Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The plan would enable Coinbase to offer digital tokens that represent ownership in publicly listed companies, effectively merging traditional equity markets with blockchain infrastructure.

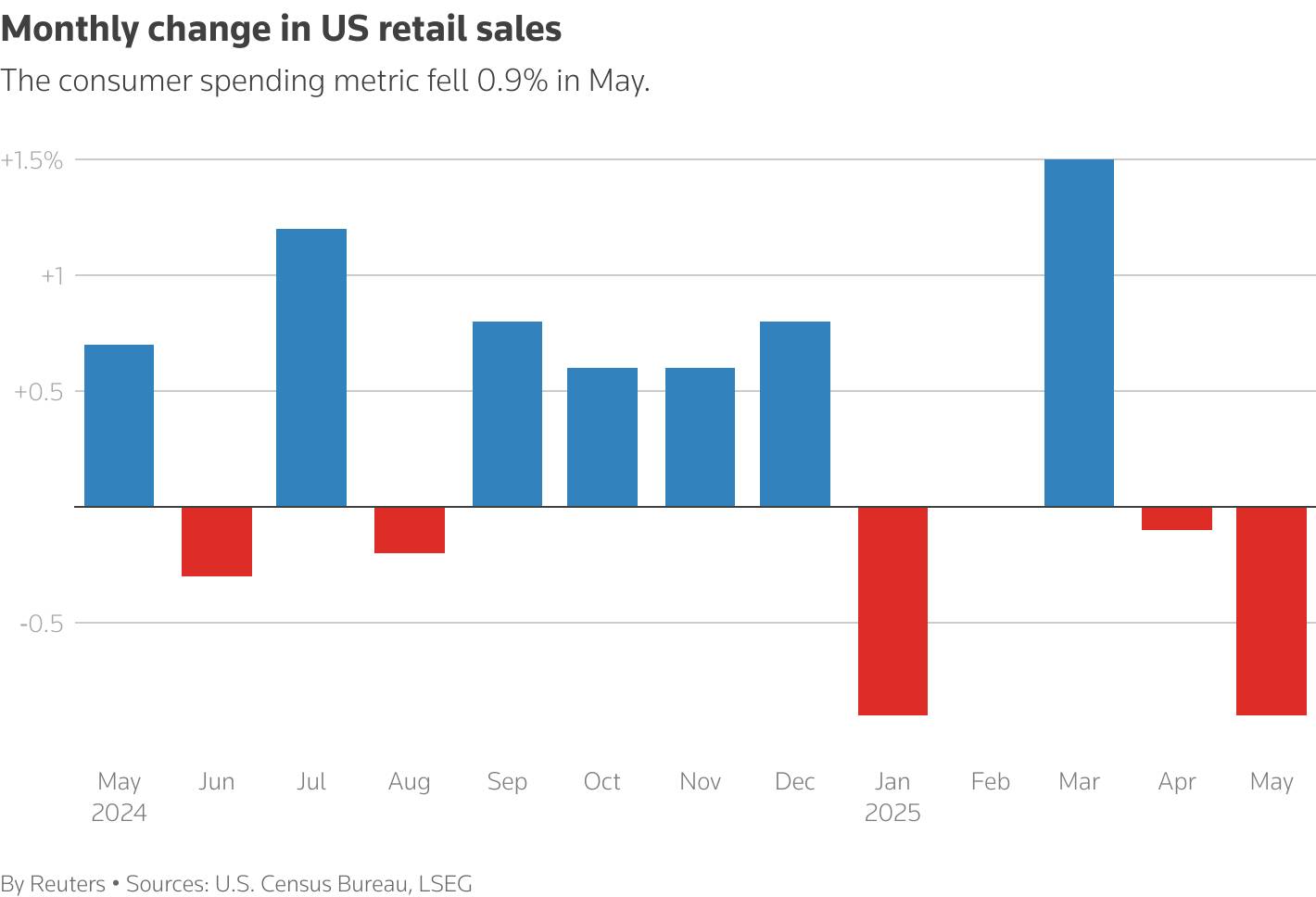

U.S. retail sales dropped more than expected in May, weighed down by a decline in motor vehicle purchases as a rush to beat potential tariff-related price hikes ebbed, but consumer spending remains supported by solid wage growth for now.

The largest decline in sales in four months reported by the Commerce Department on Tuesday added to moderate job growth last month in suggesting that domestic demand was softening. That was reinforced by other data showing production at factories, outside motor vehicle assembly, decreased in May.

President Donald Trump's aggressive and often shifting tariff position has heightened economic uncertainty, making it difficult for businesses to plan ahead. Federal Reserve officials meeting on Tuesday and Wednesday are expected to leave the U.S. central bank's benchmark overnight interest rate unchanged in the 4.25%-4.50% range while monitoring the fallout from the import duties and rising tensions in the Middle East.

