Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US dollar found fresh momentum to start the week, surging by the largest daily gain since mid-May an indication that FX market focus is shifting decisively back toward America’s underlying economic strength.

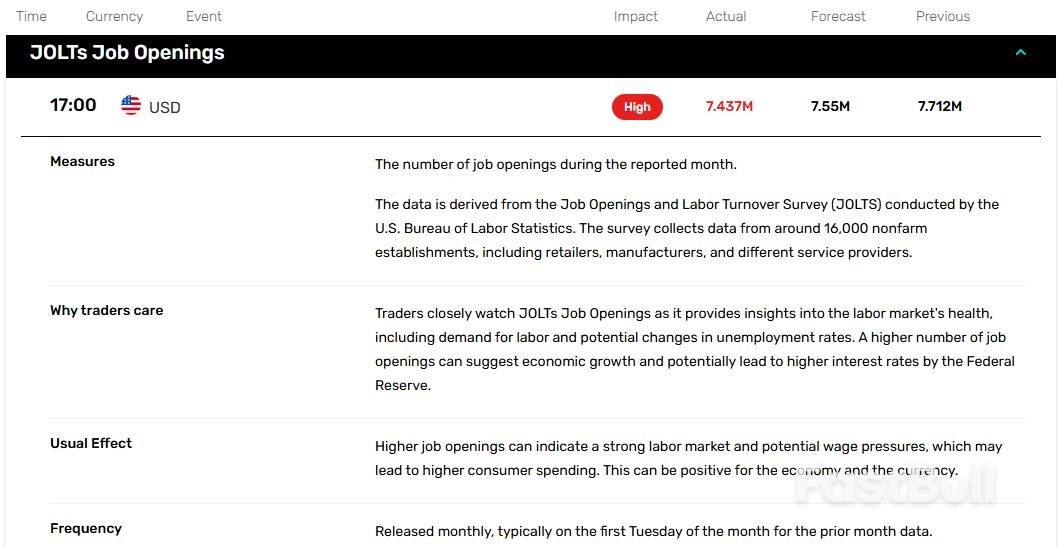

On July 29, 2025, the U.S. released JOLTs Job Openings report for June. The report indicated that JOLTs Job Openings decreased from 7.712 million in May to 7.437 million in June, compared to analyst forecast of 7.55 million.

Traders also had a chance to take a look at CB Consumer Confidence report for July. The report indicated that CB Consumer Confidence increased from 95.2 (revised from 93.0) in June to 97.2 in July, compared to analyst forecast of 95.8.

The Present Situation Index declined from 133 in June to 131.5 in July, while the Expectations Index increased from 69.9 to 74.4.

The Conference Board commented: “In July, pessimism about the future receded somewhat, leading to a slight improvement in overall confidence.”

U.S. Dollar Index climbed above the 99.00 level as traders focused on the reports. From a big picture point of view, the American currency continues to move higher as traders focus on recent trade deals.

Gold settled near the $3315 level after the release of the economic reports. U.S. dollar’s rally continues to put pressure on gold markets.

SP500 pulled back towards the 6400 level as traders reacted to the weaker-than-expected JOLTs Job Openings report.

Gold prices steadied on Wednesday as investors held back on making big bets ahead of the Federal Reserve's policy statement later in the day for cues into future rate cuts, while focus remained on U.S. trade talks ahead of the August 1 deadline.

Spot goldwas steady at $3,329.19 per ounce as of 0020 GMT. U.S. gold futuresrose 0.1% to $3,327.70.

U.S. and Chinese officials agreed to seek an extension of their 90-day tariff truce on Tuesday, following two days of talks in Stockholm.However, U.S. officials said it was up to President Donald Trump to decide whether to extend a trade truce that expires on August 12 or potentially let tariffs shoot back up to triple-digit figures.Meanwhile, the U.S. dollar indexheld steady after hitting a more than one-month high on Tuesday, making greenback-priced bullion more expensive.

Investors turned their focus to the Fed's policy to gauge its future rate cut path, following the central bank's two-day meeting, during which it is widely expected to keep rates steady, despite Trump's constant call to lower them.The U.S. trade deficit in goods narrowed to its lowest in nearly two years in June as imports fell sharply, cementing economists' expectations that trade likely accounted for much of an anticipated rebound in economic growth in the second quarter.The International Monetary Fund slightly raised its global growth forecasts for 2025 and 2026 on Tuesday, citing stronger-than-expected buys ahead of a jump in U.S. tariffs on August 1 and a drop in the effective tariff rate to 17.3% from 24.4%.

