Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

"This pattern of development is not sustainable, and so growth is at risk of slowing further over the medium-term unless the authorities take much more proactive steps to support consumer spending..."

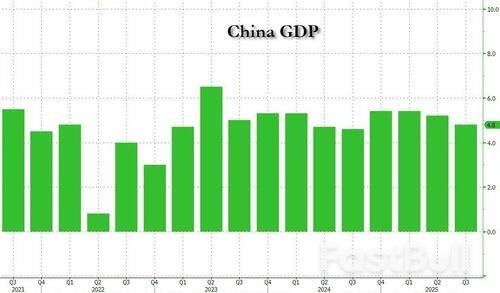

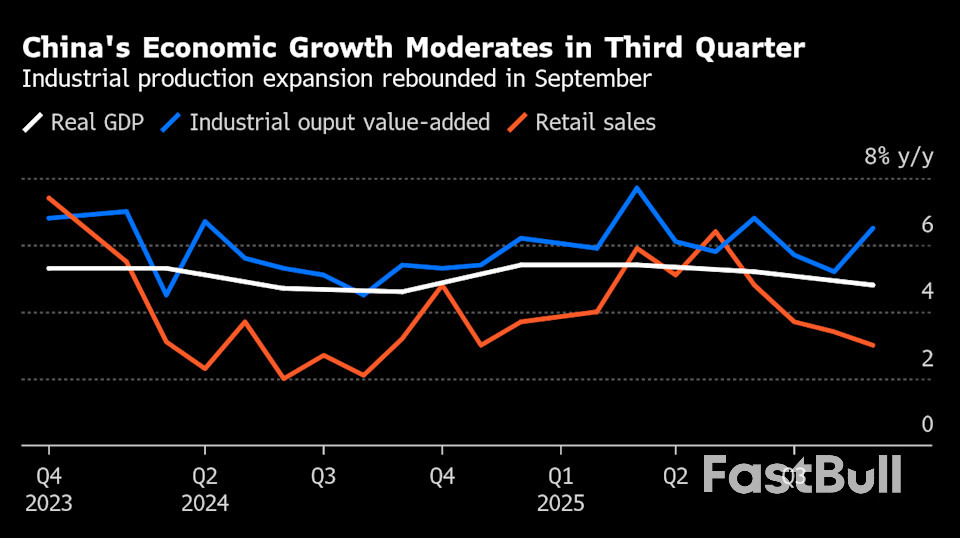

China's economic growth slowed to the weakest pace in a year in the third quarter as fragile domestic demand left it heavily reliant on the output of its exporting factories - which have sparked a global deflationary shockwave as China seeks to capture market share abroad through cutthroat price cuts sparking outrage among traditional Chinese clients - and stoking concerns about deepening structural imbalances.

While the 4.8% GDP print for Q3 came fractionally above expectations and kept China on track to reach its target of roughly 5% this year, the economy's dependence on external demand at a time of mounting trade tensions with Washington raises questions over whether that pace can be sustained. It's why analysts said further policy support is urgently needed to maintain this stable trajectory and improve domestic demand.

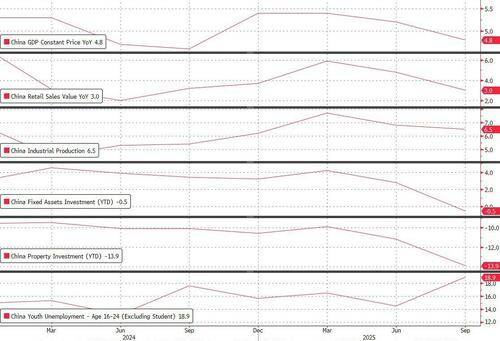

The rest of the Chinese data dump overnight was mixed:

Some notes here from Goldman:

Main points:

