Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Cryptoсurrencies are known for their volatility. While that may put some traders off, it creates many potentially lucrative opportunities for those with significant experience who can react quickly.

Cryptoсurrencies are known for their volatility. While that may put some traders off, it creates many potentially lucrative opportunities for those with significant experience who can react quickly. In this article, we’ll explore five of the most popular crypto scalping strategies and help you learn how to scalp crypto with a simple framework.

As in any other financial market, cryptocurrency scalping refers to a type of trading where traders aim to take advantage of short-term market movements. This approach involves entering and exiting trades within minutes or even seconds, aiming to capitalise on small price fluctuations.

Scalpers typically use high leverage and execute many trades to accumulate small returns over time. The objective is to make seemingly insignificant gains that add up rather than seeking larger, less frequent returns. Scalping is particularly popular in crypto trading, as digital assets are inherently volatile and experience extreme daily price changes.

How easy is scalping in the cryptocurrency market? Compared to longer-term trading styles like swing or position trading, scalping requires more discipline, stronger risk management skills, and a solid understanding of market mechanics. As such, scalping is a more advanced technique and can be considered more complex than other styles. However, through practice, crypto scalping can become accessible.

While crypto markets are open 24/7, volumes often pick up during regular trading hours for other markets. Generally, London and New York sessions, particularly their overlaps, are the most active, with plenty of volume and volatility for scalpers to take advantage of.

In terms of the best timeframe for scalping in crypto, scalping is usually done on the 1-, 2-, or 3-minute charts. 5-minute and 15-minute charts are often used to help set a directional bias.

Crypto scalping has some unique features that differentiate it from scalping in traditional financial markets like forex or stocks. They make crypto scalping both challenging and potentially rewarding, especially for traders who can navigate the fast-paced and unpredictable nature of the cryptocurrency markets.

Let’s dive into particular strategies.

1. Range Trading

Range trading is a popular scalping strategy for cryptocurrencies. It involves identifying a specific consolidation range within which an asset is likely to fluctuate. Scalpers aim to buy at the lower end of the range (support) and sell at the upper bound (resistance).To get started with range trading, traders first need to identify a ranging market on a low timeframe, like the 1- or 5-minute charts. Then, they determine support and resistance levels near the strong highs and lows of the range. These levels then serve as entry and exit points, with a trader entering at support looking to exit at resistance and vice versa.

Some will look for reversal candlestick patterns, like hammers or shooting stars, at support or resistance, respectively, before entering with a market order. Others will simply set limit orders at their chosen entry point.Stop losses are typically placed beyond the range’s high or low, depending on the direction of trade. Scalpers usually use a 1:1 risk/reward ratio or don’t place stop-loss orders, but the latter is a risky approach.

2. Breakout Trading

Breakouts occur when a level of support/resistance is broken through, often indicating the start or continuation of a trend. There are several ways you can take advantage of breakouts, but it’s not uncommon for a false breakout to occur. We can use a pullback filter to validate a trade.To start, we need to identify a support or resistance level. The easiest way is to look for relatively equal highs or lows forming, like in the chart above. When the level is broken with a strong impulsive move, we can enter on the close of the breakout candle. However, if the move isn’t particularly strong, like at a), then we could wait for a pullback. We can place a stop order to enter as the pullback itself breaks out, as marked by the dotted lines.

Profits might be taken at an opposing support or resistance level. However, some scalpers may prefer to attempt to ride the trend and trail their stop loss above or below swing points as the trend progresses. Similarly, stop losses can be placed above or below the nearest swing points.

3. Chart Patterns

Chart patterns can be a powerful tool for scalping, helping traders to identify potential trend continuations and reversals. While there are many different chart patterns out there, it’s best to stick to just one or two to avoid confusion, at least until you master their use. We’ll use rising and falling wedges in this example, as they often lead to strong moves.There are two ways to enter: either on the breakout or on the retest of the broken trendline. As you can see in the example, entering retests might be a more accurate method, but it’ll mean you miss out on some trades. Conversely, entering on the breakout is riskier, as it could just as easily be a false breakout.