Meanwhile, on Tuesday, Trump threatened tariffs and other measures on Russia "10 days from today" if Moscow showed no progress toward ending its more than three-year-long war in Ukraine.Spot silverheld steady at $38.20 per ounce, platinumfell 0.4% to $1,389.20 and palladiumremain unchanged at $1,258.75.

DATA/EVENTS (GMT) | |

0530 | France GDP preliminary QQ Q2 |

0800 | Germany GDP flash QQ SA, YY NSA Q2 |

0900 | EU GDP flash preliminary QQ, YY Q2 |

0900 | EU consumer confidence final July |

1230 | U.S. GDP advance Q2 |

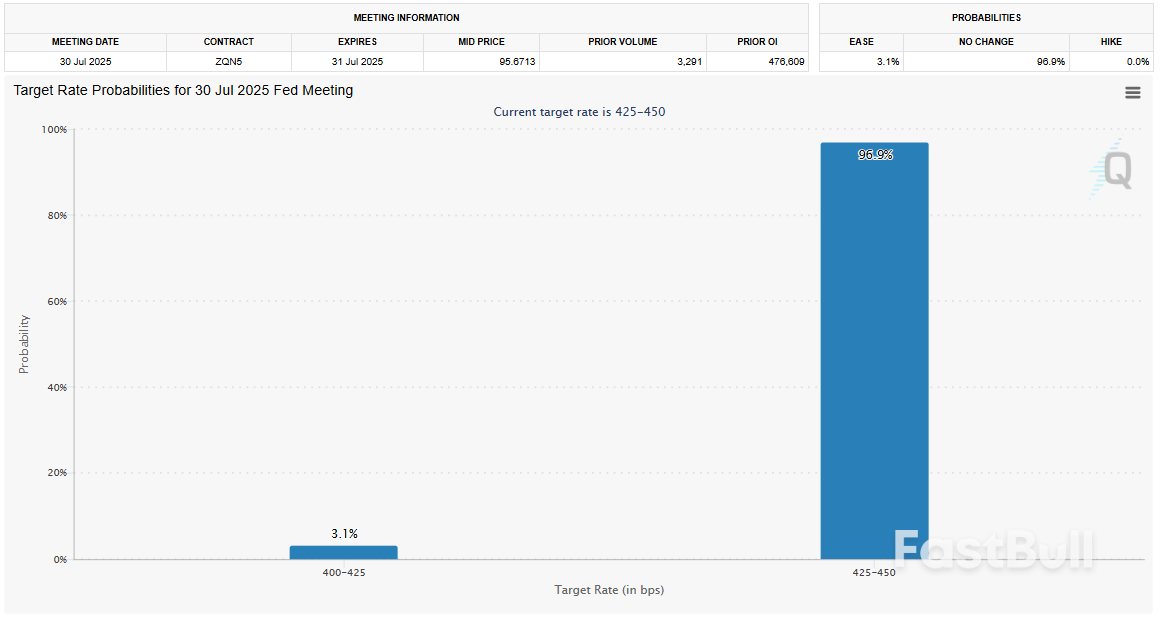

Investors parsing Jerome Powell’s remarks Wednesday for any hint that the Federal Reserve is moving closer to an interest-rate cut might be left wanting.

Policymakers are largely expected to hold interest rates steady for a fifth consecutive meeting at the conclusion of their July 29-30 gathering. Dissents from one or more officials could send the message that some members of the rate-setting Federal Open Market Committee prefer to reduce borrowing costs sooner rather than later.

But with an onslaught of economic data due before their next meeting in September, the Fed chair may opt to leave his options open until there’s more clarity about the direction of the economy and the right path for policy.

“There is no doubt that the FOMC will leave interest rates unchanged,” Bill Nelson, chief economist for the Bank Policy Institute, said Tuesday in a note. “The question is whether they will convey a greater openness to cutting rates at their September meeting,” Nelson, formerly a top economist at the central bank, said.

President Donald Trump has not ceased his calls for rate cuts. And Powell will surely field questions about the central bank’s $2.5 billion building renovation, which has become a target for Republicans attacking the Fed.

The Fed’s rate decision will be released at 2 p.m. in Washington on Wednesday, and Powell will hold a post-meeting press conference 30 minutes later.

After this week, the Fed will hold only three more policy meetings this year. In June, Fed officials signaled their intention to deliver two quarter-point rate cuts in 2025, based on their median projection. That makes a reduction in September seem likely, said Veronica Clark, an economist at Citigroup.

“The average official is still in this wait-and-see mode, but September is very reasonable,” said Clark.

