Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The financial world is buzzing with a significant update: Deutsche Bank has revised its outlook, now forecasting three Fed rate cuts this year. This pivotal shift from their previous expectation of just two cuts signals a potentially major change in the economic landscape, with implications for everything from your mortgage to the cryptocurrency market. What exactly does this mean, and why is Deutsche Bank’s updated prediction drawing so much attention?

The financial world is buzzing with a significant update: Deutsche Bank has revised its outlook, now forecasting three Fed rate cuts this year. This pivotal shift from their previous expectation of just two cuts signals a potentially major change in the economic landscape, with implications for everything from your mortgage to the cryptocurrency market. What exactly does this mean, and why is Deutsche Bank’s updated prediction drawing so much attention?

When the Federal Reserve decides on Fed rate cuts, it directly influences the cost of borrowing across the entire economy. Essentially, these cuts make money cheaper. For consumers, this could translate to lower interest rates on loans, credit cards, and mortgages. For businesses, it means less expensive capital for expansion and investment.

Historically, periods of anticipated or actual Fed rate cuts often lead to increased market liquidity. This environment can sometimes fuel investor confidence, potentially benefiting riskier assets like cryptocurrencies. However, the exact impact depends on various other economic factors.

Deutsche Bank’s latest projection marks a notable adjustment. Previously, the bank anticipated only two Fed rate cuts, specifically in September and December. Their revised forecast now adds an earlier cut, suggesting a more aggressive easing of monetary policy than initially thought. This change reflects their analysis of evolving economic data, likely including inflation trends and employment figures, which suggest the Fed might have more room to maneuver.

This updated outlook from a major financial institution provides a significant signal. It implies that the global economy might be heading towards a period of more accommodative monetary conditions sooner rather than later. Such a move by the Fed could aim to stimulate economic growth and prevent a slowdown.

The prospect of multiple Fed rate cuts has several key implications for your financial well-being:

Understanding these dynamics is crucial for making informed financial decisions in the coming months, whether you’re planning a major purchase or adjusting your investment portfolio.

While Deutsche Bank’s forecast is significant, it’s important to remember that the Federal Reserve’s decisions are primarily data-dependent. Key economic indicators will continue to shape their policy, and any shift in these could alter the path of Fed rate cuts:

Therefore, while Deutsche Bank’s projection offers a strong indication, the actual trajectory of interest rates will ultimately hinge on the evolving economic landscape and the Fed’s interpretation of incoming data.

Conclusion: Deutsche Bank’s revised forecast for three Fed rate cuts this year represents a notable shift in the economic outlook. This expectation of cheaper money could have wide-ranging effects, from encouraging borrowing and investment to influencing market sentiment across various asset classes, including the dynamic cryptocurrency space. As we move forward, closely monitoring the Fed’s communications and incoming economic data will be essential for navigating these potential changes and understanding their full impact on your finances and the broader economy.

Q1: What exactly are Fed rate cuts?A1: Fed rate cuts refer to the Federal Reserve’s decision to lower the target range for the federal funds rate. This action makes borrowing money cheaper for banks, which then passes on these lower rates to consumers and businesses through various loans, aiming to stimulate economic activity.

Q2: Why did Deutsche Bank revise its forecast for Fed rate cuts?A2: Deutsche Bank revised its forecast from two to three Fed rate cuts likely based on its analysis of evolving economic data, such as inflation trends, employment figures, and overall economic growth indicators, suggesting a greater need or opportunity for monetary policy easing.

Q3: How might Fed rate cuts impact the cryptocurrency market?A3: Generally, Fed rate cuts can create a “risk-on” environment. Cheaper money and increased liquidity might encourage investors to seek higher returns in riskier assets, including cryptocurrencies. However, the actual impact also depends on broader market sentiment and specific crypto market dynamics.

Q4: When are these three Fed rate cuts anticipated by Deutsche Bank?A4: While Deutsche Bank previously expected cuts in September and December, their revised forecast now includes an additional, earlier cut, making it three total for the year. The exact timing of the first cut is not specified beyond being earlier than previously thought.

Q5: What factors could prevent the Federal Reserve from implementing these anticipated Fed rate cuts?A5: The Federal Reserve’s decisions are primarily data-dependent. Factors such as persistent high inflation, a surprisingly robust labor market, or unforeseen global economic shocks could lead the Fed to delay or reduce the number of anticipated Fed rate cuts.

Did this article help you understand the potential impact of Deutsche Bank’s latest forecast on Fed rate cuts? Share your thoughts and this crucial information with your network! Follow us on social media for more timely updates and expert analysis on economic trends and their implications for your investments.

