Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Australia Employment (Nov)

Australia Employment (Nov)A:--

F: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)A:--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)A:--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)A:--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)A:--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo RateA:--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)A:--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)A:--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Exports (Sept)

U.S. Exports (Sept)A:--

F: --

P: --

U.S. Trade Balance (Sept)

U.S. Trade Balance (Sept)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Canada Trade Balance (SA) (Sept)

Canada Trade Balance (SA) (Sept)A:--

F: --

Canada Exports (SA) (Sept)

Canada Exports (SA) (Sept)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Sept)

U.S. Wholesale Sales MoM (SA) (Sept)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)A:--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)A:--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)--

F: --

P: --

U.K. Services Index MoM (SA) (Oct)

U.K. Services Index MoM (SA) (Oct)--

F: --

P: --

U.K. Services Index YoY (Oct)

U.K. Services Index YoY (Oct)--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)--

F: --

P: --

U.K. Manufacturing Output MoM (Oct)

U.K. Manufacturing Output MoM (Oct)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Oct)

U.K. Monthly GDP 3M/3M Change (Oct)--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's Weak Demand and Its Ripple Effect on Global Markets.

China's latest inflation data sent mixed signals through global markets. Consumer prices rose 0.7% year-on-year, the fastest pace in nearly two years. Yet producer prices fell 2.2%, extending a deflation trend that has lasted four years. This split shows how uneven China's recovery remains. Moreover, higher food costs lifted headline inflation, while weak demand still pushed factory prices lower. As a result, markets worry that China's domestic demand remains fragile. Analysts note that oversupply in sectors such as coal and energy continues to weigh on prices. And although Beijing supports consumption through targeted stimulus, it avoids broad measures. Therefore, China's growth path still looks uncertain. Investors now wait for the Central Economic Work Conference to see whether policymakers shift toward stronger support in 2026.

Markets reacted quickly to China's inflation data. The Hang Seng and CSI 300 both fell as investors reassessed the country's economic momentum. Japan's Nikkei and South Korea's Kospi also slipped, highlighting how sensitive Asia-Pacific markets are to China's signals. Lower factory-gate prices show that manufacturers still struggle with excess supply. This weakness limits China's ability to drive regional growth. And while exports remain strong, domestic spending lags behind. That imbalance pressures companies across Asia. At the same time, global traders are watching the FED. With a widely expected rate cut of 0.25%, investors hope for a softer U.S. dollar, which could lift emerging markets. Still, uncertainty remains high as inflation and growth trends diverge across regions.

The race for AI talent is heating up, and China is gaining ground fast. The country produced 3.57 million STEM graduates in 2020—more than four times the U.S. total. This surge is reshaping how tech companies recruit and innovate. Chinese firms are also securing more U.S. patents, with Huawei ranking among the top global players. Universities and industry are working closer together to push AI development and reduce reliance on foreign technology. As a result, China is developing competitive AI models at a fraction of the cost of U.S. systems. This shift signals a major change in tech leadership. Talent and data scale give China an edge even as the U.S. maintains a lead in high-end chips. Yet both markets depend on stable geopolitical conditions, and rising tensions will shape the next phase of AI innovation.

The global AI race also affects financial markets and monetary policy. Companies require massive computing and electrical power to train advanced models. Analysts warn that the U.S. could face energy shortages before it runs out of GPUs. Meanwhile, China appears better positioned on the power front, giving it another strategic advantage. These shifts matter because AI drives productivity, investment flows, and corporate earnings. Markets respond to every new breakthrough. Furthermore, the FED follows these trends closely as they influence long-term inflation and growth. As AI spreads across industries, it could lift productivity but also disrupt jobs. Policymakers must balance innovation with economic stability. Therefore, the FED's decisions on rates and future guidance will shape how quickly AI investments accelerate.

Investors now stand at a crossroads. China's inflation shows early signs of stabilization, but deflation risks remain. Its AI momentum is strong, yet global competition is fierce. Markets are waiting for the FED to deliver clarity on its rate path. A softer stance could lift risk assets worldwide. However, persistent inflation in the U.S. may limit how far the FED can go. Meanwhile, Asia-Pacific markets remain highly sensitive to China's economic signals. As a result, traders must track both macro data and technology developments. The combination of China's domestic challenges, the AI talent race, and the FED's policy moves will set the tone for markets in 2025.

The Bank of Canada held its key policy rate steady at 2.25% on Wednesday as widely expected, and Governor Tiff Macklem said the economy was proving resilient overall to the effect of U.S. trade measures.

Despite tariffs between 25% and 50% on some critical sectors such as cars, lumber, aluminum and steel, Canada's economy has shown signs of strength.

