Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

I gues Japan is now a bad guy too!

I gues Japan is now a bad guy too!

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

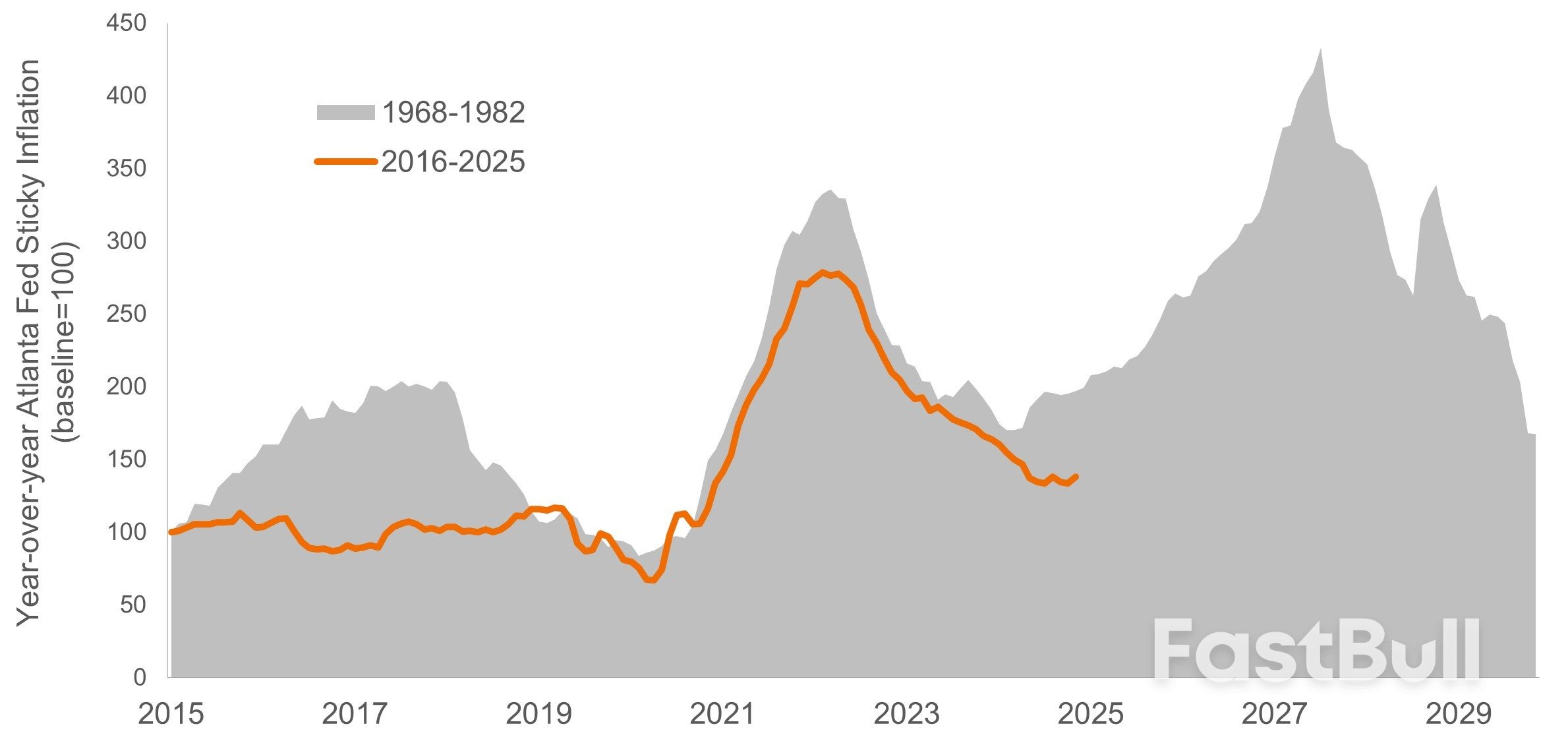

Ever since the federal funds rate reached 5.50% in response to generationally high inflation, we’ve expressed concern about the risk of policy error should the U.S. central bank blink by prematurely easing policy before the inflation threat is fully vanquished.

