Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)A:--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)A:--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)A:--

F: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)A:--

F: --

U.S. Industrial Output YoY (Nov)

U.S. Industrial Output YoY (Nov)A:--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Dec)

U.S. Richmond Fed Manufacturing Shipments Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Dec)

U.S. Richmond Fed Services Revenue Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Dec)

U.S. Conference Board Consumer Expectations Index (Dec)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Dec)

U.S. Conference Board Present Situation Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Dec)

U.S. Richmond Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)A:--

F: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

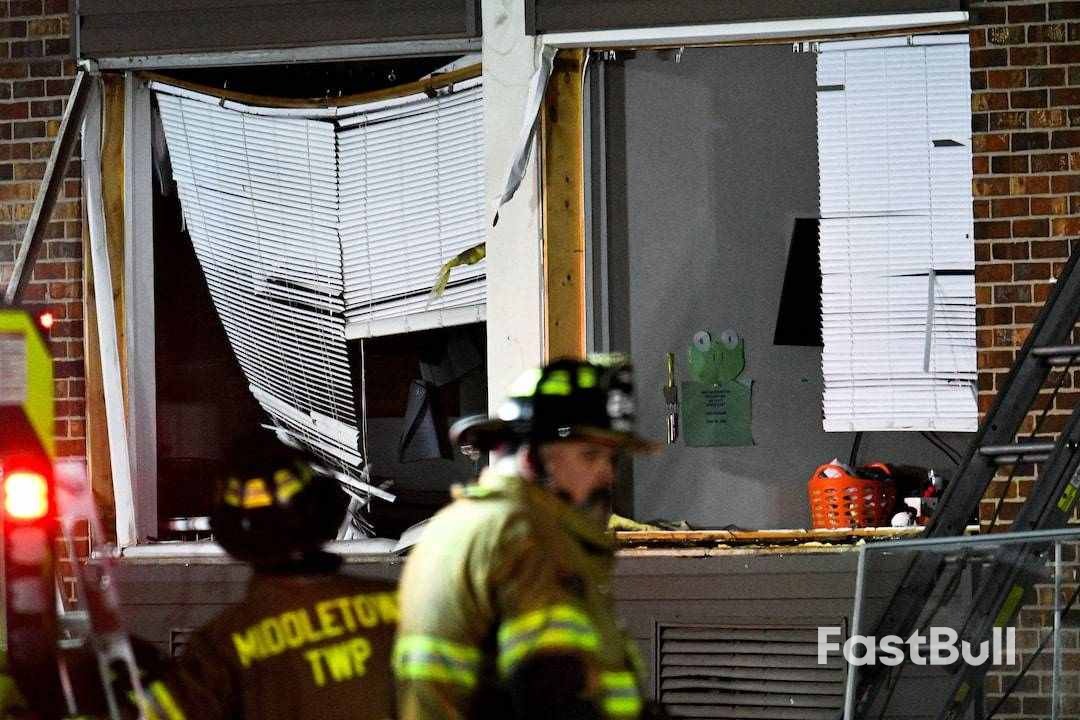

A pair of explosions and a fire, apparently sparked by leaking gas, ripped through a nursing home near Philadelphia on Tuesday, killing at least two people and prompting an intense search for victims in a collapsed portion of the building, officials said.

A pair of explosions and a fire, apparently sparked by leaking gas, ripped through a nursing home near Philadelphia on Tuesday, killing at least two people and prompting an intense search for victims in a collapsed portion of the building, officials said.

Five people were believed to be missing hours after the blasts and flames ravaged the Silver Lake Nursing Home in Bristol Township, about 21 miles (33 km) northeast of Philadelphia, Bristol Township Fire Marshal Kevin Dippolito said.

Besides the two people killed, an unspecified number of survivors were injured, Dippolito said, adding that numerous patients and staff initially trapped inside a demolished portion of the building were rescued.

