Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Capacity prices — a cost that is ultimately paid for by electricity consumers — surged in PJM’s last two July capacity auctions.

Capacity prices — a cost that is ultimately paid for by electricity consumers — surged in PJM’s last two July capacity auctions.

An Amazon Web Services data center near single-family homes on July 17, 2024, in Stone Ridge, Virginia. Data center load resulted in $16.6 billion in capacity auction revenue in the PJM Interconnection’s last two capacity auctions, according to a report released on Oct. 1, 2025, by the grid operator’s market monitor

An Amazon Web Services data center near single-family homes on July 17, 2024, in Stone Ridge, Virginia. Data center load resulted in $16.6 billion in capacity auction revenue in the PJM Interconnection’s last two capacity auctions, according to a report released on Oct. 1, 2025, by the grid operator’s market monitorPJM holds capacity auctions to help ensure that it has adequate power supplies to meet future needs. In the last auction, PJM bought capacity for a one-year period that starts on June 1. The grid operator is preparing to hold its next auction in early December to buy capacity for a year beginning on June 1, 2027.

Monitoring Analytics contends it is “misleading” to say that PJM’s recent capacity market results simply reflect tightening supply and demand.“The current conditions are not the result of organic load growth,” it stated. “The current conditions in the capacity market are almost entirely the result of large load additions from data centers, both actual historical and forecast.”Also, the “extreme uncertainty” in data center load forecasts is unprecedented and “raises questions about the meaning of clearing a capacity auction based on those forecasts,” Monitoring Analytics said.

In June, the market monitor recommended requiring new data centers to supply their own generation instead of tapping into existing power supplies in PJM.“The impact of the uncertain forecast of data center load on other customers would be limited or eliminated” by the requirement, Monitoring Analytics said in the report.PJM is in the middle of a fast-track stakeholder process to develop new rules for adding large data centers to its system with a goal of filing a proposal before the end of the year at the Federal Energy Regulatory Commission.

As part of the process, PJM is proposing to bolster its load forecasting for data centers and other large loads, according to an Oct. 1 presentation from PJM staff. Under the proposal, state utility commissions could review and provide feedback on large load adjustments before they are included in PJM’s load forecast.Utilities would also have to ask if any data center proposals in their service territory are duplicative proposals. Staff suggested requiring large load customers to post financial security for the capacity they plan to buy in an auction.

PJM has dropped a proposal for “non-capacity-backed load” that was widely opposed by its stakeholders, according to the presentation.On the issue of a price cap and floor for PJM’s capacity auctions, the last auction would have been $3.2 billion, or 20%, higher except for a cost cap that grew out of an agreement between the grid operator and Pennsylvania Gov. Josh Shapiro, a Democrat, according to the market monitor’s report.

The impact of data center development on PJM’s auction results will increase sharply in the 2028/2029 base capacity auction scheduled for June, when the maximum and minimum price caps in the agreement expire, Monitoring Analytics said.Separately, the Union of Concerned Scientists this week found that utility ratepayers in PJM will pay about $4.4 billion for data center-related transmission projects that were approved in 2024 with similar results expected this year.

Japan’s jobless rate rose to its highest in over a year, signaling a slight loosening of the labor market as speculation swirls over a Bank of Japan rate hike in the near term.The unemployment rate rose to 2.6% from 2.3% in July, the Ministry of International Affairs reported Friday, against a median economist expectation of 2.4%. Separate data from the labor ministry showed that the job-to-applicant ratio ticked down to 1.20 from 1.22, meaning that there were 120 job openings for every 100 job seekers. That was the lowest number of job openings since 2022.

While August’s figures showed a slight tempering of the job market, the data still point to overall firmness amid an ongoing labor shortage. That longer term trend has pressured companies to raise wages to attract and retain workers, helping to extend wage growth. Stable wage gains along with steady inflation remain a key condition for the BOJ to stay on its gradual tightening path.The BOJ board is scheduled to give its next policy decision on Oct. 30, with market expectations for a rate hike growing. After two board members dissented against last month’s rate hold and even a dovish member communicating a hawkish stance, more traders are betting on a hike at the end of the month.