Euro zone government bond yields were set to break a three-day losing streak on Wednesday, taking cues from U.S. Treasuries, while traders continued to price in a 90% chance of a European Central Bank rate cut by March 2026.

U.S. yields fell sharply on Friday after weaker-than-expected jobs data triggered a strong dovish repricing of Federal Reserve monetary cycle. They edged higher on Tuesday, even as economic data pointed to stalling activity in the services sector.

Germany's 10-year bond yield (DE10YT=RR), the benchmark for the euro zone, rose 2.5 basis points (bps) to 2.65%.

Benchmark 10-year U.S. yieldwas up 4 bps at 4.24% in London trade.

The yield gap between U.S. and German 10-year government bonds (DE10US10=RR) was at 159 bops after hitting 153.3 last week, its lowest level since early April.

“A stalling U.S. economy should lead to further Treasury outperformance and a smaller growth differential between the US and the euro area,” said Reinout De Bock, rate strategist at UBS, adding that he has a 135 basis point target.

“What could also help the trade, is that the bar for a September cut by the ECB seems high.”

Money markets priced in an around 60% chance of a rate cut by year-end (EURESTECBM3X4=ICAP) and an 80% chance of the same move by March 2026 (EURESTECBM5X6=ICAP).

Traders are pricing in a 90% probability of a 25-bp rate cut by the Fed in September, and a total of 125 bps of easing by October 2026.

“Given the inflation backdrop the Fed is in a tough spot. More evidence of labour market weakness is required for a move, but I guess that is what markets will possibly bet on now,” said Chris Iggo, CIO at AXA Core Investments.

“I sense expectations have changed on the U.S. economy’s near-term outlook. Recession risks have increased.”

Germany's two-year yield (DE2YT=RR) rose 1.5 bps at 1.91%.

Italy’s 10-year yieldrose 3 bps to 3.48%, with the spread versus Bunds to 82.5 bps. It hit 81.44 on Tuesday, its lowest since April 2010.

Analysts argued that with the ECB easing cycle close to an end, the air for a further BTP-Bund spread compression will probably become thinner after the summer.

They recalled that some technical factors could also fade. Positive ratings kicked off the tightening, but declining volatility favouring carry trades and lower supply over the summer have helped to extend the rally.

Key Points:

Tom Lee, co-founder of Fundstrat Global Advisors, asserts Bitcoin is replacing gold and ending its four-year cycle, due to increasing institutional adoption and macroeconomic shifts.Lee's perspective suggests Bitcoin's growing legitimacy could transform global financial landscapes, potentially driving significant price appreciation, attracting investor interest, and impacting associated cryptocurrencies.

Lee cites Bitcoin's superior properties over gold, emphasizing its role in the financial market. Institutional interest is reportedly rising post-ETF approvals, driving a shift in Bitcoin's traditional boom-bust cycles, potentially altering its market dynamics.The forecast potentially impacts global markets, stirring interest among investors and policymakers. The demand and supply imbalance noted by Lee could drive up Bitcoin's value, affecting how governments and investors view cryptocurrency investments.

Financial implications include a prospective revaluation of Bitcoin's store of value, with the U.S. possibly integrating it into strategic reserves. Regulatory adaptations could bolster this shift, fostering comfort among institutional stakeholders and promoting further adoption.The potential growth of Bitcoin could affect related cryptocurrencies such as Ethereum and Solana. Lee anticipates significant price movements due to heightened institutional flows and network adoption patterns. The financial landscape may experience material shifts in asset valuation structures.

Historically, Bitcoin's four-year cycle has led to significant price upticks, but Lee predicts a new paradigm by 2025. As Bitcoin matures, backed by substantial institutional backing, it could surpass gold’s market cap, reshaping investment norms and asset management strategies. Lee remarked, "95% of all Bitcoin has been mined, but 95% of the world doesn't own Bitcoin. There's a huge demand versus supply imbalance."

The New Zealand dollar continues to have a quiet week. In the European session, NZD/USD is trading at 0.5923, up 0.37% on the day. The kiwi has been under pressure, falling 3.4% against the US dollar in July.

