Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)A:--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)A:--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)A:--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)A:--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)A:--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)A:--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)--

F: --

P: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)--

F: --

P: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Malaysian government is expected to table the National Climate Change Bill (also known as the RUUPIN) in parliament in the coming months, providing a legal framework for climate action and anchoring market-based financing for adaptation and resilience.

The Malaysian government is expected to table the National Climate Change Bill (also known as the RUUPIN) in parliament in the coming months, providing a legal framework for climate action and anchoring market-based financing for adaptation and resilience. Malaysia's global climate pledges, including the goal of cutting methane emissions by 30% by 2030, were reaffirmed by the then acting minister of natural resources and environmental sustainability Datuk Seri Johari Abdul Ghani when announcing this timeline.

Methane, the primary component of natural gas, is also a potent greenhouse gas responsible for roughly 30% of global warming, because it traps over 80 times more heat than carbon dioxide in a 20-year period. Methane reduction is fast emerging as a defining front in the global fight against climate change.

The Environmental Defense Fund (EDF) is a global non-profit driving practical solutions for a safer climate and a more resilient energy future. For more than a decade, EDF has advanced scientific and economic efforts to highlight how methane mitigation is a rare opportunity to address emissions while benefiting energy supply, economic development, and the climate. About 25% of human-made methane comes from the oil and gas sector; reducing these emissions is an economic and climate relief opportunity.

Momentum is building across Southeast Asia to curb methane emissions from the oil and gas sector. The region's efforts gained structure in 2023 with the launch of the Asean Energy Sector Methane Leadership Program (MLP) in Kuala Lumpur — an initiative backed by Petroliam Nasional Bhd (PETRONAS) and the Japan Organization for Metals and Energy Security, now entering its second phase (MLP 2.0). PETRONAS set a regional benchmark at COP28 by becoming the first national oil company in Asean to commit to halving methane emissions by 2025. The following year, Asean energy ministers spotlighted MLP as a model of regional cooperation. By COP29, that collaboration deepened, as leading national oil companies across Asean pledged a joint path forward — to establish a regional methane emissions baseline by 2025 and set measurable reduction targets for 2030, underscoring a collective drive towards a lower emission energy future.

Progress followed by these pledges is evident. PETRONAS has already achieved a 62% methane reduction a year ahead of schedule. PETRONAS, Indonesia's Pertamina and Thailand's national oil company PTTEP have joined the UN Environment Programme Oil and Gas Methane Partnership 2.0, committing to higher standards of monitoring and transparency. In May 2025, Cambodia became one of the first least-developed countries to submit its National Methane Roadmap, aiming to increase the country's climate ambition and inform updates to its Nationally Determined Contribution. In June 2025, the Methane Management Roadmap for Oil and Gas in Asean was released by the Asean Centre for Energy (ACE), Asean Council on Petroleum and the World Bank. Most recently, in October 2025, the Asean Plan of Action for Energy Cooperation 2026-2030 includes action plans to set and promote initiatives to reduce methane emissions in oil and gas activities.

Two new studies by EDF, Swinburne University of Technology Sarawak and the Institute of Strategic and International Studies Malaysia suggest that cutting methane emissions in the country's oil and gas industry could deliver not only climate benefits but also strong economic gains.

The first study found that up to 63% of methane emissions from Malaysia's upstream oil and gas sector could be mitigated at no net cost — largely through measures such as rerouting vented gas to fuel systems and replacing high-emission equipment with zero emission alternatives. Even a 30% reduction could yield net revenues of US$8 million (RM32 million) to US$11 million, offering a clear business case for action. The findings provide Malaysia-specific data to guide investment and technology choices in the Asean region, filling a gap often dominated by US-centric data used by regional energy companies.

The second study highlights methane abatement as a potential job creator. Opportunities are expected to emerge across fields such as remote sensing, drone inspection, measurement, monitoring, reporting and verification. The oil and gas services and equipment sector stands to gain the most, with additional employment growth anticipated across downstream operations — signalling that methane reduction could become both an environmental and economic win for Malaysia.

Methane management stands out as a rare win-win for Malaysia and the broader Asean region — a strategy that strengthens both climate ambition and economic resilience. By embedding methane reduction targets into the forthcoming National Climate Change Bill, Malaysia can turn commitment into leadership, aligning the bill with its Climate Change Policy 2.0 and setting a powerful precedent for neighbours like Thailand, which is also developing climate legislation.

