Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Bank of Japan is expected to raise its policy interest rate to 0.75%, the highest level since 1995, reflecting confidence in persistent inflation and wage growth...

European Union leaders decided on Friday to borrow cash to fund Ukraine's defence against Russia rather than use frozen Russian assets, diplomats said.

"We have a deal. Decision to provide 90 billion euros of support to Ukraine for 2026-27 approved," EU summit chairman Antonio Costa posted on social media in the early hours of Friday morning after hours of talks.

Costa did not specify the source of the funding but a draft text of the summit's conclusions, seen by Reuters, said it would come from borrowing on capital markets, secured against the EU budget.

The deal will not affect the financial obligations of Hungary, Slovakia and the Czech Republic, which did not want to contribute to the financing of Ukraine, the text said.

At the same time, EU governments and the European Parliament would continue working on setting up a loan for Ukraine that would be based on the frozen Russian central bank assets, it said.

The loan to Ukraine based on the joint borrowing would only be repaid by Ukraine once it receives war reparations from Moscow. Until then, the Russian assets would remain immobilised and the EU reserved the right to use them to repay the loan, according to the text.

"It's good in the sense that Ukraine will secure funding for 2 years," one EU diplomat said.

The move follows hours of discussions among leaders on the technical details of a loan based on the frozen Russian assets, which turned out to be too complex or politically demanding to sort out at this stage, diplomats said.

"We have gone from saving Ukraine, to saving face, at least that of those who have been pushing for the use of the frozen assets," a second EU diplomat said.

The main difficulty in the use of the Russian money was providing Belgium, where 185 billion of the total 210 billion euros of Russian assets in Europe are held, with sufficient guarantees against financial and legal risks from potential Russian retaliation for the release of the money to Ukraine.

The EU sees Russia's war as a threat to its own security and wants to keep Ukraine financed and fighting.

With public finances across the EU already strained by high debt levels, the European Commission had proposed using frozen Russian central bank assets to secure a huge loan of 90 billion euros to Kyiv, with joint borrowing against the EU budget as a second option.

The joint borrowing was difficult because it requires unanimity. Moscow-friendly Hungary had said it would oppose it, just as it opposed the use of Russian assets.

But Hungarian Prime Minister Viktor Orban appeared to have agreed not to block the borrowing as long as his country, Slovakia and the Czech Republic were excluded from the guarantees for the debt.

"Orban got what he wanted: no reparation loan. And EU action without participation of Hungary, Czech Republic and Slovakia," a third EU diplomat said.

Several EU leaders arriving at the summit said it was imperative they find a solution to keep Ukraine financed and fighting for the next two years. They were also keen to show European countries' strength and resolve after U.S. President Donald Trump last week called them "weak".

"We just can't afford to fail," EU foreign policy chief Kaja Kallas said.

Ukrainian President Volodymyr Zelenskiy, who took part in the summit, urged the bloc to agree to use the Russian assets to provide the funds he said would allow Ukraine to keep fighting.

"The decision now on the table – the decision to fully use Russian assets to defend against Russian aggression – is one of the clearest and most morally justified decisions that could ever be made," he said.

Belgian Prime Minister Bart De Wever told his country's parliament early on Thursday that he had not yet seen guarantees that answered his concerns on legal and liquidity risks for Belgium to agree to the use of the Russian assets.

Russia's central bank has said the EU plans to use its assets are illegal. It filed a lawsuit in Moscow this week seeking $230 billion in damages from clearing house Euroclear.

The stakes for finding money for Kyiv are high because without the EU's financial help Ukraine will run out of money in the second quarter of next year and most likely lose the war to Russia, which the EU fears would bring closer the threat of Russian aggression against the bloc.

Law enforcement officers are investigating a link between a mass shooting at Brown University in Providence that killed two people last weekend and the shooting death of a Massachusetts Institute of Technology professor two days later near Boston, a person familiar with the matter said.

The source, who spoke on condition of anonymity as they were not authorized to discuss the matter, did not provide more details on why investigators think the two cases may be linked.

The new twist comes five days after the shooting at Brown University and during a manhunt for the shooter. The violence shook Rhode Island's capital city of Providence, and brought pressure on investigators to crack open the case.

The Brown shooting occurred on December 13 inside a classroom building, killing two students and wounding at least eight others.

Two days later, MIT professor Nuno Loureiro, 47, was fatally shot in his home in Brookline, Massachusetts on Monday evening. Brookline is 49 miles north of Brown's campus.