New Zealand’s employment report for Q2 was pretty much as expected, but the news wasn’t good. The unemployment rate rose to 5.2% from 5.1% in Q1, below the consensus of 5.3%. This marked the highest unemployment rate since Q3 2020. Employment Change declined by 0.1%, down from a 0.1% gain in Q1 and matching the consensus. This was the third decline in four quarters.

The weak figures point to growing slack in the labor market as the economy continues to struggle. Global trade tensions remain high and New Zealand’s export-reliant economy has taken a hit from softer global demand.

The Reserve Bank of New Zealand will be paying close attention to the weak job numbers, which support a rate cut in order to provide a boost to the economy. The RBNZ maintained rates in July after lowering rates at six consecutive meetings. The conditions for a rate cut at the Aug. 20 meeting seem ripe and the markets have priced in a quarter-point reduction at around 85%.

We’ll get an updated look at the inflation picture on Thursday. Inflation Expectations rose to 2.3% in the second quarter, the highest in a year. This is the final tier-1 release prior to the August rate meeting.

Three FOMC members will speak later today and investors will be hoping for some insights regarding the Federal Reserve’s rate plans. The Fed hasn’t lowered rates since December but is widely expected to hit the rate trigger at the September meeting.

Stock bulls have another reason to worry that the blistering rally in American equities may be about to cool.

The Bloomberg Intelligence Market Pulse Index pushed to a “manic” reading last month, a sign that investor exuberance may be running too hot. The measure combines six metrics like market breadth, volatility and leverage to deliver a reading on investor sentiment. When it gets into overheated territory, returns tend to weaken in the following three months.

The Pulse index’s rise comes after the S&P 500 rallied almost 30% from its April low even as the American economy and labor market have shown signs of weakening. Surveys of investor sentiment indicate bullishness is growing toward alarming levels among Americans. And just this week, Wall Street strategists issued a slew of warnings that equities could face a pullback.

“Risk taking in the stock market has gotten a bit overheated, so more muted returns may be in store in the next few months,” Michael Casper, senior US equity strategist at BI, said by phone. “But this doesn’t necessarily signal a major selloff is imminent. Sentiment could hover at these levels for awhile, which may lead to a bumpier path for stocks in the second half of the year.”

The S&P 500 notched its worst week since May last week before dip buyers stepped in to deliver its best one-day gain since that same month. The index slipped 0.5% Tuesday.

BI’s Pulse index hit 0.6 in July for the second straight month to push it into the “manic” zone. Over the past 30 years, the Russell 3000 Index — a crucial benchmark of the virtually the entire US stock market — has averaged just a 2.9% return over the next three months, according to data compiled by BI’s Casper and Gillian Wolff. When the gauge swings into what BI dubs “panic” territory, the Russell 3000 averages a 9% gain in the next 90 days.

The index signal jibes with recent warnings from a host of Wall Street strategists. Morgan Stanley’s Mike Wilson sees a correction of up to 10% this quarter, while Evercore’s Julian Emanuel is expecting a drop of up to 15%. A team at Deutsche Bank notes that a small drawdown in equities is overdue.

Added to bulls’ worries is seasonality. August and September have historically been the two worst months for the S&P 500. Friday’s jobs report showed the labor market cooling, while a private reading on the American services sector on Tuesday signaled a slowdown in output and an increase in price pressures — all while President Donald Trump pushes ahead with tariffs that are the highest since 1934.

The Pulse index has been a reliable harbinger of market performance in recent years. The readings hit “panic” levels ahead of the March 2023 regional banking crisis, the December 2018 tariff-induced slide and the 2012 European Union debt crisis.

Among the reasons for the latest “manic” reading were was the re-emergence of the meme frenzy in late July, with retail traders snapping up speculative stocks like Opendoor Technologies Inc. and Kohl’s Corp.

Of course, sentiment can stay frothy for weeks — even months — before stocks suffer a significant drop. It hit a manic reading during January 2021’s meme craze but hovered in that territory for over a year before the S&P 500 slumped into a bear market.

