Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Nov)

France Trade Balance (SA) (Nov)A:--

F: --

France Current Account (Not SA) (Nov)

France Current Account (Not SA) (Nov)A:--

F: --

P: --

South Africa Manufacturing PMI (Dec)

South Africa Manufacturing PMI (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Nov)

Italy Unemployment Rate (SA) (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

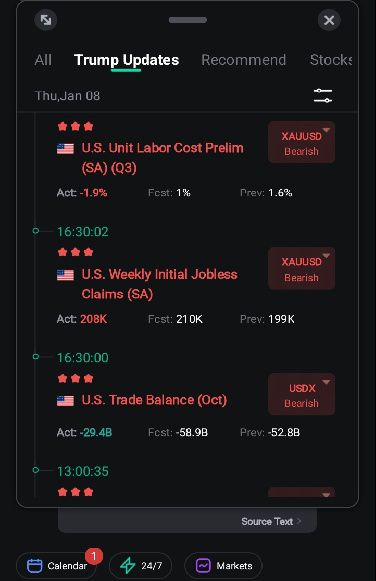

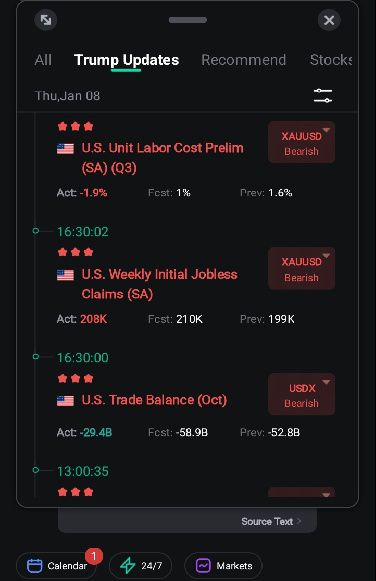

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Euro-area inflation hit the ECB's 2% target, stabilizing rates, though stubborn services costs and wages temper optimism.

Euro-area inflation has aligned with the European Central Bank's target, reinforcing the view among policymakers that interest rates can remain on hold barring any major shifts in the economic outlook.

Consumer prices in December rose 2% from the previous year, a slight decrease from the 2.1% recorded in the prior month. The figure matched economists' expectations.

A closer look at the data reveals a broader trend of moderating price pressures. Core inflation, which excludes volatile items like food and energy, slowed to 2.3%. Similarly, services inflation, a metric closely watched by the ECB, also showed signs of easing.

Price growth has now been hovering near the central bank's 2% objective for over six months. This stability has allowed the ECB to maintain its current borrowing costs since June, with both economists and investors anticipating no further policy moves in the foreseeable future.

While most ECB officials agree that inflation is largely under control, they have been circumspect about future steps, pointing to persistent uncertainty in the global economy.

At their final meeting of 2025, policymakers revised their forecasts, now expecting inflation to fall only slightly below its target this year. This upward adjustment reflects a slower-than-anticipated easing in the cost of services.

Divergent Inflation Rates Across the Bloc

Recent reports from member states show that while consumer price growth is easing across the Eurozone, the pace differs significantly from country to country.

• Spain: Inflation dropped to 3%.

• France: Inflation eased to 0.7%.

• Germany: Inflation registered at 2%.

Services inflation remains a primary point of concern for the ECB, driven partly by robust wage growth. The most comprehensive measure of pay increases held steady at 4% in the third quarter, a level considered above what is consistent with long-term price stability.

ECB President Christine Lagarde acknowledged last month that this is "a trend that we look at carefully." However, she also expressed confidence that wage pressures should moderate this year as salaries catch up to the post-pandemic price surge.

Several other factors could potentially push inflation away from the 2% target, including the ongoing effects of US tariffs, the strength of the euro, and fiscal expansion in Germany.

Under its baseline scenario, the central bank projects that inflation will average 1.9% in 2026. Following a further decline, it is then expected to accelerate back toward the 2% target by 2028.

Experts are advising Malaysia to adopt a cautious and pragmatic approach to its upcoming carbon tax, recommending a starting rate similar to Singapore's initial S$5 per tonne to avoid stifling business activity while still curbing emissions.