Your profit target and stop loss will depend on the pattern you’re using. Given that wedges typically prompt a prolonged trend, you could look for significant areas of support/resistance to start taking profits. For a more conservative approach, you might take profit at a distance equal to the height of the wedge placed from the breakout point. Stop losses might be calculated in accordance with the 1:2 risk/reward ratio.

4. Using the Relative Strength Index and Bollinger Bands

Some scalpers rely heavily on technical indicators to help them determine entries and exits. One popular combination is the relative strength index (RSI) and Bollinger Bands.

When the RSI crosses 70, indicating overbought conditions, or below 30, showing the asset is oversold, traders can look to confirm a reversal entry with Bollinger Bands. If an asset is overbought and crosses above the upper band, a short position can be considered. If the asset is oversold and the price breaches the lower band, a long position could be entered.

As for exit conditions, some scalpers may prefer to take profits at the midpoint of the Bollinger Bands or the opposing band. Others take profit when RSI crosses above or below 50, depending on the direction of trade. In terms of stop losses, traders place them above or below a nearby area of support or resistance. Alternatively, they consider the take-profit target and place the stop loss, considering their risk aversion.

5. Bid-Ask Spread

The bid-ask spread refers to the gap between the maximum price a buyer can offer (bid) and the minimum price a seller can accept (ask) for a specific asset. Scalpers can take advantage of the bid-ask spread to potentially generate returns. This strategy can be particularly effective in less liquid cryptocurrencies where spreads are naturally wider.

When spreads are wide, traders place buy orders and sell orders simultaneously. They buy at the lowest possible bid price and sell at the highest possible ask price. Traders using this strategy typically place limit orders rather than market orders. Limit orders allow them to specify the price at which they want to buy or sell, increasing the chance of capturing the spread. Since the return per trade is usually small, traders must execute many trades to achieve significant returns. This necessitates careful risk management to ensure that small losses don’t outweigh the small gains.

Now, it’s time to create your own scalping trading strategy for crypto. While your strategy will ultimately be unique to you and your preferences, you can try these steps to begin developing your own system.

Scalp trading in the cryptocurrency market has its advantages and disadvantages.

Pros:

Cons:

Crypto scalping can be a rewarding trading approach for those who can navigate its fast-paced and volatile nature. However, it’s crucial to remember that effective scalping requires more than just a good strategy. Traders must be disciplined, agile, and ready to react quickly to market changes. They should also have a deep understanding of the specific market conditions and tools available in the cryptocurrency space, including the use of automated bots and advanced charting software. Risk management is equally important, as the high leverage and frequent trades characteristic of scalping can lead to significant losses if not carefully controlled.

FAQ

What Is Scalping in Crypto?

Scalping in crypto is a fast-paced trading strategy focused on making numerous trades throughout the day to capture small returns from minor price fluctuations. Scalpers hold positions for very short periods, sometimes just seconds or minutes, aiming to build up small gains that accumulate over time rather than seeking large returns from long-term positions.

How Can You Scalp Crypto?

Scalping crypto involves selecting a cryptocurrency with significant volatility and liquidity. Traders analyse short-term market trends using technical indicators to identify optimal entry and exit points. They often place limit orders to ensure trades are executed at specific price levels, aiming for small, frequent returns. Risk management is crucial, so traders use stop-loss orders to protect against unexpected price movements, while continuously monitoring the market to react quickly to changes.

What Coin Is Best for Scalping?

The best crypto to scalp typically has several key characteristics that make it suitable for quick, frequent trades. High liquidity is crucial, as it helps traders to enter and exit positions at the desired prices. A coin with a narrow bid-ask spread is also ideal, as it reduces the cost of each trade. Additionally, the coin should exhibit consistent price volatility, offering frequent small price movements that scalpers can capitalise on.