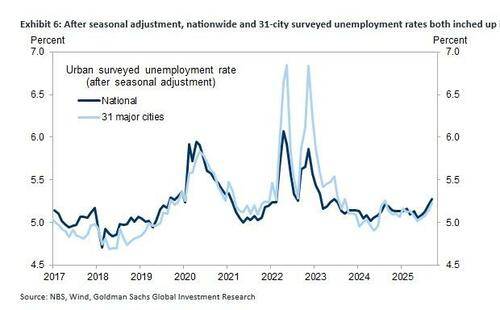

According to Goldman, despite recent developments in US-China tensions, we believe China's full-year growth target remains largely on track, given that real GDP grew 5.2% yoy during the first three quarters of this year and exports (driven by tariff frontrunning) remain resilient. Additionally, Goldman does not think policymakers see an immediate need to launch broad-based, significant stimulus in the near-term, even though incremental and targeted easing appears necessary in coming quarters to ensure stable growth and employment into next year. The majority of the growth impulse of recent easing measures -- including the nationwide childbirth subsidies, the RMB500bn policy bank new financing instrument, and the use of an RMB500bn unspent local government bond issuance quota accumulated from previous years – will likely be concentrated in late 2025 or early 2026.

That's the optimistic view. A rather more realistic one comes from Reuters which writes that Beijing may be using the headline "resilience" in growth as a show of strength in talks between its vice premier He Lifeng and Treasury Secretary Scott Bessent in Malaysia in coming days and a potential meeting between presidents Donald Trump and Xi Jinping in South Korea later.

This downbeat view is reinforced by the latest observations from Bloomberg's Econ team which overnight wrote that China's 7% investment slump shows deep demand weakness. According to a note published by BBG overnight, China’s latest data dump reassures near-term growth but underscores long-term challenges. Third-quarter GDP growth of 4.8% means the economy only needs to clear a low bar of 4.5% in 4Q to meet the 5% full-year target, helped by a surge in production.

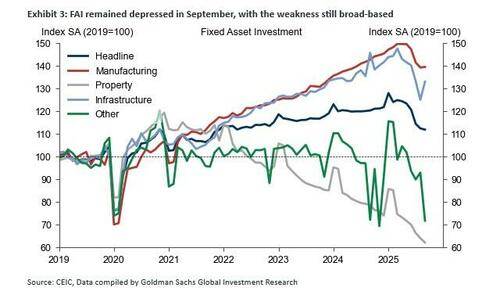

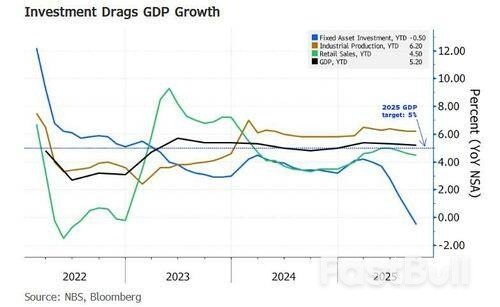

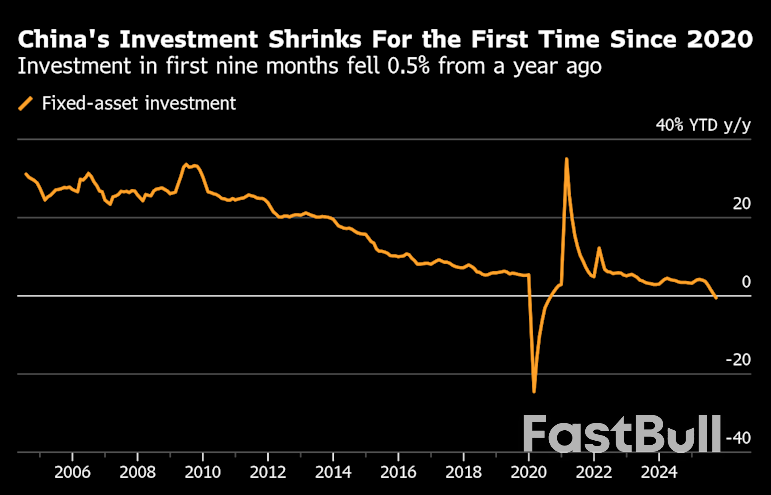

Yet the imbalance between supply and demand has aggravated. Consumption remains weak, and investment - including public investment - has emerged as the weakest link. That's because Bloomberg Economics calculates that fixed-asset investment contracted for the fourth month in a row, by as much as 7% in September.

