Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Donald Trump said the U.S. would charge a 15% tariff on imports from South Korea, one of a number of such measures announced in the run-up to his August 1 deadline to impose such levies.

President Donald Trump said the U.S. would charge a 15% tariff on imports from South Korea, one of a number of such measures announced in the run-up to his August 1 deadline to impose such levies.He also signed an executive order imposing a 40% tariff on Brazilian exports, bringing the country's total tariff amount to 50%, but with a number of notable exemptions.He has also threatened to impose a 25% tariff on goods imported from India starting on August 1.

Following are key developments:

SOUTH KOREA:

Trump said the U.S. will charge a 15% tariff on imports from South Korea, including autos, as part of a trade deal.He also said South Korea would accept American products, including autos and agriculture into its markets and impose no import duties on them.The U.S. agreed that South Korean firms would not be put at a disadvantage compared with other countries over upcoming tariffs on chips and pharmaceutical products, while retaining 50% tariffs on steel and aluminium.

INVESTMENTS:

Trump said South Korea would invest $350 billion in the United States in projects "owned and controlled by the United States" and selected by Trump.South Korea said $150 billion has been earmarked for shipbuilding cooperation, while investments in chips, batteries, biotechnology and nuclear energy cooperation accounted for the remaining $200 billion.Trump said South Korea would purchase $100 billion worth of liquefied natural gas or other energy products, which the Asian country said would mean a slight shift in energy imports from the Middle East in the next four years.

BRAZIL:

Trump slapped a 50% tariff on most Brazilian goods to fight what he has called a "witch hunt" against former President Jair Bolsonaro, but softened the blow by excluding sectors such as aircraft, energy and orange juice from heavier levies.The new tariffs are due to take effect on August 6 in the case of Brazil.General exemptions also apply to donations intended to relieve human suffering such as food, clothing, medicine, as well as publications, films, music and artworks.

INDIA:

Trump said on Wednesday the United States is still negotiating with India on trade after announcing earlier in the day the U.S. would impose a 25% tariff on goods imported from the country starting on Friday.India has resisted U.S. demands to open its agricultural and dairy markets, saying such moves would hurt millions of poor farmers. New Delhi has historically excluded agriculture from free trade pacts to protect domestic livelihoods.According to a White House fact sheet, India imposes an average MFN (Most Favoured Nation) tariff of 39% on imported farm goods, compared to 5% in the U.S., with some duties as high as 50%.

