Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks BOC Monetary Policy Report

BOC Monetary Policy Report U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Dow Jones rose while Tesla extended its rally and Nvidia fell on China AI chip news. Investors await key U.S. economic data and major earnings, with market volatility remaining elevated.

Wall Street stocks showed little conviction on Monday and gold eased as market participants watched for signs of progress in tariff negotiations at the top of an eventful week of corporate earnings and economic data.

Weakness in the tech sectorheld the Nasdaq back, but gold lost ground and benchmark U.S. Treasury yields oscillated.

"The news has evened out," Thomas Martin, Senior Portfolio Manager at GLOBALT in Atlanta. "There's not really any news today that’s market-moving."

U.S. Treasury Secretary Scott Bessent on Monday said many of the top U.S. trading partners have made "very good" tariff proposals, adding that China's recent moves to exempt certain U.S. goods from its retaliatory tariffs showed a willingness to de-escalate trade tensions between the world's two largest economies.

"We just keep on trying to dial into what the trade negotiations are going to be like," Martin added. "And it's this combination of public statements versus what's really going on behind the scenes."

Despite hopes for progress, economists polled by Reuters say the risk of global recession is high as a result of Trump's tariffs; the same group of economists expected the world economy to grow at a healthy clip a mere three months ago.

First quarter earnings season heats up this week, with Meta Platforms, Microsoft, Appleand Amazon.comamong the high-profile results on the docket.

While Monday was quiet with respect to U.S. economic data, the week is back-end loaded with closely watched indicators such as Personal Consumption Expenditures (PCE), the Institute for Supply Management's purchasing managers' index (PMI), an advance take on U.S. GDP and the April employment report.

The Dow Jones Industrial Averagerose 146.72 points, or 0.40%, to 40,275.27, the S&P 500rose 6.25 points, or 0.11%, to 5,531.38 and the Nasdaq Compositefell 15.79 points, or 0.09%, to 17,367.15.

European shares gained ground on trade negotiation optimism.

MSCI's gauge of stocks across the globeEURONEXT:IACWIrose 3.46 points, or 0.42%, to 828.20.

The pan-European STOXX 600index rose 0.74%, while Europe's broad FTSEurofirst 300 indexrose 14.58 points, or 0.71%.

Emerging market stocksCBOE:EFSrose 6.24 points, or 0.57%, to 1,103.34. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) closed higher by 0.58%, to 573.95, while Japan's Nikkeirose 134.25 points, or 0.38%, to 35,839.99.

The yield on benchmark U.S. 10-year notesfell 2.1 basis points to 4.245%, from 4.266% late on Friday. The 30-year bond (US30YT=RR) yield fell 2.8 basis points to 4.7099% from 4.738% late on Friday.

The 2-year note (US2YT=RR) yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 2.6 basis points to 3.736%, from 3.762% late on Friday.

The dollar edged lower as investors awaited further trade talks progress and girded themselves for an eventful week.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.59% to 99.16, with the euroup 0.33% at $1.1398.

Against the Japanese yen, the dollar weakened 0.68% to 142.69.

Sterlingstrengthened 0.76% to $1.3415. The Mexican pesoweakened 0.09% versus the dollar at 19.555.

The Canadian dollarstrengthened 0.21% versus the greenback to C$1.38 per dollar. Canadians are going to the polls on Monday after an election campaign in which U.S. President Donald Trump's tariffs and musings about annexing Canada became the central issue.

Crude oil softened as investors weighed a potential supply increase from OPEC+ amid ongoing trade uncertainties.

U.S. crudefell 0.94% to $62.43 a barrel and Brentfell to $66.17 per barrel, down 1.05% on the day.

Gold prices advanced in opposition to the easing greenback.

Spot goldrose 0.27% to $3,327.19 an ounce. U.S. gold futures (GCc1) rose 0.06% to $3,284.50 an ounce.