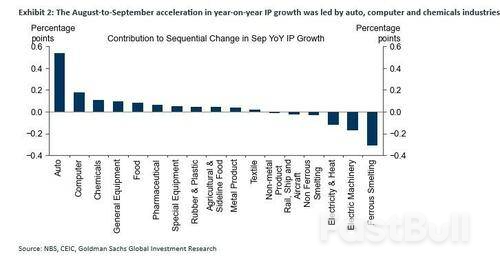

The same supply-demand imbalance is evident in the month-on-month comparison. Industrial production rose 0.64% — the highest in seven months and in line with the pre-pandemic trend - while retail sales fell 0.18%, the third monthly contraction in four months.

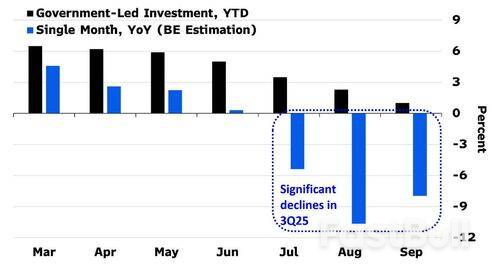

As shown below, the collapse in fixed-asset investment has become became the biggest drag on the economy, as government-led investment lost steam. Investment has deteriorated across the board, in both the private and public sectors. The latter is particularly concerning, as government-led investment has been the primary driver of investment over the past few years. BBG calculates that government-led investment declined year-on-year through 3Q, including an 8% drop in September.

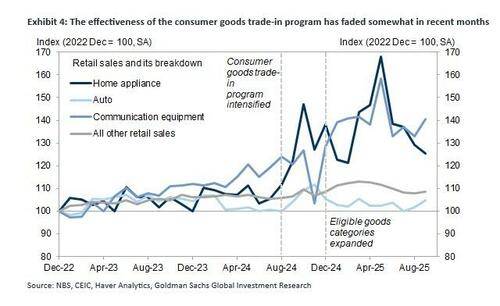

Slowing consumption is another drag on the economy. BBG estimates that retail sales growth fell below the pre-stimulus trend for the first time in September since the government ramped up stimulus in September 2024. In September, catering revenue rose only 0.9% year on year, the same as in June — the lowest growth rate since 2023. This reflected cautious consumption of households — as they spent less on unnecessary items. In addition, home appliance sales have slowed rapidly, indicating that the boost from government subsidies is fading. Sales in September increased 3.3% from a year earlier, far lower than that in August (14.3%) or July (28.7%).

Meanwhile, the only silver lining - the ongoing export strength, which itself is a function of the trade war - belies weakness on home turf, where lacklustre demand gives manufacturers no choice but to fight price wars in foreign markets, and compromise on their profitability.

Jeremy Fang, a sales officer at a Chinese aluminium products maker, says his firm lost 20% of revenue as higher sales in Latin America, Africa, Southeast Asia, Turkey and the Middle East failed to fully offset an 80%-90% order plunge in the US. Fang said he is learning Spanish to get ahead of his Chinese competitors rushing to non-U.S. markets and is now traveling abroad twice more often than he did last year.

But that extra effort isn’t enough.

"You have to be ruthlessly competitive on price," Fang said. "If your price is $100 and the customer starts bargaining, it's better to drop $10-$20 and take the order. You can't hesitate."

This also explains why despite the surging tariffs, goods increases on US imports remains very tame.

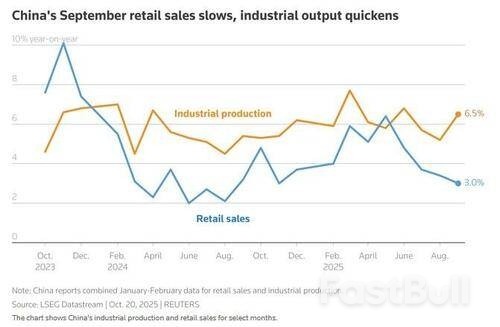

This intense competition among Chinese exporters feeds further weakness at home, with many having to cut wages and even jobs to stay in the race. As noted above, while industrial output grew to a three-month high of 6.5% year-on-year in September, beating forecasts, retail sales slowed to a 10-month low of 3.0%.

