Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

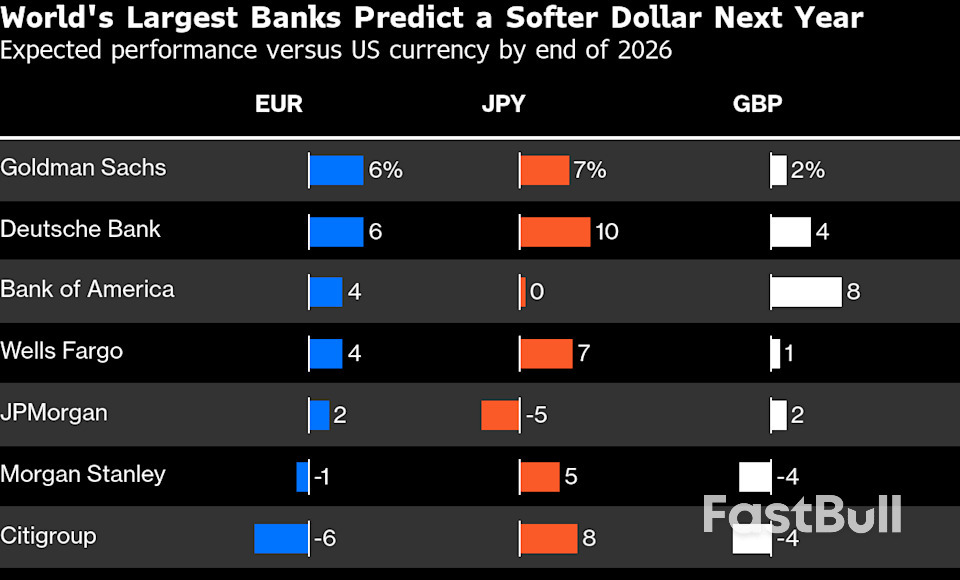

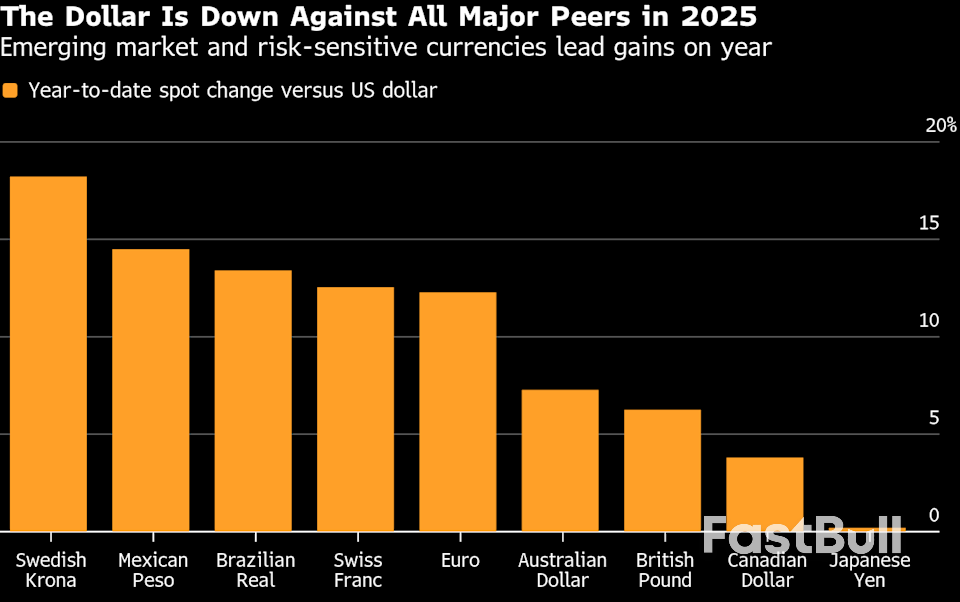

Major banks including Deutsche Bank and Goldman Sachs expect the dollar to weaken in 2026 as Fed rate cuts continue, policy divergence widens, and capital shifts toward higher-yielding and faster-growing economies.

Federal Reserve officials — including two who will become voters in 2026 — offered strongly opposing views Friday on what to do with interest rates, continuing a debate that will grip the US central bank into the new year.

