Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Broadcom shares fell as investors questioned the timing and profitability of its AI push, disappointed by limited guidance, margin pressure warnings, and a vague outlook despite strong earnings and rising AI demand.

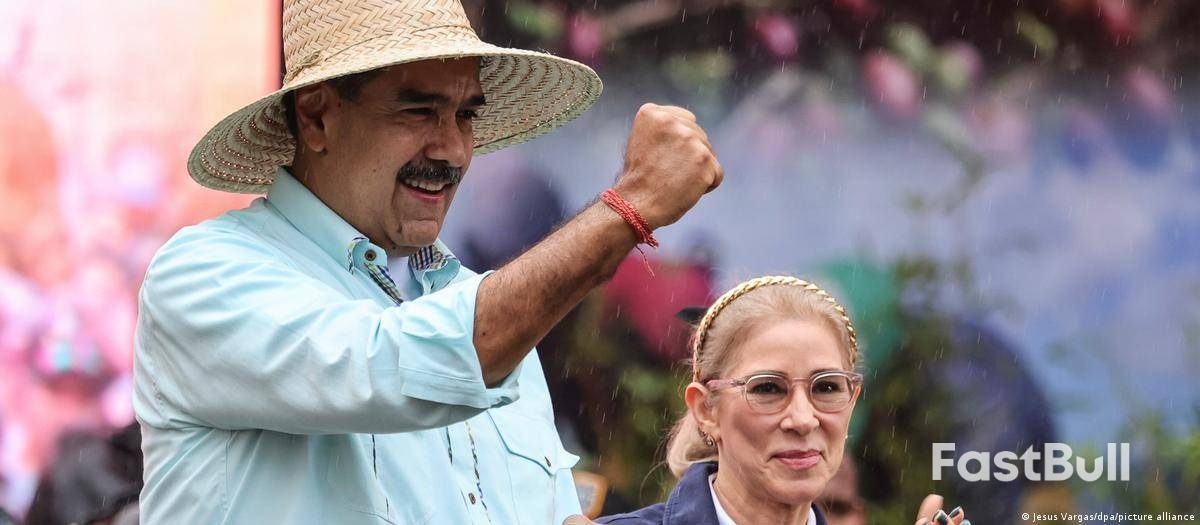

The US Treasury's Office of Foreign Assets Control published the list of sanctions on Thursday that included three nephews of Venezuela's president Nicolas Maduro and his wife Cilia Flores.

It is the latest move by the US in its ongoing political conflict with the Venezuelan regime and it comes a day after it seized an oil tanker off the country's coast.

Known in Venezuela as the 'narco-nephews' for their involvement in drug trafficking,Franqui Flores, Carlos Flores and Efrain Campo have all been denied access to any property or financial assets held in the US, and US companies and citizens can now be penalized for doing business with them.

Panamanian businessman Ramon Carretero, six firms and six Venezuela-flagged ships accused of transporting Venezuelan oil, were also included in the sanctions list.

The Treasury Department alleged that Carretero has had business dealings with Maduro's family and has also facilitated oil shipments on behalf of the Venezuelan government.

"Nicolas Maduro and his criminal associates in Venezuela are flooding the United States with drugs that are poisoning the American people," Treasury Secretary Scott Bessent said in a statement.

"Under President Trump's leadership, Treasury is holding the regime and its circle of cronies and companies accountable for its continued crimes," he added.

Flores and Campo had been jailed for years in the US on narcotics convictions. Flores had already been sanctioned in July 2017, but he was removed from Treasury's list in 2022 during the Biden administration, during an effort to promote negotiations for democratic elections in Venezuela.

Meanwhile, sources familiar with the matter said the US was preparing to seize more oil tankers from Venezuela.

Wednesday's tanker seizure was the first of its kind of an oil cargo or tanker from Venezuela, and it comes as the Trump administration has led a large military buildup in the Caribbean.

White House spokeswoman Karoline Leavitt told reporters she did not comment on the reports of future actions on oil tankers, focusing instead on the sanctions package.

"We're not going to stand by and watch sanctioned vessels sail the seas with black market oil, the proceeds of which will fuel narcoterrorism of rogue and illegitimate regimes around the world," Leavitt said.

A reduction or halt in Venezuelan oil exports would certainly strain the Maduro government's finances.

The total value of building permits increased 14.9% from the month before to a seasonally adjusted 13.82 billion Canadian dollars, the equivalent of $10.03 billion, Statistics Canada said Friday.

That was much stronger than the 1.4% drop expected for the month by economists, according to TD Securities, and builds on the upwardly revised 5.9% rise in permits in September.