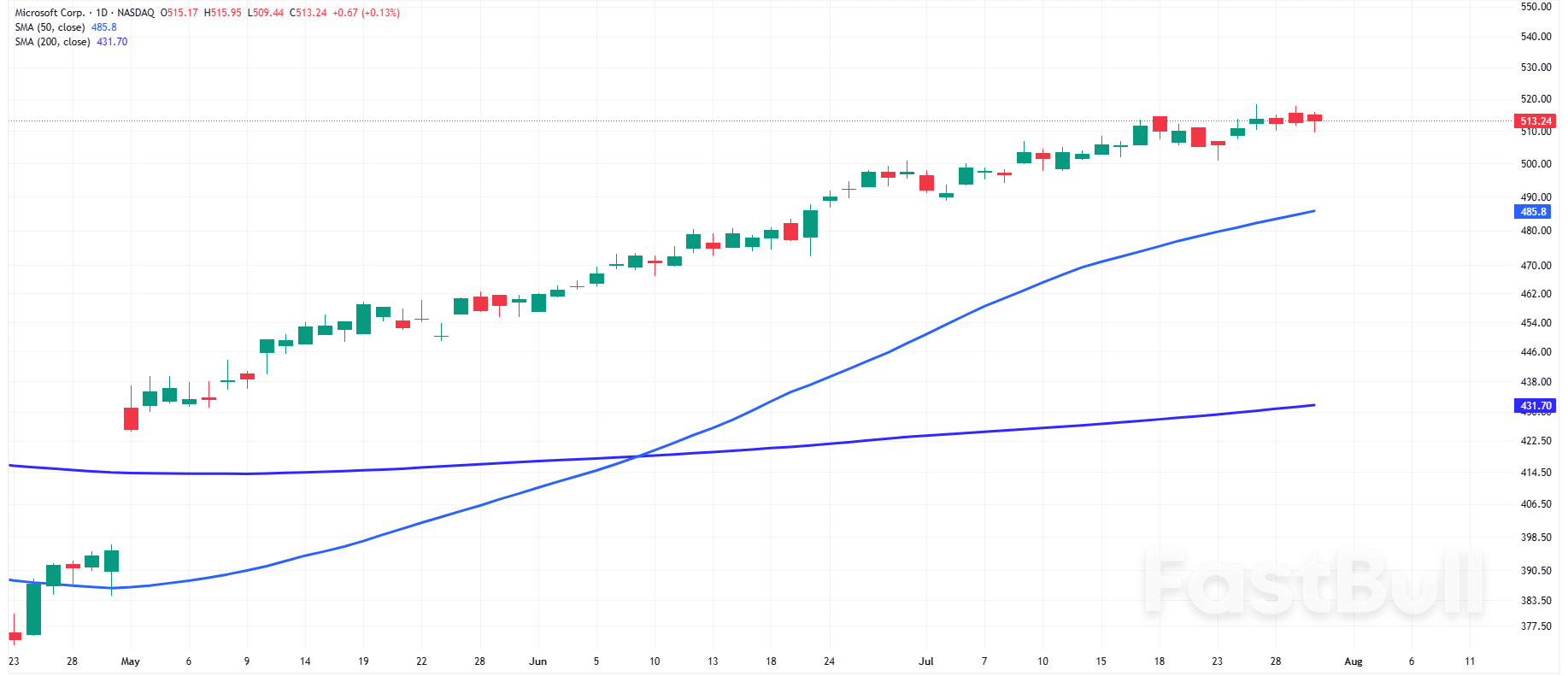

Daily Microsoft Corp.msftMM

Daily Microsoft Corp.msftMM

President Donald Trump said he extended Mexico’s current tariff rates for 90 days to allow more time for trade negotiations with the US’ southern neighbor.

“We have agreed to extend, for a 90 Day period, the exact same Deal as we had for the last short period of time, namely, that Mexico will continue to pay a 25% Fentanyl Tariff, 25% Tariff on Cars, and 50% Tariff on Steel, Aluminum, and Copper,” Trump said Thursday in a social media post.

Trump threatened last month to increase Mexico’s country-based duty to 30% starting Aug. 1. The president’s decision comes shortly after he said he would not extend his Friday deadline.

“Additionally, Mexico has agreed to immediately terminate its Non Tariff Trade Barriers, of which there were many. We will be talking to Mexico over the next 90 Days with the goal of signing a Trade Deal somewhere within the 90 Day period of time, or longer,” the president added.

A major exemption to President Donald Trump's 50% copper tariff has shocked traders and sent U.S. market prices plummeting.

The final order on copper tariffs, which the Trump administration says will boost the domestic copper production industry, applies to semi-finished products such as pipes, rods, sheets and wires. It also impacts copper-intensive items like cables and electrical components. But crucially, it does not include the raw input material copper cathode, copper ores, concentrates or scraps, as had been widely expected.

However, analysts say that may not be enough to avoid prices for a range of consumer goods containing the metal, from cookware to air conditioning units to plumbing parts, being pushed higher as a result of the tariffs.

U.S. copper prices on the Chicago Mercantile Exchange (CME) shot to a record high earlier this month, also hitting an all-time premium over the global benchmark London Metal Exchange (LME), following the initial July announcement of a 50% tariff. While importers had already sent refined copper flooding stateside at record levels through the first half of the year in anticipation of new duties, the scale of a blanket 50% rate jolted markets and put severe upward pressure on U.S. prices.

The eventual reveal on Wednesday of a tariff targeting only semi-finished products has provided yet another massive shock. In the minutes after the news, COMEX copper (metals futures contracts on the CME) fell 19% in the biggest intraday fall on record, according to bank ING.