With the Asean Methane Roadmap promising up to US$87 million in additional gas revenue alongside deep emission cuts, the case is clear: tackling methane is not a cost, but an investment in efficiency, innovation and regional energy security. The region can no longer afford to let methane leak away as lost value and rising pollution — it's time to capture its potential for a cleaner, more competitive future.

Dr Shareen Yawanarajah is senior director of Energy Transition at the Environmental Defense Fund. She leads EDF's Southeast Asia energy transition strategy and engagement agenda.

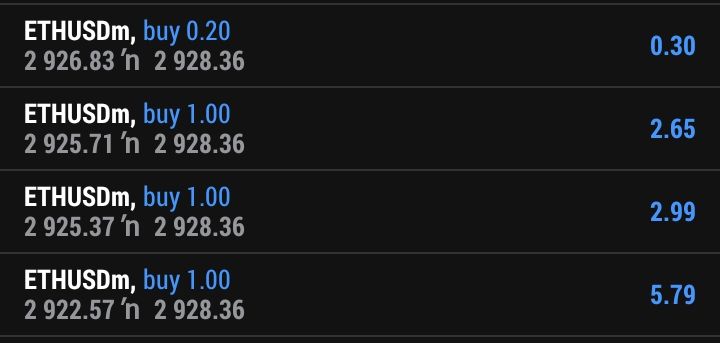

Bitcoin's price stayed subdued on December 25 as renewed activity from large holders, including whale transfers to exchanges, combined with continued outflows from US spot Bitcoin ETFs, unsettled market sentiment, raised concerns about potential sell pressure, and left traders cautious despite BTC holding above key technical support levels overall market.

A long-inactive Bitcoin whale and asset manager BlackRock moved large sums of BTC to centralized exchanges on the day according to blockchain analytics firm Onchain Lens.

BlackRock had invested 2,292 BTC that had a value of about 199.8 million dollars in Coinbase. In another transaction, a whale wallet that was dormant in eight years transferred 400 BTC, worth about 34.92 million, to the OKX exchange.

Traders keep a close eye on such transfers, which massive deposits to exchanges would typically suggest to them that there is sell-side pressure.

No direct spot selling was established, but the flows were sufficiently sufficing to place market participants on their toes.

The warning sound was supported by the ongoing weak institutional flows. According to the data provided by SoSoValue, U.S. spot Bitcoin ETFs experienced their fifth day in a row of net outflows. The continual withdrawals were an indication that the institutional demand was still weak despite the fact that Bitcoin was trading above key technical support levels.

Meanwhile, there was an overall fall in leverage in the derivatives market. BTC was trading around $87,700 at press time, falling about 0.35% on the day. According to CoinGlass, open interest was dropped at 0.99% to $57.42 billion, which means that traders were not taking on risk as they were not aggressively positioning themselves to expect a price breakout.

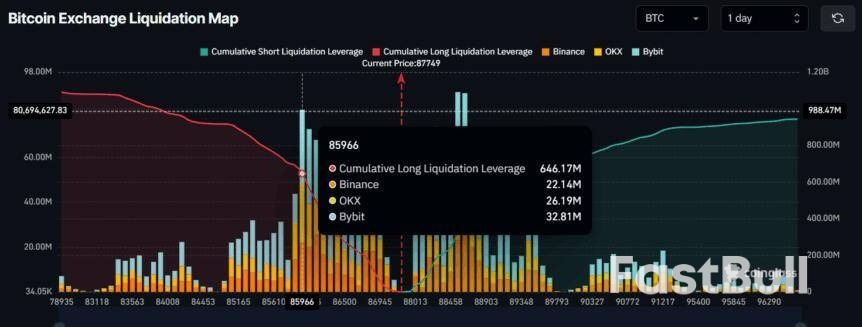

Positioning information suggested areas of bullish conviction in spite of the leverage pullback. The Liquidation Map of CoinGlass indicated that its largest concentration of leverage was on the downside and on the upside to $85,966 and 88,636 respectively.

The long leveraged positions (of a total of around 646.17 million) were concentrated nearer to the bottom whereas the short leveraged positions (of the total of around 422.42 million) were concentrated above the Bitcoin price, indicating that the traders were generally confident that BTC would be above the zone of support of 85,966.

In a larger technical context, BTC is stuck in a range of consolidation. The weekly chart analysis indicates that BTC has been trading at an average bottom of about $86,000 to a top of about $93,500 since mid-November. Such long periods of steady consolidation are, in the past, usually followed by sharp swings in one way or the other.

