Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US-China trade truce extension removed a 145% tariff threat but left tensions unresolved.

Key Points:

The US-China trade truce may have bought 90 days of calm, but beneath the surface, tensions are hardening. With tariffs, supply chains, and rare earths in play, the path to a balanced trade deal looks more fragile than ever.The US and China agreed to extend the trade war truce by a further 90 days in August. The agreement removed the threat of a 145% levy on Chinese shipments until October. However, since the extension, the two sides have made little to no progress toward a trade deal.

Despite the truce extension, tensions have escalated since two days of negotiations resulted in a pledge to uphold the Geneva Trade Agreement. Crucially, China committed to lifting restrictions on rare earth minerals, while the US would remove controls on semiconductor chip shipments.Since the Geneva agreement, the London talks, and the second 90-day truce extension, several events have dampened hopes for a balanced US-China trade deal.

In recent months, the US administration expanded its tariff policies to target transshipments. Notably, Vietnam agreed to a 40% US levy on transshipments bound for the US, while Indonesian shipments face a 19% tariff.Vietnamese exports to the US declined by 2% month-on-month in August, reflecting the effects of a 20% direct tariff and 40% transshipment levy on trade terms. Coincidentally, Vietnamese imports from China also declined 2%.Rumors suggest the US may introduce a rules-of-origin trade policy, which could further impact China’s trade terms.

The administration may also be using bilateral trade talks to weaken global demand for Chinese goods. This week, reports emerged that Trump pressured Europe to hit China and India with 100% tariffs to dissuade Russian oil purchases and increase pressure on Moscow to reach a peace deal with Ukraine. According to news outlets, the US administration will mirror the EU’s tariff.Notably, Trump’s request followed China-Russia-backed Shanghai Cooperation Organization (SCO). President Vladimir Putin and Indian Prime Minister Narendra Modi attended the summit.While targeting China through the EU, the US has also resumed trade talks with India. President Trump announced progress toward a deal, stating:

“I am pleased to announce that India, and the United States of America, are continuing negotiations to address the Trade Barriers between our two Nations. […[ I feel certain that there will be no difficulty in coming to a successful conclusion for both of our Great Countries!”Trump could pressure India to stop purchasing Russian oil and to step back from China. Could the US President be looking to tilt the balance in his favor ahead of renewed trade talks with China?

US tariffs have started to affect the Chinese economy. Exports to the US fell 33% year-on-year in August, slowing total export growth to 4.4% compared with 7.2% in July. Unemployment has risen from 5% to 5.2%, with youth unemployment soaring to 17.8% in August, up from 14.5% in July. The sharper increase in youth unemployment highlighted structural labor market challenges. Rising unemployment also weighed on retail sales, raising doubts about Beijing’s 5% GDP growth target.Beijing responded to the slowing economic momentum, pledging fresh stimulus measures. On Wednesday, September 10, China’s National People’s Congress Standing Committee held a plenary meeting, vowing to utilize fiscal policy to support stable employment and trade.

Robin Brooks, Senior Fellow at the Brookings Institution, commented on China’s trade data and economic outlook, stating:“China is in a tough spot. Its exports to the US are down 24% q/q in Jun ’25. Exporters have only 2 options: (i) transship to the US; (ii) export goods to other countries at a discount to generate demand. Either way, a big hit to profitability and a deflationary shock for China.”

Mainland China equity markets have avoided a sharp reversal of year-to-date (YTD) gains despite cracks forming in the economy and margin squeezes.The CSI 300 and the Shanghai Composite Index have risen 12.97% and 13.74% YTD, tracking the Nasdaq Composite Index (13.34%). However, the Hang Seng Index leads the way, rallying 30.61% YTD, benefiting from Mainland China and overseas investor inflows.Beijing’s pledges to support the economy have bolstered demand for Mainland and Hong Kong-listed stocks. However, trade developments, China’s housing crisis, and domestic demand will be key market forces in the near term.