To learn more about the latest economic forecast trends, explore our article on key developments shaping monetary policy and its impact on market sentiment.

We used to dread covering the monthly update of US government income and spending because, without fail, it would show that the USS Titanic was getting that much closer to the inevitable iceberg crash. A few months ago, there was a glimmer of hope when thanks to Elon Musk and DOGE, there was a brief push to cut government spending, while at the same time the US also found a new revenue stream in the form of tariffs which helped reduce the massive monthly US deficit by a modest amount. Alas, in the grand scheme of things, the modest trim in spending and the bounce in revenue proved to be too little... and too late.

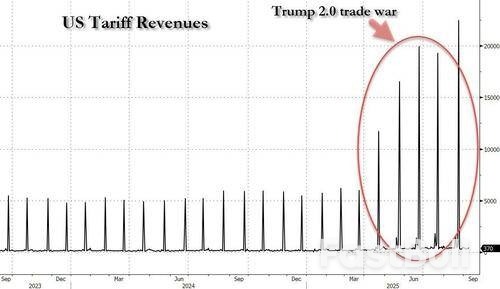

With that in mind, here is a look at the latest Treasury Income Statement for the month of August, published earlier today.First, the good news: for the fifth month in a row, the US government benefited from outsized tariff revenues, which as shown in the chart below, continue to rise and in August hit just under $30BN - or about $360BN annualized - at the current tariff rate.

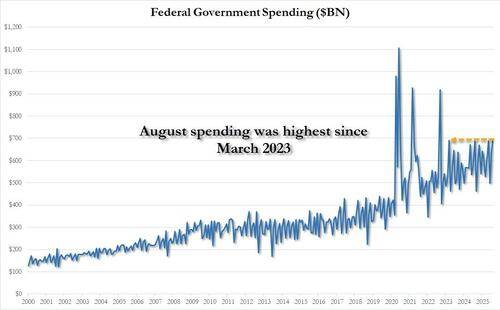

But while the tariff revenue in June was sufficient to tip the overall US Treasury budget into a (very rare) surplus, July proved to be too great an obstacle as we discussed last month. And August was just a full-blown return to the disastrous drunken-sailor spending ways of old.According to the latest Monthly Treasury Statement, in August the US government spent $689 billion, up 0.4% from the $686.6 billion a year ago, and the highest monthly spending total of fiscal 2025 which ends next month. So much for the cost-cutting efforts of DOGE.

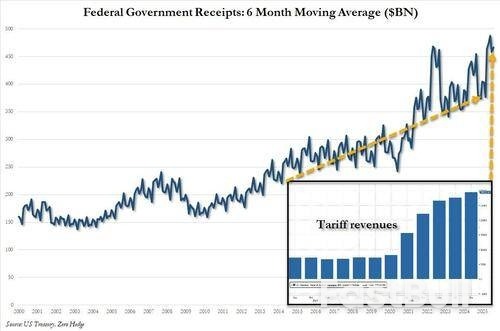

And while the huge monthly spending was somewhat offset by a 12.3% increase in revenues, which increased from $306.5 billion to $344.3 billion, this included the $29.5 billion in tariff revenues noted above. Take that out and government income would have been flat YoY.

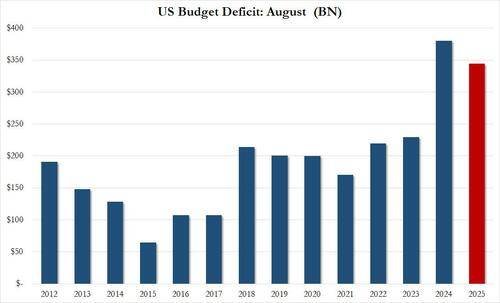

Combining the latest receipts and spending data, and we get an August deficit of $345 billion, a substantial deterioration from the $291 billion deficit in July, and the highest monthly deficit of calendar 2025. It was also the second worst August deficit in US history, with just last year's pre-election blowout of $380 billion higher, which as readers will recall, was a kitchen sink month for the Biden admin, which flooded the economy in a last-ditch effort of boosting the economy ahead of the presidential elections.

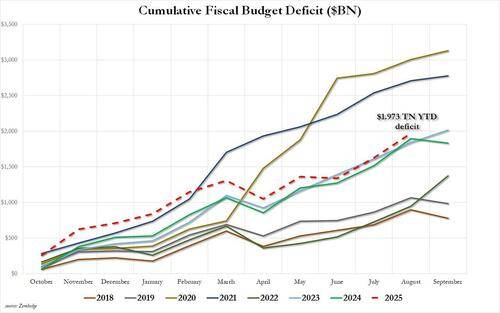

Looking at the deficit on a cumulative basis, we find that after June's improvement, the deficit took another lunge in the past two months, and in August - just one months before the fiscal year end - it hit $1.974 trillion, up 4% from the $1.897 trillion a year ago. That means that with just one month to go, 2025 is shaping up as the third worst year in US history for the budget deficit, with just the covid years 2020 and 2021, worse.