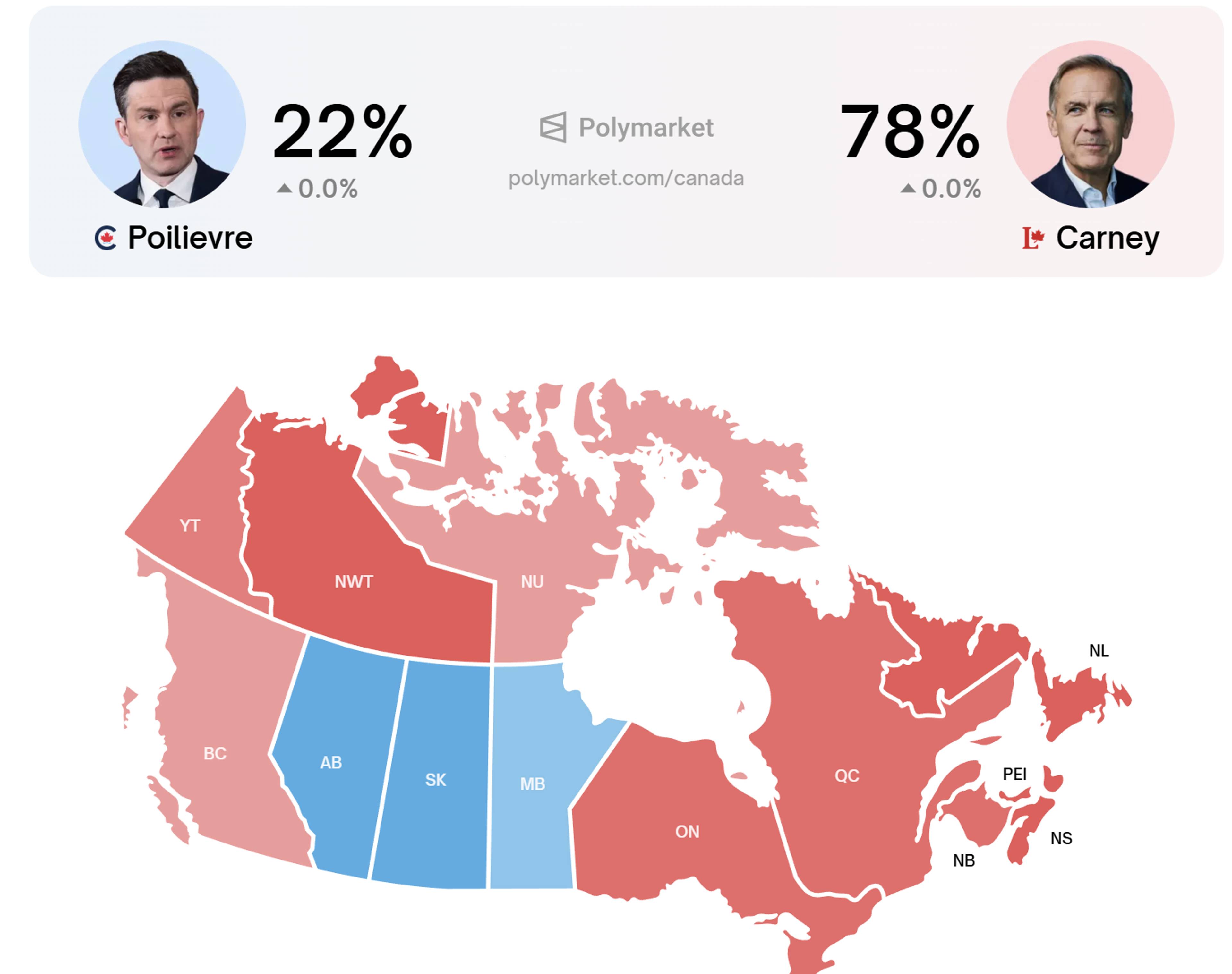

Political bettors on Polymarket and other platforms are paying attention to Canada as the nation heads to the polls.

As the country's 45th election comes to a close, a contract asking bettors to predict who will be Canada's next Prime Minister gives the Liberal Party's Mark Carney a 78% chance, and the Conservatives' Pierre Poilievre a 22% shot.