Weakening external demand could impact the labor market. Rising unemployment may weigh on consumer sentiment and spending, undermining Beijing’s efforts to boost consumption.However, addressing the housing sector crisis and reaching a trade deal with the US could change the narrative. Crucially, a trade deal would likely boost external demand, easing margin pressures. Rising margins could spur job creation and lift domestic consumption.

China CSI 300 – Nasdaq Composite Index – Daily Chart – 110925

China CSI 300 – Nasdaq Composite Index – Daily Chart – 110925For investors, China’s bid to boost domestic consumption and soften trade shocks will influence sentiment. Beijing’s stimulus efforts and trade developments will determine whether the markets can maintain their bullish momentum.However, traders should continue assessing Chinese economic data for clues on the effectiveness of Beijing’s policy measures. Retail sales and industrial production on September 15 will reveal whether July’s softer data was isolated or part of a deteriorating trend.

Softer retail sales and industrial production, alongside deflationary pressures, could bring Beijing’s 5% GDP growth target into question. Conversely, a rebound in retail sales and industrial production could send Mainland China’s equity markets to fresh 2025 highs.

Leading economist Hao Hong recently remarked on Mainland China’s market trends and consumer confidence, stating:“There’s no quick fix to boosting household confidence except for a stock market rebound.”

Key Points:

SOL Strategies began trading on the Nasdaq on September 9, 2025, with $94 million in Solana holdings under the ticker symbol 'STKE.'This uplisting enhances Solana's institutional credibility and market access, significantly impacting the cryptocurrency's U.S. exposure and liquidity.Sol Strategies has commenced trading on the Nasdaq Global Select Market, under ticker symbol 'STKE', marking a significant milestone with $94 million in Solana holdings. This uplisting from the Canadian Securities Exchange occurred on September 9, 2025.

Leah Wald, the CEO, leads SOL Strategies alongside Kyle Samani, chairing the $1 billion Solana treasury. Samani, co-founder of Multicoin Capital, is pivotal for the institutional endorsement of the Solana ecosystem.The launch brings increased liquidity and regulatory oversight for Solana-focused investments, providing greater access for U.S. investors. The support from notable crypto venture funds enhances the institutional confidence in Solana's potential.Given the backing from Multicoin Capital, Galaxy Digital, and Jump Crypto, Sol Strategies is poised to strengthen the Solana ecosystem's foundation. "The uplisting to Nasdaq marks a significant milestone for our company and underscores our commitment to enhancing the Solana ecosystem." - Leah Wald, CEO, Sol Strategies

This event holds potential implications for financial markets and regulatory landscapes, serving as a landmark for Solana-focused trading on major exchanges. The commitment indicates future opportunities for expanding Solana’s influence and infrastructure.Historical precedents, such as the listing of Coinbase on Nasdaq, suggest possible surges in market interest and funding. The focus remains on regulatory adaptations and the broader acceptance of blockchain-based financial instruments.

US stock indices had a mixed trading day yesterday after key PPI data came in well under expectations, pushing the market to lock in more Fed rate cuts in the coming months. The Dow dropped 0.48% to 45,490, while the S&P and Nasdaq again notched up fresh record closes as AI stocks powered higher (Oracle up 36%), finishing at 6,532 and 21,886 respectively. Treasury yields pulled back after the data, the 2-year down 1.2 basis points to 3.544% and the 10-year down 3.9 basis points to 4.045%. However, the dollar remained relatively steady, with the DXY up 0.02% to 97.81. Oil prices jumped higher as geopolitical tensions increased in both the Middle East and Eastern Europe, Brent up 1.66% to $67.49 and WTI up 1.64% to $63.66 a barrel. Gold also gained ground on haven flows, although it stopped just short of another record close, up 0.39% to $3,640.38 an ounce.

Yesterday’s PPI data all but locked in 75 basis points worth of Fed rate cuts by the year-end for many in the market. However, tonight’s CPI data could have a lot more to say about those odds by the end of today’s trading. The market is now 92% pricing in a 25-basis-point Fed rate cut next week, with the odds for 75 basis points by December now sitting at 64%. Tonight’s month-on-month CPI and Core CPI numbers are expected to come in at +0.3%, with the year-on-year number at +2.9%. Anything significantly off these prints will see big moves in Fed rate cut expectations—although probably not for next week—and substantial moves in the market. A lower print will see odds for the three rate cuts increase hugely and put pressure on yields and the dollar, whereas anything “sticky” could see some unwinding of those bets and consequent moves in the opposite direction.

