Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)A:--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)A:--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)A:--

F: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)A:--

F: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)A:--

F: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)A:--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Mexico Trade Balance (Nov)

Mexico Trade Balance (Nov)--

F: --

P: --

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)--

F: --

P: --

U.S. PCE Price Index Prelim QoQ (SA) (Q3)

U.S. PCE Price Index Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q3)

U.S. GDP Deflator Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A growing number of Chinese companies are looking to domicile in Singapore, betting a move to the trade-focused city-state would reduce risks their operations get disrupted by Sino-U.S. geopolitical tensions.

Key points:

A growing number of Chinese companies are looking to domicile in Singapore, betting a move to the trade-focused city-state would reduce risks their operations get disrupted by Sino-U.S. geopolitical tensions.

The trend, billed as "Singapore washing" by some analysts, started gaining traction near the end of U.S. President Donald Trump's first presidency and has since accelerated, spreading to various sectors from critical minerals to tech and biotechnology, analysts and experts said.

"Demand has always been rising...and the key thing right now is that it's probably going to accelerate at a more rapid pace," said KG Tan, CEO of InCorp Group, which helps companies relocate or expand in nine Asia-Pacific locations.

There is no official data on how many Chinese companies are domiciled in Singapore, but Tan said interest from Chinese firms is "very strong" with about 15-20% more inquiries now year-on-year.

Singapore-domiciled companies include optical products maker Terahop, backed by China-based Zhongji Innolight, which set up shop in the city in 2018.

More recent additions include data centre operator DayOne, spun off from GDS Holdings; Manus AI, an artificial intelligence agent from China's Butterfly Effect; and ChemLex, an AI-powered chemical synthesis company.

Neither Manus AI's nor Terahop's websites make reference to their Chinese backers. ChemLex CEO Sean Lin said he considers his Shanghai-founded startup a Singapore company.

DayOne CEO Jamie Khoo said in July that it always intended to split from its Chinese parent, as both companies operate under different regulatory regimes. Manus AI and Terahop did not respond to requests for comment.

Singapore offers an attractive base for firms looking to navigate U.S. tariffs and maintain access to key American technologies whose sales are restricted in China. Washington imposes tariffs of just 10% on goods from Singapore.

"The Singapore brand is trusted worldwide. Singapore is valued for its international flavour, neutrality, and is culturally easy for Chinese firms and their expats to adapt to," said Maybank China economist Erica Tay.

"With a whopping 28 free trade agreements, it is also a good base from which to grow markets outside China."

But that advantage has also left Singapore on a tightrope, as the U.S. steps up its scrutiny over Chinese firms and as some of those foreign entities have been involved in criminal activities.

Singapore-based data centre firm Megaspeed, which split from a Chinese gaming firm in 2023, faces a U.S. probe for allegedly diverting Nvidiachips used for AI.

The Asian country also had its biggest money laundering case involving foreigners of Chinese origin in 2023, and is investigating a conglomerate, owned by a Cambodian citizen of Chinese origins and accused of running vast scam centre operations.

The U.S. Department of Commerce and China's Ministry of Commerce did not respond to requests for comment. Reuters has asked the Singapore government for comment.

While a relocation in theory offers businesses more flexibility in managing tariffs, export controls and other protective trade policies, such moves do not guarantee firms freedom from political or regulatory heat.

Fast fashion firm Shein and short video platform TikTok, among the early movers to Singapore, notably failed to shield their operations from Western scrutiny.

Shein ran into political opposition in the U.S. and the UK over its efforts to go public there and also had to seek Beijing's nod for its listing plans, despite having moved its headquarters from Nanjing to Singapore.

It is now seeking China's blessing for a stock market debut in Hong Kong, and reportedly considering relocation back to China.

TikTok, owned by China's ByteDance, saw its Singaporean CEO Chew Shou Zi repeatedly grilled over his links to the Chinese government at a Congressional hearing in Washington in 2024.

ByteDance, which is required to sell its U.S. operation to a consortium of American and global investors to meet national security requirements, signed off on the sale deal, TikTok said on Thursday.