Perma-bull Ed Yardeni of eponymous firm Yardeni Research noted that not all signs are ominious. In the week through July 29, a ratio of bulls to bears identified in an Investors Intelligence survey of newsletter writers hovered at a ratio of 2.4, below a long-term average of 2.6 over the past decade, Yardeni Research analysis shows.

“In other words, sentiment wasn’t overly bullish,” Yardeni wrote in a note to clients on Sunday. “Rather than yet another correction this year, we are more likely to see seasonal choppiness.”

BI’s Market Pulse Index is based on six inputs: price breadth, pairwise correlation, low-volatility performance, defensive-versus-cyclical performance, high-versus-low leverage performance and high-yield spreads. The major difference last month was that high-yield spreads were manic in July, joining high versus low vol performance in that territory.

The Market Pulse Index ranges from 0 to 1, with the latter denoting periods of risk-on sentiment, or extreme “mania,” as BI defines it, while a level close to 0 shows a risk-off period of extreme “panic.” In July, the indicator rose to nearly 0.7 — approaching a mania stage.

Generally, two repeat readings above 0.6, like now, suggests there will be some mean-reversion activity in the equity market over the next three months, with small caps underperforming their larger counterparts, according to Casper. In fact, three months after a manic reading, the small cap Russell 2000 Index historically has underperformed the S&P 500 by 1.8% after such a figure.

“Stocks have come a long way in a short time and things seem stretched,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors, whose firm is neutral US equities and is snapping up dividend-payers like energy, financial and industrial shares. “We’re not chasing this rally or stepping on the gas pedal.”

Asian shares were mostly higher in muted trading Wednesday, after discouraging signs about the U.S. economy sent Wall Street shares declining.

Investors are sifting through a slew of corporate earnings reports to assess how businesses may have been affected by U.S. President Donald Trump’s tariffs.

Among Japanese companies, automakers Honda Motor Co. and Toyota Motor Corp. will report fiscal first quarter results this week, as will electronics and entertainment company Sony Corp.

Japan’s benchmark Nikkei 225 rose 0.6% to finish at 40,794.86. Australia’s S&P/ASX 200 added 0.8% to 8,843.70. South Korea’s Kospi was little changed, gaining less than 0.1% to 3,198.14.

Hong Kong’s Hang Seng rose 0.2% to 24,958.75, while the Shanghai Composite gained 0.8% to 3,633.99.

U.S. futures were up 0.5%.

On Tuesday, the S&P 500 fell 0.5% to 6,299.19, coming off a whipsaw stretch where it went from its worst day since May to its best since May. The Dow Jones Industrial Average dropped 0.1% to 44,111.74, and the Nasdaq composite fell 0.7% to 20,916.55.

A weaker-than-expected report on activity for U.S. businesses in services industries like transportation and retail added to worries that Trump’s tariffs may be hurting the economy. But conversely such indicators raise hopes the Federal Reserve may cut interest rates. That along with a stream of stronger-than-expected profit reports from U.S. companies helped to keep losses in check. The S&P 500 remains within 1.4% of its record.

The pressure is on companies to report bigger profits after the U.S. stock market surged to record after record from a low point in April. The big rally fueled criticism that the broad market had become too expensive.

For stock prices to look like better bargains, companies could produce bigger profits, or interest rates could fall. The latter may happen in September, when the Fed has its next policy meeting.

Expectations have built sharply for a rate cut at that meeting since a report on the U.S. job market on Friday came in much weaker than economists expected. Lower interest rates would make stocks look less expensive, while also giving the overall economy a boost. The potential downside is that they could push inflation higher.

Treasury yields sank sharply after Friday’s release of the jobs report, and they haven’t recovered. The yield on the 10-year Treasury eased to 4.19% from 4.22% late Monday and from 4.39% just before the release of the jobs report. That’s a significant move for the bond market.

In energy trading, benchmark U.S. crude rose 57 cents to $65.73 a barrel. Brent crude, the international standard, added 64 cents to $68.28 a barrel.

In currency trading, the U.S. dollar edged up to 147.66 Japanese yen from 147.61 yen. The euro cost $1.1575, down from $1.1579.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up