It is a busy calendar day ahead for traders today, with big central bank updates coming alongside key data releases, with the cross-over time between London and New York having the potential to really hit markets. Asian markets will see the initial focus on the land of the long white cloud, with Reserve Bank of New Zealand Governor Christian Hawkesby due to speak in Auckland. The big updates for the day will come later, with the European Central Bank due to update the market on its latest interest rate call just 15 minutes ahead of the key US CPI (exp. +0.3% m/m, +2.9% y/y) and Core CPI (exp. +0.3% m/m) data releases. The US Weekly Unemployment Claims numbers are due out at the same time as the CPI data, but expect the inflation numbers to dominate. Just to add a bit more spice to the mix, the ECB press conference is scheduled just 15 minutes after the US data, with traders expecting the EURUSD to be particularly lively in that “Hour of Power.”

This week, some data dampened the economic outlook for both the US and Canada. The past four months didn’t show much in that aspect, and participants started to believe that tariffs wouldn’t influence activity that much.However, it seems that the markets were too optimistic for North America. August gave a first warning sign, with the US Non-Farm Payrolls showing the first crack in the labor market, which was confirmed by last Friday’s report.

Canada is also struggling with a regressing GDP in the second quarter, undoubtedly due to downbeat employment figures (-60K in August) and pressure from tariffs on key exports such as metals (aluminum, steel) and lumber.The degrading economic outlook and slowdown in hiring are essentially bringing back hopes for cuts with a 90% priced-in Bank of Canada reduction (from 2.75% to 2.50%) at the upcoming meeting on the same day as the FOMC, September 17th.For the Federal Reserve, a much-anticipated cut should also finally take place (Rates are currently at 4.50%), and the question from which we will get an answer tomorrow is:

Any release below the expected 0.30% raise should flush the US Dollar, and markets would heavily lean towards a 50 bps (currently at 10% pricing).On the other hand, a beat should leave the 25 bps in check but reduce odds for cuts at subsequent meetings (2 meetings after this one: October and December).Let’s dive right into a few charts to get an overview on North American Markets, from US and Canadian equity Markets performance, USD and CAD performance to USDCAD and DXY charts.

North-American Indices Performance

Same as in previous weeks, the TSX just seems to absolutely disregard the downbeat economic data.Never forget that equities are forward looking and cut expectations in an economy that is still far from in shambles and expected to grow in the decades to come attract buying.US Markets are still holding resiliently against the streak of downbeat employment data also lifted by hopes for increased rate cuts.All indices have marked new record highs in today’s session actually but have since seen some profit-taking flows ahead of tomorrow’s inflation report.

Dollar Index 8H Chart

The US Dollar is holding its range as neither the NFP or this morning’s PPI have changed the outlook for future rate cuts.This puts that much emphasis on tomorrow’s CPI report which should be one of the most important one in years. Get ready!With the range still holding, I invite you to check out our most recent Dollar Index analysis to spot your levels of interest for the USD.

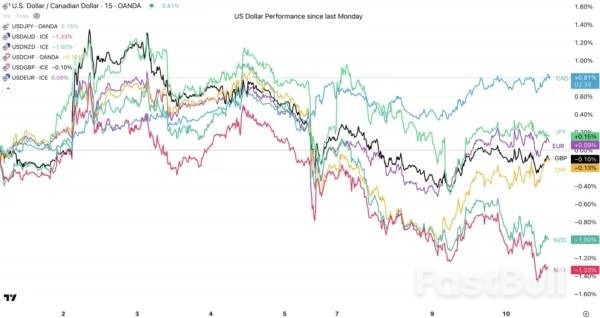

US Dollar Mid-Week Performance vs Majors

The action in the US Dollar has stayed stubbornly rangebound.