The guidance comes as the country finalizes the details of a policy first announced in Budget 2025 and reiterated in Budget 2026. The critical challenge lies in setting a price that is both effective and economically sustainable.

CGS International Securities Malaysia's head of research, Prem Jearajasingam, suggested that Malaysia should benchmark its initial carbon tax against Singapore's starting price of S$5 per tonne of carbon dioxide equivalent (tCO₂e).

Singapore introduced its tax at this level before embarking on a clear and aggressive escalation path:

• 2024: Raised to S$25/tCO₂e

• 2026-2027: Set to increase to S$45/tCO₂e

• 2030: A target range of S$50 to S$80/tCO₂e

This model provides a template for a gradual, predictable ramp-up that allows industries to adapt over time.

PwC Malaysia director Richard Baker emphasized the "very fine balancing act" the government must perform. Speaking at CGS International's 18th Annual Malaysia Corporate Day 2026, he outlined the two key risks of a miscalibrated tax rate.

"If you set the tax too high, it becomes a burden and businesses may relocate, as we have seen happen in Singapore," Baker warned. Conversely, a rate that is too low would fail to achieve its primary goal of reducing greenhouse gas emissions.

A carbon tax requires companies to pay a levy based on their emissions. To comply, firms must measure, report, and verify their output. The policy is designed to incentivize investment in cleaner technologies and energy efficiency over high-emission processes.

Baker urged companies to view the carbon tax not as a simple cost but as a catalyst for strategic investment. He recommended that businesses proactively adopt emissions-reduction measures, such as:

• Transitioning to renewable energy sources.

• Implementing energy efficiency upgrades.

• Upskilling employees for sustainability-focused roles.

To ease this transition, various government incentives are already available. These include capital allowances, tax deductions for green assets, and grants for sustainability training and compliance-related consultancy.

While key details like pricing and implementation timelines are still pending, the foundational legal framework is expected in the upcoming Climate Change Bill. The bill, set to be tabled during the first parliamentary session of 2026, will provide the legal basis for Malaysia's low-carbon transition, including provisions for emissions monitoring and reporting.

The legislation is expected to be introduced by the newly appointed Natural Resources and Environmental Sustainability Minister, Datuk Seri Arthur Joseph Kurup.

The government has indicated that the carbon tax will initially target the iron, steel, and energy sectors starting from the 2026 assessment year. Baker noted that the scope could later expand to include other emissions-intensive industries like fertilisers, cement, and aluminium.

French construction activity continued its steep decline in December, extending the sector's downturn to over three-and-a-half years, according to the latest HCOB PMI survey.

The headline HCOB France Construction PMI Total Activity Index registered 43.4 in December, slightly below November's 43.6, indicating a marginally sharper contraction. Any reading below 50 signals a decline in activity.

Unlike November, when housing and commercial activity drove the overall contraction, December's downturn was primarily fueled by the civil engineering sub-sector, which saw its steepest decline since February. Residential building work fell at its softest rate since August 2022, while commercial construction posted its slowest drop in four months.

New orders decreased rapidly as companies reported weak demand conditions and fewer calls for tender. This slump in new business led French constructors to become increasingly pessimistic about the future, with sentiment reaching its lowest level since October 2014.

Approximately 35% of surveyed firms expect activity levels to be lower by the end of 2026, while only 6% anticipate growth.

In response to weak conditions, construction companies continued to reduce purchasing activity, though the pace of decline was the slowest in seven months. Employment in the sector has fallen continuously since May 2024, with December showing the weakest drop in seven months.

Cost pressures intensified for the third consecutive month, with input price inflation reaching its highest level in almost a year, though still below the survey's historical average.

Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, noted that the construction recession, which began alongside the ECB's rate-hiking cycle in summer 2022, remains deep and persistent. He added that while there are "tentative signs of recovery in residential construction," civil engineering activity "collapsed in December."

Feldhusen pointed to several factors weighing on the sector's outlook, including weak order books, limited room for further ECB rate cuts, France's ongoing fiscal concerns, and political uncertainty.

Following US attacks on Venezuela and the capture of President Nicolás Maduro, President Donald Trump declared that American companies would move in to develop the nation's vast oil sector. His announcement framed Venezuela's resources as a source of "tremendous amount of wealth" ripe for extraction.

