Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Main Shanghai Gold Futures Contract Fell By 2.00% During The Day, Currently Trading At 1098.00 Yuan/gram

Bessent: Cap On Credit Card Interest At 10% For One Year Would Help Allow Americans To Recover From Past Inflation

The Survey Results Show That OPEC Oil Production Declined In January, With Venezuela Experiencing Significant Fluctuations

U.S. Treasury Secretary Bessant Stated That The U.S. Will Not "go To Any Lengths" To Loosen Financial Regulations

A Senior Iranian Source Said The Outcome Of The Negotiations Depends On Whether The United States Changes Its Current Approach. Consultations Are Currently Underway Regarding The Final Arrangements For Friday's Talks And Whether Direct Negotiations Can Take Place

U.S. Treasury Secretary Bessenter: The Federal Reserve’s Involvement In Other Areas Would Damage Its Independence

[Italian Banking Sector Continues To Hit Record Closing Highs] Germany's DAX 30 Index Preliminarily Closed Down 0.54% At 24,647.18 Points. France's Stock Index Preliminarily Closed Up 1.22%, Italy's Stock Index Preliminarily Closed Up 0.69% With Its Banking Index Up 0.36%, And The UK Stock Index Preliminarily Closed Up 1.22%

The STOXX Europe 600 Index Closed Up 0.27% At 619.57 Points, A Record Closing High. The Eurozone STOXX 50 Index Closed Down 0.17% At 5984.95 Points. The FTSE Eurotop 300 Index Closed Up 0.21% At 2468.84 Points

U.S. Treasury Secretary Bessant: The Fed’s Dual Mandate (maintaining Price Stability And Achieving Full Employment) Is A “very Good Balance.”

Bessent: Independence Of Federal Reserve Is Based On Its Trust Among The American People, It Has Lost That -House Financial Services Committee Hearing

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

No matching data

View All

No data

Markets grapple with AI disruption as software stocks slide, while investors rotate toward commodities. Gold and silver recover strongly, amid geopolitical risks, selective stock picking, and cautious focus on earnings and central banks.

Syria's state-owned petroleum company has signed a memorandum of understanding with U.S. energy firm Chevron and Qatar-based Power International Holding to develop the nation's first offshore oil and gas field.

The deal was finalized on Wednesday in Damascus, with U.S. Special Envoy to Syria, Tom Barrack, in attendance. This agreement marks Syria's first official move into offshore energy exploration as its new government works to expand hydrocarbon production and attract foreign investment.

According to Syria's state news agency, SANA, the agreement is designed to build strategic partnerships within the energy sector. The cooperation will focus on several key areas:

• Offshore exploration and development of oil and gas resources within Syria's territorial waters.

• Broader initiatives to support investment and growth in the country's energy infrastructure.

This pact represents a significant step for Syria as it seeks to leverage international partnerships to unlock its untapped offshore potential.

Syria's oil and gas sectors were severely damaged during the country's nearly 15-year conflict, which resulted in widespread destruction and the loss of half a million lives.

Before the conflict began in March 2011, the oil sector was a cornerstone of the Syrian economy. In 2010, the country produced approximately 380,000 barrels of oil per day, with exports, primarily to Europe, generating over $3 billion. At the time, oil revenue accounted for about a quarter of the government's budget.

The country's new authorities, which came to power after removing President Bashar Assad in December 2024, are prioritizing economic recovery.

This energy deal follows recent developments on the ground. Last month, Syrian government forces captured large areas of the oil-rich northeast and eastern regions from Kurdish-led fighters. This strategic gain could open up some of the country's largest oil fields for further exploration and development, aligning with the new government's economic agenda.

Chinese President Xi Jinping and U.S. President Donald Trump held a phone conversation on Wednesday, as reported by China's state-run Xinhua News Agency.

The official report confirmed the discussion took place but did not provide any specific details about its content. The call occurred just hours after President Xi had also spoken with his Russian counterpart, Vladimir Putin.

The high-level communication comes during a period of relative calm between the world's two largest economies. Relations have largely stabilized since Xi and Trump agreed to a one-year trade truce in South Korea last year.

Looking ahead, the two leaders are slated to meet four times this year. A potential summit could be scheduled as soon as April, continuing the dialogue established by the temporary trade agreement.

Despite the recent calm, ongoing geopolitical tensions threaten this fragile peace. President Trump's actions related to countries allied with China, including Venezuela and Iran, are testing the limits of the current understanding.

Further complicating the relationship, the U.S. president has criticized Canada for its trade agreements with Beijing. In a move aimed at reducing economic dependency on China, the Trump administration has also begun efforts to secure alternative supplies of rare earths, seeking to loosen China's control over the critical mineral market.

Indian refiners are facing a critical decision as sellers offer Russia's flagship Urals crude at an increasingly steep discount to Brent, a move that directly challenges a new trade agreement with the United States designed to limit Russian oil purchases.

Sellers are now marketing Urals crude at an $11 per barrel discount, a significant increase from the $9 discount seen just ten days ago, according to traders familiar with the matter.

Under normal circumstances, such a favorable price difference would trigger a wave of buying from Indian refineries eager to lock in cheaper supply. However, the current market dynamics are far from typical.

The primary complication is a new trade deal announced by U.S. President Donald Trump. This agreement ties lower U.S. tariffs on Indian products to a commitment from New Delhi to significantly reduce its imports of Russian crude oil.