Third quarter annualized GDP grew by 2.6%, much more than expected, while employment data showed the economy added 181,000 new jobs between September and November.

"So far, the economy is proving resilient," Macklem said in opening remarks to reporters, adding that inflationary pressures continue to be contained. Overall inflation is just above the bank's 2% target.

"Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy," said Macklem.

Uncertainty remains high and if the outlook changes, the bank is ready to respond, Macklem said, reiterating comments he made when the bank cut rates in October to their current level.

The U.S. Federal Reserve will also announce a rate decision on Wednesday and a majority of economists expect it will cut rates by 25 basis points.

Macklem said even though the economy had shown some resilience, he expected GDP growth to be weak in the fourth quarter and hiring intentions to be muted.

While the economy is adjusting to tariffs, volatility in trade and quarterly GDP numbers are making it more difficult to assess the underlying momentum of the economy, Macklem noted.

The recent data has "not changed our view that GDP will expand at a moderate pace in 2026 and inflation will remain close to target."

Andrew Kelvin, Head of Canadian and Global Rates Strategy at TD Securities called the bank's commentary a fairly cautious tone.

"It leads me to be very comfortable with the idea that the bank will be on hold for quite some time," he said.

The consumer price index eased to 2.2% in October but economists have regularly flagged that measures of core inflation, which strips out volatile components, have stayed around 3%, the top end of the BoC's inflation target.

In the months ahead, the BoC expects some choppiness in headline inflation which would push inflation temporarily higher in the near term.

But Macklem said the ongoing economic slack would roughly offset these cost pressures. He said the bank expects the growth in final domestic demand to resume after registering a flat growth in the third quarter.

The Canadian dollar weakened after the announcement and was trading down 0.13% to 1.3865 to the U.S. dollar, or 72.12 U.S. cents. Yields on the two-year government bonds fell 3.3 basis points to 2.556%.