The latest downward revisions to the US Labor data since March 2025 (you can check out the report right here) had initially hurt the USD, but as can be seen in the latest rebound, buyers have held its bid at new range extremes.War headlines around the world still maintain somewhat of a US Dollar demand which slightly reduced after this morning’s welcomed PPI report (are tariff-related price hikes really just a one-off??)Expect high swings for the USD tomorrow as markets will look to confirm the outcome of next week’s FOMC.

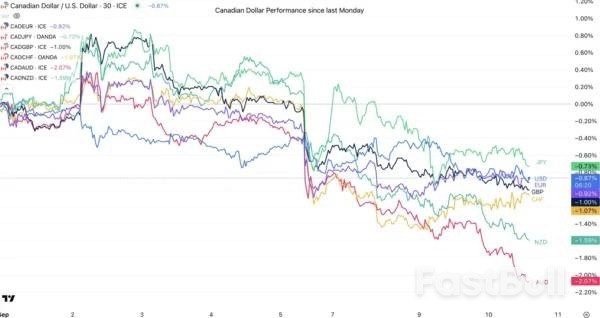

Canadian Dollar Mid-Week Performance vs Majors

The Loonie couldn’t hold its past week’s strength with the aggressively low employment figures released last Friday. This week has been atrocious for the Maple Dollar.With more cuts expected ahead, it will be very interesting to see what the Bank of Canada will have to say at next week’s meeting. The BoC would also love a higher rate cut from the USD to help with the CAD’s current downfall.

Intraday Technical Levels for the USD/CAD

USDCAD has freshly marked some highs at similar levels as the August 26th top, but seems to be consolidating at the current daily peak.It will be very interesting to spot the reactions for the US Dollar and if an eventually stronger USD would also assist the CAD on its perpetual descent.

Levels to place on your USDCAD charts:

Resistance Levels:

Support Levels:

US and Canada Economic Calendar for the Rest of the Week

With Markets not budging much from the consequent NFP and PPI reports, everything will depend on tomorrow’s US CPI release (8:30 A.M. ET).With 0.3% expected for both the Headline and Core, reactions will have to be monitored closely as Markets will jump around in all directions.To guide you with tomorrow’s volatility, track the Dollar Index, the FEDWatch Tool (for Interest rate expectations) and the 2-year yield.

Except for tomorrow’s US CPI, some other less-relevant data may still move markets with the Weekly jobless claims tomorrow, Canadian capacity utilization on Friday (8:30) and the following University-of-Michigan Consumer Sentiment at 10:00 A.M.

