Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

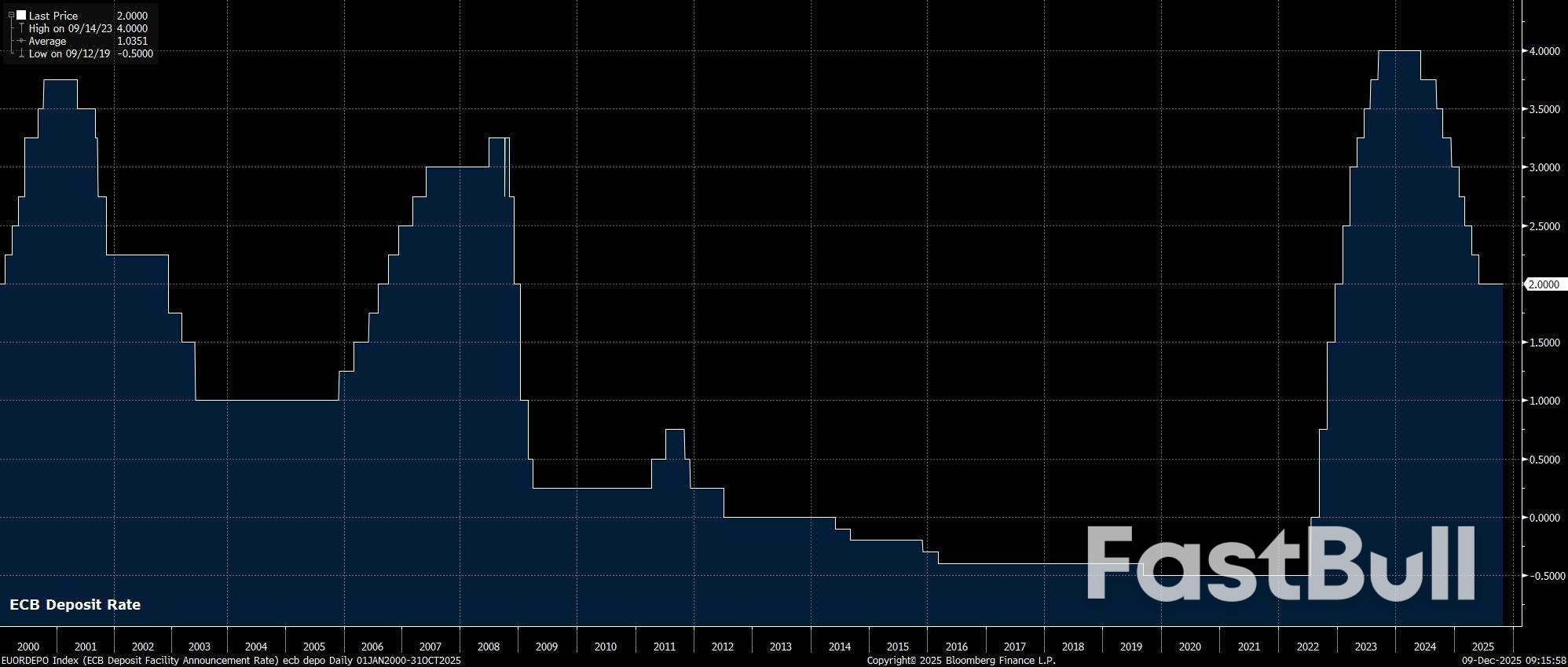

Rates On Hold: The ECB should maintain all policy settings at the December meeting, holding the deposit rate steady at 2.00%; Forecasts In Focus: December's staff macroeconomic projections will be they key area of focus, particularly whether an inflation undershoot is foreseen for 2028; Easing Cycle Over: The upcoming meet should do nothing to dispel the idea that the easing cycle is done & dusted, though policy tightening remains some considerable way off.

After what most market participants would describe as an incredibly dull October confab, the ECB's Governing Council aren't especially likely to deliver much more by way of excitement this time around, with policymakers still in a 'good place', and being set to round out the year by standing pat on all policy instruments.

As alluded to above, the ECB's Governing Council are set to stand pat at the conclusion of the December policy meeting, maintaining the deposit rate at 2.00%. Such a decision to stand pat comes not only as the EUR OIS curve discounts next-to-no chance of any further easing, but also amid little indication from any GC members that they presently see a desire to reduce rates further. All signs point to the easing cycle having now come to an end, and 2.00% being this cycle's terminal rate.

