Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Despite a sluggish economy marked by deflation and weak consumption, China's stock market has surged nearly 20% from its lows, fueling concerns of a growing asset bubble as investor optimism clashes with deteriorating fundamentals....

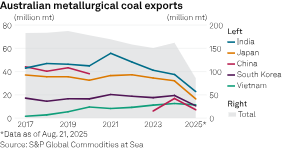

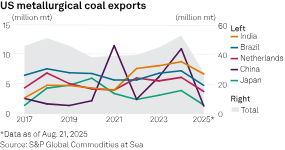

Australian metallurgical coal producers expect higher exports to India but are facing increasing competition from the US and Russia, according to S&P Global Commodities at Sea data.BHP Group Ltd., Whitehaven Coal Ltd. and Yancoal Australia Ltd. outlined increased met coal production in fiscal 2025 while talking up India's demand growth, which could help arrest declining average realized prices. Platts assessed the premium hard coking coal Australia export FOB East Coast price at $187.50/mt on Aug. 22, down from $200.50/mt a year prior.

While Japan accounts for about half of Whitehaven's total volume, "India has actually emerged with 11% now, which is good because that footprint we know will expand considerably as we go forward," Paul Flynn, managing director and CEO, said Aug. 21 during a fiscal 2025 call with analysts.In fiscal 2025, India shot up to become Whitehaven's second-largest export destination with A$795 million in revenue — all of it met coal — behind Japan's A$2.73 billion, according to the miner's annual report.

"Structurally, India is very dependent on the seaborne market for met coal. It has next to nothing in terms of its own resource ... and Australia is already the largest supplier to India of its metallurgical coal demand," Flynn said during a same-day media call."With the growth in blast furnace construction capacity in [India], we can see an outlook for growth in metallurgical coal demand that's very strong; and we see limited opportunities in the pipeline for new supply to come on, hence our view that prices will continue to tighten and you'll see better pricing emerge as a result," Flynn added.

While Australia's total met coal exports rose annually in 2024, the downtrend in exports to India that started in 2021 persisted, according to CAS data. In 2024, exports to India comprised 37.5 million mt of Australia's total of 161.9 million mt.China's return to procuring Australian coal, after banning coal from Down Under in 2020, is partly responsible for Australia's falling exports to India in recent years, said Pranay Shukla, head of dry bulk freight and commodities research at Commodity Insights, in an interview. India diversifying met coal supplies, including from the US, is also a factor, Shukla added.

India's met coal imports from the US steadily increased after 2021, hitting a record 8.8 million mt in 2024, second only to China's 11 million mt. India is already the lead destination for US met coal this year with 6.7 million mt as of Aug. 21, ahead of Brazil's 4.8 million mt and the Netherlands' 3.7 million mt. China stood at 1.4 million mt amid trade tensions with the US.The US, whose coal industry is now aided by an accommodative president, was India's third-highest met coal source behind Australia and Russia in 2024. Russia's exports to the subcontinent have also risen since 2021.

A slowdown in China's property sector lowered demand and cut met coal prices across product categories in fiscal 2025, and "India's demand has also been tempered by the early onset of the monsoon season along with higher levels of domestic production," Yancoal said Aug. 19 in its half-year report.However, "the Indian growth opportunity is real," Mark Salem, Yancoal's executive general manager of marketing, said on an analyst call Aug. 20.

"The advantage of the Indian market is that India does not produce its own metallurgical coal, unlike China. Therefore, based on their GDP growth assumptions and this demand profile based on their infrastructure plans, they will need the coking coal to meet that growth requirement," Salem said.BHP CEO Mike Henry also highlighted India as "a bright spot for commodity demand" during an Aug. 19 fiscal 2025 results call.

"Indian pig iron production growth remained strong" during fiscal 2025, and "robust hard coking coal imports from developing countries such as India will lead to growing and resilient demand for decades to come," BHP said in its results."India will likely remain the fastest-growing major economy, driven by sustained public investment, improving monetary conditions and resilient service sector activity," BHP said.

However, Henry noted on the call that BHP had underestimated the resilience of steel demand in China, whose production is believed to have peaked in 2020.BHP has seen "robust commodity demand in China from the continued strong growth there, including from the infrastructure and electrification sectors, even as demand from the property sector remains subdued," Henry added.