This move marks a stark departure from an international system based on rules, suggesting a new era where military power dictates economic rights. For President Trump, however, it's a clear economic opportunity. Venezuela holds the world's largest proven crude oil reserves, accounting for 19.4% of the global total in 2024. Yet, it's currently a minor player, producing just 960,000 barrels per day (b/d) in 2024—a fraction of its 3.3 million b/d peak in 2006.

Reviving this dormant giant is the goal, but the price tag is staggering.

Years of underinvestment, corruption, and sanctions have left Venezuela's oil infrastructure in ruins. According to an estimate from Rystad Energy, simply tripling the country's output from 1 million to 3 million b/d by 2040 would require an investment of $183 billion.

The underlying economics are just as challenging. Most of Venezuela's reserves consist of a viscous, heavy crude that is difficult and expensive to produce. It requires specialized techniques like steam injection for extraction and must be mixed with diluents to flow through pipelines.

This heavy crude also sells at a discount because it demands complex refining to be turned into consumer products like gasoline and diesel. While the sheer scale of the reserves could justify the cost in a high-priced market, global trends are pointing in the opposite direction.

The world consumed roughly 104 million barrels of oil per day in 2025, but a market flooded with supply is putting downward pressure on prices. Since the highs of mid-2022, which were driven by post-lockdown demand and Russia's invasion of Ukraine, the price of Brent crude has been in a gradual decline.

This trend was officially acknowledged by the US Energy Information Administration in a January 5 bulletin titled: "Crude oil prices fell in 2025 amid oversupply."

Since the shale revolution of the 2010s, American oil and gas firms have focused on shareholder returns rather than major upstream investments. Persistently low prices give them little incentive to pour billions into a high-risk venture like Venezuela.

Weak global economic growth is partly to blame for falling oil prices, but a more permanent structural shift is underway. The rise of low-carbon technologies, especially electric vehicles (EVs), is steadily eroding demand for fossil fuels.

This transition is visible across major economies:

• Europe: Wind, solar, and battery storage are increasingly displacing natural gas for electricity generation.

• China: An explosive boom in EVs—including cars, buses, and trucks—is cutting into oil consumption in the world's second-largest market.

In China, the share of electric and hybrid vehicles in all new vehicle sales hit 50% between January and September 2025, a massive jump from just 6.5% during the same period in 2020. As a result, oil demand in China's transport sector has likely already peaked, with a peak in the country's overall oil demand expected to follow.

China may be a frontrunner, but EV adoption is accelerating globally. Cars are becoming more affordable, battery capacity is improving, and charging infrastructure is expanding, all of which reduces "range anxiety" for consumers. For policymakers in oil-importing nations, EVs offer a path to greater energy security by reducing reliance on foreign suppliers, volatile prices, and the US dollar.

As the electrification of transport—the single largest consumer of oil—dampens demand, global supply continues to rise with new production coming from Argentina, Brazil, Guyana, and the United States itself. This dynamic suggests prices are set to fall further, making large-scale investment in new oil projects a questionable bet.

The oil bonanza promised by President Trump has so far been met with a muted public response from America's energy majors. The president has even suggested that if profits fail to materialize, the government could reimburse corporate losses—a move that would amount to a massive public subsidy for some of the world's most profitable companies.

Whether this offer is enough to incentivize investment remains uncertain, especially given the political instability in both post-intervention Venezuela and the US.

However, other strategic motives may be at play:

• Energy Security: Many US refineries are designed to process heavy crude, like Venezuela's. Securing a new source would reduce dependence on Canadian tar sands.

• Market Influence: Controlling one of the world's largest oil reserves provides leverage over global prices, a classic energy strategy.

• Geopolitical Leverage: China is currently the primary buyer of Venezuelan oil and has companies operating there. US control would be a direct challenge to a key rival.

• Historical "Compensation": President Trump has framed the move as payback for past actions by the Venezuelan government, like the 1976 nationalization of its oil industry, which harmed American corporate interests.

Regardless of the motive, attempting to exploit Venezuela's oil reserves is a risky economic gambit. It is a bet that the global transition to electric vehicles will stall—a bet against the future of energy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up