Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)A:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)A:--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)A:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)A:--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)A:--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)A:--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Exports (Sept)

U.S. Exports (Sept)--

F: --

P: --

U.S. Trade Balance (Sept)

U.S. Trade Balance (Sept)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

Canada Trade Balance (SA) (Sept)

Canada Trade Balance (SA) (Sept)--

F: --

P: --

Canada Exports (SA) (Sept)

Canada Exports (SA) (Sept)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Sept)

U.S. Wholesale Sales MoM (SA) (Sept)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. Yield--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The broader market absorbed the official-sector selling without stress, as net foreign private inflows in August and September offset net foreign official outflows, according to the Treasury’s November 18 TIC statement.

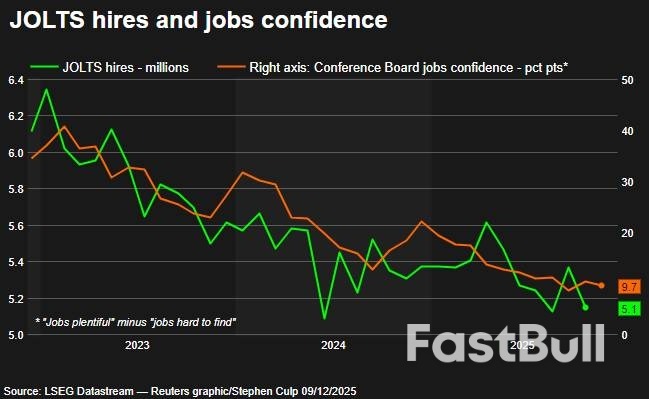

U.S. job openings increased marginally in October after surging in September, but subdued hiring and the lowest level of resignations in five years underscored the economic uncertainty that economists have largely blamed on tariffs.

The Labor Department's monthly Job Openings and Labor Turnover Survey, or JOLTS report, was released on Tuesday as Federal Reserve officials started a two-day policy meeting. Financial markets expect the U.S. central bank will cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range on Wednesday out of concern for the labor market. The Fed has lowered borrowing costs twice this year.

"The job market isn't collapsing but it is certainly losing steam," said Oren Klachkin, financial markets economist at Nationwide. "We anticipate Fed officials will try to get ahead of labor market weakness with another 25 basis points rate cut tomorrow even as inflation remains above the 2% goal."

Job openings, a measure of labor demand, were up 12,000 to 7.670 million by the last day of October, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast 7.150 million unfilled jobs. The report incorporated data for September, whose release was canceled because of the 43-day federal government shutdown.

Vacancies soared 431,000, the most in nearly a year, to 7.658 million in September. The BLS said it had "temporarily suspended use of the monthly alignment methodology for October preliminary estimates," adding that "use of this methodology will resume with the publication of October final estimates."

The bulk of the job openings in October were in the trade, transportation and utilities sector, with 239,000 vacancies, mostly at retailers. There were 114,000 fewer open positions in the professional and business services industry. Job openings in the accommodation and food services sector fell 33,000. The federal government had 25,000 fewer vacancies.

The job vacancies rate was unchanged at 4.6%. Hiring dropped by 218,000 to 5.149 million in October, with most of the declines in construction, professional and business services, healthcare and social assistance as well as accommodation and food services industries. The hires rate slipped to 3.2% from 3.4% in September. There were 5.367 million hires in September.

Layoffs crept up 73,000 to a still-low 1.854 million, concentrated in the accommodation and food services sector. The layoffs rate rose to 1.2% from 1.1% in September.

Stocks on Wall Street were mixed. The dollar gained versus a basket of currencies. U.S. Treasury yields were mostly higher.

JOLTS hires and jobs confidence

JOLTS hires and jobs confidenceThe combined September and October reports suggested the labor market remained in what economists and policymakers call a "no-hire, no-fire" state.

Labor market stagnation has been blamed on reduced labor supply amid a reduction in immigration that started during the final year of former President Joe Biden's term and accelerated under President Donald Trump's second administration. The adoption of artificial intelligence for some job roles is also reducing labor demand, especially for entry-level positions.

The unemployment rate rose to a four-year high of 4.4% in September. The BLS canceled October's employment report and will not be publishing the unemployment rate for that month as the longest shutdown on record prevented the collection of data for the household survey from which the jobless rate is calculated.

November's delayed employment report, now due next Tuesday, will include October's nonfarm payrolls data.

With the labor market wobbly, fewer workers are job hopping in search of greener pastures, pointing to benign wage inflation. The number of people quitting their jobs dropped 187,000, the largest decline since June 2023, to 2.941 million. That was the lowest level since August 2020 when the labor market was recovering from the first wave of the pandemic.

The quits rate, viewed by policymakers as a gauge of labor market confidence, slipped to 1.8%. That was the lowest reading since May 2020, and was down from 2.0% in September. Lower wages because fewer workers are changing jobs could, however, hurt consumer spending.

"This (quits rate) is a pretty 'cold' reading that has historically been consistent with wage growth of just 2.5% year-on-year," said James Knightley, chief international economist at ING. "That's not good news for consumption, but given in a service-sector economy, such as the U.S., the biggest cost input is the cost of your workforce, this suggests medium- to longer-term inflation will be on a downward trajectory."

