Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

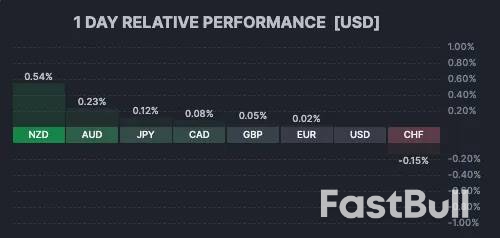

While US Markets are away for the Thanksgiving holiday, leaving the broader session fairly calm, the FX markets remain open and active, with all eyes turning to the Kiwi Dollar (NZD), posting yet another strong session.

While US Markets are away for the Thanksgiving holiday, leaving the broader session fairly calm, the FX markets remain open and active, with all eyes turning to the Kiwi Dollar (NZD), posting yet another strong session.

The Antipodean currency has faced its share of struggles this year, weighed down by a slowing New Zealand economy that proved more sensitive than its neighbor Australia to the slowdown in global trade post-tariffs—a weakness that was starkly evident in a terrible Q2 GDP growth rate of -0.9%.

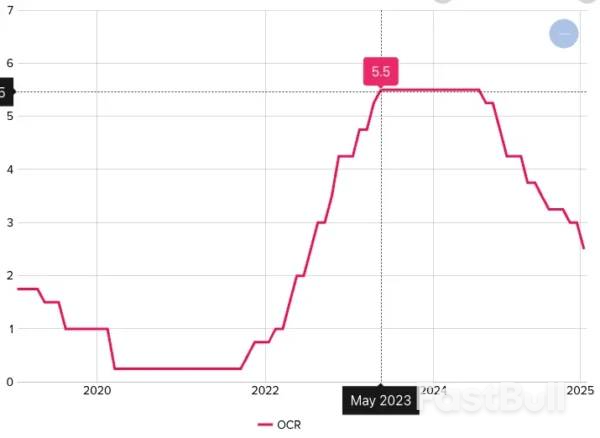

However, after 325 basis points of cuts, the data has started to come back in a flash. New Zealand Retail Sales just posted a strong beat of 1.9% versus the 0.5% expected, a sign of strong recovery that follows stronger inflation prints and improving Manufacturing PMIs.

Adding to the shift in sentiment, RBNZ Governor Christian Hawkesby mentioned that a future rate cut faces "significant hurdles."

This wording sufficed the market to assume that the 2.25% rate is the lower bound for the Kiwi rate, with markets now pricing rates to stay put throughout 2026.

This fundamental pivot is a clear sign of renewed strength for the NZD, which is up 2.65% against the US Dollar since last Friday.

Let's look at the major Kiwi pair, NZD/USD, to spot where that takes the action looking forward.

Daily Chart

Since July 1st and the comeback of the US Dollar, the NZD/USD has been in a one-way descent, exacerbated by diverging policies between the Fed and the RBNZ.

Taking the pair all the way down to a retest of the Liberation Day troughs in a Monthly Downward Channel, the action is now marking a first clear rebound in months.

Propulsed by changing fundamentals and bullish daily divergences, the ongoing action is strong and will face hurdles at the 50-Day Moving Average (0.57268) and Channel highs.

Still, when looking at how strong the current candles are, these hurdles could be breached soon. For confirmation, look at a session close above the 50-MA.

The ongoing rally is also facing a few hurdles on the intraday timeframe:

Overbought RSI levels within the Pivot Zone (0.5720 to 0.5750) could trigger some small mean-reversion.

A retest of the 4H-MA 200 (0.5690) could see higher probability for the action to continue its path higher.

NZD/USD Technical Levels to keep on your charts:

Resistance levels (NZDUSD)

Support levels

Looking even closer, the action is strongly following the 20-Hour MA at 0.57140;

Hong Kong fire authorities said they expected to wrap up search and rescue operations after the city's worst fire in nearly 80 years tore through a massive apartment complex on Friday, killing at least 94 people and leaving scores more missing.

Soon after dawn on Friday, firefighters had mostly contained the blaze that destroyed the Wang Fuk Court housing complex in the northern district of Tai Po. The eight-tower estate housing more than 4,600 people had been undergoing renovations and was wrapped in bamboo scaffolding and green mesh.