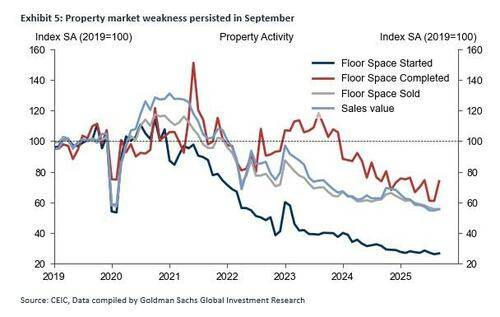

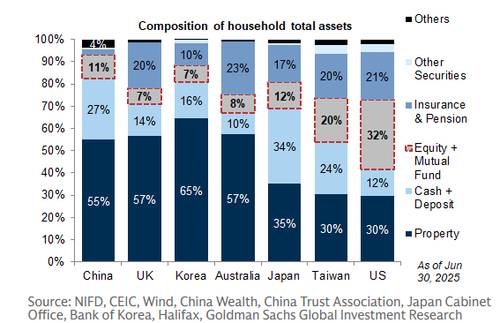

Further hitting consumers by making them feel less wealthy, data also showed new home prices falling at their fastest pace in 11 months in September. Investment in the crisis-hit property sector fell 13.9% year-on-year in the first three quarters, which is devastating for a country where some 55% of household net worth - among the highest in the world - is found in real estate.

"China’s growth is becoming increasingly dependent on exports, which are offsetting a slowdown in domestic demand," said Capital Economics analyst Julian Evans-Pritchard.

"This pattern of development is not sustainable, and so growth is at risk of slowing further over the medium-term unless the authorities take much more proactive steps to support consumer spending."

Such calls for structural measures that make China's economy more reliant on household consumption have grown louder ahead of this week's key Communist Party meeting, where its elites will discuss the country's next five-year development plan (see "Trader's Guide To Biggest China Political Meeting Starting Monday").

But while the meeting is likely to result in pledges to boost domestic demand, it will also emphasize breaking through technological frontiers and upgrading the country's sprawling industrial complex as a national security priority. This could keep the flow of economic resources tilted primarily towards manufacturers at the expense of households.

A change in its growth model would make China a bigger contributor to global demand and might help tone down trade tensions. But there is no sign that Beijing is willing to relent on the industrial front as competition with the U.S. intensifies. So far, it has been successful in diversifying away from U.S. markets. Its U.S. export sales were down 27% year-on-year last month, but shipments to the European Union, Southeast Asia and Africa grew by 14%, 15.6% and 56.4%, respectively.

And China is using its near-monopoly position in the production of rare earths as leverage to try to extract more concessions from Washington. This prompted renewed threats from Trump to add another 100 percentage points to tariffs on imports from China, but also messages from Washington that the two sides are willing to lower the temperature.

Triple-digit tariffs would effectively place a painful trade embargo on the world's two largest economies, but Beijing might feel it can bear the pain for longer.

"Relatively speaking, China is in a better position than the U.S.," said Yuan Yuwei, hedge fund manager at Water Wisdom Asset Management. "At worst, ordinary people may tighten their belts and some workers are left idle. But in the U.S., if you cut 10-20% of worker's salary, people go out into the street to protest. China can suffer for longer than the U.S."

If policymakers feel the economy is veering off target in the fourth quarter, one option is to speed up infrastructure investment given that they are currently frontloading 2026 debt issuance. After all, fixed-asset investment shrank 0.5% in January-September from a year earlier, suggesting room for improvement in that area.

Some analysts believe Beijing doesn't need more stimulus measures this year. But others still see a strong case to offer support to underperforming sectors.

"With China on track to hit this year's growth target, we could see less policy urgency," said Lynn Song, chief economist, Greater China at ING.

"But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed."

Sure enough, China's consumer confidence never managed to recovery after the covid crash, suggesting that behind the cheerful rhetoric, the mood on the ground in China is cataclysmic and that contrary to soundbites, should Trump continue to push and prod China in the ongoing trade war, he may well get what he wants.