Since Bitcoin has been fluctuating around the lower part of this range, there has been an increased fear of a possible breakdown. Technical analysts believe that a daily close below the support of the $86,000 may open up to further decline.

On the contrary, the bearish view would be nullified in case BTC were to advance beyond the upper resistance at about 93,500 mark and herald another bullish breakout.

Whale action, ETF outflows, and to a certain extent, thinning leverage have so far joined hands to hold the Bitcoin traders squarely on the defensive side.

Investors are looking for the US stock market to end 2025 on a high note next week, with equities at record peaks and nearing further bullish milestones to close out another strong year.

Major US indexes were on course to end December higher after stocks shook off turbulence earlier in the month driven by weakness in technology shares over worries tied to spending on artificial intelligence.

The S&P 500 posted a record close on Wednesday, ahead of the Christmas holiday on Thursday, and was about 1% from reaching the 7,000 level for the first time. The benchmark index was on track for its eighth straight month of gains, which would be its longest monthly winning streak since 2017-2018.

"Momentum is certainly on the side of the bulls," said Paul Nolte, senior wealth adviser and market strategist at Murphy & Sylvest Wealth Management. "Barring any exogenous event, the path of least resistance for stocks, I think, is higher."

Minutes from the Federal Reserve's most recent meeting highlight the market events in the holiday-shortened week ahead, while year-end portfolio adjustments could cause some volatility at a time when light trading volumes can exaggerate asset price moves.

Heading into the new year, investors are highly focused on when the Fed might further cut interest rates. The US central bank, which balances goals of contained inflation and full employment, lowered its benchmark rate by 75 basis points over its last three meetings of 2025 to the current level of 3.5%-3.75%.

But the Fed's most recent vote at its December 9-10 meeting to lower rates by a quarter percentage point was divided, while policymakers also gave widely different projections about rates in the coming year. The minutes for that meeting, due to be released on Tuesday of next week, may be "illuminating to hear what some of the arguments were around the table," said Michael Reynolds, vice president of investment strategy at Glenmede.

"Handicapping how many rate cuts we're going to get next year is a big thing markets are focused on right now," Reynolds said. "We'll just get a little bit more information on that next week."

Investors are also waiting for President Donald Trump to nominate a Fed chair to replace Jerome Powell, whose term ends in May, and any inkling of Trump's decision could sway markets in the coming week.

With just a handful of trading sessions left in 2025, the S&P 500 was up nearly 18% for the year, with the technology-heavy Nasdaq Composite up 22%.

However, the tech sector, which has been the main driver of the more than three-year-old bull market, has struggled in recent weeks, while other areas of the market have shined. Despite rebounding this week, the S&P 500 tech sector has declined more than 3% since the start of November. Over that time, areas such as financials, transports, healthcare and small caps have posted solid gains.

The market moves indicate some rotation into areas where valuations are more moderate, said Anthony Saglimbene, chief market strategist at Ameriprise Financial.

"There are more investors that are buying in to the narrative that the economy is on pretty solid footing right now," Saglimbene said. "And it has weathered a lot of potential roadblocks this year that might not be such roadblocks next year."

President Donald Trump has the chance to begin the reconstruction of the Gaza Strip. Delay will only destabilize the situation.

President Donald Trump's peace plan for Gaza, and his best hope for a Nobel Peace Prize, needs a big push when he meets with Israeli prime minister Benjamin Netanyahu on December 29. As of Christmas, the plan appears to have stalled, but that is only partly true. Hamas's refusal to surrender its weapons is the big problem—but the solution is far more in President Trump's hands than most realize.

I led postwar planning for Iraq at the US State Department and worked on post-conflict operations in Bosnia, Kosovo, Iraq, East Timor, Libya, and Afghanistan. After Hamas' terrorist attack on October 7, 2023, along with many others, I warned of the dangers of failing to plan for postwar Gaza and joined a group of former senior officials to develop a plan for postwar Gaza. President Trump and his team, working with Israel and Arab allies, deserve the credit for Trump's twenty-point peace plan, codified in United Nations Security Council Resolution 2803.

Our plan got closer to Trump's final plan than anyone else: international governance for a transitional period, an international oversight board, working with Palestinians from Gaza, backed up by an international stabilization force, authorized by a United Nations Security Council resolution, with a non-American in charge of the civilian effort and a US general heading up the International Stabilization Force (ISF).

All living and all but one deceased Israeli hostages have been returned, but Hamas has neither disarmed nor given up governance of the west of a "Yellow Line" that divides Gaza in half. Apart from a Civil-Military Coordination Center in Kiryat Gat, Israel, no country has sent forces for the ISF that will provide security, oversee Hamas's disarmament, and allow the Israeli army to withdraw to Gaza's borders.

