Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

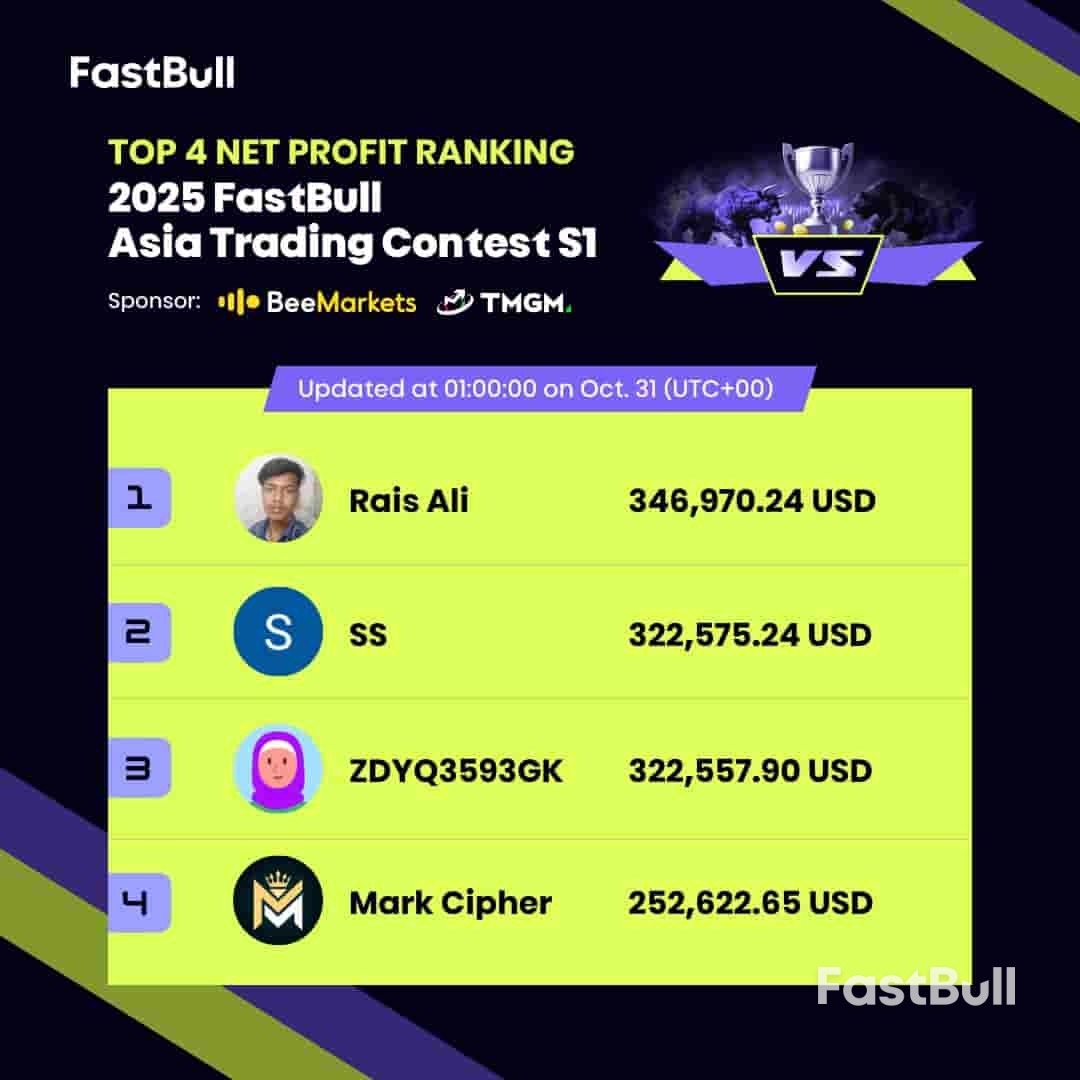

Top traders from around the world are battling fiercely on the FastBull platform, where every move could change the leaderboard!

The Indian central bank's short dollar book in the offshore derivatives market climbed in September for the first time in seven months, reflecting its efforts to stem the rupee losses.

The Reserve Bank of India's net short forward position — the amount of dollars it has agreed to sell in the future at a predetermined price — rose by $6 billion to $59.4 billion, according to Bloomberg calculations based on the central bank data.