The Bucks County emergency dispatch center received first reports of an explosion shortly after 2:00 p.m. EST (1900 GMT).

Dippolito said the first firefighters arriving on the scene, some from a fire-and-rescue station across the street, encountered "a major structural collapse," with part of the building's first floor crumbling into the basement below.

He said numerous victims were extricated from debris, blocked stairwells and stuck elevators, while firefighters ventured into the collapsed basement zone and pulled at least two more people to safety before retreating amid lingering gas fumes.

"We got everyone out that we could, that we could find, that we could see, and we exited the building," Dippolito said. "Within approximately 15 to 30 seconds of us exiting the building, knowing there was a heavy odor of natural gas around us, there was another explosion and fire."

The front of the structure appeared to have been blasted away from the inside, but the majority of the facility remained standing, though most of its windows were shattered, according to a Reuters photographer on the scene.

News footage from WPVI-TV, an ABC News affiliate, showed roaring flames and smoke billowing from the crippled building shortly after the first explosion.

The precise number of patients and staff inside at the time was not immediately known. The nursing home is certified for up to 174 beds, according to an official Medicare provider site.

More than 50 patients, ranging in age from 50 to 95, are typically in the building at any one time, WCAU-TV reported, citing a nurse employed by the facility who arrived on the scene after the blast. About five hours later, nursing home officials had informed authorities that all patients had been accounted for, Dippolito said.

In the early moments following the initial explosion, bystanders rushed to assist police and firefighters in escorting people to safety, Bristol Township Police Lieutenant Sean Cosgrove told local media earlier.

"This is the Pennsylvania way, neighbors helping neighbors in a moment of need," Governor Josh Shapiro said at the news briefing with fire and police officials.

Five hours after the incident, Dippolito said fire and rescue personnel were still treating the search effort as a rescue operation as heavy equipment was brought in to help clear away larger pieces of rubble.

Gold steadied near a record, with escalating geopolitical tensions and expectations for more US rate cuts reinforcing the latest rally.

Bullion was trading a little below $4,500 an ounce, after three days of gains brought it within 15 cents of that milestone on Tuesday. Frictions in Venezuela, where the US has blockaded oil tankers, have added to the metal's haven appeal as it heads for its best annual performance since 1979.

Traders are also betting the US Federal Reserve will follow three straight interest-rate cuts by lowering the cost of borrowing again next year, which would be a tailwind for non-yielding precious metals.

Spot gold edged up 0.2% to $4,494.73 an ounce as of 7:20 a.m. in Singapore. Silver advanced as much as 0.5% to an all-time high of $71.7741. Platinum added 0.5% to trade above $2,300 an ounce for the first time, according to data compiled by Bloomberg going back to 1987. Palladium also rose. The Bloomberg Dollar Spot Index ended the previous session down 0.3%.

The US State Department on Tuesday said it would deny visas to former EU Commissioner Thierry Breton and four others in protest of European regulation of social media.

The measure comes amid increasing tensions between the US and the Europe, with President Donald Trump's adminstration accusing Brussels of cracking down on freedoms.

Besides Breton, the US visa ban targets:

US Secretary of State Marco Rubio said the five people targeted with visa bans "have led organized efforts to coerce American platforms to censor, demonetize and suppress American viewpoints they oppose."

He did not initially name those facing the visa ban, but Under Secretary for Public Diplomacy Sarah Rogers later identified them in a post on social media.

Rogers described Breton as the "mastermind" of the EU's Digital Services Act (DSA), which imposes content moderation and other standards on major social media platforms operating in Europe.

The State Department said HateAid functions as a trusted flagger for enforcing the DSA.

Breton decried the ban as a "witch hunt."

"To our American friends: Censorship isn't where you think it is," he wrote in a post on X.

The GDI called the US action "immoral, unlawful, and un-American" and "an authoritarian attack on free speech and an egregious act of government

Global pharma giants Eli Lilly (LLY.N)and Novo Nordisk (NOVOb.CO)are scrambling to cement their lead in India's booming obesity drug market before cheaper generic versions hit shelves in March next year.

