Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

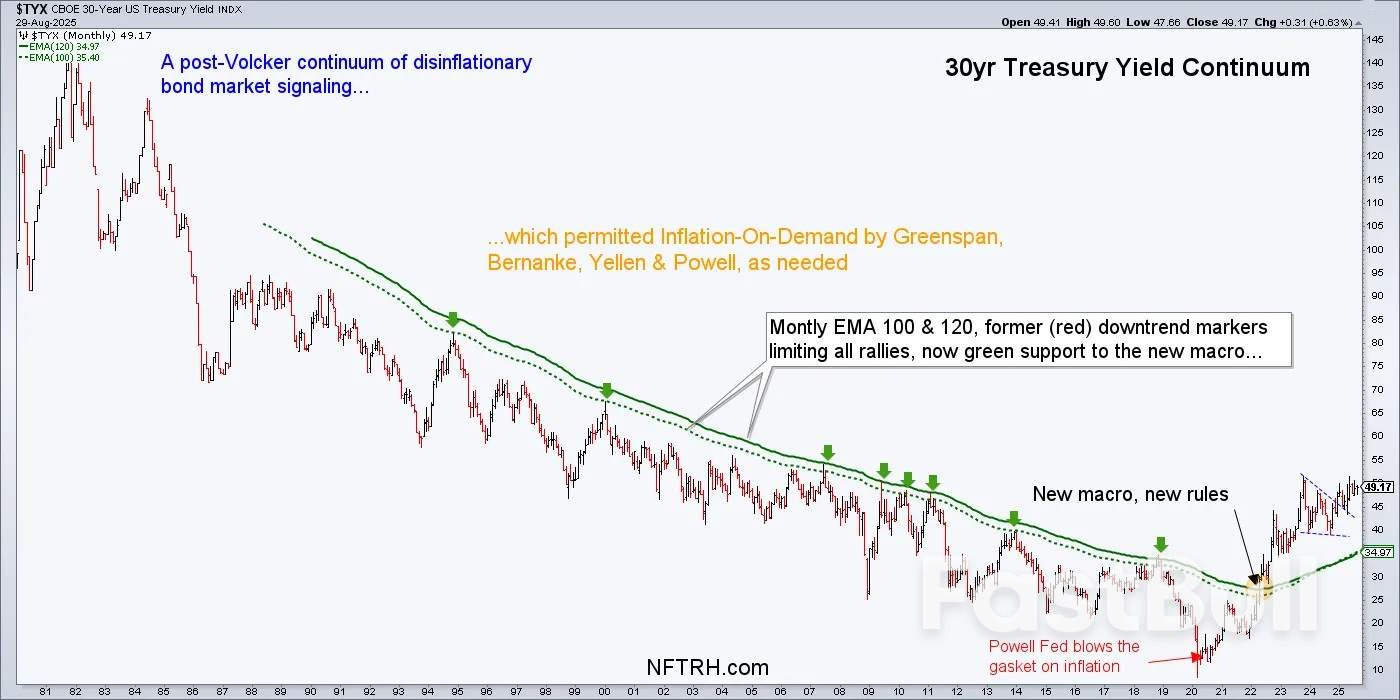

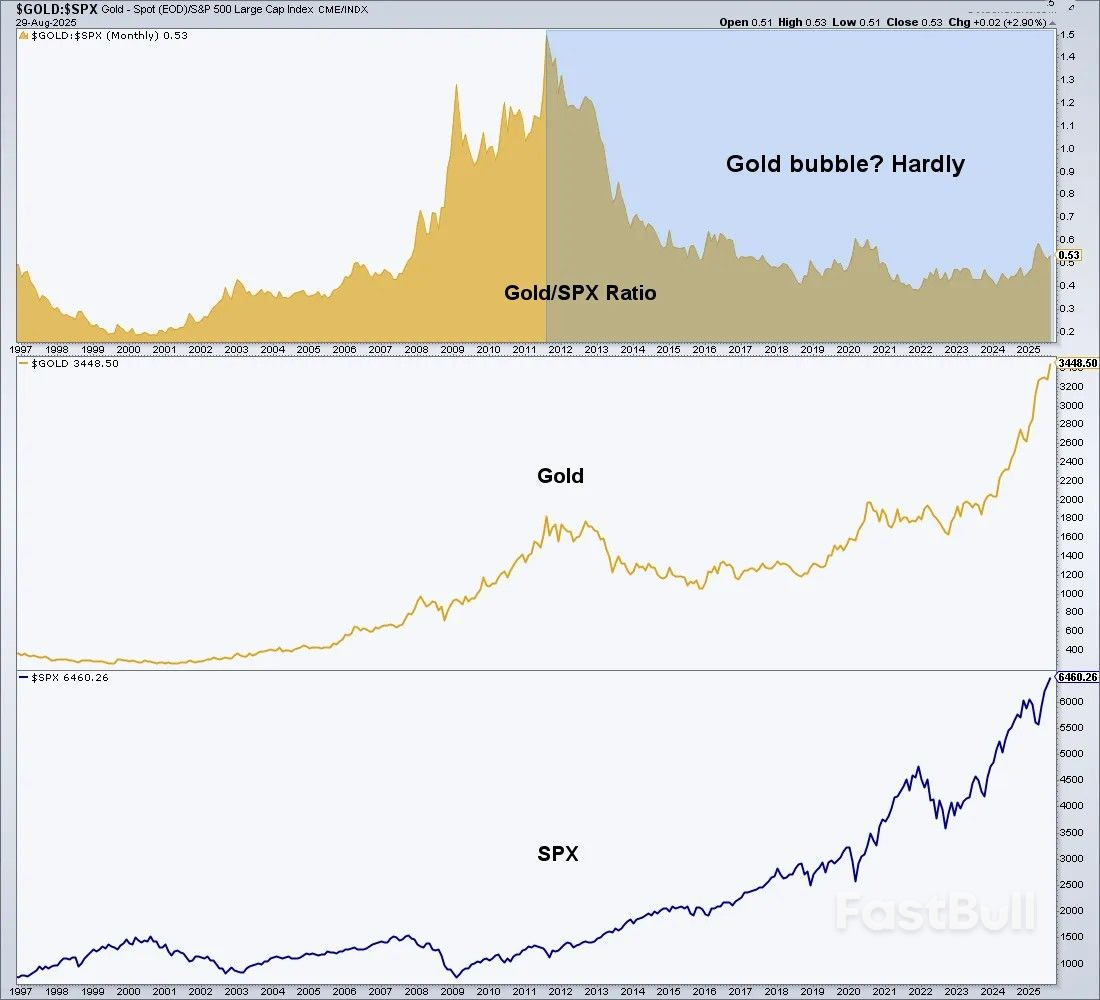

Gold and silver likely entering a new bull market after 2022’s macro shift. Short-term corrections possible, but long-term outlook favors precious metals over stocks.

The financial world is buzzing as the Gold Price Rally continues its impressive ascent, recently soaring past the $3,510 per ounce mark. This significant milestone isn’t just a number; it signals a powerful shift in investor sentiment and global economic dynamics. For those tracking market movements, whether in traditional assets or the dynamic world of cryptocurrencies, understanding this rally is crucial. Gold, often seen as a timeless safe haven, is once again proving its mettle, drawing considerable attention and sparking discussions about its future trajectory.

Several intertwined factors are converging to propel the Gold Price Rally to unprecedented levels. This isn’t a singular event but a reflection of broader economic and geopolitical currents. Investors are increasingly seeking stability amidst uncertainty, and gold historically offers just that.

These elements combine to create a compelling narrative for gold’s current strength, illustrating its enduring appeal in a complex financial landscape.

The breaking of the $3,500 barrier for gold is more than just a headline; it prompts a re-evaluation of investment strategies. For many, the Gold Price Rally reinforces gold’s role as a critical component of a diversified portfolio. While cryptocurrencies offer high growth potential, gold provides a different kind of security.

Investors often look to gold for:

Understanding these benefits helps investors, including those heavily invested in digital assets, consider how gold might complement their existing holdings and provide a layer of stability.

While the current momentum behind the Gold Price Rally is strong, no asset moves in a straight line indefinitely. Prudent investors consider both the opportunities and potential challenges ahead. The path forward for gold will likely be influenced by a dynamic interplay of global economic policies and market sentiment.

Potential Challenges:

