Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices are trading firmer this morning, with Brent up more than 1.1% at the time of writing, following additional attacks on Russian energy infrastructure over the weekend.

Oil prices are trading firmer this morning, with Brent up more than 1.1% at the time of writing, following additional attacks on Russian energy infrastructure over the weekend. The Caspian Pipeline Consortium (CPC) had to suspend loadings at its terminals after one of the moorings was damaged by Ukrainian attacks. The CPC terminal is located at Novorossiysk port in Russia, predominantly shipping Kazakhstan crude oil. It's been on the receiving end of several attacks recently. The latest incident saw Kazakhstan activate a plan to redirect exports. Shipments from the CPC terminal have averaged around 1.48m b/d so far this year, up roughly 200k b/d from last year, as the expansion of the Tengiz field in Kazakhstan supported exports.

Adding support to the market is increasing supply risks for Venezuelan crude oil after President Trump said he's considering closing the airspace over the nation. This escalation between the US and Venezuela has the US carrying out strikes on boats it claims are carrying drugs, while also building its military presence nearby. Venezuela exports around 800k b/d, of which most of the crude oil will head to China. Clearly, any further escalation puts this supply at risk.

OPEC+ met over the weekend. The group stuck to its policy of keeping output steady over the first quarter of next year "due to seasonality". This was largely expected. Meanwhile, the group will review the maximum sustainable production capacity of members, which will serve as a reference for 2027 production baselines. This could certainly lead to disagreement among members, with countries keen to secure higher baselines.

The latest positioning data shows that speculators cut their net long in ICE Brent by 57,430 lots over the last reporting week to 120,934 lots. The move was predominantly driven by fresh shorts entering the market, with the gross short growing by 39,404 lots week-on-week. Speculators also cut their net long in ICE gasoil for the first time since late October, reducing positions by 20,043 lots to a net long of 82,152 lots. Speculative selling in both crude and gasoil is likely driven by Russia-Ukraine peace plan talks.

Copper surged to a record high on Friday amid a volatile trading session after an hours-long halt on the Chicago Mercantile Exchange disrupted markets.

The renewed bullish momentum in copper follows an upbeat CESCO Week event in Shanghai, which reinforced expectations of tighter supply. Copper's rally this year has been fuelled by mine disruptions and distortions to trade flows amid Trump's tariffs. Copper is up around 27% this year.

Also, major copper smelters in China pledged to jointly cut intake of copper concentrate as falling processing fees squeezed margins. The China Copper Smelters Purchasing Team (CSPT), a group of 13 major smelters, will cut concentrate processing rates by more than 10% next year, according to Bloomberg.

China's copper smelters posted a succession of record production figures this year despite a tightening feedstock market and the government's campaign against industrial overcapacity and excessive competition. China's refined copper output has been strong despite low treatment and refining charges (TC/RC). These fees earned by smelters for processing ore into metal have plunged to record lows due to a shortage of raw materials amid rapid growth in China's smelting capacity. Spot charges have fallen as low as minus $60/t this year. Although similar pledges were made last year, they didn't result in significant reductions in refined copper output. This year, China has produced almost 10% more refined copper through October.

In its latest report, the International Cocoa Organisation (ICCO) estimates that total cocoa supply exceeded consumption by 49kt in the 2024/25 season that ended in September. This is smaller than the 142kt surplus projected in February. Meanwhile, the group reduced its global production estimates to 4.7mt for the 2024/25 season, down from its February outlook of 4.84mt. It lowered its grinding (a proxy for demand) projections to 4.6mt from 4.65mt for the season.

Export data from Ukraine's Agriculture Ministry shows that grain and legume exports in 2025/26 dropped to around 12.14mt as of 28 November, a year-on-year decline of 32%. Total corn shipments stood at 3.5mt (down 50% YoY), while wheat exports fell 17% YoY to 7.3mt. The Agriculture Ministry also reported that Ukraine's winter grain plantings are nearing completion, with farmers already planting 6.43m hectares of winter crops. That's 98% of the planned area, and slightly ahead of plantings at the same stage last year. These planting numbers include winter wheat, which was 4.7m hectares, up from 4.4m hectares at the same stage last year.

