Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's industrial output and retail sales slowed in November 2025, exposing cracks in domestic demand and signaling deeper structural challenges. ...

Britain will start regulating cryptoassets from October 2027, the finance ministry said on Monday, rules it hopes will give the industry certainty while keeping out "dodgy actors".

The new law - the government will introduce legislation into parliament later on Monday - will extend existing financial regulation to companies involved in crypto, aligning Britain with the U.S. rather than the European Union, which has built rules tailored to the industry.

A draft bill giving effect to regulation has undergone only minor changes since it was published earlier this year, a ministry spokesperson said.

Globally, interest in cryptoassets has surged since U.S. President Donald Trump came to power promising to embrace the industry, although the price of the largest cryptocurrency, bitcoin , has fallen sharply in recent months after hitting a record high.

The U.S. is pursuing what is perceived by the industry to be a more crypto-friendly approach than Britain, while the European Union's Markets in Cryptoassets rules took effect in 2024.

Britain has said it would collaborate with the U.S. on the best approach to digital assets through a "transatlantic taskforce".

Finance minister Rachel Reeves said the rules would provide "clear rules of the road", strengthen consumer protections and keep "dodgy actors" out of the market.

Natalie Lewis, a partner at Travers Smith, told Reuters she hoped the changes in the final legislation would be "more than minor" as there were "quite a few technical legal problems with the original draft".

Britain's regulatory regime for cryptocurrencies is taking shape, with the Financial Conduct Authority planning bespoke rules for trading and market abuse, custody and issuance, and the Bank of England last month unveiling its proposals for regulating stablecoins - a type of cryptocurrency - that are used for everyday payments.

At the same time, regulators continue to warn about the risks, including that investors in cryptocurrencies should be prepared to lose all of their money.

Both the BoE and the FCA have promised to finalise their rules by end-2026.

Daniel Slutzkin, head of UK at crypto exchange Gemini, said firms had "long awaited regulatory clarity" and could now start preparing to meet the new requirements.

Confidence among Japan's large manufacturers rose to the highest level in four years, reinforcing market expectations for the Bank of Japan to raise interest rates this week.

The business sentiment index advanced to 15 this month from 14 in September, the BOJ's quarterly Tankan business survey showed Monday. The result matched the median economist forecast in a Bloomberg poll.

The gauge for large non-manufacturers held at 34, remaining near the strongest level since the early 1990s. A positive reading means more firms view conditions as "favorable" than "unfavorable."

The Tankan, one of the most closely scrutinized data sets released by the BOJ, suggests Japan's businesses have so far avoided significant fallout from US tariffs — a source of uncertainty the central bank has highlighted for months. The results strengthen the case for Governor Kazuo Ueda's board to raise rates on Friday, which would mark the first increase since January.

The data showed confidence improved among oil and coal product makers, offering the BOJ an early read on how firms are responding to lower US tariffs after reductions took effect in mid-September. Roughly 70% of companies had submitted responses to the previous survey days before that change.

A still-weak yen continues to aid exporters while increasing running costs for service sector firms, which employ most of Japan's workforce. Companies expected the yen at 147.06 against the dollar for this fiscal year in Friday's data, weaker than the 145.68 they predicted in Septermber.

Ueda repeatedly cited uncertainty over US tariffs and the initial momentum of wage negotiations as factors that would be critical for authorities considering the next rate hike.

While uncertainties around US levies have somewhat receded, Japan's ties with China have deteriorated after Prime Minister Sanae Takaichi's remarks on Taiwan last month. That's raised concerns over potentially new economic spillovers including a sharp drop in the number of Chinese tourists.