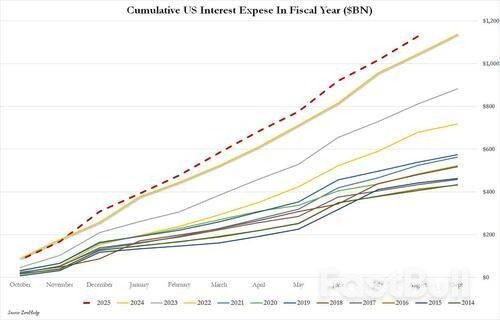

Last but not least, the epic disaster that is US gross interest spending continues to rise, and in August the US spent $111.5 billion on interest, pushing the total for the eleven months of the fiscal year to a record $1,124 trillion, and on pace to surpass $1.2 trillion for the full year.

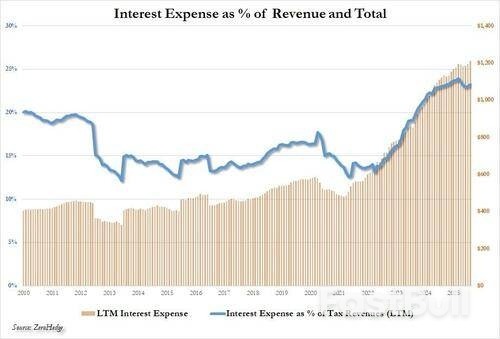

With total debt rising by about $1 trillion every 100 days, it means that interest will keep growing too, and unless revenue grows in line, we will reach a point where every taxed dollar goes to pay down US debt. As of today, interest expense eats up just over 23% of all government tax revenues, just shy of the non-wartime record high.

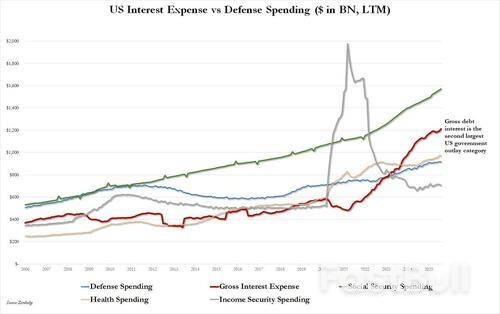

It also means that, as we first showed over a year ago, gross interest remains the second highest spending category for the US, well above defense, income security and health spending, and only Social Security remains a larger outlay category (although it is unclear for how much longer).

Bottom line: after a brief period of irrational hope in early 2025 when Musk's obsession with DOGE and cutting spending, we are again at square zero one and back on the fast-track to the debt-death of the United States. No wonder why in his most recent public commentary, Musk fully agrees with us: the government is unfixable.

Key Takeaways:

On Friday, Bitcoin not only hit a new peak of $116,000 in market value but also hit a new historical peak of 1 zetahash-per-second on the hashrate of the crypto network, the first time in Bitcoin’s history. The milestone puts the computing capacity of the network at 1 Zeta hashes per second, which highlights the fast industrialization of Bitcoin mining.

The breakthrough of zetahash indicates the tremendous growth of dedicated hardware and energy investments in ensuring the network.

According to analysts, this threshold is indicative of the maturity of the mining industry and the increasing competitiveness of rewards available to block all over the world, especially as the next halving cycle approaches. “It’s an extraordinary show of strength for Bitcoin’s security model,” said one industry observer. They added that this number would have been hard to imagine a few years ago.

The price behavior of Bitcoin evoked the same interest. The asset reached an all-time high of $116,000 and then went down a notch to trade below $115,000. The rally is a sign that investors are anticipating the U.S. Federal Reserve policy meeting that takes place on September 17, at which a change towards monetary easing is increasingly likely.

According to a recent survey of economists by Reuters, 105 of the 107 people surveyed predicted a decrease of 25 basis points in interest rates by the Fed, reducing the federal funds range to 4.00%-4.25%. Most of the participants also expect further trimming later in this year as labor market indicators remain soft and may end up cutting three applications by the end of the year.

In the past, the easier monetary policy has been driving inflows in risk-sensitive assets, and Bitcoin traders are eagerly anticipating repeat performances of these mechanisms.

Besides macro drivers, chart analysts are also pointing to technical structures that will have more BTC price upside. On the weekly chart, Bitcoin has made an inverse head-and-shoulders, which started in late 2024. The pattern was verified by the breakout above $112,000 in July, with a measured target that suggested prices of close to the $170,000 mark, an increase of almost 50% above the present levels.