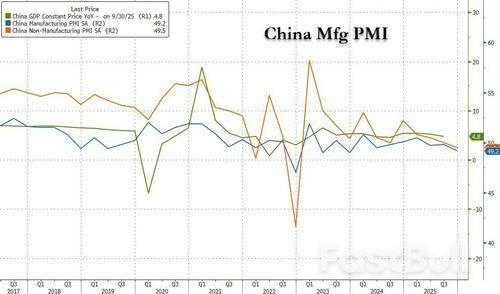

China's factory activity staged a slight improvement in November, but once again printed below the median estimate and extended its streak of declines to a record as the country's economic slowdown deepens.

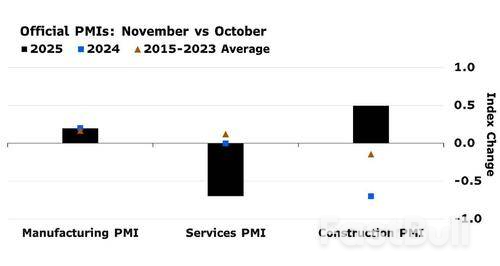

The official manufacturing PMI rose to 49.2 from 49.0 in October but remained below the 50 mark that separates growth and contraction for an eighth month. The median estimate of economists surveyed by Bloomberg was 49.4.

Adding insult to injury, the official non-manufacturing PMI fell to 49.5 from 50.1, below the 50.0 consensus forecast, and dropping into contraction for the first time since the economy reopened in 2023l it was driven by weakness in the real estate and residential services sectors.

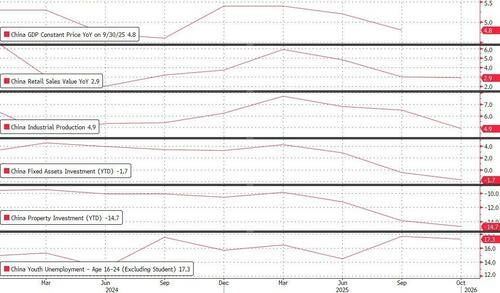

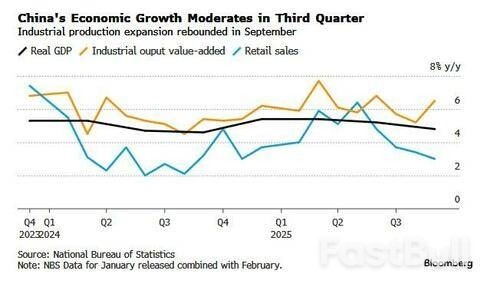

The readings offer a preliminary glimpse of how the world's second-biggest economy fared in November, after months of global trade turbulence and an unprecedented decline in investment. They suggest that GDP extended its decline and is now well below the 4.8% level Beijing pretends China is growing at. So far this quarter, industrial production had its smallest gain since the start of the year...

... while exports unexpectedly contracted, as global demand failed to offset the slump in shipments to the US.

According to Bloomberg Economics, the November PMI pointed to continuing broad economic weakness and hinted at a further down-drift in consumption. Services dropped sharply into contraction, a stark contrast to the flat reading in 2024 after the long October holiday. Manufacturing and construction also remained in contraction, despite a modest seasonal rebound.

The good news is that tensions with the US eased modestly after a temporary truce last month following a meeting in South Korea between Presidents Donald Trump and Xi Jinping. Even so, key details of the deal, including questions over Chinese shipments of rare earths, are still being negotiated, underscoring the fragility of the agreement. In fact, as reported here previously, there is still no actual rare earths agreement.

Meanwhile, a diplomatic spat with Japan in recent weeks has added to trade uncertainty, as China contemplates economic countermeasures.

Beyond geopolitical risks, weak domestic demand is still casting a pall over the outlook for Chinese factories. Growth in retail sales slowed for the fifth straight month in October, the longest such streak since the country shuttered shops because of the Covid pandemic more than four years ago.

