Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

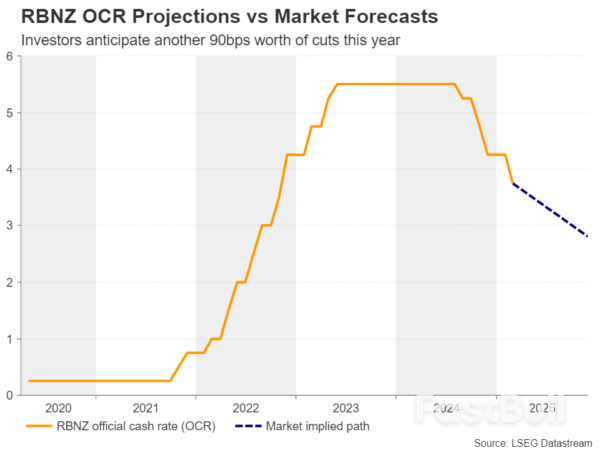

Dollar traders await US CPI data amid global trade turbulence.RBNZ to cut by 25bps, could maintain dovish stance.China’s CPI and PPI to reveal tariff impact on inflation.Strong UK GDP data could help the pound climb higher.

Today’s WTI prices are not sustainable for some US producers.

A perfect storm began to brew late Wednesday. First came President Trump’s broadside tariff blitz—blanket duties slapped on all U.S. trading partners, sparking fears of a global trade war. Yes, energy was exempt from the tariffs. Still, investors didn’t need much convincing. Stocks plunged on Thursday, recession talk started buzzing, and oil got hammered in the crossfire. Suddenly, the demand side of the oil equation is looking very shaky.

Then came the second punch: OPEC+. The cartel announced it would be adding three times the expected amount of supply starting in May. That’s not exactly what you want to hear when traders are already running scared over demand destruction.

Thursday ended up being a sharp one-day drop. Friday brought even more pain. Brent crude was down 7.01% at 12:10 pm in New York, while WTI sank to $61.73—well below the breakeven point for many U.S. shale producers—$65 on average, according to the Dallas Fed’s latest survey.

So, how long does this last? If tariffs stick around and slow the global economy, we could be looking at a “lower for longer” oil environment again—something the industry hasn’t had to contend with since COVID lockdowns.

But it’s not all gloom. Some analysts think these tariffs are more bark than bite—an opening gambit to strong-arm trade partners into concessions. If that’s the case, oil prices may rebound quickly. Until then, buckle up. Crude is suddenly in crisis mode, and the usual safety nets—OPEC+ cuts, Asian demand, U.S. shale restraint—aren’t doing the job.

Trump via his social media platform said today he spoke with Vietnam Communist Party leader To Lam, who promised to cut their tariffs to zero on US products. Under the plan Trump unveiled on 2 April, US imports from Vietnam will be subject to a 46pc tariff.

Trump late Thursday told reporters that a deal on tariffs is possible "if somebody said that we're going to give you something that's so phenomenal." He mentioned a possible deal with China over the sale of social platform TikTok, which is owned by Chinese company ByteDance. "We have a situation with Tiktok where China will probably say, we'll approve a deal, but will you do something on the tariff?", Trump said.

The Trump administration is forcing ByteDance to sell TikTok to a US company, but Beijing must approve the sale.

"The tariffs give us great power to negotiate," Trump said.

But China's commerce ministry today unveiled a 34pc tariff on all imports from the US from 10 April, and vowed that no exemptions will be granted, unlike in its previous round of tit-for-tat tariffs on US commodities.

Trump on 2 April announced a 10pc baseline tax on all foreign imports starting on 5 April, while many major US trading partners would be subject to an even higher tax beginning on 9 April. Imports from the EU would be subject to a 20pc tariff beginning on 9 April and imports from China subject to a 34pc tariff in addition to the previously imposed 20pc tariffs.

"CHINA PLAYED IT WRONG, THEY PANICKED - THE ONE THING THEY CANNOT AFFORD TO DO!", Trump said on social media after the announcement from Beijing.

Trump's executive order exempted energy commodities and many critical minerals from new tariffs, as well as trade already covered under the US Mexico Canada free trade agreement (USMCA).

But oil and stock markets continued to slide today as economists and investors concluded that the US tariffs and potential foreign counter-measures would lead to a protracted trade war and reduce economic growth globally.

The latest tariffs are likely to cut global growth rates by 0.5 percentage points and reduce US GDP growth by 1pc in 2025-26, analysts with investment bank Standard Chartered said in a note to clients today.

Federal Reserve chairman Jay Powell, speaking at a conference in Arlington, Virginia, today, warned that the latest bout of tariffs will lead to "higher inflation and slower growth." IMF executive director Kristalina Georgieva issued a similar warning on Thursday evening.

Trump retorted via his social media platform that "This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates."

What's next?

Despite touting possible deals to avoid high tariffs, Trump also said today that investors planning to move manufacturing to the US should expect no changes in his tariff policies.

Trump's cabinet also struggled to articulate what comes next, with commerce secretary Howard Lutnick saying that Trump would not lift the tariffs announced this week, while treasury secretary Scott Bessent said deals over tariff levels were possible.

Secretary of state Marco Rubio, speaking to reporters on a trip to Brussels, Belgium, said that "it's not fair to say that the economies are crashing — markets are crashing because markets are based on the stock value of companies who today are embedded in modes of production that are bad for the US.

"The markets will adjust business around the world, including in trade," Rubio said. "They just need to know what the rules are."

Federal Reserve chairman Jerome Powell said today tariff increases unveiled by US president Donald Trump will be "significantly larger" than expected, as will the expected economic fallout.

"The same is likely to be true of the economic effects, which will include higher inflation and slower growth," Powell said today at the Society for Advancing Business Editing and Writing's annual conference in Arlington, Virginia.

The central bank will continue to carefully monitor incoming data to assess the outlook and the balance of risks, he said.

"We're well positioned to wait for greater clarity before considering any adjustments to our policy stance," Powell added. "It is too soon to say what will be the appropriate path for monetary policy."

As of 1pm ET today, Fed funds futures markets are pricing in 29pc odds of a quarter point cut by the Federal Reserve at its next meeting in May and 99pc odds of at least a quarter point rate cut in June. Earlier in the day the June odds were at 100pc.

The Fed chairman spoke after trillions of dollars in value were wiped off stock markets around the world and crude prices plummeted following Trump's rollout of across-the-board tariffs earlier in the week.

Just before his appearance, Trump pressed Powell in a post on his social media platform to "STOP PLAYING POLITICS!" and cut interest rates without delay.

A closely-watched government report showed the US added a greater-than-expected 228,000 jobs in March, showing hiring was picking up last month.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up