Police said they had arrested three construction company officials on suspicion of manslaughter for using unsafe materials, including flammable foam boards blocking windows.

Firefighters said they expect a search and rescue operation at the still-smoldering complex to be completed by 9 a.m. (0100 GMT).

"We'll endeavor to effect forcible entry to all the units of the seven buildings, so as to ensure there are no other possible casualties," Deputy Fire Services Director Derek Chan told reporters early on Friday.

As many as 279 people were listed as missing in the early hours of Thursday morning, but that figure has not been updated for more than 24 hours. Chan said 25 calls for help to the Fire Department remain unresolved, including three in recent hours which would be prioritised.

Rescuers battled intense heat, thick smoke and collapsing scaffolding and debris as they fought to reach residents feared trapped on the upper floors of the complex.

A distraught woman carrying her daughter's graduation photograph searched for her child outside a shelter, one of eight that authorities said are housing 900 residents.

"She and her father are still not out yet," said the 52-year-old, who gave only her surname, Ng, as she sobbed. "They didn't have water to save our building."

Most of the victims were found in two towers in the complex, while firefighters found survivors in several buildings, Chan said, but gave no further details.

The confirmed death toll rose to 94 early on Friday, the Hospital Authority said. It is Hong Kong's deadliest fire since 1948, when 176 people died in a warehouse blaze.

Police arrested two directors and an engineering consultant of Prestige Construction, a firm that had been doing maintenance on the buildings for more than a year.

"We have reason to believe that the company's responsible parties were grossly negligent, which led to this accident and caused the fire to spread uncontrollably, resulting in major casualties," Police Superintendent Eileen Chung said on Thursday. Prestige did not answer repeated calls for comment.

Police seized bidding documents, a list of employees, 14 computers and three mobile phones in a raid of the company's office, the government added.

The city's development bureau has discussed gradually replacing bamboo scaffolding, opens new tab with metal scaffolding as a safety measure.

Hong Kong's leader, John Lee, said the government would set up a HK$300 million ($39 million) fund to help residents while some of China's biggest listed companies announced donations.

On the second night after the blaze, dozens of evacuees set up mattresses in a nearby mall, many saying official evacuation centres should be saved for those in greater need.

People - from elderly residents to schoolchildren - wrapped themselves in duvets and huddled in tents outside a McDonald's restaurant and convenience shops as volunteers handed out snacks and toiletries.

Hong Kong, one of the world's most densely populated cities, is scattered with high-rise housing complexes. Its sky-high property prices have long been a trigger for discontent and the tragedy could stoke resentment towards authorities despite efforts to tighten political and national security control.

The leadership of both the Hong Kong government and China's Communist Party moved quickly to show they attached utmost importance to a tragedy seen as a potential test of Beijing's grip on the semi-autonomous region.

The fire has prompted comparisons to London's Grenfell Tower inferno, which killed 72 people in 2017. That fire was blamed on firms fitting the exterior with flammable cladding, as well as failings by the government and the construction industry.

Nexperia warned that customers across industries are facing impending production halts, while calling on its Chinese unit to take concrete steps to re-establish dialog.

The Dutch chipmaker, which has lost the cooperation of its Chinese subsidiary since the Netherlands government took action to gain influence over decision making, said it welcomed efforts by Chinese authorities to facilitate the resumption of exports but its customers were "still reporting imminent production stoppages."

"This situation cannot persist," Nexperia wrote in an open letter to Nexperia's entities in China on Thursday. The company designs and makes essential semiconductors for the automotive and consumer electronics sectors. Carmakers from Asia to Europe have raised alarm about disruption of its output.

The Dutch government last week suspended an order that gave it powers to block or revise decisions at Nijmegen-based Nexperia. Dutch Economic Affairs Minister Vincent Karremans had called it a "show of goodwill," noting that discussions with Chinese authorities were continuing.

Nexperia said in its letter that it had made repeated attempts to directly communicate with its subsidiary through calls, emails, proposed meetings and even "formal correspondence to demand performance of rights," but did not receive "any meaningful response."

The Dutch company also pushed its Chinese unit to engage in talks either through email or a "neutral, professional third-party mediator" to restore predictable supply flows.

Wingtech Technology Co., the chipmaker's Chinese owner, did not immediately respond to an email requesting comment. It has asked for the restoration of its full control and shareholder rights over Nexperia in the Netherlands.