A failed effort by Yuxiao Fund, a Singapore-registered Chinese investor, to boost its stake in Australian rare earths miner Northern Mineralsin 2024 due to its China link also highlights the limits of being based in Singapore.

Experts argue the strategy mostly works for smaller firms but provides less wriggle room for big businesses.

"It's the low-profile entities like family offices and trading companies which tend to have an easier time avoiding attention," said Chong Ja Ian, political scientist at the National University of Singapore.

Some have already taken note of the growing scrutiny.

Dou Changlin, the chief operating officer of Shandong Boan Biotechnology, which provides clinical services for global drugmakers, said its Singapore subsidiary is used to fund the company's U.S. operations.

While the structure has helped it meet funding needs from Singapore, not from China which has stepped up scrutiny of capital flows, Dou cautions U.S. authorities could eventually draw a connection with its Chinese parent company.

"We are very small in the U.S., I don't think we're on the radar of the U.S. government yet," he said.

The Euro has started to drift a little bit lower again during the Friday session as it looks like we are in fact going to see more continuation of this consolidation. That was my base case a few days ago; if you had been watching then, I don't think we would have broken out. I think we don't have anywhere to be.

So, 1.18 I think continues to be a ceiling that extends about 50, maybe 75 pips. And then the floor is probably 1.15, maybe 1.14. With this being the case, I do think that we start to drift lower, and in fact, that's already starting to happen. So, I am bearish, short-term. In the intermediate term, I'm probably neutral. Longer term, I think I'm still bearish, but that obviously can change in a few months.

The British pound looks very much the same in the sense that it can't break over the recent ceiling at 1.34, so with that being said, I think you have a scenario where we could start to fade a bit. I mentioned yesterday that if we could break down below the Wednesday lows, I think this thing starts to unravel. We go down to the 1.32 level and then 1.30. I still believe that's the case. However, if we can break above 1.35, then obviously something changed, and it's very likely we're going higher.

With the price action that we've seen in both the Euro and the pound against the US dollar, they are doing almost nothing against each other. We are sitting at a support level in the form of 0.8750, which continues to be important. It had previously been significant resistance, and now we're trying to figure out whether or not the breakout and the pullback lead to a rally towards 0.89, or if we break down.

If we break down below 0.87, then I think the market will probably unravel a bit, maybe goes looking for the 200-day EMA. But as things stand right now, this is a neutral with a slightly bullish connotation to it. But really, this is more short-term trading back and forth than anything else.

U.S. crude oil prices were stable on Friday after President Donald Trump told NBC News that he will not rule out war with OPEC member Venezuela.

"I don't rule it out, no," Trump told the news outlet in a phone interview. He declined to say whether overthrowing President Nicolas Maduro is his goal.

"He knows exactly what I want," Trump told NBC. "He knows better than anybody."

The oil market right now is not indicating a major risk of a supply disruption. U.S. crude oil rose 29 cents, or 0.5%, to $56.44 per barrel, while global benchmark Brent was up 31 cents, or 0.5% to $60.31.

The U.S. benchmark fell to four year lows earlier this week as traders priced in the possibility of a peace agreement in Ukraine that would bring more Russian crude into a well supplied market.

Trump has been ramping up pressure on Maduro. He ordered a blockade of sanctions oil tankers off the South American nation's coast after seizing a vessel a last week.

The U.S. has staged a major military buildup in the Caribbean and launched deadly strikes on boats that it claims are trafficking drugs to the U.S. The legality of those strikes is disputed and has been the subject of scrutiny by Congress.

Venezuela is a founding member of OPEC and has the largest proven oil reserves in the world. It is exporting about 749,000 barrels per day this year with at least half that oil going to China, according to data from Kpler. Venezuela exports about 132,000 bpd to the U.S., according to Kpler.

