction with the outcome. "A lot of people said, 'Don't waste the call. You're not going to get that,'" Trump remarked. "And he did it. And we're very happy that they did it."

However, details about the timing and scope of this limited ceasefire in the nearly four-year war remain unclear. Trump did not specify when his call with Putin occurred or when the pause would begin, and the White House did not immediately provide further information.

Ukrainian President Volodymyr Zelenskyy had warned late Wednesday that intelligence suggested Moscow was preparing for another major barrage, casting doubt on the pause just as U.S.-brokered peace talks are scheduled for the weekend.

From Moscow, Kremlin spokesman Dmitry Peskov declined to comment when asked earlier on Thursday if a mutual halt on strikes against energy facilities was under discussion.

Ukraine is bracing for a brutal cold front, with temperatures expected to drop as low as minus 30 degrees Celsius (minus 22 Fahrenheit) in some areas starting Friday, according to the State Emergency Service. Ukrainian officials have consistently described Russia's strategy of targeting civilian infrastructure during winter as "weaponizing winter."

The ongoing attacks continue to discredit the peace process, according to Zelenskyy. "Every single Russian strike does," he said Wednesday.

Last year was the deadliest for civilians in Ukraine since Russia's full-scale invasion on February 24, 2022. The U.N. Human Rights Monitoring Mission reported that intensified Russian aerial attacks behind the front line killed 2,514 civilians and injured 12,142, a 31% increase from 2024.

The daily bombardments persist. Overnight, a Russian drone attack in the southern Zaporizhzhia region killed three people and started a large fire in an apartment building. In the central Dnipropetrovsk region, two people were injured as firefighters battled blazes caused by strikes.

While diplomatic efforts continue, international partners remain wary of Russia's commitment. The European Union's top diplomat, Kaja Kallas, accused Russia of not taking the negotiations seriously and called for increased pressure on Moscow.

"We see them increasing their attacks on Ukraine because they can't make moves on the battlefield. So, they are attacking civilians," Kallas said Thursday in Brussels. She insisted that Europe must be fully involved in any talks, expressing concern that European security interests might be overlooked in a settlement process led primarily by the Trump administration.

In contrast, Trump's special envoy, Steve Witkoff, expressed optimism. He noted that "a lot of progress" was made in recent talks and anticipates more headway in the coming days. "I think the people of Ukraine are now hopeful and expecting that we are going to deliver a peace deal sometime soon," Witkoff said.

An international think tank report published Tuesday projected a grim milestone, estimating that the total number of soldiers killed, injured, or missing on both sides could reach 2 million by spring.

The conflict is also being fought on a technological front. Ukrainian Defense Minister Mykhailo Fedorov confirmed Thursday that Ukraine is working with SpaceX to address Russia's reported use of the Starlink satellite service for its attack drones.

Fedorov said on Telegram that his team had contacted the aerospace company run by Elon Musk and "proposed ways to resolve the issue." He thanked Musk and SpaceX President Gwynne Shotwell for their "swift response."

SpaceX has navigated a complex position throughout the war. A year after the invasion, Shotwell stated the company was happy to provide connectivity to Ukrainians but also sought to restrict the use of Starlink for military purposes.

U.S. Defense Secretary Pete Hegseth is expected to miss the upcoming NATO defense ministers' meeting in Brussels, a move that is fueling concerns about the United States' commitment to the military alliance. This marks the second consecutive time a top official from the Trump administration has skipped a key NATO gathering, deepening worries among European allies.

The expected absence comes at a time of strained transatlantic relations, recently tested by President Donald Trump's stated desire to acquire Greenland from Denmark, a fellow NATO member.

Hegseth's decision to miss the February 12 meeting follows U.S. Secretary of State Marco Rubio’s failure to attend the NATO foreign ministers' summit in December. While the Pentagon and NATO have declined to comment, the back-to-back no-shows signal a significant shift in U.S. engagement.

Historically, the absence of a top U.S. cabinet official from a NATO ministerial meeting was highly unusual. As the alliance's primary military and political power, consistent high-level participation from the United States has long been considered standard practice.

Oana Lungescu, a former NATO spokesperson now at the RUSI think tank, warned that the move would have consequences. "If confirmed, it will send a bad signal at a very tense time in transatlantic relations, and will only deepen the concerns of other allies about the U.S. commitment to NATO," she said.