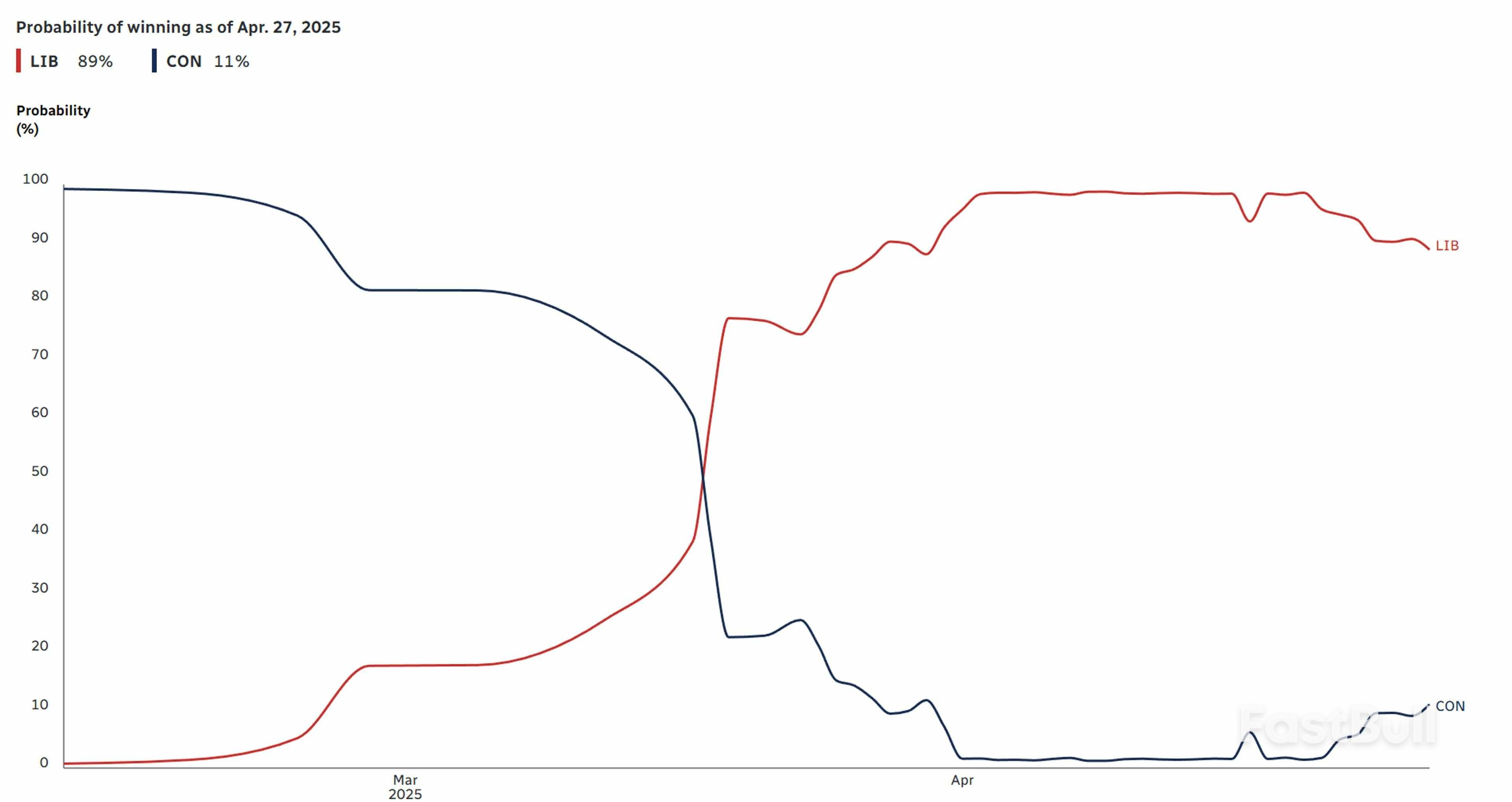

Political bettors are slightly more skeptical of Carney's chances of winning than the polls, but both are pointing in the same direction. A poll aggregator from public broadcaster CBC puts Carney's chances at 89%.