On a year-over-year basis, the overall value of permits issued last month was up 9.6%.

Building permits provide an early indication of construction activity in Canada and are based on a survey of 2,400 municipalities, representing 95% of the country's population. The issuance of a permit doesn't guarantee that construction is imminent.

Housing starts across Canada slumped 17% in October from a month prior on a seasonally adjusted annualized basis, rolling back a 14% increase in September, Canada Mortgage and Housing Corp. said last month. The six-month moving trend for starts was down 3.0% for the month.

Statistics Canada's data showed construction intentions in the residential sector climbed 14.6% from the previous month to C$8.56 billion, following a 6.6% rise in the value of permits the month before.

Intentions to build multifamily dwellings surged 21.3%, buoyed by the province of Ontario, and specifically the Toronto metropolitan area. Intentions for single-family homes rose a more modest 1.8%, with the gains being primarily attributed to Alberta.

Across Canada, a total of 24,300 multi-family dwellings and 4,100 single-family homes were authorized in October, marking a 13.6% increase from the previous month. Year-to-date, the average number of multi-family dwellings authorized stood at 21,500 a month, up from 19,100 during the same period last year.

Permits for nonresidential buildings were also strongly higher for the month, rising 15.4% to C$5.25 billion, the data agency said. That included a rise in permits for commercial and institutional buildings, more than making up for a dip in industrial plans.

Federal Reserve Bank of Cleveland President Beth Hammack said she would prefer interest rates to be slightly more restrictive to keep putting pressure on inflation, which is still running too high.

"Right now, we've got policy that's right around neutral," Hammack said Friday during an event in Cincinnati. "I would prefer to be on a slightly more restrictive stance to help continue to put pressure" on the inflation side of the central bank's mandate, she said.

Fed officials delivered a third consecutive rate reduction earlier this week, but a large group of regional bank presidents signaled they opposed the cut. Two officials, Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeff Schmid, officially dissented against the move, saying they preferred to leave rates unchanged. And six policymakers penciled in rate projections suggesting they also opposed a cut.

Hammack didn't vote on monetary policy decisions this year but will vote in 2026. Asked if she supported this week's rate reduction, she didn't directly answer the question but said it was a "complicated decision" since officials are facing pressure on both sides of their mandate.

The Cleveland Fed chief cautioned last month that lower interest rates could prolong the period of above-target inflation. She has previously said that she opposed the rate cut in October and saw little reason for a reduction in December.

Hammack said she is grateful policymakers will receive key data on prices and employment in the coming weeks that should help them understand the trends in the economy — after their publication was delayed by a federal government shutdown. She also said the Fed doesn't have the appropriate tools to address structural changes in the economy.

Inflation has been running above the Fed's 2% target for several years, and has recently been stuck closer to 3%, Hammack said.

Russian state oil and gas revenue in December is likely to almost halve from a year earlier to 410 billion roubles ($5.17 billion) as a result of lower crude prices and a stronger rouble, Reuters calculations showed on Friday.

Oil and gas revenue is the leading source of cash for the Kremlin, making up a quarter of federal budget proceeds that have been drained by heavy defence and security spending since Russia began its military campaign in Ukraine in February 2022.

For the entire year, the revenue is set to fall by almost a quarter to 8.44 trillion roubles, below the Finance Ministry's 8.65 trillion rouble forecast, according to calculations based on data from industry sources and official statistics on production, refining and supplies.

Russia reported its lowest monthly oil and gas revenue of 405 billion roubles in August 2020, when oil prices tumbled during the COVID-19 pandemic.

Sergei Konygin, a senior analyst at Moscow-based investment bank Sinara, said that the budget deficit of 1.6 trillion roubles expected in December will be covered by state bonds, but 2026 will be more difficult.

"Next year is a big challenge to the budget as it was formed under an optimistic scenario of oil at $59 (per barrel) and the rouble at 92 (per dollar)," he said.

The Russian oil price used for taxation purposes decreased in November by 16.4% from October to $44.87 a barrel while the rouble strengthened to 80.35 per dollar.

Konygin expects amendments to the budget next spring to make use of the National Wealth Fund to address the deficit under a lower assumed price of oil.

Ukraine and its Western backers have repeatedly said they want to curb Russian oil revenue to force the world's second-largest oil exporter to end the war in Ukraine.

The Finance Ministry had initially expected 10.94 trillion roubles in oil and gas revenue this year but made a downward revision in October to account for global oil prices that have been driven lower by concern over a supply glut.

The Finance Ministry will publish its oil and gas revenue estimates for December on January 14.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up