The Board of Peace, which Trump will chair, will not be announced until January. The Palestinian technocratic committee tasked with rebuilding Gaza's infrastructure has not yet been named. An executive committee that will handle vital day-to-day coordination among internationals, Palestinians, Israelis, Egyptians, and donor states has only four known names: highly respected Bulgarian diplomat Nikolay Mladenov, US envoy Steve Witkoff, Trump's son-in-law Jared Kushner, and former British prime minister Tony Blair.

While visionary plans exist, nobody has put up the money needed to start anything. Arab governments will not finance Gaza's reconstruction as long as Hamas retains its weapons, the use of which would invite Israeli retaliation, destroying whatever was rebuilt. Some think both Hamas and Israel are slow-rolling Trump's plan, increasing the suffering of the two million Gazans living in desperate circumstances and putting the security of both Israelis and Palestinians at risk while Hamas increases its chokehold over half of Gaza's territory and most of Gaza's people.

Despite this, much has been going on behind the scenes, but Trump now has to make a key choice among three clashing visions.

One, which Prime Minister Netanyahu will likely push, is Trump's approval for Israeli military action against Hamas fighters. The strategic logic is that a further weakened Hamas would eventually be unable to interfere with Trump's peace plan. However, this would result in Israeli and many Gazan casualties and disruption of humanitarian aid. How long this would take is unclear. Also, Netanyahu reportedly wants US support for an attack on Iran's missile program, which Iran is actively rebuilding. He may also ask for Trump's authorization to attack Hezbollah if it refuses to turn over its weapons to the Lebanese armed forces. Trump may agree to one of these ideas, but he will not agree to all of them.

The second is the plan that the Tony Blair Institute developed last summer. A leaked draft from September in Haaretz has a small international "executive secretariat" with five "commissioners" overseeing a Palestinian Executive Authority (PEA) that actually runs Gaza. This plan puts substantial responsibilities on the local Palestinians, who would not be affiliated with Hamas. Still, the leaked draft is weak on how Hamas would be disarmed and how to keep Hamas from extorting or coercing Gazans, including those in the PEA, into obeying its will.

It calls for partial deployment in the first two years, with full operations only in Year Three, which is too late. Audit mechanisms appear significantly understaffed. Corruption is a major reason many Palestinians mistrust the Palestinian Authority in Ramallah, and support for Gaza's reconstruction will evaporate if it replicates this failure.

With a total budget of only $90 million in the first year, the plan appears too small to oversee the amount of work required to start Gaza's physical and social reconstruction. This plan has almost certainly been improved since September, but Trump will want to know whether these problems have been addressed.

The third option is the Gaza Supply System, developed by Americans reporting to Witkoff and Kushner, which would use private capital to jump-start Gaza's physical and social reconstruction east of the Yellow Line, while employing private security contractors in roles the International Stabilization Force is unwilling to undertake. This would get around two roadblocks: first, no Arab governments have actually contributed billions of dollars to Gaza's reconstruction, and second, private security contractors are willing to work in Gaza even while the United States insists on no US boots on the ground, and other countries are unwilling to have their troops confront Hamas.

According to an article from The Guardian, private investors would be repaid for jump-starting Gaza's reconstruction through tariffs or tolls on aid and commercial trucks entering Gaza. The United States government similarly relied on customs duties and tariffs to fund public services and security until the advent of the income tax.

Historically, Hamas also charged tolls on aid trucks and taxed Gazans bringing in cash from jobs in Israel. And charging tolls on incoming trucks provides private investors with a positive incentive to increase the number of trucks entering Gaza, aligning their interests with those of the Gazan people while ensuring robust but not excessive security inspections.

Trump will have to decide soon which of these three competing proposals he will support. Waiting on Hamas to voluntarily disarm is unlikely to succeed, prolonging both the misery of 2 million Gazans and the security risk to both Israelis and Palestinians. Arab governments have not embraced Blair's plan.

The people of Gaza and Israel need to see progress, and waiting for an enlarged version of a postwar governance plan to be funded and staffed in mid-2026 is dangerously late. President Trump should approve a plan that starts, urgently, Gaza's physical and social reconstruction. The Gaza Supply System model, for all its limitations, is currently the best available approach to jump-start some level of security and reconstruction in at least half of Gaza. We have to start somewhere—and we need to start now.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up