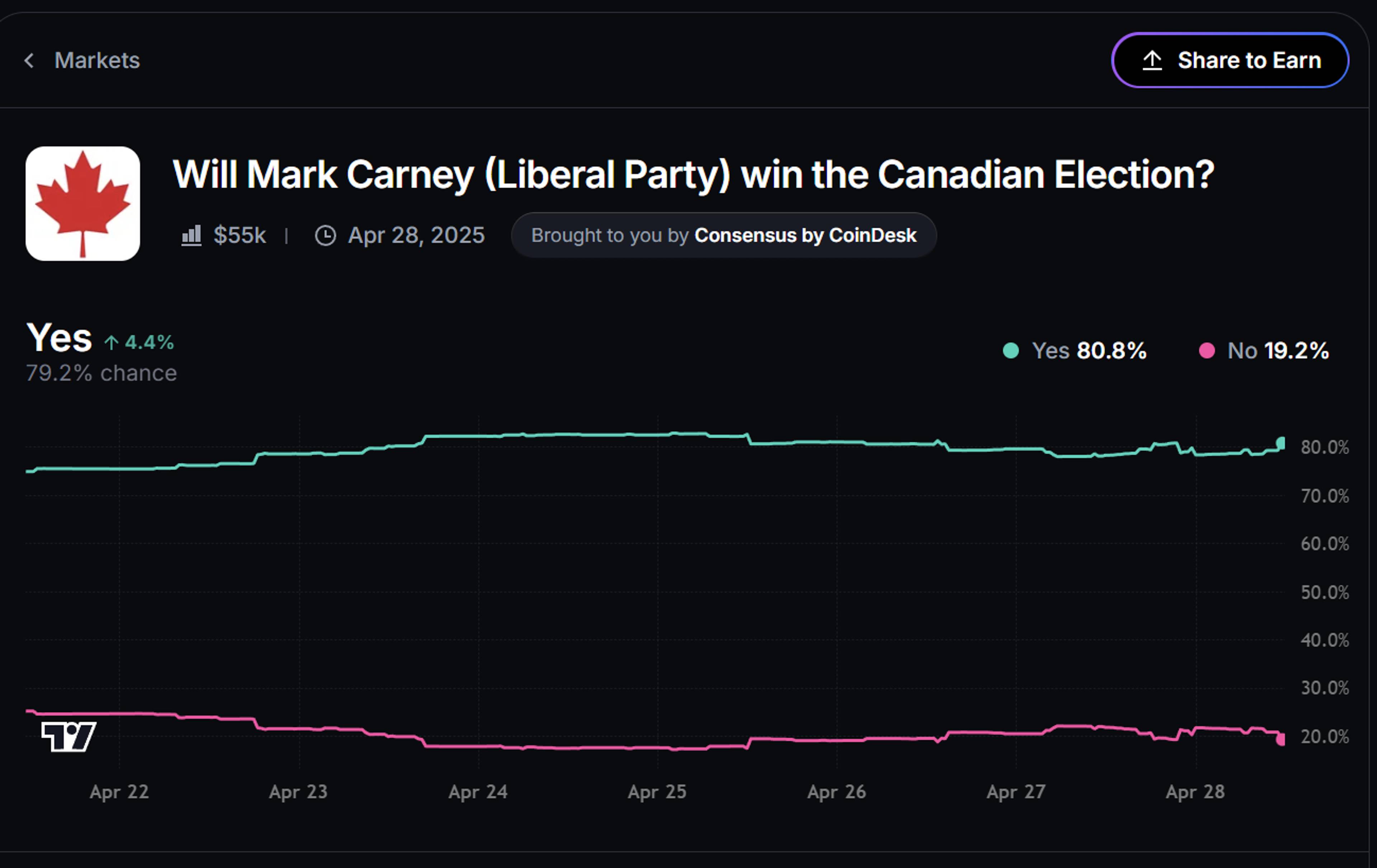

Myriad Markets, another prediction market, is giving Carney similar odds to Polymarket.

FanDuel, a licensed betting platform open only to residents of Ontario, Canada, initially gave the Conservatives a sharp, contrarian lead of 70%, according to a report from the National Post. Still, odds have fallen in line with prediction markets, and it now gives the Liberals a roughly 80% chance of winning.

Unlike the U.S. election, there isn't a crypto angle up north with leaders' campaigns focused on the trade war and inflation.

A growing narrative in certain corners of the internet is that Polymarket is prone to manipulation and its numbers aren't reliable, criticisms that echo what was said in the last weeks of the U.S. election when the site gave Donald Trump a commanding lead as polls showed a tight race.

Critics say Poilievre's chances are being suppressed and do not reflect the political sentiment of the populace.

However, manipulating prediction markets would be expensive, and there's no credible evidence that this is happening even as Polymarket is banned in Canada's largest province after a settlement with its securities regulator.