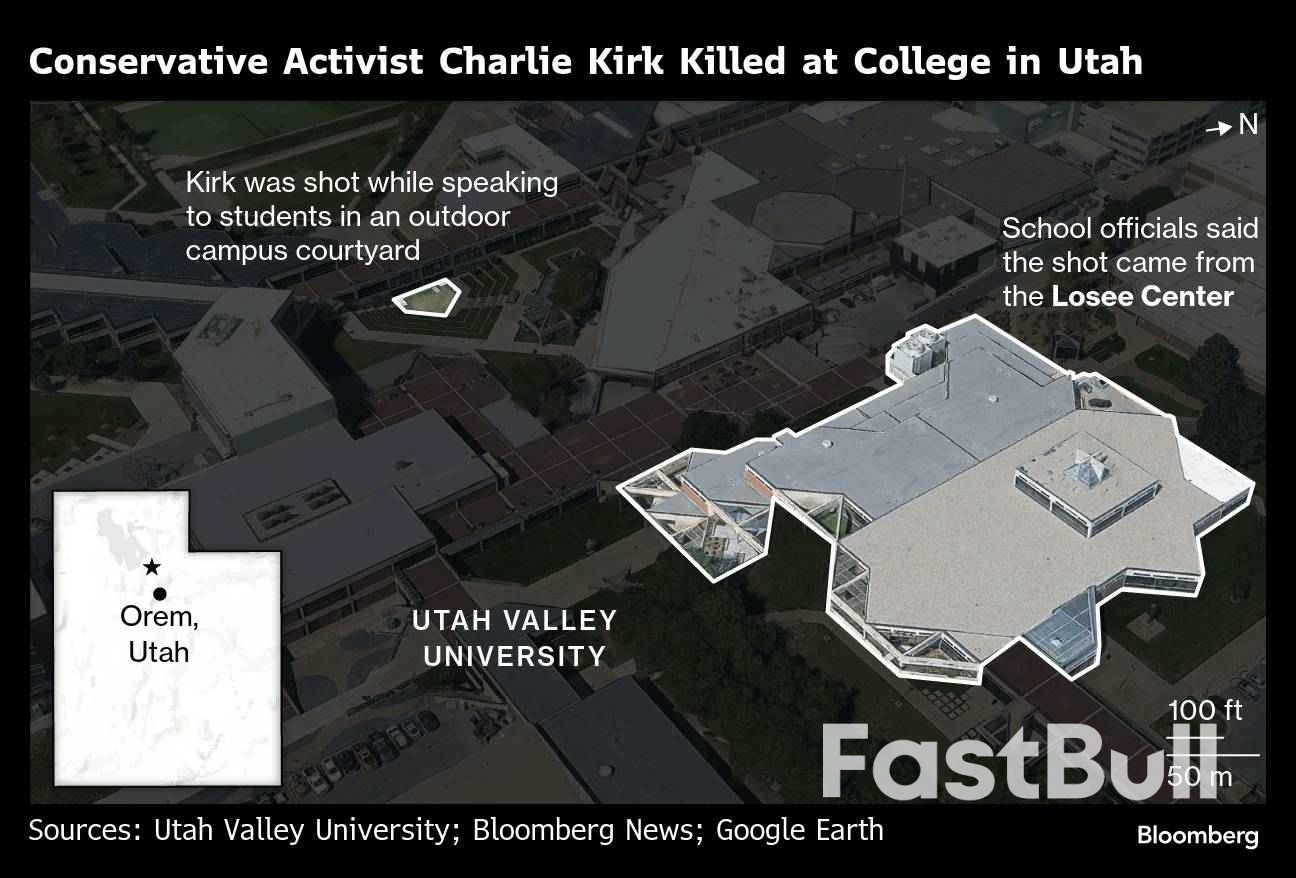

A search is underway for the killer of Charlie Kirk, a conservative activist and close ally of President Donald Trump who was fatally shot Wednesday at a Utah university.Kirk, executive director of the Turning Point USA advocacy group, was speaking at an outdoor event before a crowd at Utah Valley University when a single shot was fired from a nearby building, according to local police. Governor Spencer Cox described it as a “political assassination.”A person of interest was taken into custody and was later released, FBI director Kash Patel said in a social media post.

The shooting, the latest in a spate of political violence in the US, drew an outpouring of shock and condemnation from Republicans and Democrats alike. Kirk, 31, started Turning Point USA more than a decade ago and had turned it into one of the most influential groups helping to rally young voters to conservative causes. He leaves behind a wife and two young children.“Charlie was a patriot who devoted his life to the cause of open debate and the country that he loved so much,” Trump said in a video Wednesday evening in which he blamed rhetoric from the “radical left” for contributing to the violence.

“It’s long past time for all Americans, and the media, to confront the fact that violence and murder are the tragic consequence of demonizing those with whom you disagree day after day, year after year, in the most hateful and despicable way possible,” he said.Former Democratic presidents Joe Biden and Barack Obama denounced the violence and offered sympathies to his family. The Republican National Committee praised Kirk as a “dedicated patriot who spent his life defending conservative values and inspiring young Americans.”

Kirk was at UVU for his group’s American Comeback Tour, and was scheduled to set up a table called Prove Me Wrong, where the audience attempts to stump the pundit. There were more than 3,000 people in attendance, said Jeff Long, the university’s police chief, as well as six local police and Kirk’s personal security detail.

At approximately 12:20 pm Mountain time, about 20 minutes after Kirk began speaking, a single shot was fired from a building about 200 yards away. A supporter of gun rights, he had just began answering a question on the number of mass shooters in America over the last decade.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up