Earlier on Thursday, the Chinese government urged the Netherlands to take concrete actions to resolve concerns around Nexperia and to bring back stability to the global supply chain.

Tokyo's inflation held steady and industrial output unexpectedly rose, keeping the Bank of Japan (BOJ) on track to consider an interest rate hike in December or January.

Consumer prices excluding fresh food in the capital advanced 2.8% in November from a year earlier, according to the Ministry of Internal Affairs and Communications on Friday. Faster gains in electricity costs helped offset slower increases in processed food prices. The result was a tad stronger than the median economist forecast of 2.7% and matched the result for the previous month.

The measure that also strips out energy also increased 2.8%, unchanged from last month. Service prices, a vital component to gauge the sustainability of inflation, increased 1.5% from a year earlier. Rice prices, a driving force for this year's price gains, rose 37.9%, continuing to decelerate after the pace hit a record high of 93.8% in April.

The data, a leading indicator for national price trends, are likely to instill confidence in the BOJ that the probability of its economic outlook being realised is rising. The figures may give traders' bets on a December interest rate hike another boost after such speculation mounted recently.

"Overall, there was nothing in today's data to stop the BOJ from mulling a rate hike," said Taro Saito, head of economic research at NLI Research Institute. "My base case is a hike in January but it will be determined after considering the yen and politics."

What Bloomberg Economics says..."Tokyo's November CPI data show inflation remains sticky, supported by solid wage growth, stronger price expectations, and the rollback of energy subsidies. With Tokyo's trend pointing to national inflation near 3%... the reading would bolster confidence that price growth is persistent enough to justify further scaling back stimulus as early as December." — Taro Kimura, economist

The yen was little changed around 156.25 to the dollar after the data, while stocks were narrowly mixed.

The high cost of living is a primary focus of Prime Minister Sanae Takaichi's government. She unveiled her first economic package last week to tackle the problem. While gains in processed food slowed, the pace remained elevated at 6.5%. In addition to rice, chocolate and coffee contributed to gains.

The number of price increases by Japan's major food companies is set to reach 20,609 this year, rising 64.6% from the previous year, Teikoku Databank reported Friday.

In other data Friday, industrial production rose 1.4% in October from September, beating the consensus estimate of a 0.6% decline, while rising 1.5% from a year earlier, the Ministry of Economy, Trade and Industry reported. Car production rebounded as the US-Japan trade deal cut auto tariffs to 15% from 27.5%, while artificial intelligence (AI) demand gave a boost to information and communications equipment.

"The data suggest manufacturing is recovering from earlier US tariff hits," said Taro Kimura, economist at Bloomberg Economics. "This reinforces the Bank of Japan's assessment at its October meeting that downside risks to growth are easing."

Separately, the jobless rate held steady at 2.6% and the jobs-to-applicant ratio nudged lower to 1.18 in October, meaning there were 118 jobs offered for every 100 applicants.

In an interview with Bloomberg this week, Tomoko Yoshino, the leader of Japan's largest labor union group, urged Takaichi's government to do more to fight inflation as the yen could help inflation continue to outpace nominal wage growth. Real wages have fallen for the last nine months. Yoshino's group, Rengo, will be pushing for wage increases exceeding 5% in negotiations with employers that will culminate in March.

Takaichi unveiled an economic stimulus package last Friday with fresh spending totaling ¥17.7 trillion (US$113 billion, or RM466.63 billion), as she focuses on addressing rising costs of living with steps including expanded utility subsidies and a cut in gasoline taxes. SMBC Nikko Securities estimates the direct impact of those measures will shave 0.38 percentage point from Japan's core CPI next year.

"Owing to government gasoline and utility measures, Japan's inflation is going to decelerate quickly from here," Saito said. "I expect Tokyo inflation to be around 2.5% in the next data, but that doesn't mean the price trend will also be going down."

The national key inflation gauge picked up to 3% last month, extending the streak of readings at or above the BOJ's 2% target to more than three and a half years. Elevated costs of living were a primary reason that Takaichi's ruling Liberal Democratic Party suffered setbacks in the last two national elections, losing majorities in both houses of parliament.