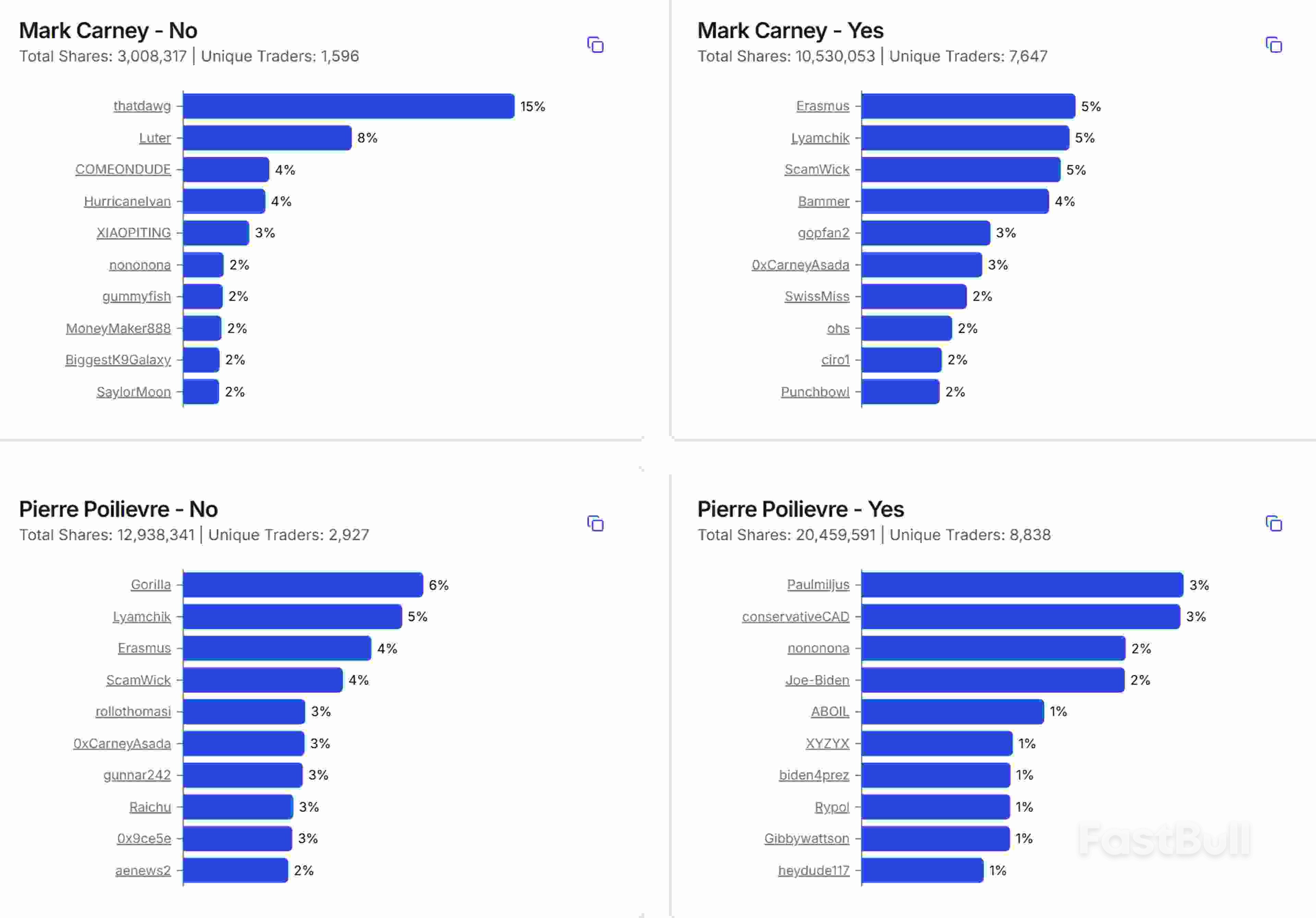

Data portal Polymarket Analytics shows that the Canadian election contract leads the platform in open interest, which is the total value of active, unsettled bets and a good measure of market engagement.

Market data also shows that position holding is quite distributed, with the largest holder of the Poilivere—No side of the contracting holding 6% of all shares and the largest holder of the Carney—Yes side holding 5%.

One bettor, who is betting big on Carney with a six-figure position, who spoke to CoinDesk, said their motives are non-partisan, and said that the quality of Canadian polling makes him confident that the Liberals will win.

"Poilievre needs a 7-point polling error to win and I think the probability of that is closer to 7% than his current market price of 23c," trader Tenadome told CoinDesk via an X DM. "The pool of Poilievre bettors seems to largely be very dumb money that believes in things like China is rigging the polls."

Currently, the trader with the largest winnings on the contract is "ball-sack" with a profit of $124,890, thanks to bets on Carney. On the other side of the trade is "biden4prez," who lost just over $98,000 – the most out of any trader – betting on Poilievre and against Carney.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up