Looking ahead, Goldman writes that the divergent supply and demand trends underscore the need for the government to find effective ways to support growth, even if the economy does not require an additional boost in 4Q. The bank sees less monetary easing in 4Q, with only one possible cut in either the policy rate or the reserve requirement ratio, unlike earlier expectation of moves on both fronts. On the fiscal front, the focus will likely be on implementation and early groundwork for 2026, such as front-loading bond issuance and putting funds in place for projects. The sharp decline in government investment highlights the urgency of identifying more viable investment projects and social programs to spur consumption.

A spate of billion-dollar deals for Indian banks has thrust the country’s financial sector into the global spotlight, at a time when US credit losses and trade tensions have rattled investors globally.Over the weekend, Emirates NBD Bank PJSC said it plans to invest $3 billion in RBL Bank Ltd., marking the biggest foreign investment in India’s banking sector. Earlier this month, Abu Dhabi’s International Holding Co. PJSC inked a deal to buy into Sammaan Capital Ltd. for about $1 billion, while Sumitomo Mitsui Financial Group Inc.’s banking unit in May agreed to pay $1.6 billion for 20% of Yes Bank Ltd.

All told, about $15 billion of deals involving financial services targets in India have been struck this year, data compiled by Bloomberg show, as global investors scour for opportunities in one of the world’s fastest-growing major economies. This builds on the momentum of prior years to invest in lenders, insurance and fintech players.The exuberance to what’s happening elsewhere is striking. Recent US collapses of Tricolor Holdings and First Brands Group have stoked fears of hidden credit losses. India itself is trying to work things out with the US after it was slapped with 50% tariffs that could hit its growth.

There also isn’t a track record of triumph by overseas buyers, as the sector remains dominated by well-entrenched local players and had struggled with a shadow bank crisis less than a decade ago.“The success story of foreign banks acquiring Indian banks is very limited” and hasn’t always reflected in profit and revenue growth, said Hemindra Hazari, an independent research analyst. The large sums foreign investors are willing to invest shows intent, but whether they can build a profitable retail franchise in India’s competitive market remains to be seen, he said.

For now, suitors are focusing on the positives. Indian lenders look relatively more insulated, and are gaining from rapid digital adoption, government moves, as well as a large under-banked population. Japan’s megabanks have been outspoken about their appetite for Indian assets, while deep-pocketed firms from the Middle East and Europe are now setting their sights on the expanding middle class in Asia’s third-largest economy.“The Indian growth story has been accepted globally,” RBL’s Chief Executive Officer R Subramaniakumar said at a briefing on Sunday. He pointed out that a stable financial system and robust regulators add to the appeal.

The Reserve Bank of India has moved in recent years to strengthen the financial sector via measures aimed at boosting credit flow, encouraging lending and financing. The regulator has also clamped down on excessive risk-taking, frequently warning shadow lenders about pursuing growth at any cost and vowing to take action if they don’t strengthen risk controls.The steps come after the sector blew up about seven years ago when a pile-up of bad loans weighed on growth. This led the government to overhaul bankruptcy laws and re-capitalize state-owned banks.

Now, policymakers are exploring ways to attract more foreign investment, including discussing options to make it easier for overseas investors to raise stakes in state-run banks and allowing large companies to apply for banking licenses, Bloomberg News reported earlier.Recent set of earnings from industry heavyweights HDFC Bank Ltd. and ICICI Bank Ltd. saw both lenders reporting better-than-expected results driven by lending growth, even as interest margins remain under pressure. The 12-member Nifty Bank Index has rallied more than 13% this year, closing at a record high on Friday.

More jumbo deals could follow. A planned government stake sale in IDBI Bank Ltd. is expected to fetch billions. Japan’s biggest lender Mitsubishi UFJ Financial Group Inc. is actively hunting acquisition targets, and is said to be in advanced talks to buy a stake in Shriram Finance Ltd.“Geopolitical risks have accelerated financial and supply chain risks, and foreign investors are looking for alphas in countries that minimize them,” said Vivek Ramji Iyer, partner and leader in financial services practices at Grant Thornton Bharat. “India’s domestic focus and low correlation with the global economy make it a lucrative entry point.”