How might policymakers alter their 2% inflation targets without getting attacked by the bond vigilantes for playing fast and loose with their mandates? The post-pandemic experience of soaring consumer prices demands a review of how central banks conduct themselves; policymakers should bite the monetary bullet by asking their political masters to allow them to adopt individual inflation bands, and fend off potential critics by adding an obligation to embrace some broad growth measure that embraces the wider economy in guiding interest rates to an appropriate level.

As I've argued before, attempting to steer multitrillion-dollar economies to land with laser precision onto a micro-specific inflation pin is a fool’s errand. The aura of invincibility and omnipotence has cracked; central banks should be voluntarily seeking reforms, or they will be reformed in ways that may prove less than ideal. The current omerta surrounding the topic is unsustainable, especially when politicians are starting to question the independence of their central banks.

Too little attention was paid at the start of the decade to the likely hangover from a heady cocktail of cutting interest rates close to zero and increased bond buying via quantitative easing — at the same time as governments delivered a bucketload of fiscal stimulus. A deliberate avoidance of accountability combined with antediluvian communications and a spreadsheet-driven mentality endanger what central bankers revere most — their independence.

Key to any reevaluation of how monetary policy is conducted has to be an attitude change. Rigid academic adherence to backward-looking datasets has to be scrapped, especially as the quality of the numbers in far too many countries is being questioned. An overhaul that pays more attention to the multitude of agents and decision makers that policymakers already informally consult when setting borrowing cost would be helpful for a start.

Above all, enhanced flexibility ought to be the new mantra. The Federal Reserve's pre-pandemic Flexible Average Inflation Targeting was short lived because the market detected a lack of conviction — it was really designed to breathe more stimulus in after a bout of sluggish growth — and, credit where it’s due, the central bank ditched it quickly as consumer prices started to accelerate. Nonetheless the initial idea is valid.

Moreover, one size doesn't have to fit all. Clumping around a 2% inflation target may seem to offer safety in numbers, but what suits the Fed isn’t necessarily appropriate for the European Central Bank. Setting a target range rather than a single mark can work provided policymakers feel confident to sometimes make clear that one end of the range is what they're aiming at for a particular period.

Multiple mandates encompassing economic variables such as maximum employment or nominal growth all have merit. And steering interest rates across the yield curve, not just overnight rates, should at least be a topic for consideration. Not paying due attention to how steep the curve is and how that affects investment and crimps government budgets leads to policy errors; the importance of calibrating short-term interest rates with the longer-dated repercussions of shrinking or expanding central bank balance sheets in an age of quantitative tightening and easing can’t be underestimated.

That, though, shouldn’t sanction explicit yield curve control, as trialed by the Bank of Japan between 2016 and 2024. Optically, there was a long period of stability — but at the heavy price of sharply reduced liquidity. Japanese government bond yields are now significantly higher; the experiment has driven buyers out of the market, perhaps for good.

Lorie Logan, president of the Federal Reserve Bank of Dallas, last week proposed replacing the central bank’s benchmark federal funds rate with a more widely used market bellwether. The federal funds market, where banks once lent to each other on an overnight basis, has ceded activity to the market for repurchase agreements, another form of short-term lending. So far, she's a lone voice willing to question the current ossification of monetary policy — and even then is only tinkering with its output mechanism, rather than the guiding inputs.

Shifting to a target range for inflation must make it explicit that consumer price increases can occasionally be allowed to linger below 2%, drifting closer to deflationary levels; otherwise, those bond vigilantes will always suspect policymakers will be more comfortable at the higher end of the spectrum. That 2% shibboleth may have been the answer once — but central bankers should be willing to move with the times and embrace change before change is inflicted on them.