Novo's strategy emphasizes price cuts and accelerated launches, while Lilly's products benefitted from hitting the market early. Both companies focused on aggressive outreach to doctors, heavier advertising about obesity, tie-ups with clinics, patient incentives and distribution deals with local drugmakers, according to doctors, analysts, medical representatives, patients and distributors who spoke to Reuters.

Lilly has even teamed up in India with well-known Bollywood actors in a social media ad campaign about obesity.

India, projected to have the world's second-largest overweight or obese population by 2050 in absolute numbers, is becoming a key battleground for obesity drugs. Analysts expect the global market for such drugs to hit $150 billion a year by the end of this decade.

Although the U.S. remains the largest market for obesity drugs, early sales figures in India show rapid uptake, even though most patients in the world's most populous nation pay for the medication out-of-pocket.

"We believe that this market can be more than $1 billion within two years," said Shrikant Akolkar, vice president at research firm Nuvama Institutional Equities.

Data analytics firm Pharmarack said in July that the market was estimated to be worth 6.28 billion rupees ($70.23 million) at present, growing fivefold since 2021.

U.S. drugmaker Lilly's Mounjaro, approved for diabetes and weight loss in India, became the top-selling therapy by value in October, with sales doubling within months of its March launch, outpacing Danish drugmaker Novo's Wegovy, which entered the Indian market in June.

"We realized just after a couple of months that for accessibility, we had to take a price cut," said Vikrant Shrotriya, Novo Nordisk's managing director in India, referring to Wegovy's price cut in November. Shrotriya spoke earlier this month while launching Novo Nordisk's blockbuster diabetes drug, Ozempic, in the country.

Ozempic, a once-weekly injection approved by the U.S. drug regulator in 2017 for Type 2 diabetes, became a global bestseller and is widely used off-label for weight loss due to its appetite-suppressing effects.

More than 20 Indian drugmakers, including Dr Reddy's (REDY.NS), Cipla (CIPL.NS, Sun Pharma (SUN.NS), Zydus (ZYDU.NS)and Lupin (LUPN.NS),plan to launch cheaper versions of Novo's weight-loss drug in India once its patent on semaglutide, the active ingredient in Wegovy and Ozempic, expires in March 2026.

Analysts expect generic drugs to cost about 60% less, intensifying the fight - particularly for Novo - for dominance in India's price-sensitive market.

Shrotriya played down concerns over looming patent expiries, telling Reuters that Novo will focus on quality, trust and affordability rather than on patents or competition in India.

Lilly's Mounjaro has quickly gained traction in India. A 2.5 mg Mounjaro KwikPen costs about 13,125 rupees ($146.79) for a month's usage, with the highest 15 mg dose going up to 25,781 rupees ($288.33).

In response, Novo cut the price of Wegovy in India by up to 37% in November, pricing its lowest dose of 0.25 mg at 10,850 rupees ($121.34) for a one-month pack. It launched Ozempic last week for a monthly price of 8,800 rupees ($98.42) for 0.25 mg.

While Wegovy is catching up, Mounjaro's early launch helped it penetrate the market, and the latter drug's claim of offering greater weight loss makes it a popular choice among patients, said five doctors who spoke with Reuters.

"Mounjaro clearly has first-strike advantage and continues to have strong demand, but price-sensitive patients are reassessing alternatives," said Dr. Anoop Misra, an endocrinologist and executive chairman of Fortis C-DOC Hospital.

Mounjaro also differentiates itself by targeting people with severe obesity, said Vishal Manchanda, analyst at Systematix Institutional Equities. He added that Lilly faces no immediate pressure to cut prices, given its strong position.

Even if Lilly lowers prices later, Mounjaro would still cost about 30% more than other branded weight-loss drugs, he said.