The RBI's intervention isn't limited to forwards — it has also been selling dollars in the onshore market to support the rupee, traders said Monday. The currency hit a record low of 88.8050 per dollar in September, weighed by punitive US tariffs, and remains Asia's worst performer this year even as a gauge of the dollar eased, lifting most regional peers.

The rise in the forwards book "shows the RBI doesn't want speculative positions to develop when nothing fundamentally has changed for the currency," said Dhiraj Nim, currency strategist at Australia and New Zealand Banking Group in Mumbai. He expects the central bank to allow a "controlled, gradual depreciation" going forward.

Bloomberg News reported in early October that the RBI has ramped up its presence in offshore markets — a reversal after months of scaling back such activity.

The central bank's actions signal it will allow some currency flexibility but will step in when needed to crush any speculative bets, traders said last month.

Meanwhile, Deputy Governor Poonam Gupta said last week that the RBI does not view a weak exchange rate as a policy tool to gain competitiveness amid global trade tensions.

The RBI's net short position in maturities of up to one month rose to $16.5 billion in September, as against $5.9 billion in the previous month, according to central bank data. The rupee traded steady at 88.79 per dollar on Monday.

QatarEnergy has awarded Samsung C&T Corp the engineering, procurement and construction contract for a carbon capture and storage (CCS) project that will serve existing natural gas liquefaction facilities in Ras Laffan Industrial City.

"The new project will capture and sequester up to 4.1 million tons of CO2 per annum, making it one of the world's largest of its kind and placing Qatar at the forefront of global large-scale carbon capture deployment, reinforcing its leadership role in providing responsible and sustainable energy", state-owned integrated energy company QatarEnergy said in a press release.

It said it had "launched" its first CCS project, with a capacity of 2.2 million metric tons per annum (MTPA), in 2019.

"Two other ongoing CCS projects will serve the North Field East and North Field South expansion projects, capturing and storing 2.1 MTPA and 1.2 MTPA of CO2 respectively", QatarEnergy added.

QatarEnergy president and chief executive Saad Sherida Al-Kaabi, who is also Qatar's energy minister, said, "All our LNG expansion projects will deploy CCS technologies, with an aim to capture over 11 MTPA of CO2 by 2035."

QatarEnergy aims to double its liquefied natural gas (LNG) production capacity to 160 MMtpa through the North Field expansion projects in Qatar and Golden Pass LNG in Texas.

The United States project will begin production by year-end, Al-Kaabi told the World Gas Conference in Beijing earlier this year.

The first liquefaction train from the North Field east expansion project will start production by mid-2026. "As for North Field West, it is in the engineering phase and will be going into the construction phase somewhere in 2027", Al-Kaabi said then.

"QatarEnergy will be the largest single LNG exporter as a company while Qatar, as a country, will be the second-largest exporter of LNG after the United States for a very long time", Al-Kaabi added.

In a separate project, QatarEnergy also contracted Samsung C&T Corp to build the 2,000-megawatt (MW) Dukhan solar power plant, which would more than double the Gulf state's solar generation capacity.

QatarEnergy expects the two-phase project to start up 1,000 MW by 2028. The second phase is expected to be completed mid-2029, according to a statement by QatarEnergy September 16.

"When completed, the Dukhan solar power plant along with Al-Kharsaah, Mesaieed, Ras Laffan solar power plants will help reduce carbon dioxide emissions by about 4.7 million tons annually, while contributing up to 30 percent of Qatar's total peak electricity demand", said Al-Kaabi.

The plant will rise about 80 kilometers (49.71 miles) west of Doha, QatarEnergy said.

The Dutch manufacturing sector continued to expand in October, but at a slower pace than the previous month, according to the latest Nevi Netherlands Manufacturing PMI data released Monday.

The headline PMI fell to 51.8 in October from September's 38-month high of 53.7, indicating a modest improvement in manufacturing conditions but with reduced momentum across all five PMI components.

New orders remained the main growth driver despite slowing from September's recent peak. The sector benefited from renewed expansion in export orders, with increased interest from customers in Europe and the Asia-Pacific region.

Manufacturing output continued its expansion that began in March, growing at a rate broadly in line with the series average. Companies increased their purchasing quantities at the strongest rate in over three years, partly in response to supply chain disruptions.

