Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

We expect a hawkish hold by the Bank of Canada today, but pressure on policymakers to hike has risen and it's admittedly rather a close call. We don't think it's a make-or-break event for CAD – but we should keep an eye on the implications of a hike for the broader market and the dollar.

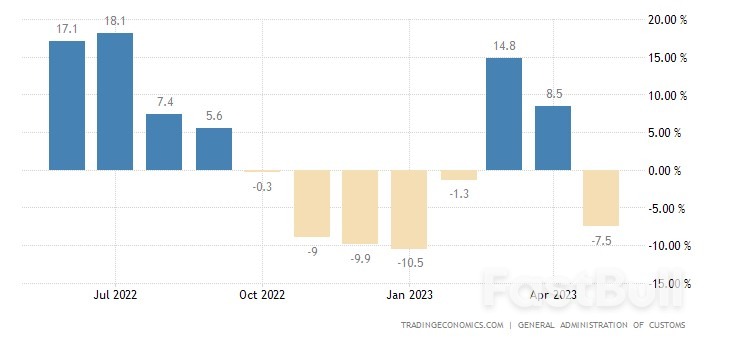

China's trade surplus for May 2023 contracted to USD 65.81 billion, marking a significant decline from USD 78.40 billion recorded during the corresponding period last year. The latest surplus figure fell short of market forecasts of USD 92 billion and represents the smallest surplus recorded since February. The narrowing trade surplus can be attributed to a sharper decline in exports compared to imports, a trend directly influenced by weak global demand.

China's trade surplus for May 2023 contracted to USD 65.81 billion, marking a significant decline from USD 78.40 billion recorded during the corresponding period last year. The latest surplus figure fell short of market forecasts of USD 92 billion and represents the smallest surplus recorded since February. The narrowing trade surplus can be attributed to a sharper decline in exports compared to imports, a trend directly influenced by weak global demand. Imports into China displayed resilience in May 2023, falling by 4.5% year-on-year to USD 217.69 billion. While this decline continues the downward trend in purchases for the third consecutive month, it is worth noting that the drop was less severe than market estimates, which had projected an 8.0% decrease. In April, imports had experienced a 7.9% plunge.

Imports into China displayed resilience in May 2023, falling by 4.5% year-on-year to USD 217.69 billion. While this decline continues the downward trend in purchases for the third consecutive month, it is worth noting that the drop was less severe than market estimates, which had projected an 8.0% decrease. In April, imports had experienced a 7.9% plunge. In Asia, at the time of writing, Nikkei is down -1.00%. Hong Kong HSI is up 0.97%. China Shanghai SSE is up 0.02%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is down -0.0054 at 0.418. Overnight, DOW rose 0.03%. S&P 500 rose 0.24%. NASDAQ rose 0.36%. 10-year yield rose 0.006 to 3.699.

In Asia, at the time of writing, Nikkei is down -1.00%. Hong Kong HSI is up 0.97%. China Shanghai SSE is up 0.02%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is down -0.0054 at 0.418. Overnight, DOW rose 0.03%. S&P 500 rose 0.24%. NASDAQ rose 0.36%. 10-year yield rose 0.006 to 3.699.

Elsewhere

Elsewhere

Source: ActionForex.com

Source: ActionForex.com The GBPAUD pair has recently experienced a significant decline following its encounter with a monthly horizontal resistance level. Moreover, the break of a rising trend line has further strengthened the bearish bias in the market. However, a potential bullish correction may be on the horizon as the price approaches a robust horizontal support zone. This article will delve into the current market conditions surrounding GBPAUD, taking into account the 61.8% Fibonacci zone, the broken channel, and the 20 EMA, and discuss the impact of Australia's unexpected interest rate hike and weaker-than-expected GDP figures on the Australian dollar.

The GBPAUD pair has recently experienced a significant decline following its encounter with a monthly horizontal resistance level. Moreover, the break of a rising trend line has further strengthened the bearish bias in the market. However, a potential bullish correction may be on the horizon as the price approaches a robust horizontal support zone. This article will delve into the current market conditions surrounding GBPAUD, taking into account the 61.8% Fibonacci zone, the broken channel, and the 20 EMA, and discuss the impact of Australia's unexpected interest rate hike and weaker-than-expected GDP figures on the Australian dollar. Thanks to $5 trillion in fiscal support doled out by the White House since 2020, U.S. citizens' excess savings grew even bigger. They peaked at around $2.1 trillion – around 9% of GDP – in August 2021, according to a recent study by the Federal Reserve Bank of San Francisco. Americans' response to the federal injection of cash was unlike anything seen in previous periods of economic hardship. Instead of nibbling away at their savings slowly, like they had done in every recession since the 1970s, U.S. consumers hit the malls, online shopping sites and the beach as soon as lockdowns eased. In less than two years, they have spent $1.6 trillion of their excess savings, the San Francisco Fed estimates.