The gap between COMEX above LME prices has been around 30% since the initial July 8 announcement, implying continued uncertainty that the overall tariff rate would end up at 50%.

However, traders were instead considering possible exemptions for countries such as major exporter Chile, or for delays to full implementation of tariffs, Albert Mackenzie, copper analyst at Benchmark Mineral Intelligence, told CNBC.

The actual situation is almost a 180-degree pivot from what was expected and what was being priced in to the CME, which was tariffs on refined copper, Mackenzie continued.

The deviation sent the CME price premium plummeting from around $2,637 at the start of Wednesday to just $90 on Thursday morning in Europe, Mackenzie said — a scale of a drop that would look like a mistake were it not for the tariff context, he added.

While traders were taking advantage of a price arbitrage, part of the reason for the huge redirection of copper supply into the U.S. has been that it would take decades for the country to be able to sufficiently increase domestic production of the metal to meet demand. The U.S. currently imports around half its copper, with major exporters including Chile, Canada, Peru and Mexico.

Analysts at Deutsche Bank stressed the "huge shock to the market" this week, noting Thursday that shares of Arizona-based miner Freeport-McMoRan — the copper company most exposed to tariffs on refined copper driving up U.S. prices — closed over 9% lower the previous day.

"Fundamentally, this does not change the copper supply-demand balance (and arguably improves it due to less demand destruction risk), but is likely to put COMEX under heavy pressure," they wrote.

Downward price pressure is likely to follow through onto the LME on a less dramatic scale, they said, in the wake of the massive build-up in refined inventories in the U.S. so far this year. The overhang "could see high shipments from the U.S. back into the global market," they said, where supply has become tight.

Duncan Wanblad, CEO of mining giant Anglo American – which has major copper operations around the world – told CNBC's "Squawk Box Europe" on Thursday that while there was currently a "material dislocation" in the placement of inventories, the demand fundamentals for copper "look great."

"Through a medium- to long- term lens, the fundamentals of copper are really underpinned by the fact that demand is looking to be very strong still in terms of the world's need for an energy transition, for the likes of battery-electric vehicles, for the likes of new energy supply, data centers, AI," he said. Supply on that longer-term outlook remains constrained, he added, amid difficulties obtaining permits and getting product into market.

One policy revealed Wednesday is that the copper tariffs will not stack on top of Trump's new duties on automobile imports, meaning only the latter rate would apply to an impacted product.

However, Benchmark Mineral Intelligence's Mackenzie pointed out that a lower U.S. market price premium does not mean no feed-through into prices for consumer products.

"If you're a manufacturer of fridges or air conditioning units, or even houses, you don't buy copper cathode. You buy wiring and other semi-finished copper products, which are the things being tariffed. So it's reasonable to assume the price increase will be reflected in some end goods," Mackenzie said.

Russ Bukowski, president of manufacturing solutions firm Mastercam, agreed.

"Although there are currently high inventories of copper in the country, the 50% increase on copper tariffs is going to hurt manufacturers in the long run and lead to higher production costs," Bukowski told CNBC.

"To stay afloat, manufacturers may have to pass these costs to consumers, which will likely drive-up prices on various goods."

Michael Reid, senior U.S. economist at RBC Capital Markets, said the impact on consumer prices would be "nuanced" as it appears via an input to other goods.

"The largest sectors that use copper as inputs include motor vehicles, plumbing fixtures and valve fittings, communications wire (i.e., cable and internet providers), and various electrical components. To that end, the manner by which those products are made matters – which is to say, if a car is imported, its copper content won't be tariffed," Reid said by email.

"Where we would expect to see it impact consumer prices the most would be in the housing/construction sector where copper inputs play a big role for electric wiring and plumbing."

"But in the context of the overall cost of a house, the impact is not as harsh as the 50% may sound – assuming the typical cost of plumbing and electric components is $10k then an aggressive full passthrough to the end consumer would mean costs rise to $15k. In the overall cost of a home, that $5k increase would be around 10%," he added.