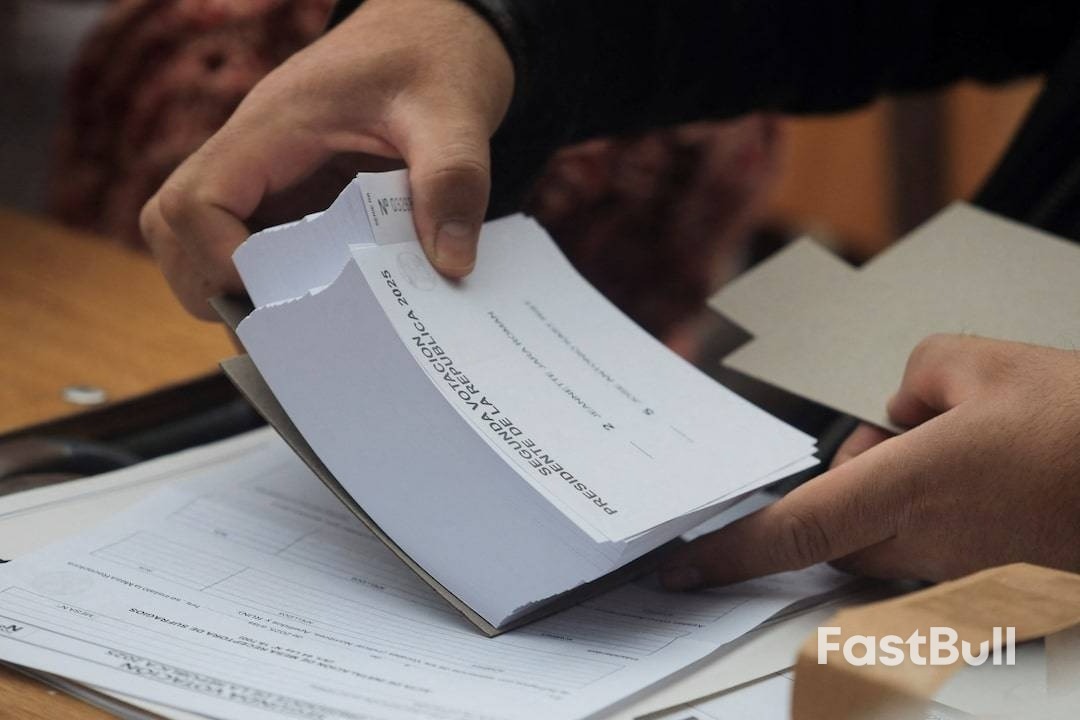

Jose Antonio Kast won Chile's presidential election on Sunday, leveraging voter fears over rising crime and migration to steer the country in its sharpest rightward shift since the end of the military dictatorship in 1990.

Kast secured a commanding 58% of the vote in a runoff with leftist candidate Jeannette Jara, who won 42% and swiftly conceded.

Throughout his decades-long political career, Kast has been a consistent right-wing hardliner. He has proposed building border walls, deploying the military to high-crime areas, and deporting all migrants in the country illegally.

His victory marks the latest win for the resurgent right in Latin America. He joins Ecuador's Daniel Noboa, El Salvador's Nayib Bukele, and Argentina's Javier Milei. In October, the election of centrist Rodrigo Paz ended almost two decades of socialist rule in Bolivia.

The campaign was Kast's third run at the presidency and second runoff, after losing to leftist President Gabriel Boric in 2021. Once seen by many Chileans as too extreme, he has attracted voters increasingly worried about crime and immigration.

His definitive win, even in parts of Chile that traditionally vote for leftist candidates, was also likely driven by voter rejection of Jara, who as a member of the Communist Party was seen by many as too extreme, said Claudia Heiss, a political scientist at the University of Chile.

Kast supporters arrived at the president-elect's campaign headquarters in Santiago on Sunday evening, waving Chile flags. Some wore red caps emblazoned "Make Chile Great Again."

Ignacio Segovia, a 23-year-old engineering student, was among them.

"I grew up in a peaceful Chile where you could go out in the street, you had no worry, you went out and you never had problems or fear," he said. "Now you can't go out peacefully."