"Tariff announcements have had a clear impact on the timing of large-ticket purchases, notably autos, but there are few signs yet that tariffs are leading to a general pullback in consumer spending," said Michael Pearce, deputy chief economist at Oxford Economics. "We expect a more marked slowdown to take hold in the second half of the year, as tariffs begin to weigh on real disposable incomes."

Retail sales fell 0.9% last month, the largest decrease since January, after a downwardly revised 0.1% dip in April, the Commerce Department's Census Bureau said. The second straight monthly decline unwound the bulk of the tariff-driven surge in March. Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, decreasing 0.7% after a previously reported 0.1% gain in April.

They increased 3.3% year-on-year in May.

Sales last month were also held down by lower receipts at service stations because of cheaper gasoline as the White House's protectionist trade policy has raised fears over global growth, restraining oil prices. But hostilities between Israel and Iran have boosted oil prices. A 25% duty on imported motor vehicles and trucks came into effect in April. Unseasonably cooler weather likely also hurt sales.

Receipts at auto and parts dealerships tumbled 3.5%. Sales at building material and garden equipment and supplies dealers dropped 2.7%. Receipts at service stations fell 2.0%, while those at electronics and appliance stores slipped 0.6%.

Sales at food services and drinking places, the only services component in the report, declined 0.9%. Economists view dining out as a key indicator of household finances.

But online sales jumped 0.9%, while those at clothing retailers increased 0.8%. Furniture store sales soared 1.2%. Sporting goods, hobby, musical instrument and book store sales advanced 1.3%.