Three policymakers focused in their comments on inflation risks, though one of them suggested he was advocating only a temporary pause to rate cuts to confirm inflation is subsiding. A fourth emphasized risks to the labor market as the bigger concern.

The remarks were the first since Wednesday, when the Fed cut its benchmark rate by a quarter percentage point for a third consecutive meeting in response to rising unemployment. Dissenting votes against the decision indicated the string of cuts has become increasingly contentious amid lingering inflation, and projections showed the median official only expects one reduction in 2026.

Two officials — Chicago Fed President Austan Goolsbee and his Kansas City counterpart, Jeff Schmid — issued statements Friday outlining the rationale for their dissents against Wednesday's rate cut. It was Goolsbee's first dissenting vote since joining the Fed in 2023, while Schmid's followed a dissent against the previous rate reduction in October.

The Chicago Fed chief said in his statement he "felt the more prudent course would have been to wait for more information" before cutting rates again after a government shutdown delayed several key economic reports in October and November, given some "concerning" data on inflation prior to the shutdown.

Speaking later in the morning on CNBC, Goolsbee added that he projected more rate cuts in 2026 than most of his colleagues: "I'm one of the most optimistic folks about how rates can go down in the coming year," he said.

Schmid was less equivocal.

"Inflation remains too high, the economy shows continued momentum and the labor market — though cooling — remains largely in balance," he said in his statement. "I view the current stance of monetary policy as being only modestly, if at all, restrictive."

The Chicago and Kansas City Fed presidents will rotate off the Fed's voting panel in 2026. Two of their incoming replacements also spoke Friday — one emphasizing concerns about inflation and the other warning of risks to the labor market.

Cleveland Fed President Beth Hammack, at an event in Cincinnati, said the central bank should keep rates high enough to continue putting downward pressure on inflation.

"Right now, we've got policy that's right around neutral," she said. "I would prefer to be on a slightly more restrictive stance."

In projections published Wednesday alongside the rate decision, six of 19 policymakers indicated they would have left the benchmark rate where it was before this week's cut to close out 2025.

Since only 12 of the 19 vote on the rate-setting Federal Open Market Committee each year, and only two of the 12 with votes dissented in favor of higher rates, some analysts dubbed the plethora of elevated rate projections "silent dissents."

Philadelphia Fed President Anna Paulson, who with Hammack will rotate into the FOMC's voting ranks next year, was the only one of the four officials speaking Friday who emphasized ongoing risks to the labor market despite the central bank's recent efforts to adjust rates toward a more neutral setting.

"On net, I am still a little more concerned about labor market weakness than about upside risks to inflation," Paulson said Friday at an event hosted by the Delaware State Chamber of Commerce. "That's partly because I see a decent chance that inflation will come down as we go through next year."

