Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold prices have had a topsy turvy start to the week but the $4000/oz handle has held firm.

Gold prices have had a topsy turvy start to the week but the $4000/oz handle has held firm. Bulls have returned and price has bounced off the confluence area at $4000 but needs acceptance above the $4100/oz handle for the rally to gather steam.

The question on the minds of market participants is whether or not Gold bulls will remain in control after the Fed minutes release and Labor data on Thursday?

Looking at the four-hour chart below, the technical picture is interesting.

Having bounced off the ascending trendline which lined up with the $4000/oz handle, Gold broke above the 100-day MA and is now testing the descending trendline drawn from the November 13 high around $4245/oz.

A break of the descending trendline and the 50-day MA around the $4096/oz handle could open up a potential rally toward the previous descending trendline touch at $4212/oz.

Of course there is a resistance area around the $4150/oz handle which could prove to be a stumbling block but bulls may be emboldened or if not will be eyeing US labor data and the Fed minutes as a potential catalyst.

To keep the bullish momentum going, the 100-day MA at 4041 is now a crucial near-term support area. If this area holds, it should bode well for bullish momentum.

The price of Gold (XAU/USD) has appeared relatively unaffected by the moves in the US Dollar Index of late. However, this does not mean that correlation is no longer something to keep an eye on.

This week's Fed minutes and Labor data releases will play a major role in rate cut expectations which will impact market sentiment and the US Dollar Index. This in turn will play a major role in the movement of Gold prices moving forward.

The aggressive repricing of rate cut probabilities for the Feds December meeting (93.7% probability a month ago vs 51.1% probability at present) has kept Gold gains in check.

However, a weak print on the labor data front could see rate cut expectations spike and thus propel Gold higher once more.

Markets already know broadly what to expect from the Fed minutes release as it was Fed Chair Powell's tone and the 10-2 vote split at the Fed's October meeting that kickstarted the hawkish repricing of rate cut expectations.

Thus the event could be sidelined by market participants in favor of Thursday's labor data release.

With U.S. President Donald Trump rolling back reciprocal tariffs on certain agriculture products, there are expected benefits for Indian farm exports to the U.S., currently worth $1 billion annually, including products such as tea, coffee and spices.

Other items exempted from the sweeping tariffs through an executive order signed by Trump last week include tropical fruits and fruit juices, cocoa, bananas, oranges, and tomatoes, beef, and some fertilizers.

India sees relief on these products as a boost for its agriculture exports to the U.S. On Monday, its ministry of commerce and industry said that while the move applies to all trading partners, it "creates [a] level-playing field for Indian exporters."

"As far as India is concerned, India was facing a duty of 50% on these products -- all that becomes zero now," one of the ministry's officials said.

India's overall agriculture exports to the U.S., excluding shrimp, is worth about $2.5 billion each year; and its farmers are expected to benefit from the latest tariff exemptions.

However, Ajay Srivastava, founder of the New Delhi-based Global Trade Research Initiative think tank, said that Trump's tariff roll-back on certain agricultural products "could marginally strengthen India's competitive position in spices and niche horticulture, but the broader gains will accrue mainly to major Latin American, African, and ASEAN farm exporters unless India expands scale."

He added that India has "almost no presence" in several of the largest exempted lines -- tomatoes, citrus fruits, melons, bananas, most fresh fruits, and fruit juices.

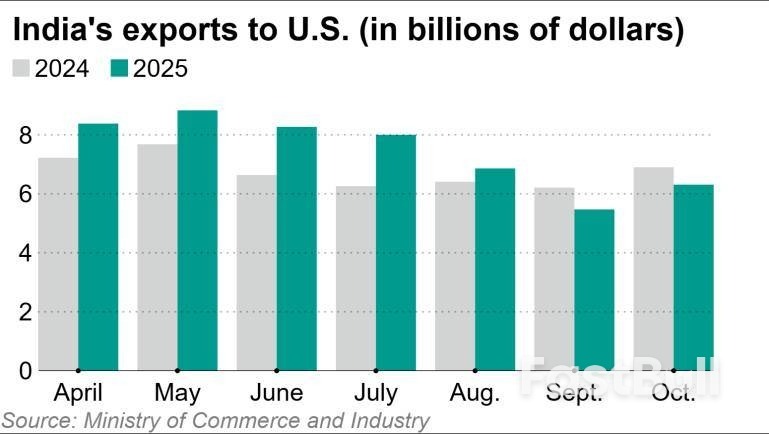

India's goods exports to the U.S. in October expanded about 15% from the previous month, marking the first month-on-month rise since May, which comes after a 20% drop recorded in September.

