Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

ALL MY TOPA LOVE YOU TOO

ALL MY TOPA LOVE YOU TOO

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

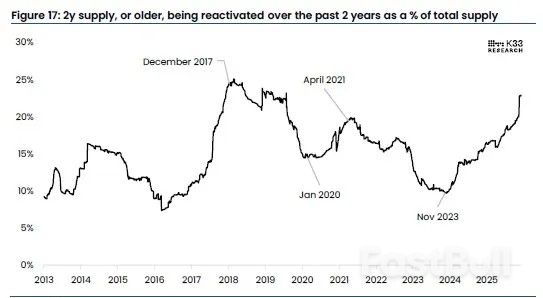

The pressure has been most acute since Oct. 10, when $19 billion in liquidations were registered following unexpected comments on punitive tariffs by US President Donald Trump.

LONDON/NEW YORK, Dec 17 (Reuters) - Oil prices rallied more than 1% on Wednesday after U.S. President Donald Trump ordered what he called a complete blockade of all sanctioned oil tankers entering and leaving Venezuela, raising global political tensions and easing concerns about a growing surplus of global crude.

Brent crude futures were up 99 cents, or 1.68%, at $59.91 a barrel at 1606 GMT, while U.S. West Texas Intermediate crude was up 93 cents, or 1.68%, to $56.20 a barrel.

Growing U.S. fuel inventories tempered the rise in crude oil prices.

Oil prices settled near five-year lows in the previous session on signs of progress in Russia-Ukraine peace talks. A peace agreement could see Western sanctions on Moscow eased, freeing up supply as the market grapples with fragile global demand.

On Tuesday, Trump ordered a blockade of all sanctioned oil tankers entering and leaving Venezuela, saying he regarded President Nicolas Maduro's administration as a foreign terrorist organization. The Venezuelan government said in a statement it rejected Trump's "grotesque threat."

"Russian risks are well telegraphed, but there are clear risks to the Venezuelan oil supply," ING analyst Warren Patterson said.

Trump's comments on a blockade came a week after the U.S. seized a sanctioned oil tanker off the coast of Venezuela.

It is unclear how many tankers will be affected and how the U.S. will impose the blockade, and whether Trump will turn to the Coast Guard to interdict vessels as he did last week. In recent months, the U.S. has moved warships into the region.

While many vessels picking up oil in Venezuela are under sanctions, others transporting the country's oil and crude by way of Iran and Russia have not been sanctioned. Tankers chartered by Chevron (CVX.N), opens new tab are also carrying Venezuelan crude to the U.S. under an authorisation previously granted by Washington.

"Venezuelan oil production accounts for around 1% of global output, but supplies are concentrated among a small group of buyers, mainly Chinese teapot refiners, the U.S., and Cuba," said Muyu Xu, senior oil analyst at Kpler.

China is the biggest buyer of Venezuelan crude, which accounts for roughly 4% of its imports.

Rising inventories of gasoline and distillate in the U.S. took some of the steam out of crude oil's rise. While crude barrels fell last week, gasoline and distillate inventories grew more than analysts expected, according to the U.S. Energy Information Administration.

Crude inventories dropped by 1.3 million barrels to 424.4 million barrels in the week ended December 12, the EIA said, compared with analysts' expectations in a Reuters poll for a 1.1 million-barrel draw.

U.S. gasoline stocks, meanwhile, added 4.8 million barrels in the week to 225.6 million barrels, the EIA said, compared with analysts' expectations in a Reuters poll for a 2.1 million-barrel build.

Distillate stockpiles, which include diesel and heating oil, rose by 1.7 million barrels in the week to 118.5 million barrels, versus expectations for a 1.2 million-barrel rise, the EIA data showed.

"Although we still expect a crude surplus to develop as early as next month, such a process will be challenged by seasonal tendencies for a supply decline as well as by an unusually strong pace of U.S. refinery activity," said consultant Jim Ritterbusch of Ritterbusch and Associates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up