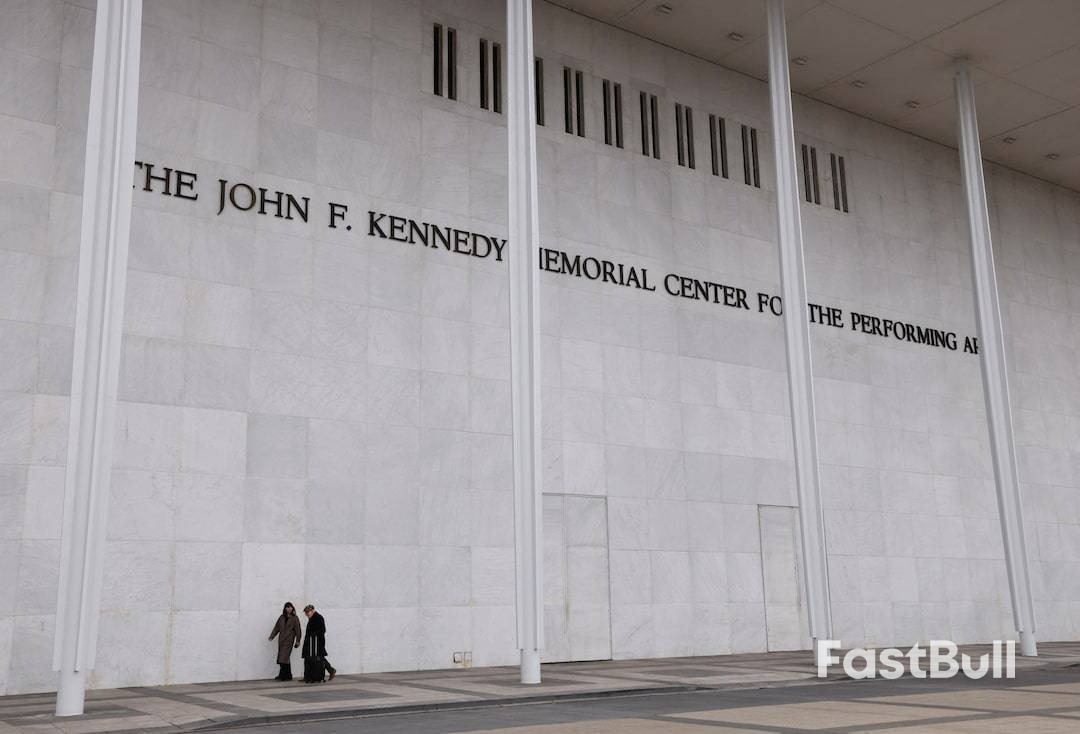

The board of the John F. Kennedy Center for the Performing Arts, which President Donald Trump filled with allies during a broad takeover earlier this year, decided on Thursday to add Trump's name to the institution, horrifying Democrats and raising questions about the legality of the change.

Trump, a Republican who is serving his second term as president, has been eager to put his stamp on Washington and his name on buildings. The administration recently added his name to the United States Institute of Peace building near the White House.

Democrats who serve on the Kennedy Center board said it could not change the name without congressional approval.

After taking little interest in it during his first term, Trump launched a revamp of the Kennedy Center shortly after returning to power. He ousted its chair and installed a new board that made him chair instead. He also fired the center's longtime president, tapping Richard Grenell, a former ambassador to Germany, to run it in her place.

The addition of Trump's name is the latest and perhaps most visible change he and his allies have made to an institution that for decades has been seen as a living memorial to Kennedy, who was assassinated in 1963.

"The Kennedy Center Board of Trustees voted unanimously today to name the institution The Donald J. Trump and The John F. Kennedy Memorial Center for the Performing Arts," Center spokeswoman Roma Daravi said in a statement. "The new Trump Kennedy Center reflects the unequivocal bipartisan support for America's cultural center for generations to come."

The Center did not respond to a question about whether congressional approval was required or would be sought for the new name.

U.S. Representative Joyce Beatty, a Democrat and ex officio board member, said she had not been allowed to weigh in on the change during the meeting. "For the record. This was not unanimous. I was muted on the call and not allowed to speak or voice my opposition to this move," she wrote on X.

Beatty and other ex officio members including Senate Democratic leader Chuck Schumer and House of Representatives Democratic leader Hakeem Jeffries said participants were prevented from speaking at the meeting. Ex officio board members receive their positions because of their government roles and through an act of Congress.