"Despite the October rebound, India's shipments to the U.S. have dropped nearly 28.4% between May and October, erasing more than $2.5 billion in monthly export value," Srivastava said in a note he shared with Nikkei Asia.

India and the U.S. started negotiating a bilateral trade agreement (BTA) after Indian Prime Minister Narendra Modi visited Washington in February and resolved with Trump to deepen ties and expand bilateral trade to $500 billion by 2030 from around $200 billion now. The two sides had also announced plans to negotiate phase one of the BTA by this fall.

However, in August, the U.S. slapped 50% tariffs on goods from India, including a 25% penalty for New Delhi's purchase of Russian oil -- the steepest among the U.S. trading partners.

On Sunday, Trump said that "any country that does business with Russia will be very severely sanctioned" as he extended support for a "very tough" legislation which is being pushed ahead by Republican lawmakers seeking to impose up to 500% tariffs on nations that purchase oil and gas from Moscow.

On Monday, India's Petroleum Minister Hardeep Singh Puri announced that Indian state-run oil companies had concluded a one-year deal for the import of around 2.2 million metric tonnes of U.S. liquefied petroleum gas -- about 10% of the country's annual imports. Calling the move "a historic first!" Puri posted on X: "One of the largest and the world's fastest growing LPG market opens up to the United States."

This has been "in works for long [and] is not something new," a senior official at the ministry of commerce and industry said separately. "India has been contemplating purchase of LPG from the U.S. The opportunity was not there [earlier and has now] come to the fore... This is in the overall context of keeping trade with the U.S. in the right mix. It's not part of any [trade] negotiation package per se, but definitely as [a] part of our endeavor [for] balanced trade [between the two countries]."

On the BTA, the official said that India and the U.S. were negotiating a package to address reciprocal tariffs. This package "is more or less near closure [but] I can't put a deadline to it," the official added.

"The BTA will have multiple packages, multiple tranches, [and] this will be the first tranche which will address the reciprocal tariffs."

The Federal Reserve remains divided ahead of its December meeting, but this is unlikely to force the central bank to hit the brakes on another rate cut, Standard Chartered says, warning that expected softening in the labor market will continue to steer monetary policy.

"We hold to our view that the FOMC will cut in December, largely because we see a good chance that employment data for September to November will be very soft," Steve Englander, Head, Global G10 FX Research and North America Macro Strategy said in recent note. "This should be enough to push the Fed centrists to the cutting side," he added.

"November labor release will be weak, in our view," he added, noting that "seasonal hiring is likely to be very weak, layoffs unseasonably high," setting a bearish tone on the labor market heading into the meeting.

Dissents against the Fed December policy decision is likely whether the Fed cuts or holds rates amid strong views on either scenario among Fed members in recent commentary.

"If the FOMC cuts in December, there could easily be four dissents. If it stays on hold, there are likely to be three (possibly more) dissents," Englander added.

The deep divide at the Fed is made of those "who want to cut probably want to cut more than 25 basis points, and those who want to hold want to hold for more than one meeting," Standard Chartered said.

The root cause of the divide is not differing economic readings, which are "likely to be resolved by incoming data," Englander said, but rather "different assessments of how policy should respond to above-target inflation and below-target labour outcomes."

The strongest hawkish voices include Jeffrey R. Schmid, President of the Federal Reserve Bank of Kansas City; Susan M. Collins, President of the Federal Reserve Bank of Boston; and Alberto G. Musalem, President of the Federal Reserve Bank of St. Louis. Their desire to "avoid front-loading cuts that might be hard to reverse contrasts with the dovish stance of Governor Stephen Miran, who believes that equilibrium interest rates are lower than commonly believed and disinflationary pressures are stronger, especially from rents," Englander added.

At the December meeting, Standard Chartered believes the Fed doves are likely to prevail as consensus will lean toward delivering "labour-market insurance with another cut," rather than turning attention to inflation, which is far less threatening as unit labour costs - a key source of domestic inflation - are clearly trending downward.

Overseas investors are gradually increasing their use of a new bond repurchase facility for their purchases of Chinese bonds after the nation gave them greater access to the onshore repo market in September.