BOJ governor Kazuo Ueda has kept the benchmark rate at 0.5% since January, as he awaits more evidence that underlying inflation will achieve the 2% target. With the economy having escaped a devastating impact from US tariffs, as was once feared, almost all BOJ watchers expect a rate hike no later than January.

Kazuo Momma, former BOJ executive director in charge of monetary policy, told Bloomberg this week that the odds of a rate hike are "fairly high" at the December policy meeting, given the recent weakening of the yen. The central bank will deliver its next policy decision on Dec 19.

"Food inflation is expected to subside but a risk is the renewed weakening of the yen," Saito said. "The yen could be boosting upside risks."

Key Points:

USD/JPY took the spotlight in early trading on Friday, November 28. Japanese inflation figures fueled speculation about a Bank of Japan rate hike. The sticky inflation figures coincided with reports of another solid wage rise in 2026, two key considerations for policymakers.

A weaker Japanese yen may also pressure the BoJ to raise interest rates, given the upward pressure on import prices. Higher import prices erode household purchasing power, weighing on private consumption.

Crucially, rising expectations of a BoJ rate hike clash with bets on a December Fed rate cut, signaling a reversal of USD/JPY's November gains.

Headline inflation for Tokyo increased 2.7% year-on-year in November, easing from 2.8% in October. However, the so-called core-core inflation rate held steady at 2.8%, well above the BoJ's 2% target.

November's data supported economists' predictions for a December rate hike. In the November Reuters poll, conducted between November 11 and 18, 43 of 81 economists expected the BoJ to raise interest rates by 25 basis points to 0.75% on December 19.

Meanwhile, consumers opened their purse strings in October, indicating an economic recovery in the fourth quarter. Retail sales rose by 1.7% year-on-year, up sharply from a 0.2% increase in September. Rising consumer spending may fuel demand-driven inflation, bolstering the case for tighter monetary policy, given that inflation remains well above the BoJ's target.

Friday's data followed updates from wage negotiations, with Japanese labor unions calling for another hefty wage hike in the spring of 2026. Notably, early signs of strong wage growth would ease the BoJ's concerns over US tariffs having a longer-term impact on the Japanese economy. Higher wages could boost private consumption, which accounts for around 55% of GDP.

For context, the Japanese economy contracted by 0.4% quarter-on-quarter in the third quarter after expanding by 0.6% the previous quarter. Private consumption increased just 0.1% in the quarter, down from 0.4% in the second quarter.

One potential curveball for USD/JPY could be the BoJ's concerns about market disruption. In July 2024, the BoJ cut the purchases of Japanese Government Bonds (JGBs) and raised interest rates, sending USD/JPY below 140. The stronger yen triggered a carry trade unwind, leading to heavy losses across global equity and crypto markets. A BoJ rate hike, coupled with a Fed rate cut, may lead to another yen carry trade unwind, something policymakers may wish to avoid.

USD/JPY edged higher after the inflation and retail sales figures, despite a potential narrowing of US-Japan interest rate differentials in favor of the yen.

USDJPY – Daily Chart – 281125 – Yen Carry Trade Unwind

USDJPY – Daily Chart – 281125 – Yen Carry Trade UnwindWhile speculation about a BoJ rate hike intensifies, traders should closely monitor FOMC member speeches. Ahead of the Thanksgiving holiday, policymakers raised expectations of a December Fed rate cut.

Growing calls for further monetary policy easing next month could lead markets to fully price in a policy adjustment. A more hawkish BoJ and more dovish Fed may send USD/JPY toward 150.

According to the CME FedWatch Tool, the probability of a December cut has soared from 39.1% on November 20 to 86.9% on November 28.

USDJPY – Daily Chart – 281125

USDJPY – Daily Chart – 281125Key Market Drivers to Watch Today:

China's leading telecommunication firms Huawei and ZTE,have won a string of contracts this year to supply 5G equipment in Vietnam, in another sign of Hanoi's strengthening bonds with Beijing, stirring concern among Western officials, seven people with direct knowledge of the situation told Reuters.

For years, Vietnam was seen as reluctant to use Chinese technology in sensitive infrastructure, but in recent months it has embraced Chinese tech companies as sometimes frosty relations with its northern neighbour have warmed while ties with Washington have soured over tariffs on Vietnamese goods.