Flynn also pointed to Chinese policy being "focused on constraint of surplus production of coal and of course, surplus steel production."Whitehaven's coal exports to China surged by over 957% to A$571 million in fiscal 2025 — all metallurgical — to become the miner's third-highest export destination after not even making its top 10 in fiscal 2024.

The Federal Reserve’s (Fed) annual gathering in the Rocky Mountains is usually a time for central bankers and their wonky friends to kick back, discuss a few complicated economic topics and then go for a hike in the shadow of Grand Teton.This year, the Fed’s Jackson Hole symposium, which wrapped up Saturday, was at times a tense affair and drove home how difficult the path ahead is for the US central bank.

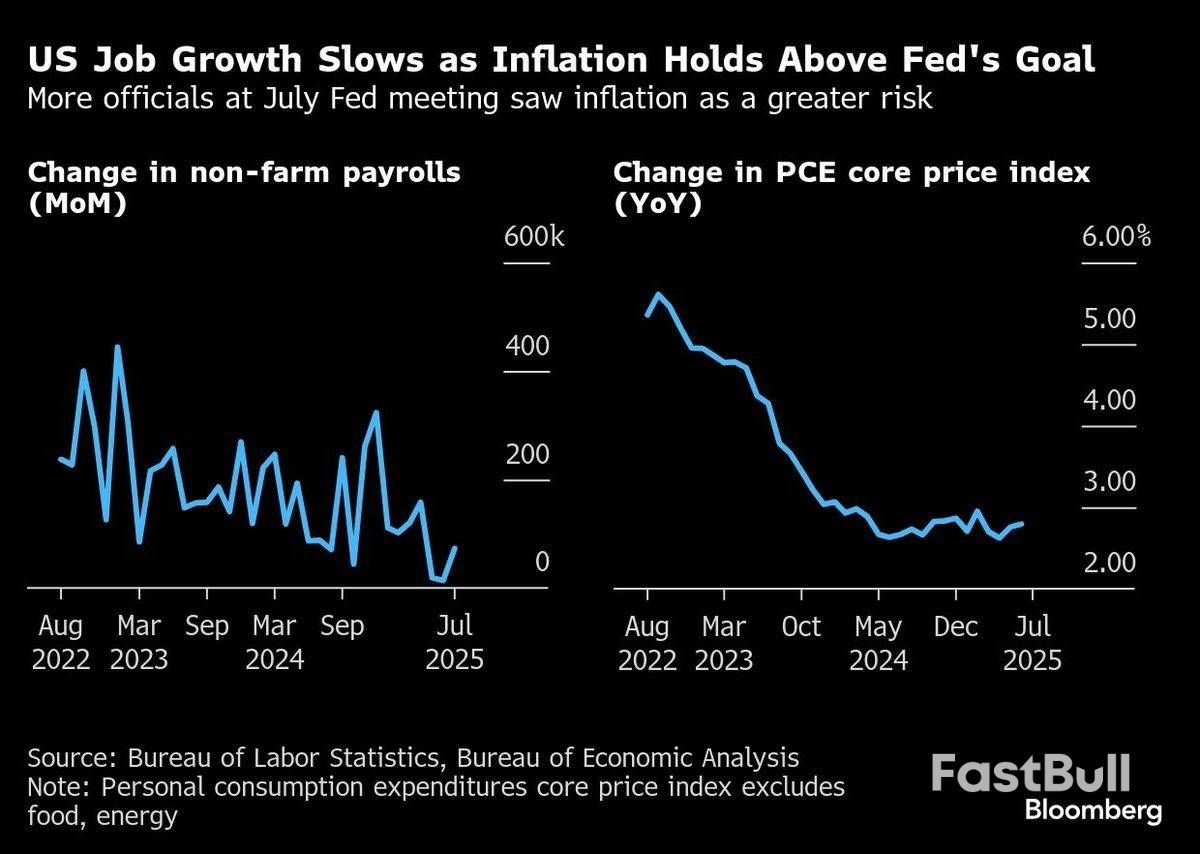

On Friday, Chair Jerome Powell used his keynote speech to signal the Fed is headed for an interest-rate cut as soon as its next policy meeting in September. Yet there are clear divisions among policymakers over whether that’s the right call. Powell, himself, noted the economy has handed Fed officials a “challenging situation”.Policymakers are grappling with inflation that’s still above their 2% goal — and rising — and a labour market that’s showing signs of weakness. That unnerving reality, which pulls policy in opposite directions, is made worse by a high degree of uncertainty about how each of those factors will evolve over the coming months.

