Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's exports massively beat market expectations in November as manufacturers rushed to ship out inventory on the back of a trade deal with Washington, following a meeting between the leaders of the world's top two economies.

China's exports massively beat market expectations in November as manufacturers rushed to ship out inventory on the back of a trade deal with Washington, following a meeting between the leaders of the world's top two economies.

Outbound shipments surged 5.9% in November in U.S. dollar terms from a year earlier, China's customs data showed Monday, topping economists' forecast for a 3.8% growth in a Reuters poll. That growth marked a rebound from an unexpected 1.1% drop in October — the first contraction since March 2024.

Imports growth of 1.9%, however, missed expectations for a 3% rise, as Beijing renewed pledges to expand imports and work toward balancing trade amid widespread criticism against its aggressive exports.

Imports had grown just 1% in October from a year earlier as a protracted housing downturn and rising job insecurity continued to be drag on domestic consumption.

Chinese manufacturers breathed a sigh of relief after Chinese leader Xi Jinping and U.S. President reached a deal during their meeting in South Korea in late October, putting on hold a raft of restrictive measures for one year.

The two sides agreed to roll back steep tariffs on each other's goods, export controls for critical minerals and advanced technology, with Beijing committing to buying more American soybeans and working with Washington to crack down on fentanyl flows.

Following the truce, the U.S. levies on Chinese goods remain at around 47.5% according to Peterson Institute for International Economics. Beijing tariffs on imports from the U.S. stand at around 32%

China's factory activity shrank for an eighth month in November, an official manufacturing survey showed, with new orders staying in contraction. A private survey focused on exporters showed manufacturing activity unexpectedly fell into contraction.

Chinese policymakers are expected to meet later this month for the annual Central Economic Work Conference, to discuss economic growth target, budget and policy priorities for next year. The specific targets will not be officially announced until the "Two Sessions" meeting in March next year.

Beijing is expected to keep the 2026 growth target unchanged at "around 5%," according to Goldman Sachs, which would require incremental policy easing early next year to ensure a growth acceleration from a likely lackluster reading in the fourth quarter of 2025.

The Wall Street bank expects Chinese authorities to lift the augmented fiscal deficit ceiling by 1 percentage point of GDP, cut policy rates by a total of 20 basis points and step up stimulus measures to rein in the housing slump.

Australia will not extend cost-of-living relief to households in the form of electricity rebates, Treasurer Jim Chalmers said, as the government looks to rein in spending in the face of large, structural budget deficits.

"This wasn't an easy decision, but it's the right decision," Chalmers told reporters in Canberra on Monday. "This was a difficult call that we made as a Cabinet, but it's the right call."

Chalmers added that the decision "recognizes the pressures on the budget." The government has spent almost A$7 billion ($4.5 billion) on three rounds of energy rebates so far, Chalmers told reporters.

The rebates covered virtually every household in Australia.

The government first announced the energy rebates in late 2022 as a temporary measure and later extended them through 2025. The plan has helped put some downward pressure on headline inflation.

The center-left Labor government will announce a midyear budget outlook next week with Chalmers saying there won't be a mini-budget this time but "there will be savings and there will be difficult decisions."

Chalmers said that Australian inflation is "higher than we would like" and the budget update would take that into consideration.

"We've got two sets of challenges here. At the front end, we've got this challenge with inflation, which is more persistent than anyone would like," Chalmers said. "And in the medium term and the longer term, we're trying to turn around two decades of underperformance on productivity."

Chalmers' decision comes a day before Australia's central bank is expected to leave interest rates at 3.6% for a third straight meeting.

U.S. lawmakers on Sunday unveiled an annual defense policy bill authorizing a record $901 billion in national security spending next year, billions more than President Donald Trump's request, and provides $400 million in military assistance to Ukraine.

The sweeping 3,000-page bill includes a 4% raise for enlisted troops but excludes a bipartisan effort to spur housing construction that some lawmakers had hoped to include in the final bill.

House Speaker Mike Johnson, a Louisiana Republican, said in a statement that the legislation would advance Trump's agenda by "ending woke ideology at the Pentagon, securing the border, revitalizing the defense industrial base, and restoring the warrior ethos."