While Sweden's Ericsson (ERICb.ST), opens new tab and Finland's Nokia (NOKIA.HE), opens new tab secured contracts for Vietnam's 5G core infrastructure, with U.S. chipmaker Qualcomm (QCOM.O), opens new tab providing network equipment, Chinese companies have begun winning smaller tenders with state-owned operators, so far unreported public procurement data shows.

A consortium including Huawei was awarded a $23 million contract for 5G equipment in April, weeks after the White House announced tariffs on Vietnamese goods. ZTE has won at least two contracts, one last week, totalling more than $20 million for 5G antennas. The first publicly disclosed deal came in September, a month after U.S. tariffs took effect.

Reuters could not establish whether the timing of these wins was linked to U.S. tariffs, but the deals raised concerns among Western officials.

The exclusion of Chinese contractors from Vietnam's digital infrastructure, including undersea fibre-optic cables, has long been identified by Washington as a key condition for support in advanced technologies.

Huawei and ZTE are banned from U.S. telecom networks as an "unacceptable risk" to national security. Sweden and other European countries have similar restrictions.

Ericsson declined to comment on Chinese companies, but said it was "fully committed to support its customers in Vietnam."

Huawei, ZTE, Nokia, Qualcomm, the U.S. embassy in Vietnam, China's embassy, Sweden's foreign ministry or Vietnam's tech ministry responded to requests for comment.

The unaligned Southeast Asian nation is a crucial battleground in the competition for global influence. Its proximity to China has made it a major industrial hub for multinationals such as Apple, Samsung and Nike, which rely on Chinese components and Western consumers.

Under Western pressure, Vietnam long took "a wait-and-see approach" to Chinese technology, said Nguyen Hung, a specialist in supply chains at RMIT University Vietnam. But "Vietnam has its own priorities," he added, noting the new deals could spur deeper economic integration with China.

Hanoi and Beijing have made progress recently on other sensitive projects, including cross-border rail links and special economic zones close to the Chinese border, which Vietnam had previously discarded as security risks.

Huawei lost multiple bids this year on 5G equipment in Vietnam, according to tender data. But it has cooperated on technical services, and signed an agreement in June on 5G technology transfers with Viettel, Vietnam's army-owned main telecom operator, according to Vietnam's defence ministry.

Viettel did not respond to a request for comment. One person at the company said Chinese technology was cheaper. The sources declined to be named because the information they shared was not public.

The Chinese contracts have been discussed in at least two meetings of senior Western officials in Hanoi in recent weeks, diplomatic sources said. In one meeting, a U.S. official warned they could undermine trust in Vietnam's networks and jeopardise access to U.S. advanced technology.

In a meeting this month officials explored whether areas using Chinese technology could be sealed off from the rest of the network to prevent data leaks, one of the sources said.

But suppliers of antennas and equipment could still gain access to network data, said Innocenzo Genna, a telecommunications lawyer, noting "Western contractors may face the awkward prospect of working alongside firms they do not trust."

The Trump administration has ordered a full review of permanent residency status — so-called "Green Cards" — of immigrants from 19 countries, in the wake of the attack on two US National Guard personnel in Washington, DC.

An Afghan national who entered the US in 2021 after working with American military and intelligence services in Afghanistan has been arrested in connection with Wednesday's shooting near the White House.

On Thursday, US President Donald Trump confirmed the death of one of the two National Guard members who was shot.

In response to the shooting, Joseph Edlow, director of the US Citizenship and Immigration Services (USCIS), said on X: "I have directed a full scale, rigorous reexamination of every Green Card for every alien from every country of concern."

The full-scale review of residency status, at the behest of President Donald Trump and carried out by the USCIS, comes after the suspect from Wednesday's shooting was identified as Afghan national Rahmanullah L.

The 19 countries under scrutiny were named in a June proclamation, which had initially imposed entry restrictions on nationals from states deemed deficient in screening and vetting protocols.

Among the countries listed are Afghanistan, Iran, Somalia, Libya and Yemen, as well as Cuba, Venezuela, Chad, and Eritrea.

Critics warn the policy risks penalizing hundreds of thousands of lawful permanent residents based solely on nationality.

Whether the review will lead to revocations or deportations remains unclear.

For now, the administration frames it as a protective measure aimed at national security in light of the DC attack.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up