“We’re getting some cross-currents and it’s in a difficult environment,” Chicago Fed President Austan Goolsbee said in an interview on the sidelines of the conference. “I always say the hardest job the central bank has is to get the timing right at moments of transition.”The conference also highlighted the political pressures weighing on the Fed. Those are likely to intensify in coming months as President Donald Trump looks to put his stamp on what may be the most prominent federal institution to have so far escaped his overhaul attempts.

As Powell delivered his speech Friday morning, Trump said he would fire Fed Governor Lisa Cook if she didn’t resign over recent allegations that she committed mortgage fraud. It’s the latest attempt by the administration to pressure the Fed from multiple angles as Trump relentlessly pushes for lower interest rates.Security for the event was noticeably heightened compared to recent years, adding to the tension at the gathering. Officers from the Fed Police, US Park Police and Teton County Sheriff’s Office, some in military-style fatigues and carrying weapons, were a constant presence.

Earlier Friday morning, officers had to remove one person, the Trump-backer and Fed gadfly James Fishback, after he confronted Cook in the lobby of the lodge and shouted questions about the mortgage controversy.

Powell, in what was likely his final Jackson Hole speech at the helm of the Fed, detailed the cloudy signals coming from the economy.While the effect of tariffs on prices is now visible, there are still questions about whether that will reignite inflation in a more persistent way, he said. He called the labour market’s current status — with both falling demand for, and declining supply of workers — “curious”.

Even with those uncertainties, Powell opened the door to a rate cut at the Fed’s Sept 16-17 meeting, though it wasn’t as clear a signal as at last year’s conference. Then, the labour market was deteriorating but inflation worries had receded, and many policymakers shared a desire to cut soon. The backing is not nearly as strong this year.

Recent data have shown inflation has stalled above the Fed’s 2% goal, with some measures indicating that price pressures may be spilling over to products and services not directly impacted by tariffs. Meantime, while hiring has slowed significantly over the summer, other labour market indicators, like the low level of unemployment, paint a more stable picture.Without much clarity on how the economy will unfold, disagreements over how to proceed are festering among policymakers. Already, two governors dissented at the Fed’s July meeting, when officials didn’t cut rates. If they do cut in September, others may dissent in the opposite direction.

Policy disagreements could grow in the coming months as Trump names new officials to vacancies at the Fed and Powell’s term as chair ends in May. The president has already tapped Stephen Miran, who chairs his Council of Economic Advisers, to fill an open slot on the Fed board that expires in January.

The discord among Fed officials comes at a time when the central bank is facing intense scrutiny from the White House. The topic seeped into conversations over coffee, during meals and in between sessions, even if there wasn’t much outright discussion of it during official conference proceedings.

Karen Dynan, an economics professor at Harvard University and frequent attendee of the conference, said she wasn’t surprised that central bankers didn’t want to wade into conversations about politics. Still, she said the conference set an example of how big-picture economic issues should be approached.

“This year it feels particularly meaningful that we have a bunch of papers that are grounded in good economics done by people who are prominent experts,” Dynan said. “These are not problems that can be solved by thinking about one’s intuition or talking to just a circle of people around you — you really need this sort of expertise.”

One issue that received less attention was the new framework Powell unveiled in his speech.The document, which will guide policymakers as they pursue their inflation and employment goals, is the culmination of a months-long review of the previous one, implemented in 2020. The new strategy removes some of the language that more narrowly focused on the pre-pandemic challenge of persistently low inflation.

It’s a return to basics and sets the Fed up to more clearly focus on its mandates of maximum employment and stable prices, said Carolin Pflueger, associate professor at the University of Chicago Harris School of Public Policy.In his remarks, Powell “emphasised that his job is inflation and unemployment, and that can only be achieved within an independent Fed,” Pflueger said. “I think people appreciate that.”