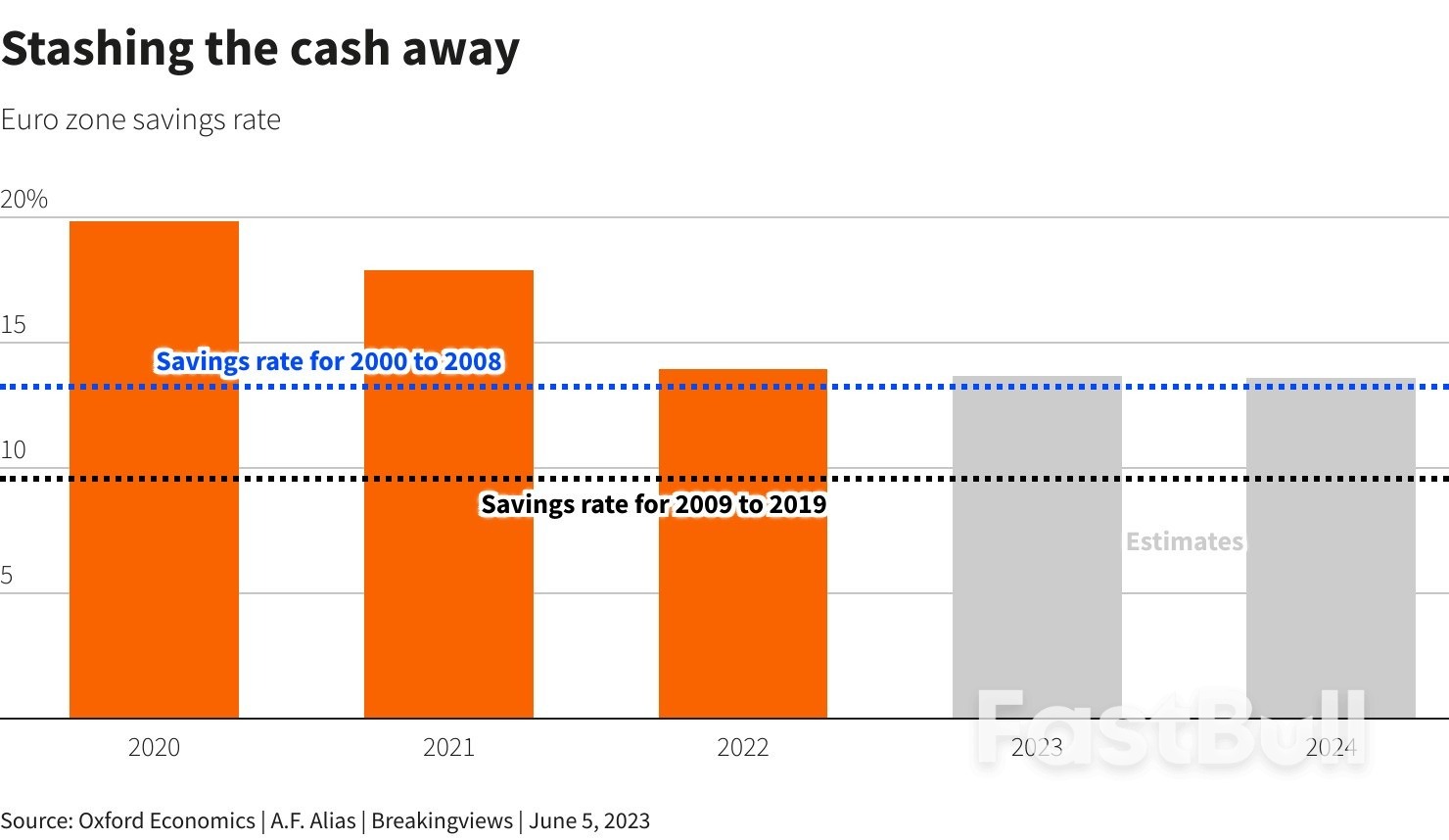

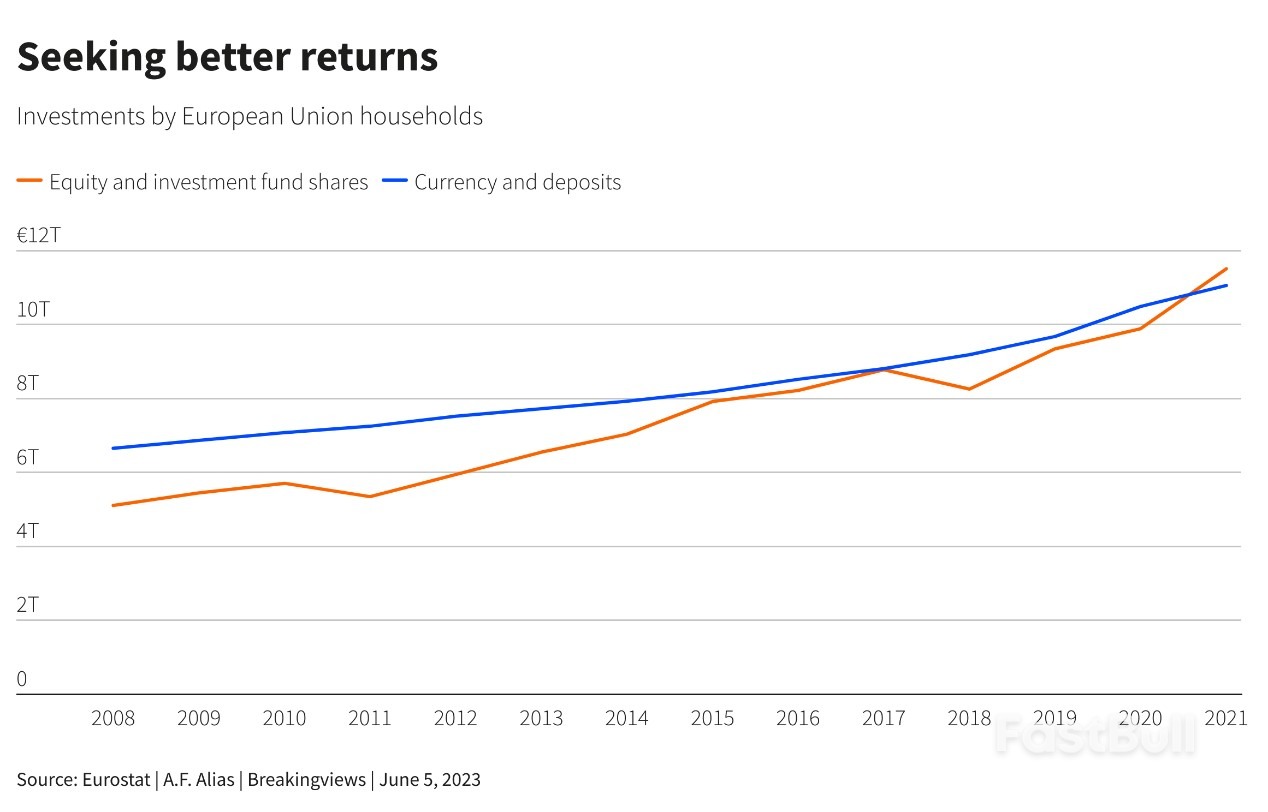

Thanks to $5 trillion in fiscal support doled out by the White House since 2020, U.S. citizens' excess savings grew even bigger. They peaked at around $2.1 trillion – around 9% of GDP – in August 2021, according to a recent study by the Federal Reserve Bank of San Francisco. Americans' response to the federal injection of cash was unlike anything seen in previous periods of economic hardship. Instead of nibbling away at their savings slowly, like they had done in every recession since the 1970s, U.S. consumers hit the malls, online shopping sites and the beach as soon as lockdowns eased. In less than two years, they have spent $1.6 trillion of their excess savings, the San Francisco Fed estimates. Such parsimony is welcome news for ECB President Christine Lagarde. She has raised the cost of money by 375 basis points since July 2022, taking the deposit rate from negative to 3.25%. Yet inflation still rose at an annual rate of 6.1% in May, more than three times the ECB's 2% target. Less spending by consumers should pave the way for lower prices, especially for services, where inflation has been accelerating since last year, rising from an annualised 3.5% in May 2022 to 5% last month.

Such parsimony is welcome news for ECB President Christine Lagarde. She has raised the cost of money by 375 basis points since July 2022, taking the deposit rate from negative to 3.25%. Yet inflation still rose at an annual rate of 6.1% in May, more than three times the ECB's 2% target. Less spending by consumers should pave the way for lower prices, especially for services, where inflation has been accelerating since last year, rising from an annualised 3.5% in May 2022 to 5% last month.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up