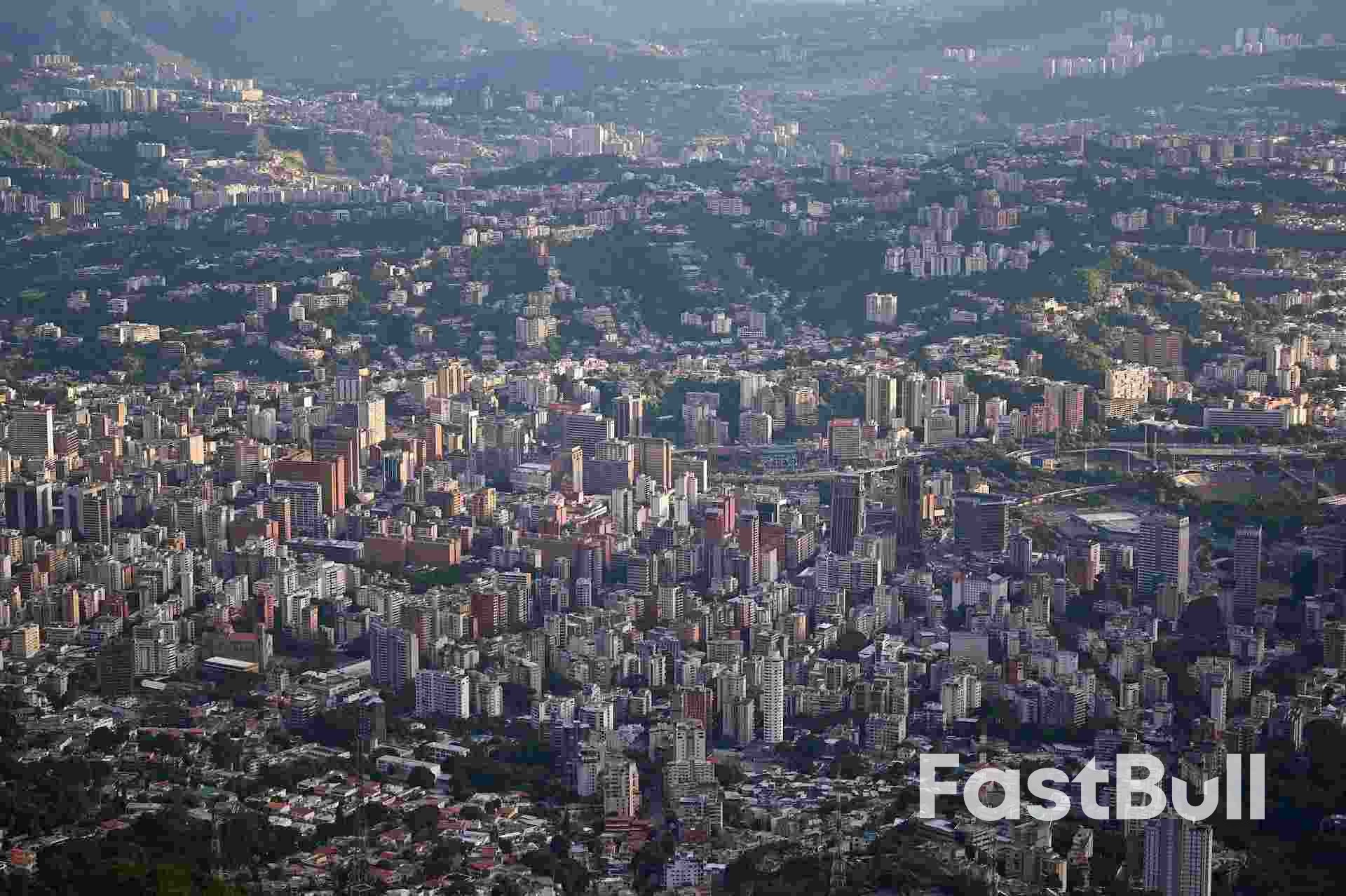

President Donald Trump's top national security advisers briefed members of Congress about the administration's campaign against suspected Venezuelan drug traffickers on Tuesday, as the president suggested he could extend U.S. military operations to Mexico and Colombia.

Secretary of State Marco Rubio, Secretary of Defense Pete Hegseth, Chairman of the Joint Chiefs of Staff Dan Caine and CIA Director John Ratcliffe held a classified briefing for Congress' "Gang of Eight" representing intelligence committee and Senate and House of Representatives leaders from both parties after members of Congress clamored for more information.

Democrats emerged from the meeting dissatisfied. "I asked them what their strategy is, and what they were doing, and again, did not get satisfying answers at all," Senate Democratic Majority Leader Chuck Schumer of New York told reporters after the briefing.

Republicans mostly declined to comment beyond saying they were still studying the issues.

Trump said in a wide-ranging interview with Politico conducted on Monday that he could extend anti-drug military operations to Mexico and Colombia and hinted at land operations in Venezuela. He also took aim at Europe, including another call for Ukrainian elections and support for Hungary's leader.

Trump repeatedly declined to rule out sending troops into Venezuela as part of an effort to bring down President Nicolas Maduro. Asked if he would consider using force against targets in other countries where the drug trade is highly active, including Mexico and Colombia, Trump said: "I would."

The U.S. military has massed much of its naval strength in the southern Caribbean since early September, conducting at least 22 strikes on boats in waters around Venezuela that have killed nearly 90 people.

The campaign has come under heightened scrutiny in recent days as details emerged of a September 2 decision to launch a second strike on a suspected drug boat that killed survivors of the first attack.

Trump's comments in the Politico interview reiterated much of his world view outlined in the sweeping national security strategy released last week that seeks to reframe the country's global role.

That strategy, which aides called the Trump Corollary to the 19th-century Monroe Doctrine asserting U.S. dominance in the Americas, focused on the U.S. reasserting itself in the Western Hemisphere while warning Europe that it must change course or face "erasure."

"They're weak," Trump told Politico, referring to Europe's political leaders. "They want to be so politically correct."

A spokesperson for the European Commission, asked about Trump's comments, defended the bloc's leaders and said the region remained committed to their union despite challenges such as Russia's war in Ukraine and Trump's tariff policies.

In the interview, Trump again said he thought it was time for Ukraine to hold elections as the war nears its four-year mark. Ukraine is expected to share a revised peace plan with the U.S. later on Tuesday, one day after hastily arranged talks with European leaders.

He also said he did not offer a financial lifeline to the government of ally Hungarian Prime Minister Viktor Orban, who met with Trump last month at the White House.

"No, I didn't promise him, but he certainly asked for it," he said.

President Donald Trump held talks with British Prime Minister Keir Starmer, French President Emmanuel Macron and German Chancellor Friedrich Merz as the US pushes for a deal to end Russia's war in Ukraine.

The leaders spoke by phone Wednesday, people familiar with the matter told Bloomberg. The White House didn't immediately respond to a request for comment.

The call came as Ukraine and its European allies prepared to send the Trump administration revised proposals for a possible peace agreement with Russia.

Three documents are being discussed between the countries. One is an overall framework to end the war, the second concerns security guarantees for Kyiv and the third focuses on Ukraine's reconstruction.

On Monday, Ukrainian President Volodymyr Zelenskiy said the main sticking points remained over territory and security guarantees.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up