That appreciation became apparent when Powell was greeted Friday morning with a standing ovation from economists and policymakers from around the world — and not for the first time this year.For them Fed independence is not only a matter of principle but also practicality, since decisions taken in Washington inevitably come with consequences that spread far beyond.

The euro strengthened by 1% against the dollar following Powell’s remarks, adding downside risks to euro-area inflation that’s already seen falling to 1.6% next year.“If a cut does come and reflects slower US growth, that probably means slower growth for them given the size of the US,” Maurice Obstfeld, a senior fellow at the Peterson Institute for International Economics and the former chief economist at the International Monetary Fund, said of the euro area and other economies.

Gold’s hopes for an aggressive cut in the Fed’s federal funds rate, the associated decline in Treasury bond yields, and the weakening of the US dollar have not yet materialised. The Fed is likely to ease monetary policy in September. However, it may then pause again. Its slowness is bringing investors’ interest back to the greenback.

Clouds are gathering over the precious metal due to Donald Trump’s efforts to end the armed conflict in Ukraine. The start of hostilities, followed by the West’s freezing of Russia’s gold and foreign exchange reserves, was the starting point for the Gold’s rally. Since February 2022, gold has risen 1.7x and reached a record high of more than $3,500 per ounce in April. The rally was driven by de-dollarisation, active buying of bullion by central banks, and increased demand for ETFs.

In the second quarter, central bank activity in the precious metals market declined significantly, and capital flows into specialised exchange-traded funds slowed. Without these advantages, XAUUSD can forget about recovering the upward trend. However, the favourable external background in the form of monetary stimulus from the Fed, lower Treasury yields, and a weaker US dollar in the medium term will give gold a boost.

The gold chart clearly shows consolidation since April, with the price right in the middle of the 12% range from peak to correction lows. This tedious five-month movement to the right is likely to end in the coming weeks, as August often marks the start of major trends in gold. The duration of consolidation is often directly proportional to the strength of the breakout.From a technical analysis perspective, given the accumulated overbought condition, the downside potential is huge – up to $3000 or even $2200 per ounce. However, the upside potential is no less impressive: $4600 in an extreme bullish scenario, including the Fed switching to a mode of absolute softness.

Retail spending levels rose 0.5% in the June quarter, beating expectations. Retail sector conditions remain tough, but we are starting to see signs of the long-awaited recovery taking shape.

June quarter retail sales

Year to June

The June retail spending report was better than expected. While overall spending growth is still modest, spending appetites are gradually firming, including a lift in some discretionary categories.Retail spending rose 0.5% over the June quarter. That’s the third quarter in a row that spending levels have been pushing higher. The result was well ahead of our own forecast and the average market forecast for a fall in spending over the June quarter.At first glance, today’s result seems at odds with comments from the retail and hospitality sectors of continued soft trading conditions. But digging under the surface, we can start to see what’s going on.

In several sectors (especially durable items for the home), spending levels remain well down on the levels we saw in 2021. In addition, while spending levels are turning higher, spending growth remains quite modest – the volume of goods sold rose around 2.5% over the past year, compared to gains of around 4.5% per annum before the pandemic.But while the retail sector is still confronting some tough trading conditions, we are starting to see signs that the long-awaited recovery is taking shape. Spending levels have risen for the past three quarter. That includes gains in discretionary areas like recreational goods and electronics. However, it is still a mixed picture with spending in sectors like hospitality still flat.

Today’s update is an encouraging sign for spending over the remainder of 2025. Spending levels are already pushing higher, and the full impact of the large reductions in interest rates over the past year is yet to be felt.Over the coming months, increasing numbers of borrowers will be rolling on to lower borrowing rates. The related lift in disposable incomes could be sizeable in some cases, and that’s set to boost spending through the latter part of the year.

There are still some headwinds for the retail sector. Most notably, unemployment is likely to rise around to 5.3% before the end of the year.

Even so, it looks like a recovery in the retail sector is now taking shape.

We’re forecasting flat GDP growth over the June quarter. Today’s result was ahead of our expectations. However, we’ll take a closer look at how our forecast for GDP growth is shaping up over the next couple of weeks as additional data on June quarter activity is released.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up