The big geopolitical headline this week was President Trump on Monday and Tuesday making clear that if Russia can't reach a ceasefire agreement with Ukraine within 10 days, secondary sanctions will follow, which takes the new deadline to Friday, Aug. 8.The Kremlin has again responded in follow-up, boasting that Russia has developed immunity to sanctions, with Kremlin spokesman Dmitry Peskov describing an economy which has been functioning successfully for a long time under huge, unprecedented sanctions.

"We have been living under a huge number of sanctions for quite a long time. Our economy operates under a huge number of restrictions. Therefore, of course, we have already developed a certain immunity to this," Peskov told reporters.Indeed this is consistent with recent observations of Western travelers, including Tucker Carlson, who say that grocery and clothing stores are stocked full, and life is going along as usual in all major cities.Still, not all is rosy - especially in southern border areas impacted by regular Ukrainian drone strikes. Russian forces are busy trying to create sizeable buffer zones within Ukraine.

Also, unexplained internet outages are happening with increased frequency across multiple parts of Russia. One fresh report points to a mobile internet shut down which happened in 62 regions simultaneously on Monday.This has prompted calls for Russians to 'be prepared' - with state sources citing security measures resulting in occasional service disruptions:

A senior Russian lawmaker is urging citizens to adjust to the growing likelihood of widespread internet disruptions by relying more on cash and preparing for reduced access to digital services.Vladimir Gutenev, head of the State Duma’s Industry and Trade Committee, told the pro-Kremlin news outlet Life that Russians should be ready for “regular and necessary” internet shutdowns and recommended withdrawing cash in advance to avoid being caught off guard.

“Restricting or shutting down the internet is a necessary measure,” Gutenev said. “There are critical infrastructure facilities whose failure could have serious consequences.”Essentially, all of this points to the Kremlin's planning not to comply with Trump's ultimatum. Likely, the White House knows that it can't force Russia to the negotiating table, especially when Ukraine's Zelensky is refusing to agree to territorial concessions.

But the Trump administration likely wants to be seen as "doing something" and so the usual sanctions playbook can create that appearance, and perhaps satisfy the hawks as well as some European allies. But it is tantamount to kicking the can down the road, and once again risking direct confrontation with Russia militarily - all the while the policy is unlikely to achieve the intended results.

Oil prices fell on Thursday as investors weighed the supply risks from U.S. President Donald Trump's push for a swift resolution to the war in Ukraine through more tariffs, while a surprise build in U.S. crude stocks on Wednesday also weighed on prices.

Brent crude futures for September , set to expire on Thursday, declined by 61 cents, or 0.83%, to $72.63 a barrel by 1326 GMT. U.S. West Texas Intermediate crude for September fell 68 cents, or 0.97%, to $69.32.

Both benchmarks lost ground on Thursday after recording 1% gains on Wednesday.

"The market front-runs the implications of President Trump's announcements before remembering that these policy intentions can turn on a dime if he can strike a deal," said Harry Tchiliguirian at Onyx Capital Group.

"We're seeing a re-evaluation until there is more clarity," he added.

Trump said he would start imposing measures on Russia, including 100% secondary tariffs on its trading partners, if it did not make progress on ending the war in Ukraine within 10-12 days, moving up an earlier 50-day deadline.

The U.S. has also warned China, the largest buyer of Russian oil, that it could face huge tariffs if it kept buying.

On Wednesday, the U.S. Treasury Department announced fresh sanctions on more than 115 Iran-linked individuals, entities and vessels, stepping up the Trump administration's "maximum pressure" campaign after bombing Iranian nuclear sites in June.

Meanwhile, U.S. crude oil inventories rose by 7.7 million barrels to 426.7 million barrels in the week ending July 25, driven by lower exports, the Energy Information Administration said on Wednesday. Analysts had expected a draw of 1.3 million barrels.

Gasoline stocks fell by 2.7 million barrels to 228.4 million barrels, far exceeding forecasts for a draw of 600,000 barrels.

"U.S. inventory data showed a surprise build in crude stocks, but a bigger than expected gasoline draw supported the view of strong driving season demand, resulting in neutral impact on the oil market," said Fujitomi Securities analyst Toshitaka Tazawa.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up