"Beyond using the Kennedy Center to reward his friends and political allies, President Trump is now attempting to affix his name to yet another public institution without legal authority," they said in a statement. "Federal law established the Center as a memorial to President Kennedy and prohibits changing its name without Congressional action."

Daravi said the full board was invited to attend in person and "the privilege of listening in on the meeting was granted to all members, even those without a vote, such as ex officio member Joyce Beatty."

Earlier this month Trump hosted the Kennedy Center Honors, the institution's flagship awards show for the arts, and referred to it as the "Trump Kennedy Center" at one point from the stage. Yet on Thursday, he told reporters he was surprised and honored by the board's decision, while adding that his administration is "saving" the center's building through fundraising and renovation efforts.

"We saved the building," Trump said. "The building was in such bad shape, both physically, financially and every other way."

Trump has complained that the center had become run-down and has worked to raise funds, including at a performance of "Les Miserables" this summer, to make renovations.

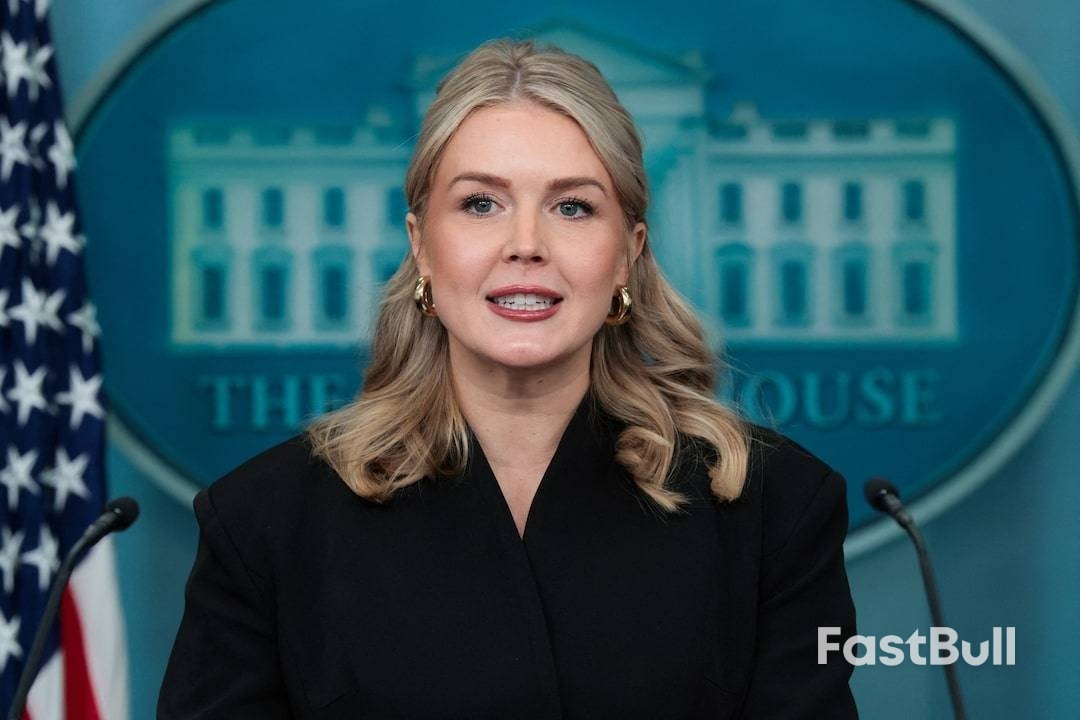

"Congratulations to President Donald J. Trump, and likewise, congratulations to President Kennedy, because this will be a truly great team long into the future!" White House spokeswoman Karoline Leavitt said on X.

Kennedy's grandnephew, former U.S. Representative Joe Kennedy, said the board did not have the right to change the Center's name.

"The Kennedy Center is a living memorial to a fallen president and named for President Kennedy by federal law. It can no sooner be renamed than can someone rename the Lincoln Memorial, no matter what anyone says," he wrote on X.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up