As Bloomberg notes, the recent downswing in the economy doesn't mean that additional stimulus measures are on the table. Chinese policymakers are in no rush to act now that their annual growth target of around 5% for this year looks to be within reach. Meanwhile, China's credit growth - previously the envy of the western world - has slowed to a trickle as the demand simply isn't there, as Beijing is scared to making China's massive debt bubble even bigger.

China already injected additional stimulus worth 1 trillion yuan ($141 billion) since late September, including unused bond quota for provinces to expand investment and repay arrears owed to companies, as well as new funding for policy banks to spur investment. That, however, has not been enough, as we reported recently in "China Prepares New Property Stimulus Package As Housing Crisis Enters Year Six."

Looking at the next five years, Beijing has made clear it plans to keep tech and manufacturing as the top priorities even as it pledged to "significantly" boost the share of consumption in its economy. Net exports contributed nearly a third of China's growth this year.

China's economic growth decelerated last quarter to the slowest pace in a year. Analysts see a further slowdown, forecasting the weakest this quarter since the final three months of 2022, when the nation was nearing the end of its Covid Zero lockdowns.

Severe weather across parts of Asia has claimed nearly 1,000 lives, with Indonesia and Sri Lanka among the worst affected by heavy rainfall, flooding and landslides.

Three tropical cyclones, coinciding with the northeast monsoon which typically brings heavy downpours to Southeast Asia this time of year, have caused widespread destruction in the region. Peninsular Malaysia and southern Thailand have also received significantly above-normal rains in the past week, according to data from the US Climate Prediction Center.

In Indonesia's Sumatra island, the intense storm activity has left at least 442 people dead and another 402 missing, while Thailand's latest death toll stands at 169. Storm Senyar, which circled the Strait of Malacca last week, has now dissipated over the South China Sea, according to the Hong Kong Observatory.

In Sri Lanka, fatalities from heavy flooding rose sharply on Sunday, almost doubling to 334 dead and another 370 missing. Cyclone Ditwah, which came ashore in the island nation on Friday, is forecast to bring heavy rains to some parts of southern India on Monday, according to forecasts.

Meanwhile, Storm Koto is forecast to linger in the waters east of Vietnam as it gradually weakens over the next few days. It will likely bring more rains to central and northern-central Vietnam, which have already been pounded by storms and historic floods that have racked up at least $3 billion in losses in recent weeks.

The dollar began December on the back foot, as investors braced for a pivotal month that could bring the Federal Reserve's final rate cut of the year and the confirmation of a dovish successor to Chair Jerome Powell.

In Asia, eyes were on a speech by Bank of Japan (BOJ) Governor Kazuo Ueda for clues on whether the central bank could deliver a rate hike later this month to stem a slide in the yen.

After an hours-long outage at the world's largest exchange operator CME Group last week which upended trading across stocks, bonds, commodities and currencies, the foreign exchange market was back in full swing on Monday, though moves were largely muted as traders awaited key data releases and events scattered throughout the month.

The yen extended gains from earlier in the session on data which showed Japanese corporate spending on factories and equipment rose 2.9% in July-September versus the same period in the previous year, signalling the world's fourth-largest economy was weathering the impact of U.S. tariffs quite well.

The Japanese currency was last 0.2% higher at 155.84 per dollar, away from its 10-month trough of 157.90 hit last month that left traders alert to the risk of a yen-buying intervention from Tokyo.

Finance Minister Satsuki Katayama said on Sunday that recent erratic swings in the foreign exchange market and rapid yen weakening are "clearly not driven by fundamentals".

"I'll definitely be closely watching his speech today, because Ueda has a great opportunity to provide a guide to financial markets over the near-term BOJ policy outlook," said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

"Given recent communication by officials and the sharp weakening of the Japanese yen, Governor Ueda could well use his speech to signal a rate hike later this month. It is our base case that he will provide stronger guidance to markets about an imminent hike."