Offshore investors conducted 13.1 billion yuan ($1.84 billion) of bond repurchases via the Bond Connect channel from Hong Kong in October, up from 810 million yuan the previous month, according to data from China Central Depository & Clearing Co.

Trading using the channel began Sept. 26, when China broadened overseas investors' access to the onshore market by allowing bond repurchase transactions via the Bond Connect channel from Hong Kong. The initiative was part of Beijing's effort to enhance foreign investors' interest in yuan-denominated assets by enabling them to use a key liquidity function for bond trading.

The policy has so far had little impact in stemming foreign outflows from Chinese bonds. Overseas holdings of the nation's debt in the interbank market fell to 3.73 trillion yuan in October, the lowest level since December 2023, central bank data show. One reason is the fact that Chinese bond yields remain well below those on US Treasuries.

The low yield appeal of Chinese bonds could deter demand for using repurchases to leverage up positions, said Stephen Chiu, head of Asia foreign exchange and rates at Bloomberg Intelligence in Hong Kong.

Foreign use of the repo trade channel under the Hong Kong Connect program still represents only a small fraction of overall trading levels of domestic and overseas investors. CCDC data show it settled a total of 103.8 trillion yuan of bond repurchases last month.

The Australian government plans to start requiring power companies to provide at least three hours of free daytime electricity to customers in a bid to narrow the mismatch between renewable energy supply and demand.

The Solar Sharer program is to go into effect in July and will begin in the states of New South Wales, South Australia and Queensland before being expanded. The government is soliciting public feedback regarding the proposed rule, according to a notice released Nov. 4.

All households equipped with wireless smart meters will be eligible to receive free electricity. This will include homes without solar panels installed. People who rent their home are also eligible.

Renewable energy is a growing source of electricity in Australia, accounting for 36% of the total last year.

Rooftop solar panels are driving this growth. Over 4 million households out of a population of roughly 27 million people have solar panels installed.

Solar panels now account for 12% of Australia's electricity generation, and the proportion is expected to rise further.

Solar power is generated during the day, but household electricity demand jumps in the evening, when many people return home. Electricity supply exceeds demand during the day.

If power supply is out of step with demand, outages may occur. To maintain the correct balance, renewable energy need to be shut down.

There is also "negative" pricing, where electricity producers essentially pay consumers or power retailers to take the surplus off their hands.

Imbalances between supply and demand have become a widespread concern in Australia. Between 9 a.m. and 2 p.m., over 30% of wholesale electricity is traded for less than zero Australian dollars.

Other countries have faced similar mismatches. French electricity prices went negative on the market for a total of 205 hours during the first half of the year. That exceeded the 128 hours logged in 2023.

During the first half, Germany's had 224 negative pricing hours, triple as many as a year earlier. Spain recorded its first negative pricing hour in April.

In the U.S., California accounted for a quarter of the negative price hours. In Japan, power producers have been curtailing excess output.

Several companies in Australia have already started to offer free electricity voluntarily. In July, AGL rolled out a plan in South Australia, a renewable energy rich state, to provide power free of charge from 10 a.m. to 1 p.m.

In 2020, Red Energy began offering electric vehicle owners two hours of free electricity on weekends.

"On average, these customers used almost double the electricity during the free period compared to the average customer," said a Red Energy spokesperson.

But such plans often charge higher rates outside of free hours. The Australian government says it is working with regulators to develop measures to prevent power companies from raising rates during non-free periods of the day.

If companies are directed not to meaningfully increase prices during non-peak hours, it "will depress retailer profits," said Bruce Mountain, professor at Australia's Victoria University.

The Australian Energy Council, an industry group, has been critical of the free electricity plan.

Granting consumers universal access to free power "places material risks on retailers that in some instances might only be mitigated by them exiting a market," Louisa Kinnear, the Australian Energy Council's CEO, said in a statement.

U.S. businesses averaged approximately 2,500 weekly layoffs for the four weeks ending November 1, 2025, reported by the ADP Research Institute, reflecting ongoing labor market adjustments.

While this layoff trend shows moderation compared to prior months, its impact on risk sentiment across financial and cryptocurrency markets remains under review.