Lilly declined to comment on its Indian pricing strategy. It said, however, that early response to Mounjaro in India has been "highly encouraging."

Ozempic, Wegovy and Mounjaro belong to a class of drugs called GLP-1 agonists, which mimic a hormone that slows digestion and helps people feel full longer.

Novo has sued Dr Reddy's and Sun Pharma in a local court to enforce semaglutide patents and attempted to block generics until March 2026.

Longer patent protection for Mounjaro's active ingredient, tirzepatide, which extends at least until the middle of the next decade, also gives Lilly an advantage, analysts said.

The battle has expanded beyond pricing and patents.

Demand for weight-loss treatments in India is spreading beyond urban elites as interest grows among middle-class families, office workers, women nearing menopause and people with obesity-related complications in smaller towns.

Lilly has partnered with India's third-largest drugmaker by revenue, Cipla (CIPL.NS), to launch a second tirzepatide brand, Yurpeak, targeting smaller towns, and teamed up with Apollo Hospitals (APLH.NS) to raise awareness of obesity and diabetes. It is also investing more than $1 billion to expand contract manufacturing in India.

Cipla said it would help market Lilly's weight-loss medication in deeper markets in India.

Meanwhile, Novo has tied up with Emcure Pharmaceuticals (EMCU.NS),and launched a second semaglutide brand, Poviztra, to widen distribution beyond India's major cities. It has teamed with startup Healthify to offer patients health coaching and with Apollo to raise awareness of obesity.

In India, where prescription drug ads are prohibited, Novo launched a "WeGoWithYou" obesity awareness campaign that connects people to doctors to learn more about the disease and its management. Lilly has a similar initiative known as "WeKnowNow" that talks about obesity management.

Both drugmakers are pushing to frame obesity as a disease, utilizing newspaper ads, billboards, airport displays and pamphlets at wellness clinics.

Neither company disclosed its spending on marketing in India.

($1 = 89.4160 Indian rupees)

Bank of Japan policymakers debated the need to continue raising interest rates to levels deemed neutral to the economy with some arguing doing so will help achieve long-term, stable growth, the minutes of their October meeting showed on Wednesday.

A few in the nine-member board also said recent yen declines could lead to an overshoot in inflation by pushing up import costs, the minutes showed.

At the October 29-30 meeting, the BOJ kept interest rates steady at 0.5% but Governor Kazuo Ueda sent a strong signal on the chance of a near-term rate hike. At the subsequent meeting in December, the central bank raised rates to 0.75%.

Platinum soared to an all-time high, trading above $2,300 an ounce for the first time on tight supplies and historically elevated borrowing costs.

The metal rose for a 10th straight session — its longest winning streak since 2017 — and has advanced more than 150% this year, the biggest annual gain since Bloomberg began compiling data in 1987. The recent surge has come as the London market shows signs of tightening, with banks parking metal in the US to insure against the risk of tariffs.

Used in the automotive and jewelry sectors, platinum has been caught up in the wave of investment that poured into precious metals this year. Gold and silver have also risen to records.

More than 600,000 ounces of platinum are sitting in US warehouses — an amount much higher than usual — as traders await the outcome of Washington's Section 232 probe, which could lead to tariffs or trade restrictions on the metal.

Meanwhile, shipments to China have been robust this year, and demand optimism has been bolstered as contracts recently began trading on the Guangzhou Futures Exchange. Prices in Guangzhou have risen well above other international benchmarks.

Platinum is on course for a third annual deficit this year, due to supply disruptions in major producer South Africa. High borrowing costs have also been an issue for manufacturers that use the metal to produce goods ranging from chemicals to glass to laboratory equipment. Industrial users often choose the less capital-intensive option of leasing, rather than buying the commodity outright.

Platinum rose as much as 3.1% to a record $2,361.23 as of 8:19 a.m. in Singapore. Sister metal palladium gained as much as 2.5%.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up