While Chile remains one of the safest countries in Latin America, violent crime has spiked in recent years as organized crime groups have taken root, capitalizing on the country's porous northern desert borders with coca-producing neighbors Peru and Bolivia, major international marine ports, and surge of migrants susceptible to human and sex trafficking.

The vast majority of migrants in Chile illegally have arrived from Venezuela in recent years, government data shows.

Kast's proposals include creating a police force inspired by U.S. Immigration and Customs Enforcement to rapidly detain and expel migrants in the country illegally.

He has also touted massive cuts in public spending.

Chile is the world's largest copper producer and a major producer of lithium, and expectations of less regulation and market-friendly policies have already buoyed the local stock market, peso and equity benchmark.

However, Kast's more radical proposals are likely to face pushback from a divided Congress. While right-wing parties won seats in both legislative houses in a November general election, most of those gains came from more traditional parties. The Senate is evenly split between left and right-wing parties, while the swing vote in the lower legislative body belongs to the populist People's Party.

He will have to satisfy a wide electoral base, said Guillermo Holzmann, a political analyst and professor at the University of Valparaiso.

"It is clear that not everyone who voted for Kast is from his party. That is, much of his vote is borrowed," he said.

That fact may stay Kast's hand on policies like abortion. He has previously been outspoken against abortion and the morning-after pill, but rarely spoke about it during the recent campaign. Changing the country's abortion laws would require the support of more than half of the Congress - and polls suggest most Chileans support existing rights.

A more dovish rate cut than anticipated by the U.S. Federal Reserve has created an interesting setup for fixed income markets next year. The focus on its independence adds another dimension.

As expected, the Federal Reserve cut interest rates last week for the third consecutive time this year, lowering the policy rate by a quarter point to the 3.5 – 3.75% range, the lowest level in three years.

Mounting concerns over a weakening U.S. labor market, outweighing sticky inflation, persuaded the Fed to cut again, with risk markets overall reading a more dovish tone than expected from the meeting, broadly supporting equity indices and helping push front-end Treasury yields lower.

Importantly, Fed Chair Jerome Powell suggested the Fed had now done enough to bolster the threat to employment while leaving rates high enough to continue weighing on price pressures, a framing that could otherwise be read as the Fed is comfortable pausing at this level and waiting to see how the economy performs.

While the majority of the 12 voting Federal Open Market Committee (FOMC) members voted for the cut, three dissented Fed governor Stephen Miran, who called for a half-point reduction, and Chicago Fed's Austan Goolsbee and Kansas City Fed's Jeffrey Schmid, who both backed a hold.

Dissent was expected, and even though the numbers were lower than some estimates, it still marked the biggest dispersion among FOMC members since 2019.

So long as there is tension between the balance of risks across the Fed's dual mandate, we expect the divergence in opinion among members on future policy direction will continue.

Interestingly, the FOMC created some optionality on future decisions, stating that in "considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks."

That assessment will come into play this week as a series of important delayed macro data is released—including the October and November payrolls and unemployment rate for November—potentially giving some indication as to which way the Fed may lean going into next year.

Chair Powell posited that the current level of short-term rates is now "within a broad range of estimates of its neutral value" and argued that any further rate cuts from here would need to come from a combination of materially weaker labor market with a higher unemployment rate.

Whether, and to what extent, we see that, our current baseline expectation is that the FOMC does deliver another quarter-point reduction in the first quarter of 2026, with more cuts potentially through the year should downward pressure be applied by a new dovish FOMC chair.

Powell steps down in May, with Kevin Hassett, President Trump's economic adviser and known dove, seen as the favorite to succeed him although other candidates, including former Fed governor Kevin Warsh, Fed governors Christopher Waller and Michelle Bowman, and BlackRock's Rick Rieder, are also on the shortlist being vetted by Treasury Secretary Scott Bessent. An announcement is expected early in the new year, an event that will likely have read-through across the rates market.

