Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

For several years – especially since the United States banned ZTE and Huawei in 2018 and 2019, respectively – U.S. export controls on cutting-edge technologies have been framed as a measure to safeguard national security.

For several years – especially since the United States banned ZTE and Huawei in 2018 and 2019, respectively – U.S. export controls on cutting-edge technologies have been framed as a measure to safeguard national security. On the same grounds, the Biden administration banned the sale of certain U.S.-made chips to China in 2022 and 2023. To circumvent such restrictions, Nvidia developed the H20 chip, a downgraded form of its H-100 Graphic Processing Unit (GPU), and AMD developed the MI308, both to serve the Chinese markets.

Nvidia’s CEO Jensen Huang has often vocally opposed the restrictive export controls targeting China, claiming the policy is counterproductive for the United States’ economic and strategic interests. Through active lobbying during the current Trump administration, which is following a more inward-looking approach, Nvidia managed to get an official permit for H20 sales to China – albeit for a fee.In a highly unusual settlement, Nvidia and AMD will hand over 15 percent of their revenue from H20 and MI308 chip sales to China directly to the U.S. government. This arrangement is not a standard export tariff, nor a conventional tax. It is a direct revenue-sharing deal between the government and the two companies, targeted at a single foreign market, i.e., China.

According to estimates by Bernstein Research, by the end of 2025, Nvidia will have sold over 1.5 million H20 chips in China, generating about $23 billion in revenue, and AMD is projected to record $800 million in China chip sales. That means the deal could deliver more than $2 billion directly to the U.S. Treasury.Unlike in China, where the provision of “golden shares” (a shareholding arrangement enabling the Chinese government to buy a certain percentage of shares in private enterprises) highlights the intimate relationship between the Chinese state and its private corporations, such policy moves in the United States are extremely rare. However, the Trump administration in July followed a similar approach when it approved the takeover of U.S. Steel by Japan’s Nippon Steel.

While the Nippon Steel deal aimed at securing critical industries from falling under foreign control, it also indicated a growing trend of state capitalism in the United States. Now the revenue-sharing agreement with AMD and Nvidia exemplifies a larger pattern where companies are falling into quid-pro-quo arrangements to prevent the imposition of tariffs and preserve their own market position, while pledging to bring jobs, revenues, and market concentration to the United States. However, the deal also risks replacing principle-driven trade policy with ad hoc bargaining, leaving both allies and adversaries uncertain about U.S. red lines.For U.S. chipmakers, it’s better to earn some revenue from China than none. While the deal gives direct access to the lucrative China market, it also directly eats into Nvidia’s and AMD’s profits. This will create ripples in the broader market ecosystem, wherein corporate planning, profit margins, and investor confidence could all be affected.

Major U.S. companies with considerable market share in China will be watching closely. If the government is willing to impose a revenue-sharing requirement for chip sales, might it do the same for other strategic sectors? This could prompt firms to rethink their China strategies, diversify supply chains, or intensify lobbying to either pursue or avoid similar arrangements. The message to shareholders becomes clearer after this move: geopolitical risk is no longer an abstract factor; instead, it directly shapes revenue streams.

One possible explanation behind the decision is the “engage to constrain” strategy: selling downgraded chips keeps China reliant on U.S. technology, thereby maintaining a degree of influence over its AI development. The H20 and MI308 chips, being less powerful than flagship models, are intended to fall below the threshold of national security risk.This could prove to be a pitfall for two reasons. First, Washington has previously failed to accurately gauge Chinese firms’ ability to refurbish outdated hardware and optimize it for higher-grade applications. This means that even downgraded chips can accelerate China’s AI capabilities, including in areas with military applications.

Second, the free flow of H20 chips is unlikely to halt China’s renewed drive toward indigenous chip development. In fact, the renewed synergies between governments and private chipmakers in China are likely to take advantage of this policy relaxation to prepare themselves for any future restrictions. Thus the new policy, which resolves to protect domestic interests, will again fuel Beijing’s determination to achieve chip independence and undermine U.S. strategic objectives in the long term.

By reversing the ban and taking a revenue share, Washington risks sending a conflicting message: that security concerns can be waived in exchange for commercial concessions. The shift from safeguarding national security to commodifying strategic concerns poses several questions. If sensitive technology can be sold for a price, how credible will future restrictions appear to allies, adversaries, and U.S. companies alike?