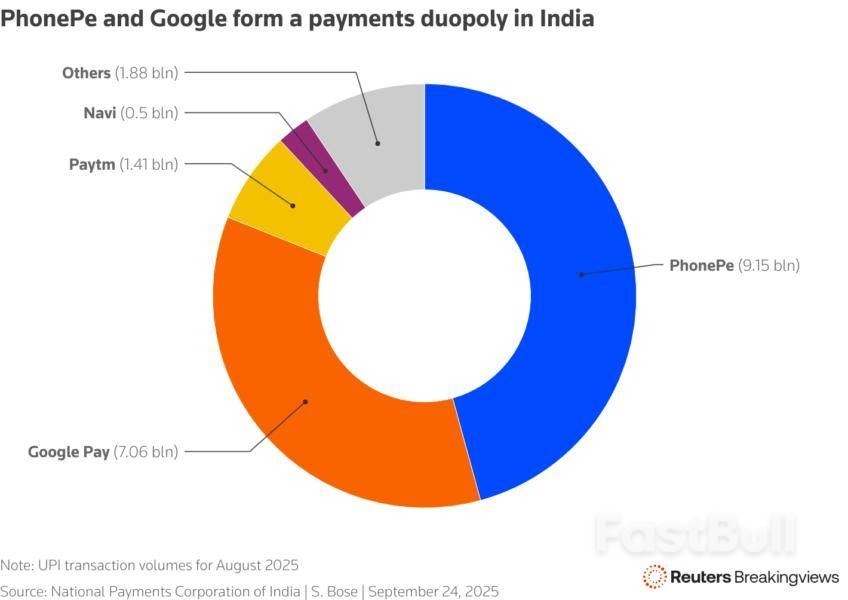

India's financial technology startups are lining up for credit. Among them is Walmart-backedpayments champion PhonePe, which on Wednesday said it has confidentially filed for an initial public offering in Mumbai. A mooted $15 billion valuationlooks punchy, but its shot at grabbing the ultimate fintech prize in the country is half decent.The U.S. retailer owns about 84% of the startup, which it acquired as part of its 2018 acquisition of e-commerce platform Flipkart. PhonePe's target valuation would imply a multiple of 13 times sales for the year to end March 2026, assuming its topline grows at the same 40% pace as it did in the previous year. That compares to 9 times Paytm-owner One97 Communicationscommands among investors.

PhonePe is superior in multiple ways. Though Paytm swung to profit in the June quarter, PhonePe's losses are narrowing and it has faced none of the regulatory heat that has mired its rival. The Walmart unit also enjoys a 46% share in transactions passing through India's homegrown bank-to-bank mobile payments system, where its closest competitor is an application owned by Alphabet'sGoogle.

Yet simple payment transactions earn no fees in India. To profit, PhonePe needs to gradually convert its 200 million monthly active users and 40 million-strong merchant network into customers of financial products, from loans to insurance and mutual funds.It's a promise that Paytm is starting to realise. Its revenue from financial services distribution doubled during the year to end June and accounted for 29% of its quarterly topline. PhonePe, by virtue of its bigger share of payments, ought to have a larger database spanning utility bill payments to restaurant outings that it can leverage to decide who is creditworthy.

The upstart will probably churn out a different, slightly lower, class of customer to those chased by India's traditional lenders, including HDFC Bankand ICICI Bank. They already have strong digital sourcing engines, however, so there will be some overlap in who they target. And the $72 billion Bajaj Financehas a formidable grip on the consumer loan market too that's proven hard to break.Yet if India is to produce anything like a real fintech winner, PhonePe is more than likely to be it.

Walmart-backed Indian fintech firm PhonePe on September 24 said it has confidentially filed for a Mumbai initial public offering.

The company plans to raise around 120 billion rupees ($1.35 billion) through a sale of existing shares, Moneycontrol reported on the same day, citing unnamed industry sources. Walmart, Tiger Global and Microsoft could sell a combined 10% stake in the IPO, the report added.PhonePe narrowed losses during the year ended March 31 to 17.3 billion rupees ($194.7 million) from 19.96 billion rupees ($225 million) in the previous 12-month period, the company said in a regulatory filing on September 22.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up