Opportunities:

For those looking at long-term strategies, monitoring these factors is key to understanding the sustained potential of gold.

The remarkable Gold Price Rally past $3,500 is a testament to its enduring role in the global financial system. It serves as a potent reminder of the importance of diversification and the search for stability in an ever-changing economic landscape. Whether you are a seasoned investor or new to market dynamics, gold’s current performance offers valuable insights into prevailing market sentiments and future economic outlooks. As the world continues to navigate complex challenges, gold’s timeless appeal as a store of value and a hedge against uncertainty remains as strong as ever, making it a crucial asset to watch.

Here are some common questions about the current surge in gold prices:

The Gold Price Rally is a topic of significant interest for investors globally. If you found this analysis insightful, consider sharing it with your network on social media. Your engagement helps us continue to provide valuable market insights and discussions. Stay informed and share the knowledge!

To learn more about the latest gold price trends, explore our article on key developments shaping financial markets and investment strategies.

This post Unstoppable Gold Price Rally: Why $3,500 is Just the Beginning first appeared on BitcoinWorld and is written by Editorial Team

Wall Street is pulling further from its records on Tuesday, ground down by tightening pressure from the bond market.

The S&P 500 sank 0.9 per cent after falling as much as 1.4 per cent at the start of trading. The Dow Jones Industrial Average was down 305 points, or 0.7 per cent, as of 10:10 a.m. Eastern time, and the Nasdaq composite was down 1.1 per cent. All three are still relatively close to their recently set all-time highs.

Nvidia and other companies that have benefited from the frenzy around artificial-intelligence technology were some of the heaviest weights on the market. They have soared for years on belief that they’re at the vanguard of the next revolution for the global economy. But they’ve also shot so high that critics say their prices have simply become too expensive.