A broad pullback in the dollar over the past few sessions has given some reprieve to the yen, though the Japanese currency remains just 0.9% stronger for the year and continues to languish near milestone lows against the euro and sterling.

In other currencies, the euro rose slightly against a weaker dollar, up 0.02% to $1.1600.

Sterling was little changed at $1.3240, having clocked its best week in over three months on Friday in a sign of relief among investors after British Finance Minister Rachel Reeves revealed her long-awaited budget.

Still, the main focus for investors was on the outlook for U.S. rates, with markets now pricing in an 87% chance the Fed will cut by 25 basis points when it meets next week, according to the CME FedWatch tool.

The sharp repricing of Fed easing expectations and a report that White House economic adviser Kevin Hassett has emerged as the frontrunner to be the next Fed chair have dragged on the dollar, which on Friday clocked its worst week in four months.

U.S. Treasury Secretary Scott Bessent said there was a good chance President Donald Trump would announce his pick before Christmas.

The greenback was struggling to recoup losses against a basket of currencies on Monday and eased slightly to 99.42.

The Australian dollar eased 0.08% to $0.6543, while the New Zealand dollar was down 0.09% to $0.5733.

"With December FOMC now closer to fully pricing a 25bp cut, we think the market will increasingly focus on the pricing of subsequent meetings," said economists at Goldman Sachs in a note.

"Division on the committee is restraining more dovish pricing, but with a large amount of labor market data due before the January meeting we think too little is priced in Q1."

November's U.S. employment report will be released on December 16, after the Fed's policy meeting this month, and will include October nonfarm payrolls.

There will be no unemployment rate for October as the longest shutdown in history prevented the collection of the household survey data.

Elsewhere, bitcoin was down 3.6% to $87,881.82, while ether fell 5% to $2,871.59.

South Korea's exports remained solid in November, buoyed by robust demand for semiconductors and autos, offering reassurance for policymakers as they navigate a wave of global protectionism.

Shipments adjusted for working-day differences climbed 13.3% in November from a year earlier, after a 14% gain in the previous month, according to data released Monday by the customs office. Headline exports climbed 8.4%, following a revised 3.5% increase in October. Imports rose 1.2%, resulting in a trade surplus of $9.7 billion.

Semiconductor exports continued to lead the momentum, climbing almost 39% amid sustained appetite for artificial intelligence and data center demand. Automobiles also rebounded with a nearly 14% gain, more than offsetting the drag from sectors including petrochemicals.

The upbeat trade report comes days after the Bank of Korea kept its benchmark rate steady at 2.5% and tweaked its statement to indicate it's not quite as tilted toward further rate cuts as it has been until now. Governor Rhee Chang Yong said the board is evenly split on the outlook, with three members open to further easing and the other three expecting to stand pat in the near term. The central bank slightly upgraded growth and inflation forecasts through 2026.

Alongside the rate decision, the BOK raised its 2026 growth outlook to 1.8% from 1.6% projected in August and lifted its 2025 estimate to 1%, reflecting solid third-quarter output supported by strong chip exports and a steady recovery in private consumption.

South Korea and the US finalized a landmark agreement last month to cap US tariffs on imports of Korean goods at 15%. The deal includes cars that were previously subject to a 25% levy. Seoul expects the auto rate to be retroactively reduced starting Nov. 1 as the country's ruling party proposed a special bill to implement its $350 billion investment pledges last week.

Rhee said outbound shipments and firms' equipment investment will outperform expectations, supported by the global semiconductor upcycle and the recent trade accord breakthrough with Washington.

By destination, shipments to the US dipped 0.2% as sectors such as steel and auto parts weakened due to the American levies, while exports to China rose 6.9%. Shipments to the Middle East jumped about 33%, and those to Southeast Asia gained 6.3%.

With exports equivalent to more than 40% of the country's GDP, the continued strength may give the BOK room to stay patient with policy as it monitors domestic risks including rising household debt levels and elevated property prices.

At first glance the decision by OPEC+ to leave oil output levels unchanged for the first quarter of next year could be viewed as confirmation the exporter group is concerned about a looming crude supply glut.