The measure is a compromise between versions of the National Defense Authorization Act passed earlier this year by the Senate and House of Representatives, both controlled by Trump's fellow Republicans.

Trump in May asked Congress for a national defense budget of $892.6 billion for fiscal year 2026, flat compared to 2025 spending. That includes funding for the Department of Defense, as well as other agencies and programs involved with security and defense.

The House bill set spending at that level, but the Senate had authorized $925 billion.

The NDAA authorizes Pentagon programs, but does not fund them. Congress must separately pass funding in a spending bill for the fiscal year ending in September 2026.

In addition to the typical NDAA provisions on purchases of military equipment and boosting competitiveness with rivals such as China and Russia, this year's bill focuses on cutting programs reviled by Trump, such as diversity, equity, and inclusion initiatives, and deploying troops to the southwest U.S. border to intercept undocumented immigrants and drugs.

It also repeals two resolutions authorizing the use of military force in Iraq in 1991 and 2002.

Considered "must-pass" legislation, the massive NDAA is one of a few major pieces of legislation that Congress passes every year and lawmakers take pride in having passed it annually for more than six decades.

The bill typically emerges after Republican and Democratic lawmakers negotiate for weeks behind closed doors. But the process this year was much more partisan than usual.

Some Democrats had threatened to stall the measure over Trump's use of the military in U.S. cities, until Republican Senator Roger Wicker, chairman of the Armed Services Committee, agreed to hold a hearing this week on the issue.

Earlier this year, Republicans defeated Democratic efforts to block the deployment of the military to American cities and to bar the conversion of a luxury jet given by Qatar to serve as Air Force One.

Gold (XAU) is trading higher near $4,205 in early Monday trading, as markets widely expect the Federal Reserve to cut interest rates at its upcoming meeting. This policy shift supports investor interest in the metal, especially in the face of a cooling labour market. The expectations of easier monetary policy continue to provide a bullish backdrop for gold.

Moreover, recent data show that inflation remains above the Fed's 2% target. However, slowing job growth has increased pressure for a rate cut. A 25-basis-point reduction is now largely factored into the price. The lower rates weaken the US dollar and Treasury yields, both of which benefit gold prices. If the Fed confirms this dovish stance on Wednesday, gold may extend its gains toward the $4,380 resistance zone.

On the other hand, central bank demand continues to support gold's long-term bullish trend. The People's Bank of China added to its gold reserves for the 13th consecutive month, lifting total holdings to over 74 million troy ounces. This consistent buying reinforces gold's role as a strategic reserve asset in times of currency uncertainty or geopolitical tension. Sustained demand from global central banks provides a floor for gold prices.