Suppliers' delivery times lengthened again in October due to shortages, capacity pressures, and delays at ports and shipping routes caused by strikes. Pre-production inventories decreased slightly as firms worked to optimize stock levels.

On the pricing front, input costs rose only slightly, with higher food, energy, wage and raw material costs cited as the main drivers. Only the investment goods segment reported increased input costs. Despite this, firms raised their selling prices at a moderate rate across all manufacturing sub-sectors, with both input cost and charge inflation receding to one-year lows.

Employment fell for the first time since May amid reduced backlogs of work. Companies attributed lower headcounts to voluntary departures, restructuring, and cuts to temporary staff.

Albert Jan Swart, Manufacturing Sector Economist at ABN AMRO, noted a dichotomy in Dutch industry, with high-tech production improving while energy-intensive sectors face pressure. He highlighted that three chemical factories in Chemelot near Geleen are closing, following earlier factory closures in the Rotterdam region.

Manufacturer confidence about the year ahead remained positive but subdued compared to historical averages, with 42% of firms expressing optimism based on new client wins and plans to expand product offerings and capacity.

Pakistan's manufacturing sector showed signs of improvement in October, with the HBL Pakistan Manufacturing PMI rising to 49.6 from 48.0 in September, though it remained below the 50.0 neutral threshold for the second consecutive month.

The latest data indicated only a fractional deterioration in the health of the sector, as manufacturing production continued to decline but at a softer pace than in September. This marked the first instance of back-to-back output contractions in the survey's history, which began in May 2024.

New orders decreased for the sixth consecutive month, though the rate of decline eased from September. Manufacturers cited several factors hindering demand, including inflation, taxation, electricity load shedding, and subdued client confidence. New export orders fell for the fourth straight month.

The survey revealed a record depletion in backlogs of work, with the rate of reduction accelerating from September to the most prominent level in the 18-month series history. This excess capacity led firms to reduce headcounts for the fifth consecutive month.

Input costs continued to rise markedly in October, though at a slightly slower pace than in September. Respondents attributed the increase to higher raw material prices and tax burdens. In response, manufacturers raised their output prices at the fastest rate in three months to protect margins.

Purchasing activity decreased for the second month in a row, with the latest decline being the steepest in the survey's history. Stocks of finished goods fell for the fifth time in six months as some firms favored using existing inventories to complete orders rather than expanding production.

Despite these challenges, manufacturers maintained an optimistic outlook for output growth over the next 12 months, supported by expectations of easing cost pressures and planned business expansion. However, the degree of confidence declined for the fourth consecutive month as firms expressed concerns about how quickly inflationary pressures might ease.

Humaira Qamar, Head of Equities & Research at HBL, noted that while the Large-scale Manufacturing Index improved by 4.4% in the first two months of fiscal year 2026, the latest PMI reading suggests emerging headwinds in the near term.

She added that "green shoots in the manufacturing economy are likely to reemerge, supported by strong business confidence and a gradual strengthening of demand-side conditions."

If you're wondering can you transfer Bitcoin to Picnic wallet account, this guide will walk you through the essentials. From understanding Picnic’s wallet features to exploring supported networks, fees, and transaction times, we cover everything you need to know to make your Bitcoin transfer secure and efficient.

Picnic Wallet is a digital wallet platform designed for managing, storing, and transferring cryptocurrencies with ease. It enables users to create a wallet in minutes, receive or send Bitcoin and other assets, and monitor transactions through an intuitive interface. Unlike some custodial wallets, Picnic gives users greater control over their digital assets, resembling a self custody crypto wallet in design and accessibility.

The wallet supports on-chain and Lightning Network transactions, offering users flexible options for how to transfer bitcoins to wallet addresses. Its modern interface allows both beginners and experienced traders to handle their funds conveniently while maintaining security. For those transitioning to self-custody wallets, Picnic presents a simplified alternative without overwhelming technical requirements.

Picnic’s hybrid approach—combining convenience with self-control—makes it appealing for users seeking to move their assets safely. Whether you are learning how to transfer crypto to wallet platforms or exploring decentralized solutions, Picnic Wallet bridges accessibility and ownership.