Post the Fed meeting, front-end Treasury yields have followed policy rates lower—a move partly supported by the central bank announcing it would immediately start buying short-dated Treasury bills to help manage market liquidity—yet long-end yields across 10- and 30-year Treasuries have broadly risen.

Higher expected growth rates combined with increasing concerns about fiscal overreach and debt sustainability are among the main factors driving long-end yields higher. Such factors are, therefore, priced in, which in our view suggests the worst may be over for long interest rates, a call we highlighted in our fixed income theme for Solving 2026. Indeed, we would argue that improving carry profiles in longer maturities on the back of lower policy rates should provide support to the long end of yield curves.

Nvidia has told Chinese clients it is evaluating adding production capacity for its powerful H200 AI chips after orders exceeded its current output level, according to two sources briefed on the matter.

The move comes after U.S. President Donald Trump said on Tuesday the U.S. government would allow Nvidia to export H200 processors, its second-fastest AI chips, to China and collect a 25% fee on such sales.

Demand for the chip from Chinese companies is so strong that Nvidia is leaning toward adding new capacity, one of the sources said. They declined to be named as the discussions are private.

"We are managing our supply chain to ensure that licensed sales of the H200 to authorized customers in China will have no impact on our ability to supply customers in the United States," an Nvidia spokesperson said in a statement to Reuters after the story was published.

Major Chinese companies including Alibaba and ByteDance have already reached out to Nvidia this week about purchasing the H200 and are keen to place large orders, Reuters reported on Wednesday.

However, uncertainties remain, as the Chinese government has yet to greenlight any purchase of the H200. Chinese officials convened emergency meetings on Wednesday to discuss the matter and will decide whether to allow it to be shipped into China, said one of the two sources and a third source.

Very limited quantities of H200 chips are currently in production, Reuters reported on Wednesday, as the U.S. AI chip leader is focused on producing its most advanced Blackwell and upcoming Rubin lines.

Supply of H200 chips has been a major concern for Chinese clients and they have reached out to Nvidia seeking clarity on this, sources said.

As part of the briefing provided by Nvidia, the company has also given them guidance on current supply levels, said one of the first two people, without providing a specific number.

The H200 went into mass deployment last year and is the fastest AI chip in Nvidia's previous Hopper generation. The chip is manufactured by TSMC using the Taiwanese firm's 4nm manufacturing process technology.

TSMC declined to comment on capacity allocations for specific customers, pointing instead to recent remarks by Chairman and CEO C.C. Wei on the company's capacity planning approach amid surging AI demand.

China's Ministry of Industry and Information Technology (MIIT) did not immediately reply to requests for comment.

Chinese companies' strong demand for the H200 stems from the fact that it is easily the most powerful chip they can currently access.

It is about six times more powerful than the H20, a downgraded chip from Nvidia tailored for the Chinese market that was released in late 2023.

Trump's decision on the H200 comes at a time when China is pushing to promote its own domestic AI chip industry. As domestic chip companies have yet to produce products that match the H200, there have been concerns that allowing the H200 into China could stymie the industry.

"Its (H200) compute performance is approximately 2-3 times that of the most advanced domestically produced accelerators," said Nori Chiou, investment director at White Oak Capital Partners.

"I'm already observing many CSPs (Cloud Service Providers) and enterprise customers aggressively placing large orders and lobbying the government to relax restrictions on a conditional basis," he said, adding Chinese AI demand exceeds the capacity of local production.

During the emergency meetings, there was a proposal to require each H200 purchase to be bundled with a certain ratio of domestic chips, one of the first two sources and a third source said.

For Nvidia, adding new capacity is also challenging at a time when it is not only transitioning to Rubin but also competing with companies including Alphabet's Google for limited advanced chipmaking capacity from TSMC.

It was a Saturday afternoon in the middle of 2024, and Lailatul Sarahjana Mohd Ismail's children were asking – again – to go to McDonald's.

But Ms Lailatul, like scores of other Muslims in Malaysia, was boycotting the fast-food chain and other American brands over US support for Israel.