The news also surfaced as the Trump administration weighs military options against Iran, a scenario where close coordination with NATO allies would typically be paramount.

This apparent disengagement aligns with a new National Defense Strategy published by the Trump administration last week. The document explicitly redefines America's role, signaling a pivot away from its traditional security posture in Europe.

The strategy states: "In Europe and other theaters, allies will take the lead against threats that are less severe for us but more so for them, with critical but more limited support from the United States."

In place of Hegseth, diplomats expect Elbridge Colby to attend the Brussels meeting. As the Pentagon's policy chief, Colby was a key architect of the new defense strategy.

Experts argue that Hegseth's absence is a missed chance to repair and strengthen the alliance at a critical moment. Jamie Shea, a former senior NATO official and a fellow at the Friends of Europe think tank, noted that the timing is particularly poor. Trump and NATO chief Mark Rutte had recently agreed that the alliance should take on a greater role in Arctic security, partly to ease the tensions over Greenland.

"It has to be recognised that Hegseth has criticised NATO more than he has shown a desire to lead it," said Shea. "At a time when transatlantic security consultations at high level are more needed than ever, this is another missed opportunity for the U.S. to show leadership and initiative in the alliance."

A digital euro is essential to guarantee Europe’s economic sovereignty and reduce its dependence on foreign payment providers, according to European Central Bank Executive Board member Piero Cipollone.

"Today, Europe is significantly reliant on non-European payment systems and if we don't do anything this reliance will increase," Cipollone stated in Rome. He described this dependence as a "structural vulnerability" for the region's economy.

For years, the ECB has been developing a digital counterpart to cash, aiming to lessen the continent's reliance on US-based firms like Visa, Mastercard, and PayPal for everyday retail payments.

Concerns over this financial dependency have intensified amid recent trade threats from Donald Trump. However, Cipollone emphasized that the initiative is driven by the ECB's core mission, not external politics.

"It's not, however, about reacting to someone, but about acting on our mandate," he said. "The ECB must guarantee the proper functioning of payment systems and such a marked dependency on extra-European systems in such a crucial sector represents a systemic risk."

The ECB's project, launched in 2021, is currently awaiting a solid legal framework. Cipollone reiterated a potential timeline where a pilot phase for the digital euro could begin in 2027, with a full issuance following in 2029.

Progress has been slow. While the European Commission presented a proposal in 2023 and member states reached a common position in December, the biggest roadblock remains the European Parliament, which has yet to finalize its stance. Some lawmakers reportedly favor a private-sector alternative over a public digital currency.

Cipollone also addressed the risks posed by stablecoins, which have been championed by figures like Trump. He warned that these instruments could "threaten financial stability" in Europe. The International Monetary Fund has echoed these concerns, noting that stablecoins could disrupt traditional lending, weaken monetary policy, and trigger runs on safe assets.

The ECB official suggested that citizens should be provided with simple and reliable public alternatives. "The response is to guarantee an efficient combination of public and private money in euros," Cipollone explained.

While the primary objective of the digital euro is to serve the domestic economy, he noted that the infrastructure could eventually be expanded for use by countries outside the euro area.

The UK's approach to regulating stablecoins is now under review as the House of Lords Financial Services Regulation Committee initiates a formal inquiry. The committee is seeking public and expert input on the proposed regulatory frameworks drafted by the Bank of England (BoE) and the Financial Conduct Authority (FCA).

Baroness Noakes, the committee's chair, stated the goal is to determine if these proposals are "measured and proportionate" responses to the evolving stablecoin market. The inquiry will also explore the potential impact of stablecoins on traditional financial services like banking and payments, weighing the opportunities against the risks of their increasing adoption in the UK.

Industry participants, experts, and the public have until March 11 to provide written submissions. The committee is also set to hear oral evidence in a public session this Wednesday.

This parliamentary inquiry coincides with ongoing efforts by UK authorities to establish clear oversight for digital assets. The Bank of England has made developing a framework for "systemic stablecoins" a priority, aiming to finalize its approach by the end of the year.

Sasha Mills, the BoE's Executive Director for Financial Market Infrastructure, highlighted that these initiatives are crucial for shaping the future of digital finance in the UK. The central bank's proposed regime for systemic stablecoins includes several key features:

• Central Bank Access: Issuers of systemic stablecoins could hold a deposit account directly with the Bank of England.