The deal explicitly pushes India to increase its purchases of American oil and other commodities. In exchange for cutting ties with Russian supply, the U.S. has also suggested that Indian buyers could gain access to crude from Venezuela and potentially even Iran, offering alternative sources.

Refiners Pause and Await Government Clarity

In response to the deal, Indian refiners are reportedly halting new purchases of Russian oil as they seek official guidance from their government. Sources indicate that companies are preemptively pausing transactions until they receive clarification on how to navigate the new trade relationship with the U.S.

The situation marks a potential turning point for India, the world's third-largest oil importer. Following Russia's invasion of Ukraine in early 2022, India dramatically ramped up its intake of discounted Russian crude.

For nearly four years, this strategy made Russia its single largest oil supplier, accounting for approximately one-third of the nation's total crude imports. Now, refiners must weigh the immediate benefit of cheap Russian oil against the broader economic implications of the U.S. trade agreement.

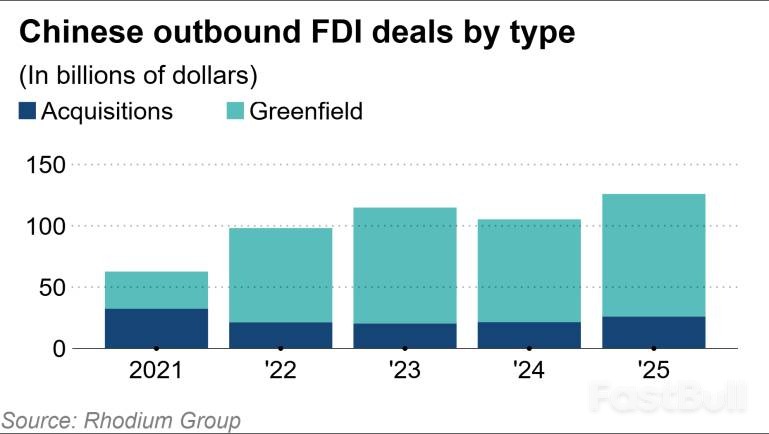

Chinese foreign direct investment (FDI) abroad surged by 18% in 2025, reaching $124 billion in a clear strategic shift away from Western nations and toward emerging markets in Africa, the Middle East, and Asia. This marks the highest level of outbound investment since 2018, though it remains below the peak seen in 2016.

According to a report released Wednesday by the Rhodium Group, a New York-based research firm, this new wave of capital is overwhelmingly focused on energy and basic materials. The trend highlights how the world's second-largest economy is adapting to global trade tensions and rising resource demand.

Nearly half of all announced Chinese outbound investments last year targeted the energy sector—spanning both fossil fuels and renewables—and essential commodities. This surge is propelled by escalating trade and technology disputes between Washington and Beijing that have disrupted supply chains, as well as the growing energy needs of data centers worldwide.

"Energy and basic materials investment will continue [this year], partly because these sectors are naturally high-value and long-term in nature," noted Danielle Goh, a senior research analyst at Rhodium. "Commodities like these tend to attract follow-on investment over time."

In contrast, the automotive sector's share of Chinese FDI fell to its lowest point since 2020. The slowdown reflects a deceleration in new electric vehicle manufacturing and upstream supply chain projects abroad, even as Chinese firms continue to localize some production in regions like Eastern and Central Europe. However, the report notes that overseas markets are still primarily served by exports from China's domestic manufacturing base.

The flow of Chinese capital has decisively turned toward Asia and sub-Saharan Africa. Asia received approximately $40 billion in new transactions, while Africa saw several landmark deals.

Key projects in 2025 that underscore this trend include:

• Guinea: Major investment in the Simandou iron ore mine.

• Nigeria: Two significant lithium processing plants.

• Indonesia: A $5.9 billion joint venture for a refining and chemical complex by Tongkun Group, Xinfengming Group, and Tingshan Group, one of the year's largest transactions.

Separate research from Griffith Institute Asia and Shanghai's Green Finance & Development Center confirms that China's Belt and Road Initiative (BRI) also remains highly active, with most funds directed toward mineral processing in metals and mining. In 2025, Kazakhstan emerged as the top recipient, securing about $25.8 billion for projects related to aluminum and copper.

While Chinese FDI remains dominated by greenfield investments focused on new manufacturing facilities, mergers and acquisitions (M&A) are making a strong comeback. After a steady decline from 2016, the value of M&A transactions has nearly doubled since 2022, partly driven by Chinese consumer goods companies expanding abroad.

The Rhodium report also highlighted that Chinese firms have leveraged capital made available from the deleveraging of the domestic property sector to expand manufacturing capacity at home, which continues to outpace overseas investment.

The pivot toward emerging economies coincides with a sharp decline in investment in developed nations. According to Rhodium, North America, Europe, and Oceania now account for less than 20% of total announced Chinese FDI, a drop of roughly 70% from 2016 levels.

This retreat is a direct response to increasing scrutiny and protectionist policies from Western governments. Germany has blocked several Chinese acquisition attempts, and Switzerland recently passed legislation to screen Chinese investments in strategic industries.

US Market Sees Heightened Caution

Chinese companies have become particularly guarded about investing in the United States amid rising geopolitical tensions. Last year, the White House instructed the Committee on Foreign Investment in the U.S. (CFIUS) to intensify its reviews of Chinese investments in advanced technology, infrastructure, and farmland.

This cautious environment has led to a reluctance to commit significant capital. "There's growing risk that projects may not ultimately move forward, so Chinese companies have been reluctant to invest heavily," said Goh.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up