Earlier this year Japan’s largest firms pledged wage increases exceeding 5% during annual labor negotiations, marking the steepest gains in over three decades. The next round of wage talks is expected to begin later this month, with attention focused on whether businesses can maintain momentum despite concerns over a US-led tariff war weighing on corporate performance.Chronic labor shortages are becoming a serious threat to business operations. From January to August this year, 237 companies filed for bankruptcy as a result of lack of labor, up about 22% from the same period last year, according to Tokyo Shoko Research. Many of them cited the inability to meet rising wage demands, the report said.

In response, many firms are turning to foreign workers. A record 2.3 million foreign workers were in Japan’s job market as of October last year, filling gaps left by the domestic workforce.

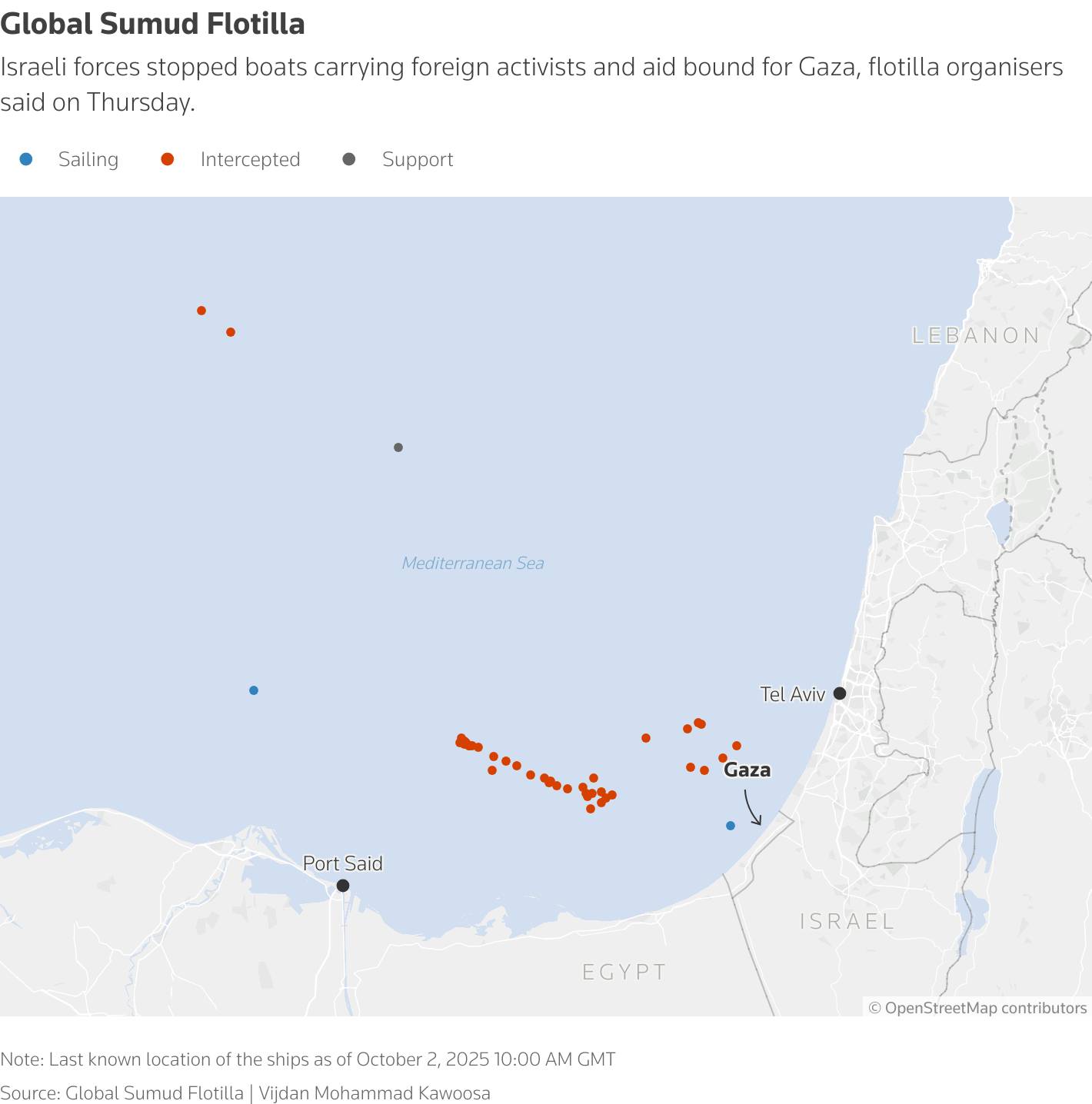

Israel faced international condemnation and protests on Thursday after its military intercepted almost all of about 40 boats in a flotilla carrying aid to Gaza and took captive more than 450 foreign activists, including Swedish campaigner Greta Thunberg.

Cameras broadcasting live feeds from the boats showed armed Israeli soldiers in helmets and night vision goggles boarding the ships, while passengers huddled in life vests with their hands up.

A video from the Israeli foreign ministry showed Thunberg, the most prominent of the passengers, sitting on a deck surrounded by soldiers.

Pro-Palestinian demonstrators took to the streets in cities across Europe as well as in Karachi, Buenos Aires and Mexico City to protest Israel's capturing of the activists two years into its assault on Gaza. Italian unions called a general strike for Friday.

The Global Sumud Flotilla, the organiser of the voyage, said on X that more than 450 volunteers had been detained. Earlier it said some of them were transferred to one large cargo vessel before being taken ashore.

One boat, the Marinette, was "still sailing strong," flotilla organizers said on a live video stream that showed the crew piloting the boat. Organizers said the Marinette was about 80 nautical miles from Gaza on Thursday night, and about 10 nautical miles from where Israel began intercepting other boats in the flotilla.

Thunberg, 22, best known for her environmental protests, had pre-recorded a video that was released on her behalf after her ship was boarded.

"If you are watching this video, I have been abducted and taken against my will by Israeli forces," she said. "Our humanitarian mission was non-violent and abiding by international law."