That said, the swaps curve has got rather excitable of late, now discounting around a 1-in-5 chance that the ECB will deliver a 25bp hike by the end of next year, spurred on by hawkish comments from Exec. Board member Schnabel in recent days. That pricing does appear rather over-ambitious at this juncture, given the likelihood of a relatively sustained inflation undershoot, hence participants will be watching for any explicit pushback on the idea that policy will be tightened within the next 12 months.

With the GC set to hold all policy settings steady, focus will naturally fall on whether policymakers decide to make any guidance tweaks.

The chances of said tweaks, however, range between 'incredibly slim' and 'none at all', with the accompanying policy statement set to simply reiterate the commentary that has been used for many months, and is now incredibly familiar to all participants. Consequently, the statement will repeat that policymakers will continue to adopt a 'data-dependent' and 'meeting-by-meeting' approach to upcoming decisions, while also making no 'pre-commitment' to a particular policy path.

Perhaps the most interesting area of the December confab will be the updated round of staff macroeconomic projections, particularly the first read on how the projections see the eurozone economy evolving into 2028.

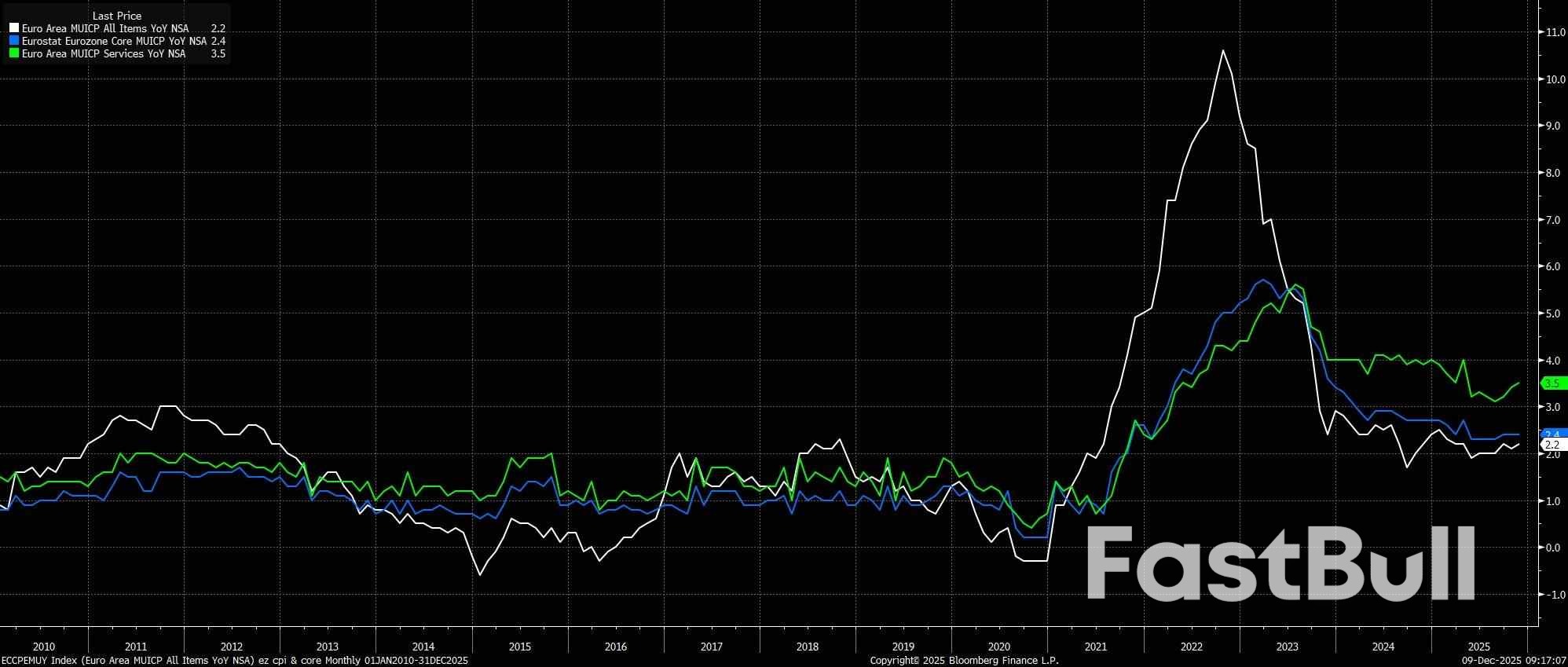

On inflation, the projections are again likely to point to headline CPI undershooting the 2% target both next year, and in 2027. While services inflation has started to bubble away once more in recent months, the beginning of 2026 will see a significant energy-induced base effect impact the data, dragging headline price metrics (much) lower in the first half of the year.