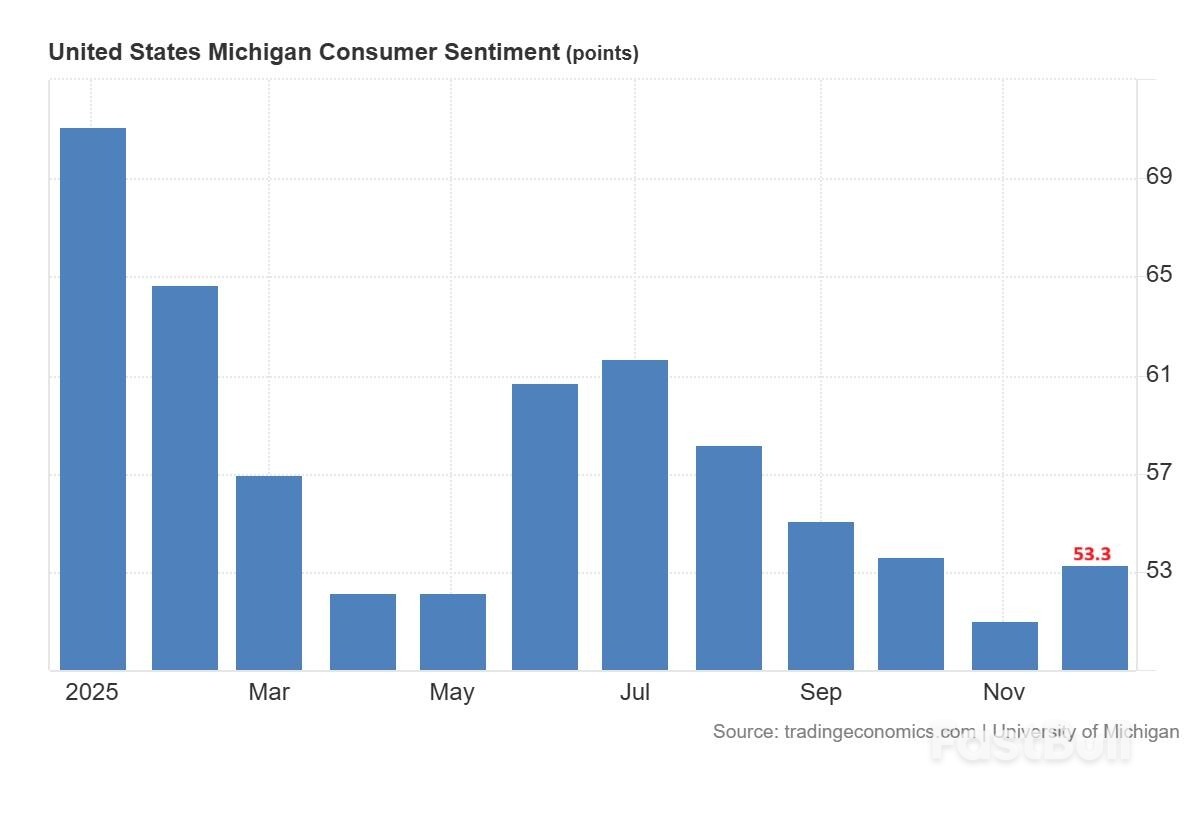

However, improved US consumer sentiment poses a risk to gold in the near term. The University of Michigan consumer sentiment increased to 53.3, beating expectations and signalling some resilience in the US economy. If the dollar strengthens on the back of better economic data, gold could face resistance. A stronger dollar makes gold more expensive for foreign buyers, potentially limiting upside momentum in the days ahead.

XAUUSD Daily Chart – Bullish Consolidation

The daily chart for spot gold shows that the price is consolidating within an ascending broadening wedge pattern. It has broken out of the triangle and is now consolidating around the $4,200 area.

A break above $4,260 could trigger a move toward the $4,380 resistance level. Furthermore, a breakout above $4,380 would likely initiate a strong surge in gold prices. The sustained consolidation above the $4,000 region signals strong support in the gold market. This has been followed by the formation of a bullish structure, indicating growing positive momentum.

The 4-hour chart for spot gold shows that the price is consolidating above a rising trendline. Notably, the price has formed a double bottom pattern on this line multiple times. Each time, the price tests the support level, a rebound follows. Therefore, a break above $4,260 would be a bullish signal and could push the price toward the $4,380 level.

XAGUSD Daily Chart – Strong Bullish Momentum

The daily chart for spot silver (XAG) shows a strong bullish formation confirmed by a cup-and-handle pattern. The breakout above $54.50 has solidified a bullish structure. A move above $59.33 would likely push prices higher toward the $62 level. Furthermore, the strong upward momentum, supported by the rising 50-day and 200-day SMAs, indicates a firmly bullish trend in the silver market.

The 4-hour chart for spot silver shows that the price has formed a strong bullish pattern. An inverted head-and-shoulders formation is developing above the $45.80 level. A breakout above $54.50 pushed the price to a new record high at $59.33.

Following this high, silver is now consolidating within a wedge pattern, which signals short-term volatility. The upcoming Federal Reserve meeting on December 10 is likely to act as a catalyst for the next major move in the silver market.

US Dollar Daily – Negative Momentum

The daily chart for the USD Index shows that it is trading below the 99 level and remains weak below the 200-day SMA. The loss of momentum following the failure to break above 100.50 suggests the index is preparing for another move lower.

A break below the 98 level could trigger a sharp decline toward the 96.50 support area. Furthermore, a drop below 96.50 would likely open the door for a deeper move toward the 90 level. To negate this bearish setup, a decisive break above 100.50 is required.

