Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Defense stocks surged after Israel's airstrikes on Iran heightened Middle East tensions. Lockheed Martin rose 3%, oil prices jumped 8%, and U.S. markets opened lower amid fears of wider conflict.

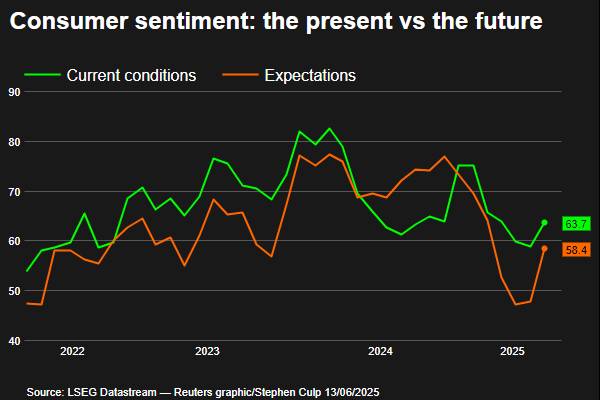

U.S. consumer sentiment improved for the first time in six months in June as trade tensions between the U.S. and China eased, but households worried about the economy's trajectory.

The rise in sentiment reported by the University of Michigan's Surveys of Consumers on Friday was, however, overshadowed by Israel's missile strikes against Iran, which boosted oil prices to multi-month highs and weighed on global stock markets.

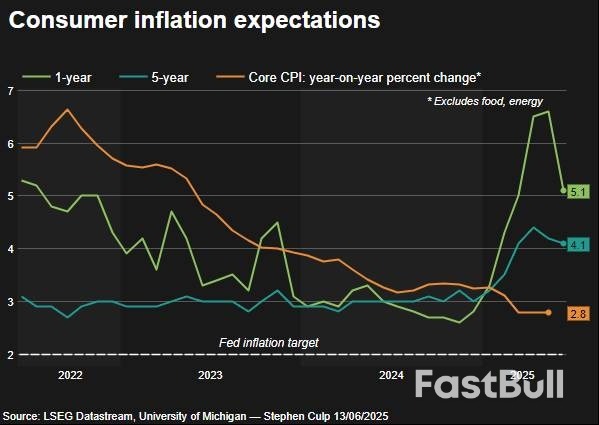

Though consumers' inflation expectations also improved this month, higher oil prices are likely to translate into pain at the pump. Gasoline prices have been generally low this year, freeing up much needed money for spending elsewhere.

"The improvement may be short-lived if current geopolitical risks as well as the increase in oil prices continue," said Eugenio Aleman, chief economist at Raymond James. "The same is going to probably be true for inflation expectations."

The University of Michigan's Consumer Sentiment Index jumped to 60.5 this month from a final reading of 52.2 in May.

Economists polled by Reuters had forecast the index would rise to 53.5. The index, however, remained about 20% below last December's level, when sentiment soared in the wake of President Donald Trump's victory in the November 5 election.

Sentiment rose across all age, income, wealth, political party affiliation groups and geographic regions. While the share of consumers giving unsolicited comments about tariffs was down from May, it was higher than any other month since the election.

Stocks on Wall Street fell. The dollar rose against a basket of currencies. U.S. Treasury yields were higher.

The U.S. and China have made big strides towards de-escalating their trade war, with Washington slashing tariffs on Chinese goods to 30% from 145% until mid-August. They agreed earlier this week on a framework covering tariff rates.

"Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed," Joanne Hsu, the director of the University of Michigan's Surveys of Consumers, said in a statement. "However, consumers still perceive wide-ranging downside risks to the economy."

Hsu said consumers' views on business conditions, personal finances, buying conditions for big-ticket items, labor markets and stock markets were all nowhere near the upbeat readings of six months ago.

Some economists were dismissive of the survey, noting that the response rate was very low. Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, called it "a broken compass."

Consumers' 12-month inflation expectations fell to 5.1% from 6.6% in May. Hsu said consumers' fears about the potential inflation surge from import duties have "softened" somewhat.

Their views have probably been influenced by tame consumer price increases over the past three months.

Economists say consumer inflation has remained benign because businesses are still selling inventory accumulated before Trump's tariffs kicked in. They expect inflation to accelerate from June through the second half of the year. Long-run inflation expectations dipped to 4.1% from 4.2% last month.

"But the fact they (inflation expectations) remain historically high shows anxiety over prices hasn't dropped off consumers' list of worries," said Oren Klachkin, financial market economist at Nationwide.

Federal Reserve officials, who will hold a policy meeting on Tuesday and Wednesday, could take note of the decline in inflation expectations, though the higher readings had previously been dismissed as an outlier.

The U.S. central bank is expected to leave its benchmark overnight interest rate in the 4.25%-4.50% range at the end of its meeting next week while policymakers monitor the economic effects of tariffs.

Daily Nasdaq 100 Index

Daily Nasdaq 100 Index Daily Light Crude Oil Futures

Daily Light Crude Oil Futures

Daily American Airlines Group, Inc (AAL)

Daily American Airlines Group, Inc (AAL)The prospect of a shift in US monetary policy when President Donald Trump replaces Jerome Powell at the end of his term as Federal Reserve chair in May 2026 has interest-rate traders looking for pay dirt.

That was evident this week in Secured Overnight Financing Rate futures — a principal way for traders to wager on changes in the Fed’s policy rate. The combination of high-volume selling of the March 2026 contract and buying of the June 2026 contract amounts to a bet that the central bank will cut interest rates in the interim.