Yes, you can transfer Bitcoin to the Picnic Wallet account, but understanding how the process works is essential before sending funds. Picnic supports both on-chain and Lightning transactions, giving flexibility depending on your preferred method. When learning how do i move crypto from exchange to wallet setups like Picnic, it’s vital to double-check address formats and network types to avoid transaction errors.

| Transfer Type | Description | Average Speed | Use Case |

|---|---|---|---|

| On-Chain Transfer | Standard Bitcoin network transfer confirmed through blockchain miners. | 10–60 minutes | For larger transactions or long-term storage. |

| Lightning Network | Off-chain, instant transactions for small or frequent payments. | Seconds | For daily use or quick peer-to-peer transfers. |

Knowing how to move crypto to wallet services like Picnic ensures a smooth process and helps avoid mistakes that could result in lost funds. For users transitioning to self-custody wallets, Picnic offers an accessible, secure bridge between exchange-based holdings and independent asset control.

Transferring Bitcoin to your Picnic Wallet is a straightforward process, but it requires attention to detail to ensure your funds arrive safely. The steps below outline how to transfer bitcoins to wallet accounts like Picnic, suitable for both beginners and users transitioning to self-custody wallets.

Open the Picnic Wallet app or website and sign in to your account. Navigate to the “Receive” section to generate your Bitcoin receiving address. This is the address you will use when sending funds from an exchange or another wallet.

Once your address appears, copy it carefully. Each wallet generates unique Bitcoin addresses, so confirm the entire string before proceeding. Copy-paste errors are common when learning how to move crypto to wallet platforms, so always double-check.

On your exchange, locate the withdrawal or send option. If you’re exploring how do i move crypto from exchange to wallet applications, this step is key. Paste your Picnic Wallet address, choose the network type (on-chain or Lightning), and enter the amount you wish to send.

Review transaction details carefully, including fees and network selection. Once verified, confirm and initiate the transfer. Depending on the network type, your Bitcoin may take anywhere from seconds (Lightning) to about an hour (on-chain) to appear in your Picnic Wallet.

After the network confirms your transaction, your Bitcoin balance will update in Picnic Wallet. You can check the transaction history for confirmation. This process is typical when learning how to transfer crypto to wallet services across different ecosystems.

The overall process is simple, but maintaining precision ensures safety. For users interested in self custody crypto wallet management, Picnic provides a balanced entry point between accessibility and control.

Before moving Bitcoin to any wallet, understanding security and cost factors is crucial. Picnic Wallet incorporates industry-standard encryption and seed phrase recovery, aligning with practices used by established self custody crypto wallet systems. These measures ensure your funds remain protected even if your device is lost or compromised.

For investors transitioning to self-custody wallets, Picnic’s design provides familiar functionality while minimizing technical complexity. The platform’s structure blends convenience with a degree of independence, which appeals to users exploring how to transfer bitcoins to wallet systems securely.

| Transaction Type | Network Fee Range | Typical Confirmation Time | Recommended For |

|---|---|---|---|

| On-Chain Transfer | $1 – $5 (varies with network congestion) | 10 – 60 minutes | Larger or long-term transactions. |

| Lightning Network | Usually under $0.01 | Instant to a few seconds | Small, frequent payments or testing transfers. |

Understanding how to move crypto to wallet applications like Picnic can help avoid common pitfalls such as sending funds over the wrong network. Whether you’re learning how to transfer bitcoins to wallet setups or refining your crypto security habits, a balanced approach between cost, speed, and safety will deliver the best results.

You can transfer Bitcoin by copying your target wallet’s address, pasting it into your sending wallet, entering the amount, and confirming. Make sure the network type matches and double-check the address before submitting.

Yes, Picnic uses encryption, seed phrase recovery, and user-controlled keys to secure assets. However, users should still back up recovery phrases and verify addresses before every transaction.

Not directly. You first need to sell Bitcoin through an exchange or platform that supports withdrawals to a bank account. Picnic currently focuses on crypto transfers, not fiat conversions.

In summary, if you’re asking can you transfer Bitcoin to Picnic wallet account, the answer is yes. Picnic supports both on-chain and Lightning transfers, providing flexibility and security. By understanding its fees, safety measures, and proper transfer steps, users can move their Bitcoin confidently and manage assets effectively.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up