White House economic adviser Kevin Hassett said Tuesday there is "plenty of room" to cut interest rates further, though he noted that rising inflation could alter this outlook.

Speaking at the WSJ CEO Council, Hassett, who is widely considered a front-runner to become the next Federal Reserve chair, compared the current economic environment to the 1990s, describing it as a "potentially extremely transformative time."

When asked how he would respond if President Donald Trump requested interest rate cuts that he personally disagreed with, Hassett provided a specific example of when rate cuts would be inappropriate. "If inflation has gone from 2.5% to 4%, you can't cut rates then," he said, according to a tweet from Wall Street Journal Fed reporter Nick Timiraos.

As Brazil's markets rallied, month after month, and global investors kept flooding in, the gains were big enough to overshadow the risks from a presidential election that's still almost a year away.

Then, in just a few hours, that suddenly changed.

The nation's assets have been dragged down by waves of selling since Flavio Bolsonaro — the son of the now-incarcerated former populist leader Jair Bolsonaro — emerged as a contender in next year's race. That dampened local investors' hopes that the right would coalesce around Tarcisio de Freitas, a governor seen in Brazil financial circles as the strongest challenger to President Luiz Inacio Lula da Silva.

Friday saw the worst of the selloff. Bond yields jumped. Stocks tumbled as much as 4.5% in the deepest slide in over four years. And the real slumped over 3%, its biggest decline since US President Donald Trump's April tariffs unleashed havoc around the globe. While assets bounced slightly Monday amid mixed signals from Flavio Bolsonaro on whether he would carry out his bid, they were whipsawed by volatility Tuesday when the senator said his candidacy was "final."

The moves were a stark reminder of the political risks that have been largely ignored as investors stampeded back into developing countries around the world this year.

Brazil has been a major beneficiary, leaving its currency up more than 13% against the dollar even after its recent pullback. That was partially driven by carry traders, who borrow in countries where rates are low and invest in those offering higher yields and have seized on local interest rates pinned at 15% even as central banks in the US and Europe started nudging them lower.

"People were caught by surprise," said Jose Oswaldo Monforte, a portfolio manager at hedge fund Vinland Capital.

"To think that everything would move linearly toward an optimal solution a year in advance seems a bit naive to me," he said. "I can only navigate this well by managing risk and having a safety margin. What I can say is there will be volatility and we need to be prepared."

The shift marks the latest example of politics imperiling what have been strong rallies across Latin America. Earlier this year, Ecuador's bonds sold off when it looked like the socialist challenger posed a significant threat to President Daniel Noboa, who went on to reelection. And Argentina's markets tumbled when President Javier Milei was delivered a setback in a local vote, only to rebound strongly when he defied expectations by prevailing in October's Congressional elections.

In Brazil's case, the broader push into emerging markets was strong enough to shunt aside the worries about rising public debt and deficits under Lula.

While the October 2026 race is still taking shape, in financial circles the attention had largely focused on a potential presidential bid by Freitas, the Sao Paulo governor. He served as infrastructure minister in Bolsonaro's administration, a role that boosted his profile with local and foreign businesses, and as governor oversaw the privatization of the state's water-utility while also taking steps to scale back public spending.

His name had continued to resurface in political and market discussions. At a September event, Luis Stuhlberger, CEO and CIO of Verde Asset Management, said Freitas "has been very vocal" about reducing costs. Stuhlberger warned of an "extremely negative" scenario for Brazilian assets if Lula wins re-election next year.

Eduardo Cohn, a portfolio manager at Heritage Capital Partners, said many local hedge funds had been piling into stocks and betting on lower interest rates — positions he said would gain from a Freitas victory. In recent monthly notes, several Brazilian hedge funds said they were doubling down on bullish bets in local assets.

"Funds were very heavily positioned in this trade, and the tendency now is to protect their performance in this final stretch of the year," Cohn said.

That primed markets for a sharp jolt from a surprising political turn that — for now at least — seems to have derailed the prospect of Freitas' candidacy. Flavio Bolsonaro's announcement suggested the election will be a rematch between Lula and the Bolsonaro family, or a race with a swath of right-wing names instead of a united bid. Both scenarios could potentially bolster Lula's re-election chances.

Freitas, who never confirmed he would leave his post as Sao Paulo governor to vie for the nation's top job, announced late Monday that he supports Flavio Bolsonaro's bid. On Tuesday, Bolsonaro's eldest son reiterated he is committed to the race and said he would only step aside if his father was freed from prison — where he's serving a sentence for seeking to overturn the last election — and was allowed to run for office again.

The shakeup continued to drag on markets Tuesday as traders reassessed the country's outlook. Brazil's real fell as much as 1.1% and interest-rate contracts pushed upward, indicating that traders are anticipating they will remain elevated.

"Markets are still with the idea that a fractured right will boost Lula's odds," said Daniel Balaban, a foreign-exchange broker at XP Inc. in New York. "The reaction today is aligned with that narrative."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up