The two key areas of focus for the upcoming inflation projections will be, firstly, whether headline inflation is set to have risen back to 2% by the end of the horizon, in 2028. Secondly, if another undershoot is pencilled in for that year, the question becomes one of whether the Governing Council's doves view that as reason enough to begin pushing for further policy easing, in the early months of next year.

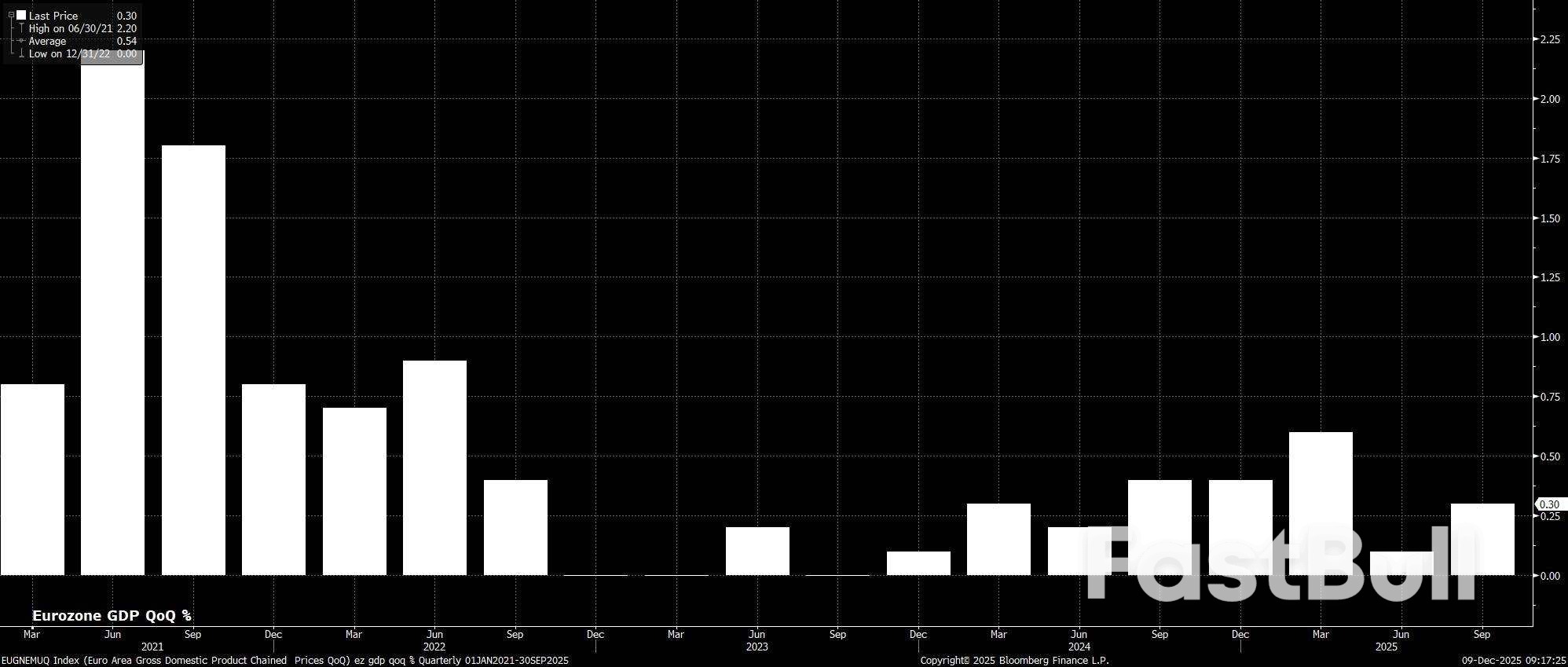

Meanwhile, on growth, there are likely to be relatively little by way of significant changes to the forecast GDP growth path, not least considering that many of the headwinds which have buffeted the eurozone economy in 2025 will increasingly turn to tailwinds as we move into the new year. Said tailwinds are relatively numerous, including increased certainty in terms of global trading relationships (especially with the US), as well as the lagged effects of ECB policy easing, plus a broadly looser fiscal stance next year.

Of course, said fiscal stance will not be entirely equal across the bloc. The vast majority of any fiscal boost next year will come from Germany, where not only is a significant increase on defence and infrastructure spending on the cards, but also a considerable number of tax changes which should provide a boost to personal consumption. That, in turn, at an aggregate level, is likely to offset the impact of further fiscal consolidation in both France, and Italy, which should result in the overall GDP growth forecast remaining broadly unchanged, seeing the eurozone work its way back towards potential growth in 2027 and 2028.