• Liquidity Support: A potential liquidity facility would act as a backstop for stablecoin issuers.

• Backing Requirements: Stablecoins would need to be backed by a specific asset mix: 60% in short-term UK government bonds and 40% in Bank of England deposits.

• Holding Limits: To manage risk, temporary holding limits are proposed at £20,000 for individuals and £10 million for businesses.

The BoE defines "systemic stablecoins" as fiat-pegged tokens, particularly those denominated in pound sterling, that are widely used for retail or corporate payments within the UK and could pose a risk to financial stability.

Currently, popular stablecoins like USDC and USDT, which are primarily used for crypto trading, are not classified as regulated payment instruments in the UK. However, this is expected to change under the new regime, with full implementation targeted for October 2027.

The UK's regulatory efforts are developing against a backdrop of starkly different international approaches to stablecoins.

The US Approach: Legislating Guardrails

In the United States, the GENIUS Act, signed in 2025, provides a clear regulatory path. The law mandates that stablecoins must be backed one-for-one by US dollars or equivalent high-quality liquid assets, such as short-term Treasury bills. Issuers are also subject to US banking and anti-money-laundering regulations. Regulators are expected to release detailed implementation rules under the CLARITY Act by mid-2026.

China's Stance: A Complete Prohibition

In contrast, mainland China maintains a strict ban on all cryptocurrency-related activities. In December, Chinese authorities reiterated that any business involving virtual currencies, including stablecoins, is considered an illegal financial operation. The government views them as a risk to monetary sovereignty, citing concerns about money laundering and uncontrolled cross-border capital flows. Instead of allowing private stablecoins, China is focusing its financial innovation efforts on its central bank digital currency, the digital yuan (e-CNY).

President Donald Trump announced on Thursday that the U.S. will reopen all commercial airspace over Venezuela, clearing the way for American citizens to travel to the country. The president said he informed Venezuela's acting President Delcy Rodríguez of the decision.

Trump stated he directed Transportation Secretary Sean Duffy and military officials to implement the change by the end of the day. "American citizens will be very shortly able to go to Venezuela, and they'll be safe there," he added.

As of the announcement, the Venezuelan government had not issued a public comment.

This move follows earlier signals that the U.S. is exploring a restoration of relations with the South American nation. Earlier this week, the Trump administration notified Congress of its first steps toward possibly reopening the U.S. Embassy in Venezuela, which was shuttered after diplomatic relations collapsed in 2019. The move comes after a U.S. military raid that ousted then-President Nicolás Maduro.

In letters to 10 congressional committees, the State Department detailed its plan to send a growing number of temporary staff to perform "select" diplomatic functions. "We are writing to notify the committee of the Department of State's intent to implement a phased approach to potentially resume Embassy Caracas operations," the department stated.

Despite the president's announcement encouraging travel, the State Department's official advisory for Venezuela remains at its highest level: "Do not travel." The department has not yet responded to inquiries about whether this warning will be updated.

The current advisory cautions that Americans face a high risk of wrongful detention, torture, kidnapping, and other dangers. When diplomatic ties broke down in 2019, the State Department strongly warned U.S. citizens against traveling to Venezuela.

The decision to reopen the airspace reverses a policy implemented in November. As part of a pressure campaign against the Maduro government, Trump declared that the airspace "above and surrounding" Venezuela was to be considered "closed in its entirety."

Following that declaration, the U.S. Federal Aviation Administration (FAA) issued a warning to pilots about heightened military activity in the region. In response, international airlines began canceling their flights to Venezuela.

Responding quickly to the news, American Airlines announced on Thursday its intent to reinstate nonstop service from the U.S. to Venezuela in the coming months. The carrier was the last U.S. airline flying to the country before it suspended service in March 2019.

"We have a more than 30-year history connecting Venezolanos to the U.S., and we are ready to renew that incredible relationship," said Nat Pieper, American's chief commercial officer. "By restarting service to Venezuela, American will offer customers the opportunity to reunite with families and create new business and commerce with the United States."

The airline stated that it will share more details about its return to service as it works with federal authorities to complete security assessments and obtain the necessary permissions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up