But it’s still an open question how much Powell will move expectations in that direction, said BPI’s Nelson. Investors are already putting the probability of a rate cut in September at more than 60%, according to pricing in federal funds futures contracts. Fed officials might not want those odds to move higher before they’ve had a chance to review the economic data coming before the meeting, Nelson said.

Policymakers will see two more jobs reports, including the July report due on Friday, before they gather on September 16-17. They’ll also get additional data on inflation, spending and housing.

“If the committee wants to keep its options open, it will have to be studiously neutral and continue to emphasize data-dependence,” Nelson said.

If the Fed chooses to maintain its characterization of the labor market as “solid” in its post-meeting statement, it could elicit dissenting votes from officials who are worried that the US employment landscape is looking more fragile.

Fed Governor Christopher Waller laid out his argument for a July rate cut in a detailed speech earlier this month, expressing concern about a labor market “on the edge” that could deteriorate rapidly if the Fed doesn’t offer more support. Another governor, Fed Vice Chair for Supervision Michelle Bowman, has also expressed a readiness to lower rates as soon as this meeting.

If both Waller and Bowman dissent, it would be the first time since 1993 that two governors voted against a policy decision. While notable, some Fed watchers say it’s normal to have disagreement among officials when policy is nearing a turning point.

Powell is likely to face questions about his reading of the latest inflation data. The Fed chief and other officials have expressed cautiousness about lowering rates until they better understand the impact of tariffs on prices. Trump’s Aug. 1 deadline for trade deals could provide some additional clarity on where the average tariff rate will settle, and by extension, the economic outlook.

Waller has said he expects tariffs to lead to a one-time price bump, while other officials are worried the hit to inflation could prove more persistent.

Prices of some goods have risen, but many economists are puzzled as to why the effects haven’t been more pronounced. The impact may be delayed by businesses front-loading imports of inventories, absorbing the blow through lower profit margins and, at least for now, sharing some of the burden of tariffs with others across the supply chain, said Gregory Daco, chief economist for EY-Parthenon.

There’s no shortage of additional topics that could come up in the press conference, including the Fed’s renovation project, and the tour given to Trump and other Republicans last week. Powell may be peppered with questions about whether political pressure is affecting officials’ ability to make policy decisions.

Powell may also be asked to respond to a proposal from Treasury Secretary Scott Bessent that the central bank conduct a review of non-monetary policy functions to address what he called “mission creep.”

“An internal review would be a good start,” Bessent said in a Bloomberg TV interview on July 23. “And if the internal review didn’t look like it was serious, then maybe there could be an external review.”

Key Takeaways:

The U.S. SEC has approved in-kind redemptions for Bitcoin and Ethereum ETFs, allowing investors to redeem shares directly for BTC and ETH, aligning crypto ETFs with traditional commodities.This decision enhances efficiency and reduces costs for investors and issuers, potentially leading to future ETF expansions and increased market participation in the crypto sector.

SEC's approval of in-kind redemptions for Bitcoin and Ethereum ETFs marks a significant shift. Previously, crypto ETFs required cash redemptions, necessitating asset liquidation. In-kind options align these ETFs with longstanding commodity models like gold, streamlining processes and costs. The key players include SEC Chairman Paul S. Atkins and Director Jamie Selway. Both emphasize how the rule enhances operational flexibility and efficiency. This decision is anticipated to set a precedent for potential altcoin ETF models.

The immediate market impact includes reduced fees and better liquidity for Bitcoin and Ethereum ETFs. Such changes make these products more appealing to both institutional and retail investors. Analysts predict that market dynamics will shift favorably due to this. From a financial standpoint, the move enables direct settlements, increasing transactional efficiency. Bloomberg analysts foresee this approval paving the way for broader adoption of in-kind redemption models in cryptocurrency ETFs.

President Donald Trump’s flurry of trade deal announcements are so far proving light on detail — with key aspects still under negotiation, partners giving mixed signals about what they signed up for, and big numbers shrinking under scrutiny.

Trump touted landmark agreements with Japan and the European Union in the past week, adding to pacts with a handful of smaller economies. An extension of the US-China tariff truce is also in the works. The administration is taking a victory lap, claiming vindication for Trump’s bargaining style as he prepares a raft of import-tax hikes before an Aug. 1 deadline.

“I think the trade deals are working out very well — hopefully for everybody, but for the United States they’re very, very good,” the president said Tuesday while flying home to Washington from Scotland.

Yet while the scale of America’s tariff wall is becoming clearer, other details remain fuzzy in the extreme – especially investment promised by counterparties, which on paper exceeds $1 trillion for the EU and Japan deals alone.