Earlier this week, an FBI official said authorities did not believe there was any link between Saturday's shooting at Brown and the MIT's professor's murder. Loureiro was a member of the departments of nuclear science and engineering and physics as well as MIT's Plasma Science and Fusion Center.

Investigators in Providence said the suspect in the Brown University shooting escaped on foot into nearby streets, prompting a search that relied heavily on residential security footage because of a lack of surveillance cameras in the classroom building and surrounding area.

Police released images and video of a masked man believed to be the shooter, based on survivor accounts, and have repeatedly asked for the public's help in identifying that man. The footage showed the suspect walking in a nearby neighborhood both before and immediately after the attack, including moments when police vehicles arrived with flashing lights.

"He could be anywhere," Providence Police Chief Oscar Perez said on Wednesday, adding that authorities did not initially know the suspect's identity or motive.

Providence Mayor Brett Smiley said residents and students had grown "restless and eager" for an arrest as the search stretched into several days.

Police also circulated photos of another unidentified man seen near the area, saying they wanted to speak with him as a potential witness who may have relevant information.

Authorities initially announced a person was in custody a day after the shooting, but later released that individual after determining he was not involved.

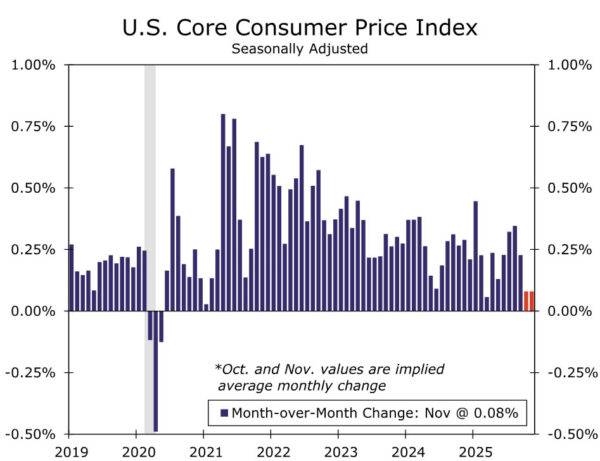

The November CPI report creates more questions than answers about the recent pace of price growth. Consumer prices rose 2.7% in the 12 months ending in November, materially below our expectations for a 3.0% gain. The core index similarly fell short of expectations, advancing 2.6% over the past 12 months versus our forecast for a 2.9% increase. The stark miss comes on the heels of the longest-ever government shutdown that led the BLS to skip October data collection and not begin the November collection process until the middle of the month.

As such, we caution against reading too much into today's report. The November data suggest core prices rose 0.16% over the past two months, or an average of 0.08% per month. For comparison, the core index has increased at an average monthly pace of 0.25% this year. CPI data are not revised, and as a result we believe the data will be noisy for at least another month or two. A bounce back in prices in the December CPI report to be released on January 13 is probably coming. Through the noise, we believe inflation is slowing on trend, even if today's reading overstates the magnitude of the slowdown. We remain comfortable with our current projection of rate cuts from the FOMC in March and June of next year.

The government shutdown appears to have caused issues in the consumer price inflation data collection process. The two-month percent change in headline and core CPI were 0.20% and 0.16%, respectively, meaningfully below our forecasts of 0.45% and 0.48%. For context, the two-month change in headline and core CPI from July to September was 0.69% and 0.57%, respectively. This pushed the year-ago pace of headline and core CPI inflation down to 2.7% and 2.6%, a steep decline from 3.0% and 3.1% in September. The slowdown was broad-based across nearly all categories, adding to our suspicions that the shutdown's disruptions caused issues in the data. Data collection didn't begin until the second half of November, which may have skewed the sample more than we anticipated.

Food prices rose 0.06% over the past two months, a significantly slower pace than the 0.25% average monthly rise this year. Taking a step back from this report's noise, forward-looking measures of food-related commodities have slipped into deflation territory, which, when coupled with recent rollbacks on select food tariffs, point to a disinflationary trend in food inflation even if not to the extent implied in today's report. Energy was the lone category that came in reasonably near expectations, rising 1.08% over the past two months and up 4.1% year-over-year in November. This is likely due to gasoline prices being collected from a non survey source and thus being one of the few sub-categories the BLS was able to publish price data for in October. New and used autos prices were also produced under their usual methodology and came in a touch stronger than we expected.