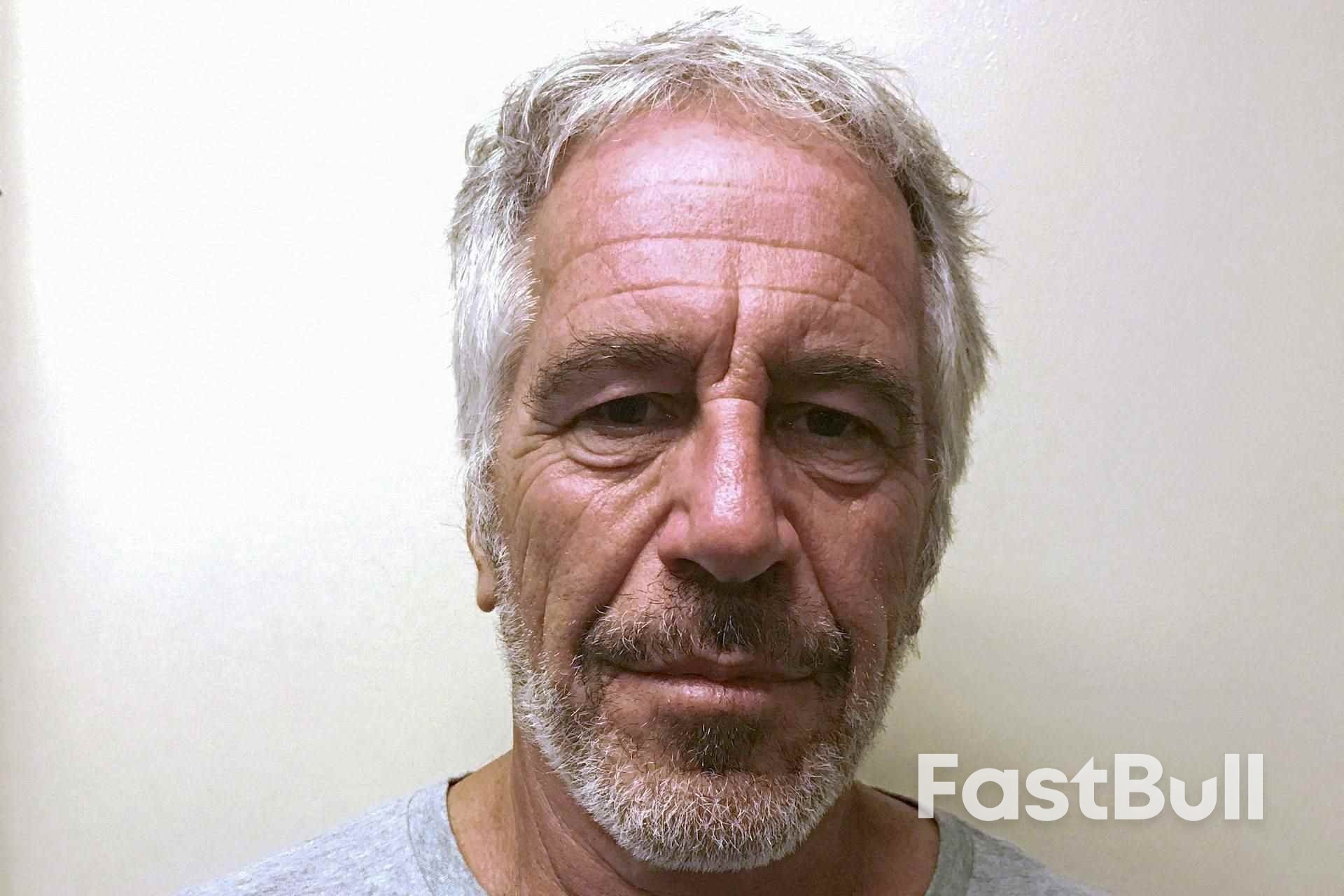

WASHINGTON, Dec 12 (Reuters) - Democrats on a congressional oversight panel released more than a dozen new images from the estate of the late convicted sex offender Jeffrey Epstein on Friday, including photos of now-President Donald Trump.

Trump is featured in three of the 19 photos shared by House Oversight Committee Democrats, who said they are reviewing more than 95,000 images produced by the estate.

In one black-and-white photo, Trump is seen smiling with several women — whose faces are redacted — on each side of him. A second image shows Trump standing beside Epstein, and a third, less-clear image shows him seated alongside another woman, whose face is also redacted, with his red tie loosened. It was not clear when or where the photos were taken.

Former President Bill Clinton, former Trump aide Steve Bannon, Bill Gates and former Treasury Secretary Larry Summers also appear in the batch of images, as well as sex toys, a $4.50 "Trump condom" emblazoned with Trump's face and the all-caps phrase "I'M HUUUGE!"

"These disturbing photos raise even more questions about Epstein and his relationships with some of the most powerful men in the world," Representative Robert Garcia of California, the top Democrat on the oversight committee, said in a statement. "We will not rest until the American people get the truth. The Department of Justice must release all the files, NOW."

The congressional Democrats said they redacted the women's faces to protect the identities of Epstein's victims.

The White House did not immediately respond to a request for comment.

Trump and Epstein were friends during the 1990s and early 2000s, but Trump says he broke off ties before Epstein pleaded guilty to prostitution charges.

Trump has consistently denied knowing about the late financier's abuse and sex trafficking of underage girls.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up