That choice, in solidarity with the people of Gaza, did not override her kids' craving for fried chicken, one of the chain's most popular offerings in the country.

As the chorus for crispy drumsticks grew louder, Ms Lailatul temporarily quelled the dissent by frying her own at home. And then she went a step further - she launched her own small-scale competitor to the mega chain.

Just over one year in, Ahmad's Fried Chicken – the brand that Ms Lailatul and her husband, Mohd Taufik Khairuddin, which originally started out of a food truck – has grown to 35 outlets. By the end of 2026, that number will soar to about 110.

In Malaysia, customers who have sworn off global restaurant chains in solidarity with Palestine have fuelled a boom in local brands.

Malaysian cafe chain Zuspresso, for instance, which had fewer locations in the country than Starbucks in 2023, doubled its store count in 2024 as Starbucks' shrank.

Today, the chain known as Zus Coffee is the largest coffee purveyor in Malaysia, with more than 700 outlets that sell pumpkin spice lattes as well as concoctions infused with local flavours such as coconut and palm sugar.

Even as the prospects for a peace plan in the Middle East is increasing, the consumer shift to homegrown alternatives appears to have staying power.

"The change is permanent," said Adib Zalkapli, founder of Viewfinder Global Affairs, a geopolitical consulting firm that tracks trends across South-east Asia.

Malaysia is by no means a make-or-break market for major global brands. The size of the food-service industry in the country will almost double to US$27.5 billion (S$35.5 billion) by 2030, said estimates research company Mordor Intelligence. By comparison, in the United States, it will surpass US$1.5 trillion.

But the loss of its customers still has commercial implications, especially since Malaysia is not the only country rethinking its relationship with global consumer brands.

Coca-Cola Icecek, which bottles and sells Coke products in the Middle East, reported a loss of market share in Turkey and Pakistan this summer, following calls to boycott Western companies with perceived links to Israel.

In Indonesia, which has the world's largest Muslim population, KFC's franchise operator Fast Food Indonesia has closed dozens of outlets over the past two years as buyers abstained from its fried chicken. The list goes on.

And once customers made the shift to local brands, many said they are not going back.

Malaysia's Zus Coffee, which expanded to the Philippines in late 2023, has since launched storefronts in Thailand, Singapore and Brunei as it realises everyone, not just Malaysians, want localisation and tailor-made products.

In the Philippines, for example, it is building allegiance by selling coffee drinks flavoured with ube, or purple yam. "This growing confidence in local brands is something we strive to sustain," said Zus chief operating officer Venon Tian.

Of course, not every local brand that thrived during the boycott period will survive.

"Expansion may slow down from resource constraints," said Azizul Amiludin, a senior nonresident fellow at the Malaysian Institute of Economic Research.

And while consumers may be gravitating towards local names now, "legacy brands have their heritage and their strength", said Sydney Lawrance Quays, chief executive officer of Berjaya Food, the operator of Starbucks in Malaysia.

Despite the boycotts, store closures and steep losses triggered by the Gaza conflict, the company still "believes strongly in the Starbucks brand", Mr Quays said, adding that business is gradually recovering.

For now, domestic brands such as Ahmad's Fried Chicken are riding high. The restaurant chain founded by Ms Lailatul and her husband, both 34, brings in about RM3 million (S$947,000) in sales per month, an excellent return on the RM700,000 they initially invested to build the first physical storefront in December 2024.

In Shah Alam – a manufacturing hub in Selangor, Malaysia's most developed state – the bright red exterior and sleek layout of a recently opened Ahmad's could easily be mistaken for any one of the international fast-food chains.

Inside, Faisal Mohamad and his wife settle at a table with fried chicken, fries and soft drinks for lunch.

When it comes to international fast-food brands, "I don't think I'll go back. The local ones are just as good," said Mr Faisal, 41, also a frequent consumer of coffee from Zus. "This has everything the other restaurants offer, minus the political issues."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up