According to the ADP Research Institute, U.S. businesses averaged 2,500 weekly layoffs for October's final week. This marked a stabilization in the labor market, contrasting previously higher figures and indicating an easing in labor market challenges. ADP Research Institute noted, "For the four weeks ending November 1, 2025, U.S. businesses averaged approximately 2,500 weekly layoffs." ADP Research

Dr. Nela Richardson, ADP's Chief Economist, explained job growth resumed modestly in October, marking the first increase since July. Despite the modest gains, pay growth remained flat, underscoring balanced shifts in supply and demand. Dr. Richardson reflected, "Private employers added jobs in October for the first time since July, but hiring was modest relative to what we reported earlier this year. Meanwhile, pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced." ADP Research

This labor market trend impacts sectors differently, with gains in education and healthcare, while professional services see declines. Layoffs persist in certain industries, signaling ongoing adjustments in the market landscape.

Financial implications suggest no direct funding shifts linked to labor trends. However, these indicators may influence risk sentiment among investors broadly, with indirect effects on market confidence reported.

Broader macroeconomic conditions continue to shape employment patterns, with technology and demographic factors playing pivotal roles. ADP's data reflect ongoing adjustments without direct ties to cryptocurrency markets.

Historical patterns reveal a recent downturn in August-September, followed by recovery. These fluctuations underscore how technological advancements and demographic changes impact labor trends, guiding future predictions.

ICE Brent settled a little more than 1% higher yesterday, with the market moving closer to the $65/bbl level. Market participants appear more concerned about supply risks than the odds of a surplus going forward.

These concerns are clearly reflected in the middle distillate market, where the ICE gasoil crack continued to rally. It's now above US$38/bbl, up from around $23/bbl in mid-October. Meanwhile, the prompt ICE gasoil timspread surged to a backwardation of more than $43/t. Worries over Russian diesel supply amid sanctions and Ukrainian attacks on Russian refineries are driving the market's strength.

The strength in the middle distillate market should prompt refiners to maximise yields on middle-of-the-barrel products. Meanwhile, broader strength in refinery margins should support refinery runs. The strength in refinery margins certainly makes a more bearish view of the crude oil market less likely.

ICE Futures Europe said that the delivery of diesel under the ICE gasoil contract, which is produced from Russian oil in third countries, will be banned from January. This move by the exchange aligns with the EU ban on refined products derived from Russian oil, which also comes into effect in January.

Numbers overnight from the American Petroleum Institute show that US crude oil inventories increased by 4.4m barrels over the last week. Refined products also saw stock builds, with gasoline and distillate stocks increasing by 1.5m barrels and 600k barrels, respectively. Overall, the report was relatively bearish. However, the market will be more focused on the release of the widely followed US Energy Information Administration (EIA) inventory numbers later today.

Freeport said it plans to restore copper production at its Grasberg operations in Indonesia drove a rally in copper prices. A September mudslide led the miner to declare force majeure. It restarted production from two parts of the copper mine in late October (the Deep Mill Level Zone and Big Gossan) and plans to ramp up at the Grasberg Block Cave underground mine in the second quarter of 2026. Freeport expects Grasberg to produce about one billion pounds of copper and nearly one million ounces of gold in 2026. That's roughly 10% lower than what the company estimated in September following the incident.

The partial restart at Grasberg will help to ease supply challenges for smelters facing feedstock shortages. Grasberg is the world's second-largest copper mine, contributing around 4% of global production.

Copper supply has been hit by a wave of disruptions this year. The disruption at Grasberg has added to the already high number of supply problems this year, including flooding at the Kamoa-Kakula mine in the Democratic Republic of the Congo (DRC) in May and an accident at the El Teniente mine in Chile in July.

Data from China's National Bureau of Statistics (NBS) show that refined copper output rose 8.9% year on year to 1.204mt in October, primarily driven by stronger ore purchases. In other metals, zinc output rose 15.7% YoY to record highs of 665kt, as smelters benefited from higher fees and improved ore supply, whereas lead production decreased 2.4% YoY to 645kt for the period.

The USDA announced further export sales of US soybeans to China for the 2025/26 marketing year. China has bought a further 792k tonnes of US soybeans, according to the USDA, which takes total purchases since October to a little over 1m tonnes. However, the pace will need to pick up if China is to buy 12m tonnes of soybeans before the end of the year. The number was mentioned by the US following talks between President Trump and President Xi. However, US soybeans are more expensive than the Brazilian supply. With estimates for yet another record harvest from Brazil next season, competition from Brazil will likely remain fierce.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up