Turning to the post-meeting press conference, it seems highly unlikely that President Lagarde will seek to 'rock the boat' to any significant degree, thus raising the prospect of another turgid and dull affair, in keeping with the remarks delivered last time out, in October.

As a result, it is highly likely that Lagarde will simply reiterate the remarks that she made last time out, namely that policy is still in a 'good place', and that the ECB will ensure policy remains in such a place, while likely also confirming that the December decision to stand pat was a unanimous one.

As always, in addition to the presser, any post-meeting 'sources' stories will also be closely watched, particularly in determining how much weight, if any, policymakers are placing on the 2028 inflation forecasts.

On the whole, the December ECB confab is unlikely to be one that goes down as a game-changer in terms of the broader policy outlook.

While the GC's doves may seek to argue for another rate reduction early next-year, it remains likely that an overwhelming majority of policymakers see little-to-no need to shift to a more accommodative policy stance. Barring a material deterioration in economic growth, policymakers are likely to be relatively comfortable tolerating a modest inflation under-shoot, continuing to place more weight on 'hard' data, as opposed to staff projections.

As such, the base case remains that the ECB's easing cycle has now come to an end, and that the next rate move will indeed be a hike. Such a hike, however, is near-certain not to come next year, with the deposit rate set to remain at 2.00% through the end of 2026, and the matter of policy tightening one that will, eventually, be addressed in 2027.

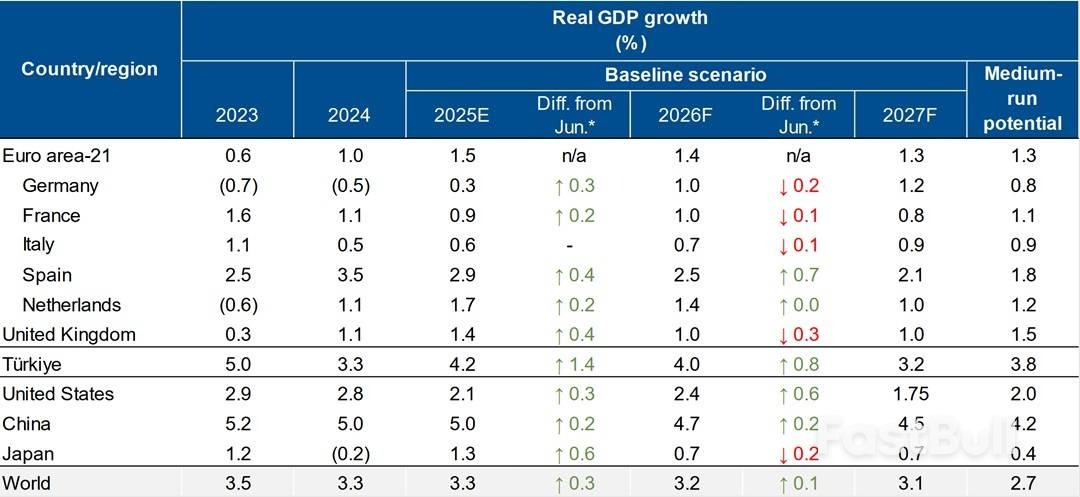

Scope Ratings (Scope) has slightly revised up its global growth estimate for 2025 since June forecasting. The agency now sees global growth of 3.3% for this year before a resilient 3.2% next year (Table 1).

Euro area-21 growth expectations remain moderate: 1.4% next year after the 1.5% this year.

A pick-up is foreseen in the German economy (to 1.0% growth next year) alongside moderate growth in France (1.0%) and Italy (0.7%).

The European economy nevertheless continues to be buoyed by strong recovery across much of the periphery. Ireland is forecast for 3.0% growth next year, with Spain at 2.5%, Portugal (2.1%) and Greece (2.0%). Growth in parts of central and eastern Europe bolsters the regional economy, including growth of 3.2% in 2026 in Bulgaria after euro accession. Meanwhile, the UK economy may grow a moderate 1.0% next year.

Scope has revised US growth up to around 2% for this year before the US economy grows an above-potential 2.4% next year. The rating agency projects growth of 4.7% for next year in China after the economy achieves its 5% growth target for this year, supported by the recent temporary easing in US-China trading tensions.

*Changes compared with June 2025's Global Economic Outlook. Negative growth rates presented in parentheses. Source: Scope Ratings forecasts, regional and national statistical offices, IMF.