For Trump, these capital pledges are evidence that his protectionist agenda is on course to do what he promised it would: revive American manufacturing and create jobs. If actual investment falls short of the big numbers, tariffs could end up boosting revenue for the government – and costs for US consumers and companies – while failing to achieve those loftier goals.

Trump’s deal with Japan includes a $550 billion fund that the US called a “foreign investment commitment,” and the president said amounts to “a sort of signing bonus.”

But Japanese officials said only 1% or 2% of the total – a maximum $11 billion — would be investment, with the rest essentially made up of loans. And they said the 90%-10% profit split in America’s favor highlighted by Trump’s team only applies to that smaller investment portion.

At minimum, the two countries are describing the accord differently, raising the potential for future snags.

“It’s not that $550 billion in cash will be sent to the US,” Japan’s top trade negotiator Ryosei Akazawa said. But Commerce Secretary Howard Lutnick put it this way, speaking last week to Fox News: “This is literally the Japanese government giving Donald Trump $550 billion.”

Lutnick said Trump would increase tariffs again if Japan reneged on the fund. As for the EU deal, he acknowledged on Tuesday that there’s “plenty of horse-trading left to do.”

The EU pledged $600 billion in new investments. European officials say the target is just an aggregate of promises by companies, and the bloc can’t commit to a binding target. Neither side has spelled out the contents.

“Basically they’re going to build the factories,” Lutnick told Fox News Monday. “All the car companies committed they’re going to build the factories. The pharmaceutical companies have gone out and said they’re going to build these factories.”

The EU also promised energy purchases from the US worth $750 billion over the next three years — roughly triple the current pace. That target could strain the capacity of American exporters as well as European importers, some analysts say.

Aside from the tariff rates, much of the recent deals consist of “vague promises with large numbers attached that don’t have any mechanisms for follow-through,” said Alex Jacquez, who served on the Biden administration’s National Economic Council. “Nobody seems to believe that these checks as written are actually going to cash.”

There’s more clarity around the tariff numbers, though they’re still in flux too.

Trump will raise duties on most imports from Japan and the EU to 15% from the current 10%. Those partners will get a partial waiver on certain industry-specific US tariffs that carry higher rates worldwide – like for automobiles – but not on others like steel and aluminum, where talks on an exemption involving quotas continue.

The revised auto tariffs on Japan and the EU are not yet finalized but are expected to take effect on Aug. 1, according to a White House official.

Trump says there are more of these sectoral tariffs to come, and some of his recent deals may cause confusion by preempting yet-to-be-announced numbers.

For instance, he pledged 15% tariffs for the EU on semiconductors and pharmaceuticals — two sectors where rates haven’t been finalized. A senior US official also said that Trump agreed to grant Japan whatever the lowest rate is for those two categories, but that commitment isn’t in the public US fact sheet.

A White House official said that the lower 15% rates for pharmaceuticals and chips would only kick-in once higher levies Trump has threatened under Section 232 of the Trade Expansion Act take effect.

Other already-announced deals have raised questions too – like the one with Vietnam earlier this month, which appears to have surprised officials in Hanoi with a tariff of 20%, higher than they were said to have agreed to.

US and Chinese negotiators, after two days of talks in Sweden this week, said they’re on track to extend the tariff truce between the two countries. A wildcard there is Trump’s threat to impose new charges on countries that buy energy from Russia.

China is the biggest buyer of Russian oil — followed by India, which is still embroiled in talks with the US.

The fate of the two biggest US trade partners also seems to be headed down to the wire. Trump has downplayed the chance of a deal with Canada, though Canadian Prime Minister Mark Carney shrugged that off. Both Canada and Mexico face tariff hikes this week, but they won’t apply across the board. Goods compliant with the USMCA trade pact are poised to maintain their current exemption, a major relief for both countries.

Some critics say the administration’s deal-by-deal approach to tariff rates risks ending up as a patchwork that lacks coherence. US auto companies, for example, objected to the Japan agreement, saying imported cars that don’t have any US content are set to be taxed less than North American-built models that do.

For all the unresolved questions, the administration is casting Aug. 1 as something of a milestone in setting rates after months of threats. It’s just not likely to be the final word in Trump’s rolling dealmaking.

Several more pacts are very close, and tariff rates will either be agreed or imposed by Aug. 1, Kevin Hassett – head of the White House National Economic Council – said on Tuesday. But even after that, “people can continue to negotiate,” he said. “The president is always willing to negotiate.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up