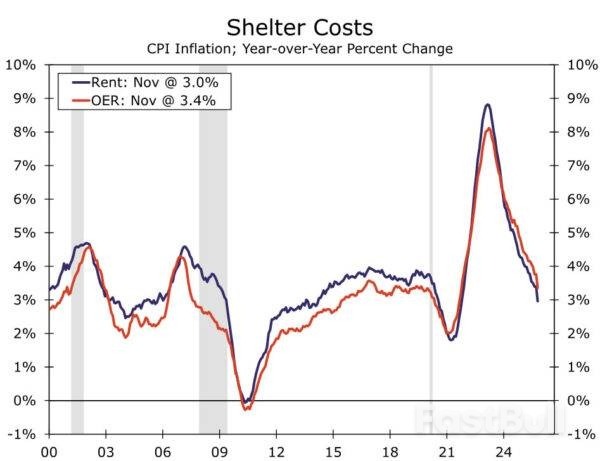

Core goods prices rose only 0.06% between September and November, compared to a 0.15% average monthly rise headed into this report. Similarly, core services rose only 0.16% over the past two months. Shelter inflation was a prime example of the puzzlingly weak inflation data in core. Owners' equivalent rent rose 0.27% over two months, while rents rose just 0.13%. The weak outturn lead these categories down to 3.4% and 3.0%, respectively, on a year-over-year basis, breaking away from their recent trends (chart). In short, we are not putting much weight on the details of this report, and we anticipate a bounce back in the December reading to be released on January 13.

While materially softer than expected, we think the collection issues around this particular report means it will do little to change Fed officials' current views on inflation. Inflation pressures are softening, but not to this degree. With the Fed waiting for (reliable) inflation data before cutting rates again, today's data add to our conviction that the FOMC will be on hold at the January meeting. That said, data issues aside, our belief is that inflation is slowing on trend, even if today's print overstates the slowdown. When paired with the softening in the labor market, we remain comfortable with rate cuts in March and June of next year. At that point, we believe cleaner data will give the Committee more confidence that inflation is leveling off and will soon be moving back toward 2%.

A U.S. appeals court said on Thursday it will consider whether millions of Apple customers can band together in a lawsuit accusing the iPhone maker of monopolizing the market for apps and inflating prices, after a trial judge stripped the case of class action status earlier this year.

In a brieforder, the San Francisco-based 9th U.S. Circuit Court of Appeals said it will review a ruling that decertified a class of nearly 200 million consumers who claim Apple's App Store rules led to $20 billion in overcharges.

U.S. District Judge Yvonne Gonzalez Rogers in Oakland, California, ruled in October that the customers failed to provide a model "capable of reliably showing classwide injury and damages in one stroke" by matching Apple accounts to consumers, while limiting the number of "unharmed" consumers in the class.

The three plaintiffs asked the appeals court to overturn the decision and revive the class action before their individual claims are decided. Class actions can expose companies to far greater damages than individual lawsuits.

Apple did not immediately respond to a request for comment.

Mark Rifkin, a lawyer for the plaintiffs, said they "look forward to briefing and arguing the merits of the appeal in the Ninth Circuit."

The lawsuit, filed in 2011, accuses Apple of violating U.S. antitrust law by too tightly restraining how customers download apps and pay for transactions, causing overcharges for apps and in-app content on their iPhones and iPads. Apple has denied any wrongdoing.

In their appeal, the consumers called the decertification ruling "manifestly erroneous," saying they showed Apple's conduct harmed virtually all class members.

They warned the ruling creates a "death knell" for claims worth only $268 collectively for the three named plaintiffs.

Apple told the appeals court that the plaintiffs still can pursue individual claims and that review was unwarranted because the decertification order turned on fact-specific rulings, not unsettled law.

The case is In re Apple iPhone Antitrust Litigation, 9th U.S. Circuit Court of Appeals, No. 25-7122.

Japan's core consumer prices rose 3.0% in November from a year earlier, data showed on Friday, staying above the central bank's 2% target for the 44th straight month.

The outcome reinforces market expectations the Bank of Japan will raise interest rates to 0.75% from 0.5% at a two-day policy meeting concluding on Friday.

The increase in the core consumer price index (CPI), which excludes volatile fresh food prices, matched a median market forecast and was steady from the year-on-year pace of rise in October.

An index stripping away volatile fresh food and fuel costs, which is closely watched by the BOJ as a better gauge of underlying price trends, rose 3.0% in November from a year earlier, compared with a 3.1% increase in October.

The BOJ exited a decade-long, radical stimulus programme last year and raised short-term interest rates to 0.5% in January on the view Japan was on the cusp of sustainably hitting its 2% inflation target.

With stubbornly high food prices keeping inflation above its 2% target, a growing number of BOJ board members have signaled their readiness to vote for a rate hike to avoid being behind the curve in addressing the risk of too-high inflation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up