Italian Foreign Minister Antonio Tajani said he expected the members of the flotilla to be expelled from Israel on Monday and Tuesday and sent to European capitals on charter flights.

The Israeli foreign ministry said in a statement it was taking all the people it had captured from the flotilla ashore at Ashdod, and that all were "safe and in good health."

"One last vessel of this provocation remains at a distance," the ministry said. "If it approaches, its attempt to enter an active combat zone and breach the blockade will also be prevented."

Turkish President Tayyip Erdogan criticised Israeli aggression, saying it showed Israel's government has no intention of letting hopes for peace grow.

"I condemn the thuggery directed at the Global Sumud Flotilla, which set out to draw attention to the barbarity of children dying of hunger in Gaza and to deliver humanitarian aid to the oppressed Palestinians,” he said in a speech to officials from his AK Party in the capital Ankara.

The Istanbul chief prosecutor's office said it had launched an investigation into the detention of 24 Turkish citizens on the vessels, Turkey’s state-owned Anadolu news agency reported.

South African President Cyril Ramaphosa urged Israel to immediately release South Africans who were on the flotilla, including former President Nelson Mandela's grandson, Nkosi Zwelivelile Mandela.

The activists were expected to be transferred to the immigration authority upon arrival in Ashdod, from where they will be moved to Ketziot Prison in southern Israel before they are deported, said Suhad Bishara, the director at Adalah, a human rights organisation and legal centre in Israel.

The flotilla, which set sail in late August, was transporting medicine and food to Gaza and consisted of more than 40 civilian vessels with parliamentarians, lawyers and activists in a high-profile display of opposition to Israel's blockade of Gaza, which many have said amounts to violations of the Genocide Convention.

Israeli officials have repeatedly denounced the mission as a stunt. Israel is defending itself against charges of genocide in the International Court of Justice and broader global opprobrium, arguing its actions have been in self-defense.

As the flotilla sailed across the Mediterranean Sea, Turkey, Spain and Italy sent boats or drones in case their nationals required assistance, even as it triggered repeated warnings from Israel to turn back.

Israel's navy had previously warned the flotilla it was approaching an active combat zone and violating a lawful blockade, and asked organisers to change course. It had offered to transfer any aid peacefully through safe channels to Gaza.