It was widely expected that the eight members of OPEC+ undertaking voluntary oil output cuts would stick to their plan of leaving production levels unchanged for the first three months of next year.

It was also no surprise that the group reiterated their commitment to market stability amid a "steady global economic outlook and current healthy oil market fundamentals as reflected in low inventories."

The language used in the brief statement after the meeting on Sunday was familiar, but so are the issues around OPEC+'s view that the oil market is in a good place.

The market consensus is that the global oil market is facing a series of issues, some of which are pulling prices in different directions.

An example of this is the conundrum of how to view the ongoing conflict in Ukraine and the moves to reach a peace agreement, which in theory will allow for a full return to the market of Russian crude and refined products.

There is the reality that Western sanctions are starting to tighten parts of the global crude and product markets.

Much of the expected glut of crude is from sanctioned exporters Russia, Iran and Venezuela.

It's also likely that much of this oil is currently being stored on vessels at sea, with data from commodity analysts Kpler showing a surge in what is termed oil on water to just under 250 million barrels, up some 215 million barrels since September.

This means that while the crude oil may be physically present, it's not necessarily available to be purchased and refined.

There is some hope that China's release of additional crude import quotas last week will allow for some Iranian and Russian cargoes to go to the world's biggest oil importer.

But even if this does happen, it does little to relieve tight product markets unless Chinese refiners also substantially increase their exports of refined fuels, and buyers are prepared to take these products amid concerns they may have been produced from sanctioned crude.

There are expectations among product traders in Asia that China will lift fuel exports in December as many of the refiners have unused product quotas, but it still remains to be seen how many additional shipments of fuels such as diesel and gasoline will be offered to the market.

Another question is whether there will be enough extra fuel exported from China and also from other North Asian refiners, such as Japan and South Korea, to meaningfully lower the profit margins on diesel and gasoline, which reached two-year highs in November.

The market is also having to balance the reality of tightness of unsanctioned oil and products with the hope that this will be alleviated by some sort of peace deal in Ukraine.

There are encouraging words coming from the ongoing series of meetings involving the United States, Ukraine and Russia, but even if some sort of agreement is reached it is likely to take a while before Russian energy exports are able to be freely traded.

There is also the question as to whether previous buyers of Russian crude and products, especially those in Europe, would be willing to go back to buying from Moscow.

Amid all the uncertainty surrounding the outlook for the crude oil market, the only sensible course of action for OPEC+ was to sit tight.

The group still has some 3.24 million barrels per day (bpd) of production cuts in place even after raising output quotas by some 2.9 million bpd since April.

The market consensus is that OPEC+ won't need to increase output in 2026 and may even need to cut back if it wants to keep the price of global benchmark Brent crudearound the $63.20 a barrel it ended at on November 28.

But much will depend on the interplay between sanctioned crude and products and unsanctioned oil, a factor currently complicating the true state of global supply, demand and inventories.

Optimism in Britain's services sector declined at the fastest pace in three years in the three months to November, hurt by ongoing cost pressures that have eroded profits, the Confederation of British Industry said on Monday.

Finance minister Rachel Reeves' annual budget on November 26 - which set out 26 billion pounds ($34 billion)in tax rises - was unlikely to spark a rebound in morale, the CBI said.

"Last week's Budget will add further costs to businesses, while also hampering business investment and profitability, notably with the addition of national insurance contributions to salary sacrifice pension contributions and failure to address punitive business energy costs," CBI official Charlotte Dendy said.

Separate figures from the Institute of Directors, also released on Monday, showed business sentiment had edged up only marginally after the budget and was still near record-low levels.

* CBI services optimism falls to -50 in the three months toNovember from -29 in August, lowest in three years

* CBI services volume falls to -38 in three months toNovember from -30 in August * CBI survey based on 398 firms surveyed between October 28and November 13

* IoD survey shows post-budget sentiment at -72 versus -73in November before budget

* IoD survey conducted from November 14-26, two thirds ofrespondents employ fewer than 50 people

($1 = 0.7551 pounds)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up