Volume in the spread between the two contracts exceeded 60,000 on Thursday, the second highest on record. The highest-volume day was April 9, when Trump’s decision to pause tariffs on some trading partners spurred huge moves in US financial markets. Open interest in the contracts — products of CME Group Inc. — increased, suggesting that traders set new positions in them as opposed to liquidating existing ones.

Fed policymakers have eight scheduled meetings a year to set the target band for the federal funds rate, which SOFR conforms closely to. The last one of Powell’s current term is set for April 28-29. The next one is June 16-17.

Speculation that a successor would cut interest rates immediately is rooted in Trump’s persistent scolding of Powell for not having done so already. In April, Trump said the end of Powell’s term “cannot come fast enough.”

Since then — including last week — Trump has said he won’t fire Powell. But he’s kept up pressure on the central bank to cut rates, and said he intends to name a successor soon.

Powell’s Fed raised interest rates sharply in 2022 and 2023 in response to accelerating inflation, and cut them three times toward the end of last year, before Trump was inaugurated to a second non-consecutive term in January.

Since then, policymakers — who’ve projected cutting rates further before next year — have taken the position that the 4.25%-4.5% band remains appropriate in light of employment and inflation trends.

That’s infuriated Trump, who during his first term in 2017 nominated Powell to become Fed chair the following year.

Fed policymakers have their fourth meeting of the year next week and are expected to leave rates unchanged. They also will update their economic projections for the first time since March, when their median forecast was for two quarter-point rate cuts by year-end.

Economists surveyed by Bloomberg predict quarter-point rate cuts in September and December this year.

Israel's attack on Iran is the latest in a series of global conflicts that are ratcheting airlines' security concerns, while weighing on their operations and profitability.

An increasing number of conflict zones around the world means airlines are forced to take longer and costlier routes – impacting fuel, emissions and passengers.

For passengers, this means flight cancellations and delays or longer journeys as jets are diverted away from conflict areas. Airlines are grappling with more airspace closures, threats from missiles or drones and GPS jamming.

Israel's attack on Friday is part of a broader trend of escalating geopolitical tensions that are “directly impacting global aviation”, following the situations in Ukraine and the Red Sea, according to independent security, aviation, maritime and energy analyst Dean Mikkelsen.

“We’re witnessing a growing patchwork of restricted airspace and this is putting considerable pressure on airlines and passengers alike,” he told The National.

For travellers, the most immediate impact will be on fares as aviation disruption results in longer flight times due to rerouting. In this case, routes need to be adapted around Iranian, Syrian and at times even Iraqi airspace, Mr Mikkelsen said.

Fuel consumption is expected to rise significantly. Jet fuel already makes up around 30 per cent of an airline's operating costs and that burden only grows when 30 to 90 minutes of extra flight time is needed.

Mr Mikkelsen estimates that routes from Asia to Europe or the Gulf to North America could translate to a 7 per cent to 15 per cent increase in fares, particularly on long-haul itineraries, especially as the peak summer season approaches.

Other knock-on effects are those on crew hours, insurance premiums and scheduling complexity, all of which erode profitability, he noted. “Carriers already operating on tight post-pandemic margins will feel this sharply,” he added.

The Israel-Iran conflict throws the region's aviation industry into question, especially with the uncertainty about how long the hostility will last.

Airspaces should always remain neutral and accessible when it is safe to do so, according to the International Air Travel Association.

Closures, in addition to using them in retaliatory ways, “fragment global connectivity, disrupt operations and hurt passengers and economies”, the Geneva-based Iata said.

Conflict zones substantially add to the disruption risks: in 2024, geopolitical conflicts led to significant airspace restrictions, affecting a substantial portion of long-haul routes, according to Iata data.

For instance, the Russia-Ukraine conflict, now in its fourth year, forced the rerouting of about 1,100 daily flights, leading to longer flight times and increased operational challenges, it said.

Fuel and emissions have also surged. Detours around conflict zones can lead to an average fuel consumption increase of 13 per cent on affected routes, Iata added.

When British Airways had to suspend flights to Beijing because it needed to avoid Russian airspace, the flight time was almost three hours longer and fuel costs increased by a fifth.

In October 2024 alone, multiple flights encountered Iranian missiles aimed at Israel, leading to diversions and emergency manoeuvres, Iata said.

The effect that conflict zones have on airspaces is also reflected in the shift of activity to other areas. For instance, countries like Egypt, with many rerouted flights passing through its airspace, would result in increased overflight fees and greater regional air traffic.

“The Cairo Flight Information Region is becoming a crucial alternative corridor, alongside Jordan and Saudi Arabia,” Mr Mikkelsen said.

Airlines across the region have delayed and cancelled flights following Israel’s early morning attack on Iran.

Ben Gurion Airport in Tel Aviv has shut down until further notice, Iran has declared its airspace closed and Iraq has temporarily suspended civilian operations at all its airports.

In the UAE, Etihad Airways cancelled its services to and from Tel Aviv, as Israel placed its air defence systems on high alert in anticipation of possible retaliation.

Other major airlines, including Emirates, Lufthansa and Air India, rerouted services mid-flight on Friday. An Emirates flight from Manchester was diverted to Istanbul, while an Air India flight from New York to Delhi was diverted to Sharjah.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up