The flotilla is the latest seaborne attempt to break Israel's blockade of Gaza, much of which has been turned into a wasteland by almost two years of war.

In a statement, Hamas, which governs Gaza, expressed support for the activists and called Israel's interception of the flotilla a "criminal act", calling for public protests to condemn Israel.

The U.S. and Israel announced a new proposal to end the conflict this week that includes Hamas surrendering. U.S. President Donald Trump, who said he would temporarily oversee governance of Gaza under his plan, gave Hamas a few days to respond, and warned of continued escalation if Hamas refused.

The boats were about 70 nautical miles off Gaza when they were intercepted, inside a zone that Israel is policing to stop any boats approaching. The organisers said their communications, including the use of a live camera feed from some of the boats, had been scrambled.

Israel began its Gaza offensive after the October 7, 2023, Hamas-led attack on Israel in which some 1,200 people were killed and 251 taken as hostages back to Gaza, according to Israeli tallies. The offensive has killed over 66,000 people in Gaza, Palestinian health authorities say.

Japan stands a good chance of having its first woman prime minister or its youngest leader in the modern era after a vote on Saturday to pick the head of the nation’s ruling party.

The front-runners in the potentially historic Liberal Democratic Party election are conservative nationalist Sanae Takaichi, 64, and her more moderate rival Shinjiro Koizumi, 44. Opinion polls suggest Cabinet Secretary Yoshimasa Hayashi, 64, may also be a contender.

They are among five candidates vying to replace Prime Minister Shigeru Ishiba, who is stepping down after a series of electoral defeats.

The next leader is likely to become premier as the LDP is the biggest group in parliament, but that is not assured as the party – which has run Japan for almost all the postwar period - lost its majorities in both houses under Ishiba.

Takaichi pledges to jolt the economy with aggressive government spending that could spook investors in an economy with one of the world's biggest debt loads. She has raised the possibility of redoing an investment deal with U.S. President Donald Trump that lowered his punishing tariffs.

Farm minister Koizumi, son of former premier Junichiro Koizumi, as well as the other candidates, say they would trim taxes to help households cope with rising living costs but otherwise hew more closely to Ishiba's economic restraint.

Whoever wins Saturday's vote will inherit a party in crisis and a sluggish economy.

Dissatisfaction with the LDP is pushing many voters, especially disillusioned younger people, to opposition parties such as an upstart anti-immigrant far-right party.

"Koizumi and Takaichi offer two quite different approaches to that renewal," said Tina Burrett, a political science professor at Tokyo's Sophia University. Koizumi is seen as someone who could forge consensus with other parties while Takaichi would shake up "a world of rather grey politicians", she said.

If chosen, Koizumi would be a few months older than Hirobumi Ito when he became Japan's first prime minister in 1885, under the nation's prewar constitution.

Koizumi leads among the 295 LDP lawmakers who will vote for party leader, followed by Hayashi and Takaichi, according to an Asahi newspaper report on Wednesday. But Takaichi is ahead of both of them among rank-and-file party members who will get an equal number of votes in the first round on Saturday, a Nippon Television survey found.

If, as seems likely, the election goes to a second round, the advantage could shift as the vote of grassroots LDP members would fall to 47.

Takaichi, an ally of assassinated former Prime Minister Shinzo Abe, has the most expansionist economic platform of the LDP candidates. She has promised to double the size of the economy in a decade with heavy state investment in new technologies, infrastructure, food production and other areas of economic security.

She has said she would carry over Ishiba's trade agreement with Trump, in which Japan agreed to invest $550 billion in the U.S. in return for lower tariffs on automobiles and other Japanese products, but mentioned the possibility of renegotiation if the deal proves to be unfair.

Cabinet ministers Hayashi and Koizumi have defended the deal.

For whoever wins, one of their first acts as premier is expected to be hosting Trump in Tokyo at the end of October, Reuters has reported.

Domestically they face the tall task of rejuvenating a party increasingly seen as out of touch with voters, said James Brown, a politics professor at Temple University in Tokyo.

"There's every possibility that we'll be returning to this issue of yet another election for the leadership of the country before too long," Brown said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up