Nvidia, whose chips are powering much of the move into AI, fell 2.1 per cent.

Other losing Big Tech stocks included Amazon, which fell 1.9 per cent, and Alphabet, which sank 1.8 per cent.

The overall stock market was feeling pressure from rising yields in the bond market, where the 10-year Treasury yield climbed to 4.26 per cent from 4.23 per cent late Friday. When bonds are paying more in interest, investors are less willing to pay high prices for stocks.

Longer-term bond yields are on the rise around the world, in part because of worries about how difficult it will be for governments to repay their growing mountains of debt.

In the United States, longer-term Treasury yields are feeling added pressure from President Donald Trump’s attacks on the Federal Reserve for not cutting interest rates sooner. The fear is that a less independent Fed will be less likely to make the unpopular decisions needed to keep inflation under control, such as keeping short-term interest rates higher than investors would like.

Tuesday was also the first opportunity for trading in the U.S. Treasury market after a federal appeals court ruled that Trump overstepped his legal authority when announcing sweeping tariffs on almost every country on Earth, though it left the tariffs in place for now. While the tariffs have created confusion and may have hurt the U.S. job market, they also have brought in revenue that could help the U.S. government pay some of its debt.

In another signal about increasing worries in financial markets, the price of gold rose 1.1 per cent and was near its record. The metal has often provided a haven for investors in times of uncertainty.

Treasury yields did trim their gains a bit after a report said U.S. manufacturing contracted by more last month than economists expected. Many companies told the Institute for Supply Management’s survey that tariffs are continuing to make conditions chaotic.

“Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy,” said one company in the chemical products industry said, while noting that orders across most product lines have weakened.

The worse-than-expected report could give the Federal Reserve more leeway to cut its main interest rate for the first time this year at its next meeting in a couple of weeks. That in turn helped stock prices trim their losses.

On Wall Street, Constellation Brands tumbled 6.8 per cent after the beer, wine and spirits company warned that it’s seen a slowdown in purchases of its high-end beers, particularly among its Hispanic customers. That pushed it to slash its forecast for profit this fiscal year.

Kraft Heinz fell 3.5 per cent after announcing that it’s splitting into two, a decade after a merger of the brands created one of the biggest food companies on the planet.

One of the companies will include shelf stable meals and include brands such as Heinz, Philadelphia cream cheese and Kraft Mac & Cheese. The other will include the Oscar Mayer, Kraft Singles and Lunchables brands. The official names of the two companies will be released later.

Among the market’s few gainers was PepsiCo, which rose 2.9 per cent after an investment firm said it sent suggestions to the company’s board to reaccelerate its growth and boost financial performance. The investor, Elliott Management, has a history of buying into companies and then pushing for big changes that can lead to better stock performance.

In stock markets abroad, indexes slumped across Europe, with Germany’s DAX losing 1.7 per cent. That was after a more mixed finish in Asia, where indexes rose 0.9 per cent in Seoul but fell 0.5 per cent in Hong Kong.

President Donald Trump said India has offered to cut its tariff rates following the US imposition last week of 50% levies as punishment for its purchases of Russian oil.“They have now offered to cut their Tariffs to nothing, but it’s getting late. They should have done so years ago,” Trump said in a Truth Social post Monday. It wasn’t clear when the offer was made, or whether the White House plans to reopen trade talks with India.

The new US tariffs doubled the existing 25% duty on Indian exports. The levies hit more than 55% of goods shipped to the US — India’s biggest market — and hurt labour-intensive industries like textiles and jewellery the most. Key exports like electronics and pharmaceuticals are exempt, sparing Apple Inc’s massive new factory investments in India for now.The tariffs have stunned Indian officials and follow months of trade talks between New Delhi and Washington. India was among the first countries to open trade talks with the Trump administration, but its own high tariffs and protectionist policies in sectors such as agriculture and dairy have frustrated US negotiators.

India’s Ministry of External Affairs did not respond to a request for comment outside regular office hours and the White House didn’t immediately respond to requests for comment. The US Trade Representative’s Office also didn’t immediately respond.As part of its trade negotiations, India had expressed willingness to offer zero tariffs on some goods like auto components and pharmaceuticals, while barriers on sectors like agriculture and dairy remained red lines it wouldn’t breach, Bloomberg News has reported earlier.

India has also made several moves to satisfy Trump’s grievances this year, including overhauling its tariff regime to reduce import duties on prominent American goods like bourbon whiskey and high-end motorcycles made by Harley-Davidson Inc.But Trump has grown frustrated with India for buying Russian oil, which he said helps fund President Vladimir Putin’s war in Ukraine.

Indian Prime Minister Narendra Modi and Putin met in China, signalling that New Delhi’s ties with Moscow remain firm despite the relentless pressure from the Trump administration. Modi declared Monday that India and Russia share a “special” relationship.Modi has also taken steps to mend ties with China. He held talks with Chinese President Xi Jinping in Tianjin on Sunday at a regional security and economic summit, with both sides pledging to be partners, not rivals. They discussed border issues, resuming direct flights and increasing trade, according to official readouts.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up