Source: TradingView

Source: TradingViewThere is also a bigger building that was left standing, dating back to March 2021. Bitcoin fell below the neckline at $73,000 in November 2024, and subsequently, the level was retested at the correction of April at $74,400. Having received that backing, technicians estimate that a possible target could be $360,000, or a 217% improvement on the current price.

Independent strategist Merlijn The Trader observed that the existence of both of these patterns at the same time is an indicator that a Bitcoin supercycle has been ignited. In the short term, the traders are tracking a smaller inverse head and shoulders on the four-hour chart. That arrangement suggests a potential run to $120,000, as long as Bitcoin is above $113,000 in the next few sessions.

Key points:

South Korean Foreign Minister Cho Hyun has urged the U.S. Congress to support a new visa for his country's businesses, as hundreds of mainly Korean workers arrested during a massive U.S. immigration raid last week were set to return home on Friday.During his meetings with U.S. senators in Washington, Cho reiterated concerns among South Koreans over the detention of Korean professionals participating in investment projects in the United States, his ministry said in a statement.

A plane carrying more than 300 Korean workers who were detained during the raid at a Hyundai Motorand LG Energy Solutionbattery joint venture in the state of Georgia has left the United States, bound for South Korea.The plane is expected to touch down in South Korea at around 2 p.m. (0500 GMT), according to LG Energy Solution, whose workers and subcontractors were among the detainees.After being held for a week by U.S. Immigration and Customs Enforcement, the South Korean workers have been released and flown from Atlanta.

The raid that sent shockwaves across South Korea has threatened to destabilise ties, at a time when both countries are seeking to finalise a trade deal, and to scare off South Korean investment in the United States that U.S. PresidentDonald Trumphas been keen to secure.Following the raid, the battery plant is facing a minimum startup delay of two to three months, Hyundai CEO Jose Munoz said on Thursday.In the wake of the raid, Washington and Seoul have agreed to discuss establishing a new visa category for South Koreans, Cho has said.U.S. Commerce Secretary Howard Lutnick said on Thursday that hundreds of South Korean workers arrested during the immigration raid had the wrong visas.

"I called up the Koreans, I said, oh, give me a break. Get the right visa and if you're having problems getting the right visa, call me," Lutnick said in an interview with Axios.Asked if the raid had created tensions between the countries, Lutnick told CNBC Trump would "go and address that."

"So I think he's going to make a deal with different countries that when they want to build big here, he'll find a way to get their workers proper work visas, meaning short-term work visas, train Americans and then head home," he said.South Korean companies have complained for years that they have struggled to obtain short-term work visas for specialists needed at their high-tech U.S. plants, and had come to rely on a grey zone of looser interpretation of visa rules under previous U.S. administrations."Minister Cho emphasized that fundamental preventative measures are essential to ensure that our workforce is not subjected to unfair treatment in order to fulfil our companies' investment commitments to the United States," the ministry said in a statement.

Spain sees hosting talks between the United States and China in the coming days as a chance to repair ties with Donald Trump's government, days after Washington described its plan to impede arms sales to Israel as "emboldening terrorists".

Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng chose Madrid as the venue to continue their discussions, and a government source said Spain would make use of that opportunity.

The U.S. on Tuesday said measures announced by Prime Minister Pedro Sanchez to limit access to Spanish ports and airspace for ships and planes carrying weapons for Israel were "deeply concerning" because they might limit U.S. operations.

Under an agreement signed in 1953, the U.S. military has used the Morón air base and the Rota naval base, both in southern Spain, for more than 70 years.

Sanchez also angered Washington when he said Spain would not meet demands for NATO members to raise defence spending to 5% of gross domestic product, prompting Trump to threaten to raise tariffs against Spain.

As Spain's ties with the U.S. have deteriorated, its relations with China have warmed.

Sanchez has visited China three times in as many years, and switched his vote to abstain on whether the EU should apply tariffs to Chinese EVs, having supported them, as he seeks to position Spain as an interlocutor between China and the EU.

That the U.S. was able to use Spain's military bases for refuelling during its bombing of Iranian nuclear sites in June shows that Spain never overstepped the line and that its transatlantic relationship remains intact, said José-Ignacio Torreblanca, senior adviser to the Madrid office of the European Council on Foreign Relations.

"We do not yet know who requested it (Spain hosting the meeting) - whether it was the Chinese - but it is good for Spain," Torreblanca said. He added that Spain's government would get the opportunity to speak with Bessent and discuss its concerns, and this would give Madrid "an advantage" in future negotiations with Washington.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up