The 4-hour chart for the US Dollar Index shows that the index is consolidating below the 99 level after forming a double top at the 100.50 level. This pattern suggests further downside in the short term. However, the broader trend remains in a consolidation phase between the 96.50 and 100.50 levels. A breakout from this range will determine the next major move in the US Dollar Index.

Thailand has launched air strikes along its disputed border with Cambodia, the Thai military said on Monday, after both countries accused the other of breaching a ceasefire agreement brokered by U.S. President Donald Trump.

At least one Thai soldier has been killed and four wounded in the fresh clashes that broke out around two areas in the easternmost province of Ubon Ratchathani, Thailand's military said in a statement, after its troops came under Cambodian fire.

"The Thai side has now begun using aircraft to strike military targets in several areas," the statement said.

Cambodia's defence ministry said in a statement that the Thai military had launched dawn attacks on its forces at two locations, following days of provocative actions, and added that Cambodian troops had not retaliated.

The border dispute had erupted into a five-day war in July, before a ceasefire deal brokered by Malaysian Prime Minister Anwar Ibrahim and Trump, who also witnessed the signing of an expanded peace agreement between the two countries in Kuala Lumpur in October.

At least 48 people were killed and an estimated 300,000 temporarily displaced during the July clashes, with the neighbours exchanging rockets and heavy artillery fire.

But following a landmine blast last month that maimed one of its soldiers, Thailand said it was halting the implementation of the ceasefire pact with Cambodia.

In Thailand, more than 385,000 civilians across four border districts are being evacuated, with over 35,000 already housed in temporary shelters, the Thai military said.

Thailand and Cambodia have for more than a century contested sovereignty at undemarcated points along their 817-km (508-mile) land border, first mapped in 1907 by France when it ruled Cambodia as a colony.

Simmering tension has occasionally exploded into skirmishes, such as a weeklong artillery exchange in 2011, despite attempts to peacefully resolve overlapping claims.

It's shaping up to be a big week for markets, with the US Fed's rate decision front and center. While Nifty futures are flat and regional markets mixed, sentiment for local equities is on a reasonably positive footing after the RBI's rate cut and liquidity boost on Friday. Adding to the optimism is a visiting US delegation, which raises hopes of meaningful progress on the trade deal. It's also a busy stretch for primary markets: ICICI Prudential AMC launches its IPO, looking to raise about $1.2 billion — the fifth billion-dollar-plus listing of the year. And watch InterGlobe Aviation — regulators holding IndiGo's CEO accountable for the flight-cancellation crisis means the stock could stay in the spotlight after last week's 9% slide.

India's latest GDP print evoked a mixed market reaction despite beating all estimates. Incred is firmly in the bull camp. The firm says the pickup in personal consumption through July-September, paired with a buoyant festive season, should help keep the growth engine humming. The RBI's decision Friday to cut its policy rate for the first time in six months — and its signal that more easing is possible — reinforces Incred's view that policy will remain supportive of growth. The rupee's slide to a record low remains a cause of worry, but analysts argue that reasonable price-to-earnings valuations, coupled with the RBI's pro-growth tilt, should offset much of the drag.

Systematix is equally upbeat about another corner of the market: value retail. The segment, it says, is set to stay dominant thanks to the country's large, young consumer base — and that advantage isn't fading anytime soon. Rising disposable incomes and the rapid shift to online shopping are also expanding the market. Trent continues to push hard on expansion, especially through its Zudio format, which analysts say stands out on fashionability. Even so, the stock has had a rough year, sliding 41%.

The cement story is less cheerful. Demand improved in October-November, and dealers expect the trend to sustain as construction activity gains pace, according to analysts at Antique. But the benefit may be capped: prices were largely flat in November and fresh supply keeps coming. On top of that, fuel prices are inching up with the weakening rupee — a squeeze that could hit margins. Antique remains bullish on UltraTech Cement and JK Cement.

The monumental chaos that slammed InterGlobe Aviation's operations is finally getting priced into the stock. Shares tanked about 9% last week — the most since 2022 — pushing the relative strength index into oversold zone, a trading signal traders keep a close eye on. IndiGo's stock is now the most oversold it has been since January. That said, any rebound will be riddled with risk, given that the government has capped airfares and asked and the company to show cause for the meltdown that nearly brought the aviation sector to its knees.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up