European Central Bank Executive Board member Isabel Schnabel reiterated that the international role of the euro should be enhanced.

“For sovereignty, we need a strong currency, and this is our responsibility here at the ECB,” she said Monday in Frankfurt. “This is why we think it’s so important to foster the international role of the euro.”

Speaking on a panel chaired by Bloomberg’s Stephanie Flanders, she referred to comments by ECB President Christine Lagarde saying that “this role needs to be earned — it doesn’t just fall from the sky.”

Innovation, growth, integration and defense all are “the basis for a strong euro in the international sphere,” she said. “And of course, the international role of the euro would also be supported by a large and liquid European bond market.”

“We’ve made some important steps in that direction,” Schnabel said. “But more will be needed.”

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. Retail sales and industrial production data are not published in January

Retail sales and industrial production data are not published in JanuaryThe Bank of Canada’s survey of businesses shows firms are still worried the ongoing trade war will limit their sales, though their expectations for inflation eased.

The central bank’s business outlook indicator rose slightly to minus 2.3 in the third quarter, up from minus 2.4 previously. The bank said despite the “gradual improvement,” firms’ outlook and intention “remain subdued.”

“Expectations for growth in domestic export sales remain soft due to concerns about the broad economic effects of trade tensions,” the bank said in the report released Monday.

Firms no longer expect sales growth to strengthen. Policymakers said they spoke with exporters of steel and aluminum, who have been hit with major US tariffs, and reported “especially weak outlooks.” Those firms also said the levies are “leading to significant layoffs.”

Businesses’ inflation worries moderated, and the bank said it sees their one-year-ahead inflation expectations below the peak reached earlier in the trade conflict.

At the same time, firms expect cost increases amid the trade uncertainty and tariffs, though they reiterated that weaker demand is limiting their ability to pass those higher costs on to consumers.

The combined evidence of tariff damage, uncertainty and easing inflation expectations all point to an economy increasingly in excess supply, and suggest officials may be more comfortable cutting borrowing costs. The Bank of Canada’s benchmark overnight rate is currently 2.5%, and policymakers next set rates on Oct. 29.

Markets increasingly expect a quarter percentage point cut at that meeting, after the central bank faded worries about some elevated measures of core inflation and Governor Tiff Macklem reiterated that he viewed both the labor market and growth as “soft.”

Businesses also reported fewer capacity constraints, and binding labor shortages fell to the lowest level since 2020, the bank said. Firms’ investment intentions remain weak, and most businesses say their outlays are intended to replace or repair machinery and equipment.

Uncertainty was the most cited response when firms were asked about their most pressing concerns, followed by cost pressures, slowing demand and taxes and regulations.

The Bank of Canada also released its survey of consumers, which showed perceptions about financial well-being improved modestly in the third quarter. Spending plans also improved, driven by wealthier consumers such as homeowners and older people, the survey found. For less wealthy consumers, including young people and those whose highest level of education is high school, spending intentions declined.

Consumers also saw a deterioration in the labor market during the third quarter, coinciding with a steady increase in the unemployment rate. The decline in job-finding prospects was particularly sharp for public-sector workers, as the federal government undergoes a spending review.

Meanwhile, most consumers expect the worst impacts of the trade war on the economy are yet to come. The survey finds about two-thirds of consumers expect Canada will enter a recession over the next 12 months, roughly the same as the previous quarter, but significantly higher than compared to before the trade conflict with the US began.

Consumers also think the ongoing trade dispute will fuel inflationary pressures. The survey shows consumers’ inflation expectations in the short run remained above pre-pandemic averages, while longer-term inflation expectations also rose.

Consumers’ inflation expectations for vehicles, which faces US tariffs, rose significantly in the third quarter, remaining comparable to levels seen after the Covid-19 pandemic when supply chain problems drove up prices.

The survey shows consumers continue to prioritize Canadian-made goods and domestic vacations over American ones. Nearly 60% of respondents said they were spending more on goods made in Canada, while 62% said they’re spending less on US goods. About a third of respondents said they’re spending more on Canadian vacations and 53% said they’re spending less on vacations in the US.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up