More broadly, U.S. allies involved in semiconductor supply chains – Japan, South Korea, Taiwan, and the Netherlands – may see this as a signal to adopt similarly transactional policies, fragmenting the global trade environment. During the Biden administration, these allies were part of the broader export control regime. If this model is perceived as putting a price tag on national security, it could weaken the legitimacy of future export controls, embolden adversaries to test U.S. resolve, and encourage allies to question U.S. consistency.The United States now walks a fine line. Whether this is a masterstroke of transactional diplomacy or a short-sighted policy gamble will depend on whether Washington can secure broader strategic gains without undermining its own credibility.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesKey Points:

Vietnam will pilot a digital asset exchange in an international financial center, finalized by the Ministry of Finance, and awaiting government approval in August 2025.This move signals Vietnam's commitment to digital finance, potentially increasing regional liquidity and paving the way for modernized economic infrastructure.

Vietnam's move to pilot a digital asset exchange stems from legislative developments that include the National Assembly's resolution and the Ministry of Finance's comprehensive proposal. The planned pilot policy, awaiting August submission, will encompass trading, issuance, and management of digital assets, with a focus on blockchain and cybersecurity. The policy is designed to offer service providers the autonomy to select listed assets.The pilot exchange aims to boost liquidity and demand for leading digital assets, serving both Vietnamese and foreign markets. Vietnam's central bank's ongoing research into a national digital currency underlines the government's long-term strategy for a digital economy. Service providers will play a key role in asset selection, potentially elevating trading volumes.

Market observers note the announcement's potential to catalyze investment flows into Vietnam's digital asset market. Blockchain proponents herald this as an opportunity for expansion and innovation. The exchange pilot suggests broad support for blockchain technology, attracting notable attention within the regional and global financial community.

Did you know? Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region.

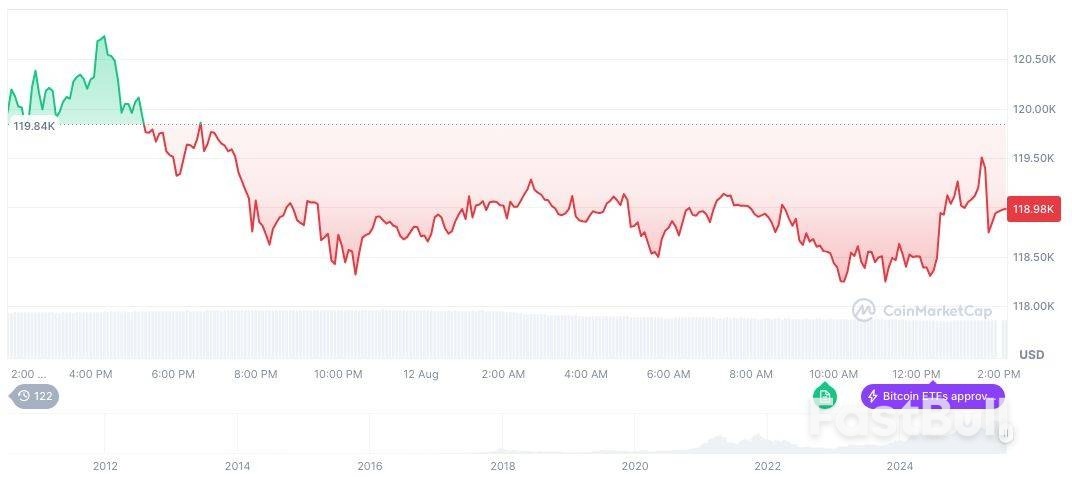

As of the latest data from CoinMarketCap, Bitcoin (BTC) holds a price of $119,220.74, with a market capitalization of $2.37 trillion and a dominance of 58.81%. However, its 24-hour trading volume decreased by 10.61% to $73.77 billion. Over 90 days, BTC's price increased by 15.74%.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.The Coincu research team highlights that Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region. "The pilot policy for digital asset trading finalized for government review by August," states the Vietnam Ministry of Finance. By integrating blockchain tech into the infrastructure, the exchange is positioned as a model of innovation in Southeast Asia's financial landscape. The pilot policy is anticipated to accelerate Vietnam's standing in an evolving financial climate.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up