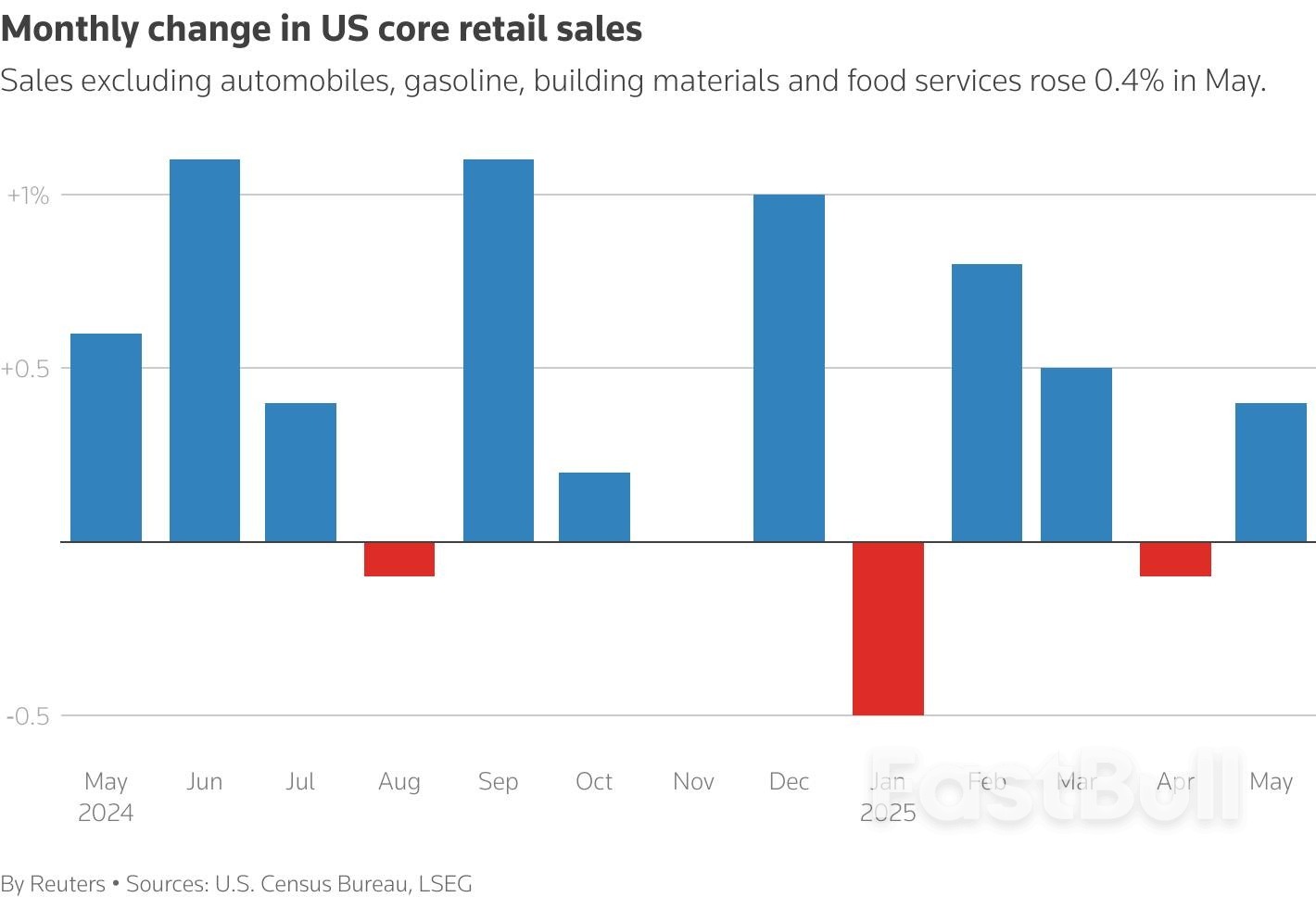

Retail sales excluding automobiles, gasoline, building materials and food services increased 0.4% in May after an upwardly revised 0.1% fall in April.

These so-called core retail sales, which correspond most closely with the consumer spending component of gross domestic product, were previously reported to have dropped 0.2% in April.

Economists estimated that growth in consumer spending, which accounts for more than two-thirds of economic activity, was so far this quarter tracking at least a 2.0% annualized rate after slowing to a 1.2% pace in the first quarter.

The Atlanta Fed is forecasting GDP rebounding at a 3.5% annualized rate in the second quarter. The anticipated surge will largely reflect a reversal in imports, which have fallen sharply as the frontloading of goods fizzled. The economy contracted at a 0.2% pace in the January-March quarter.

Downside risks to consumer spending are, however, rising. The labor market is slowing, student loan repayments have resumed for millions of Americans and household wealth has been eroded amid tariff-induced stock market volatility. Economic uncertainty could lead to precautionary saving.

"The outlook for consumer spending is cloudy," said Bill Adams, chief economist at Comerica Bank.

Stocks on Wall Street fell. The dollar rose against a basket of currencies. U.S. Treasury yields fell.

Economists said retailers likely offered discounts last month, adding that could explain part of the benign consumer price data in May. They, however, expected price pressures to build up in the month ahead.

That thesis was supported by a separate report from the Labor Department's Bureau of Labor Statistics showing import prices, excluding fuels and food, increased 0.4% in May after advancing 0.5% in April. In the 12 months through May, the so-called core import prices increased 1.3%.

Core import prices are being driven by dollar weakness, with the greenback down about 6.2% this year on a trade-weighted basis. Trump's aggressive trade posture has shaken investors' confidence in the dollar, eroding the appeal of U.S. assets.

"This is another sign that inflation will pick up this summer and into the fall as prices start to reflect the higher costs for goods from enacted tariffs," said Ben Ayers, senior economist at Nationwide.

A third report from the Fed showed manufacturing output edged up 0.1% in May, lifted by a 4.9% jump in motor vehicle and 1.1% rise in aerospace and miscellaneous transportation equipment production. That followed a 0.5% decline in April.

But excluding motor vehicles, factory output fell 0.3% amid declines in fabricated metal products, machinery and nonmetallic mineral products. There was also a steep decrease in energy nondurable consumer goods production.

Manufacturing, which accounts for 10.2% of the economy, relies heavily on imported raw materials.

Trump has defended the duties as necessary to revive a long-declining U.S. industrial base, but economists say that cannot be accomplished in a short period of time, citing high production and labor costs as among the challenges.

"Continued uncertainty around where trade policy will ultimately land is preventing many businesses from taking on new capital expenditures, unsure of the policy and underlying demand environment," said Shannon Grein, an economist at Wells Fargo. "We expect manufacturing to continue to tread water in the months ahead."

The Federal Reserve will consider plans to ease leverage requirements on larger banks at a meeting later this month, kicking off what is expected to be a broad effort to reconsider bank rules.

The U.S. central bank announced the board meeting, scheduled for June 25, to discuss changes to the so-called "supplementary leverage ratio," which requires banks to set aside capital against assets regardless of their risk.

The meeting will be the first following Fed Governor Michelle Bowman's confirmation as the central bank's top regulatory official. It could be the first of several rule-easing projects at the Fed as Bowman, a Republican tapped by President Donald Trump, has charted an ambitious plan for overhauling how the central bank regulates and monitors some of the nation's largest and most complex banks.

The Fed did not provide any details on the proposal under consideration, but banks have clamored for years for changes to the supplementary leverage ratio, potentially by exempting traditionally safe assets or revising the formula used to calculate the requirement.

The industry has argued the requirement was meant to serve as a baseline, requiring banks to hold capital against even very safe assets, but has grown over time to become a binding constraint on lending, and can actually hinder their abilities to intermediate Treasury markets during times of stress.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up