Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

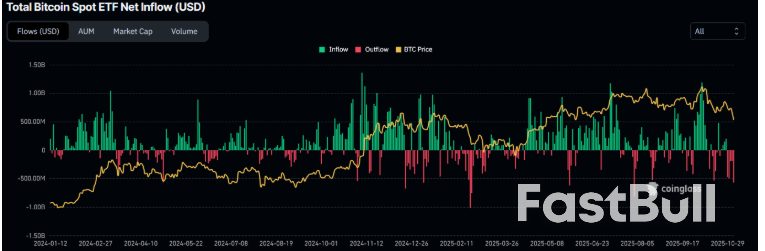

Bitcoin slipped under $100K as the U.S. shutdown drained liquidity, pressuring risk assets. ETF outflows continue, but technical indicators suggest this is a mid-cycle correction rather than a new bear market.

Americans expect inflation to moderate in the near term while expressing concerns about the job market and their personal finances, according to a Federal Reserve Bank of New York report released Friday.

The bank's Survey of Consumer Expectations for October showed households anticipate inflation to reach 3.2% a year from now, down from September's 3.4% expectation. Three and five-year inflation expectations remained unchanged at 3% for both time horizons.

Despite the improved inflation outlook, respondents showed increased concern about employment conditions. They predicted a higher unemployment rate in the coming year compared to the previous month's survey and anticipated greater difficulty finding work if they became unemployed, though they expressed less worry about losing their current jobs than in September.

The heightened concern about future employment was particularly pronounced among respondents under age 60 and those with some college education.

The survey also revealed growing pessimism about both current and future financial situations. However, Americans reported that credit is now easier to obtain and expected it to become even more accessible in the future.

Expectations for future earnings and income were mixed in October. Households anticipated declines in gasoline and food prices, while the expected year-ahead increase in medical costs reached its highest level since February 2023.

The survey was conducted throughout October amid the government shutdown and growing concerns about job market conditions. Last week, the Fed reduced its interest rate target by a quarter percentage point to the 3.75%-4.00% range, aiming to support employment while maintaining downward pressure on inflation, which remains above the Fed's 2% target.

Fed officials have indicated that the relative stability of longer-term inflation expectations gives them confidence that inflation will eventually return to target, as these expectations significantly influence current price pressures.

Gold (GC=F) futures sat near $4,000 per ounce on Friday, remaining steady after last month's sharp sell-off but raising questions over where the precious metal is headed next.

Gold is still on pace for its best year since 1979, driven by central bank purchasing and increased inflows into exchange-traded funds (ETFs), bar and coin purchases. But the yellow metal is off roughly 9% from its all-time high north of $4,350 last month.

Analysts at Macquarie Group said Thursday they believe gold prices have likely peaked, noting that other central banks began cutting rates ahead of the Federal Reserve, which has remained noncommittal about another move in December. Rate cuts typically boost the metal's appeal over yield-bearing assets.

"With global growth beginning to rebound, central bank easing cycles near an end, real interest rates still relatively high and tensions between the US and China easing (at least for now), we suspect the near-term peak is in, with prices likely to fall over the coming year." chief economist Ric Deverell wrote on Thursday.

"However, the decline will likely be slower than seen after previous peaks, with prices remaining well above the end-2023 level through the current US Presidential term," he added. Gold was sitting near $2,000 per troy ounce almost two years ago.

The analysts noted if geopolitical tensions re-escalate or concerns about the size of the US government return, gold may rally further.

Gold saw its biggest daily drop in more than a decade in October, bringing a stunning rally to a sudden stop. It still ended the month with a roughly 5% gain.

A World Gold Council report released earlier this week said that a stronger dollar fueled gold's seesaw from its recent all time high.

"With no long-term momentum 'sell' signals seen thus far, our view is that an October decline will likely provide a healthy and much needed breather in the core long-term uptrend," the report said.

Even if a peak is reached, some Wall Street analysts still expect gold to rise from current levels from end of year.

"Despite the recent pullback in gold to around USD 4,000 an ounce from a peak above USD 4,300/oz, our target remains USD 4,200/oz for the next 12 months; a rise in political and financial market risks could lead gold to our upside target of USD 4,700/oz," UBS analysts said in note on Thursday.

Meanwhile Goldman Sachs analysts predicted last month that gold will reach $4,900 per troy ounce by the end of next year.

"While a correction in speculative upside call options structures likely contributed to the selloff, we believe sticky, structural buying will continue further, and still see upside risk to our $4,900 end-2026 forecast from growing interest in gold as a strategic portfolio diversifier," said Goldman Sachs analysts in October.

Key points:

The United Nations Security Council on Thursday will start negotiations on a U.S.-drafted resolution to endorse President Donald Trump'sGazapeace plan, said a senior U.S. government official, and authorize a two-year mandate for a transitional governance body and international stabilization force.

The U.S. formally circulated the draft resolution to the 15 council members late on Wednesday and has said it has regional support from Egypt, Qatar, Saudi Arabia, Turkey, and the United Arab Emirates for the text.

"The message is: if the region is with us on this and the region is with us on how this resolution is constructed, then we believe that the council should be as well," the senior U.S. government official, speaking on condition of anonymity, told Reuters.

A council resolution needs at least nine votes in favor and no vetoes by Russia, China, France, Britain or the United States to be adopted. When asked when the draft text could be put to a vote, the official said: "The sooner that we move, the better. We're looking at weeks, not months."

"Russia and China will certainly have their inputs, and we'll take those as they come. But at the end of the day, I do not see those countries standing in the way and blocking what is probably the most promising plan for peace in a generation," the official said.

Trump told reporters later on Thursday that the international force would deploy "very soon." U.S. Secretary of State Marco Rubio then noted that the countries volunteering to contribute troops "need this U.N. mandate in order to be able to do it."

The draft resolution, seen by Reuters, would authorize a Board of Peace transitional governance administration to establish a temporary International Stabilization Force in Gaza that could "use all necessary measures" - language for force - to carry out its mandate.

The ISF would be authorized to protect civilians and humanitarian aid operations, work to secure border areas with Israel, Egypt and a "newly trained and vetted Palestinian police force."

The ISF would stabilize security in Gaza by "ensuring the process of demilitarizing the Gaza Strip, including the destruction and prevention of rebuilding of the military, terror, and offensive infrastructure, as well as the permanent decommissioning of weapons from non-state armed groups."

The official said the draft U.N. resolution gives the ISF authority to disarm Palestinian militants Hamas, but that the U.S. was still expecting Hamas to "live up to its end of the agreement" and give up its weapons.

Hamas has not said whether it will agree to disarm and demilitarize Gaza — something the militants have rejected before.

The senior U.S. official said the ISF was shaping up to be around 20,000 troops.

While the Trump administration has ruled out sending U.S. soldiers into the Gaza Strip, it has been speaking to Indonesia, the UAE, Egypt, Qatar, Turkey and Azerbaijan to contribute.

"We've been in steady contact with the potential troop contributors, and what they need in terms of a mandate, what type of language they need," said the official. "Almost all of the countries are looking to have some type of international mandate. The preferred is U.N."

The official said he was unaware if Israel had ruled out any specific countries from contributing troops to the ISF, but added: "We're in constant conversations with them." Israel said last month it would not accept Turkish armed forces in Gaza under the U.S. peace plan.

That 20-point plan is annexed to the draft U.N. Security Council resolution.

"Time is not on our side here. The ceasefire is holding, but it is fragile, and ... we cannot get bogged down in wordsmithing in the council. I think this is a real test for the United Nations," the senior U.S. official said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up