*Changes compared with June 2025's Global Economic Outlook. Negative growth rates presented in parentheses. Source: Scope Ratings forecasts, regional and national statistical offices, IMF.Nevertheless, the balance of medium-run risks for the global economic and credit outlook remains tilted to the downside. Four factors are relevant here:

Recent US policy has had significant effects on the global economy. Pro-cyclical tax cuts, rate reductions and deregulation may present near-term support for the US and global economy, but at the cost of raising longer-run economic imbalances.

The unwinding of post-war alliances and the war in Ukraine have prompted greater European defence expenditure and increased associated risks for sovereign debt sustainability while amplifying the chance of greater geopolitical fragility. The US decisions to halt foreign aid and review its participation in international financial institutions have raised concerns for developing economies. A reversal of climate commitments exacerbates natural-disaster risks for vulnerable countries.

Elevated borrowing rates and financial deregulation undermine longer-run financial resilience. Scope sees higher steady-state borrowing rates lasting for longer. This is although many central banks continue easing policy, while institutions such as the ECB are on hold and the Bank of Japan gradually tightens. Sustained higher borrowing rates interact adversely with elevated market valuations and financial deregulation.

Sector Outlooks across the rating franchises entering 2026 range from negative for the sovereign asset class, to balanced for financial institutions, to modestly positive for sub-sectors of structured finance.

Webinar: Register here to engage with Dennis Shen, Chair of Scope Ratings' Macroeconomic Council, on Thursday, 15 January 2026 (3 pm CET) as he outlines the principal factors behind the agency's outlook of growing risks facing the resilient global economy.

The RBA kept the cash rate on hold as expected. The Board was slightly more hawkish but Governor Bullock was firmly focused on the upside risks to inflation. We are less convinced that capacity constraints will be an issue for inflation, which could bring back the debate for rate cuts.

Today's decision by the RBA to leave the cash rate unchanged at 3.6% was widely anticipated by the market and economists. It was a unanimous decision. The statement struck a slightly more hawkish note but in the following media conference, Governor Bullock indicated that the Board was focused on the upside risks to inflation.

She confirmed that at today's meeting "a rate cut was not on the table", adding that supply and demand conditions are a little tight. The potential necessary conditions for a rate hike in 2026 were also discussed as the Board believe the balance of risks for inflation have tilted to the upside.

While the Board acknowledged that some of the recent increase in underlying inflation was due to temporary factors, they still saw some signs of a broader pick-up. They also remain concerned over labour market tightness and strong growth in broader measures of wages and high unit labour costs.

They will continue to monitor these factors against a backdrop of what they believe to be a stronger pick up in private demand that could lead to capacity pressures.

But as our Chief Economist Luci Ellis recently noted in "Swing up, you won't hit a wall", the view that stronger private demand will quickly collide with supply constraints is misplaced. Indeed, we think the RBA and some other economists' projection of trend growth of 2% is too conservative. We see 2¼% or higher as realistic given population, participation, and potential productivity gains.

There is no denying that overall productivity has been very weak. But as we have previously highlighted, this in part reflects the rapid increase in the share of the care economy over recent years, which is very labour intensive and mechanically less productive than the market sector. But as private demand and the market sector become an increasing driver of economic growth, this will support an improvement in headline productivity measures. This is not just a shift in the composition of the economy. The recovery in business investment, as seen in the Q3 National Accounts, and the solid lift in private business capex intentions will see the share of business investment lift from its historical lows. With more capital per worker, we will see stronger productivity. Then there is the technological innovation and adoption, including an eventual lift from AI.

It is also worth noting that the economy is not booming. Real disposable income per person has only just returned to 2020 levels, the stimulatory impact of Stage 3 tax cuts are rolling off and with rates on hold for longer, the boost from earlier rate cuts will also fade.

Overall, we do not expect the economy to hit a hard capacity wall any time soon. If this view proves correct, the economy can grow faster without triggering further inflation, reducing the need for slightly restrictive policy.

Indeed, we expect core inflation to ease back toward, and eventually below, the mid-point of the target band by the end of 2026. Much of the recent increase reflects higher administrative prices, seasonal volatility and the removal of cost-of-living assistance. These are unlikely to be repeated to the same extent. Further out, as productivity improves and wage inflation moderates this will also support lower core inflation.

As such, our current baseline is for two more 25bp rate cuts but not until mid-2026. This would bring the policy rate to 3.1% – 125bp below its peak this monetary cycle.

Still, following Governor Bullock's comments in today's press conference, the probability of a rate hike has risen. This would be dependent on persistence of the current reacceleration in inflation. Instead, we see the risks as being more tilted to a prolonged pause. The evolution of the data over the coming months will see the RBA reassess the sustainability of inflation moving back to target and the restrictiveness of current policy settings.

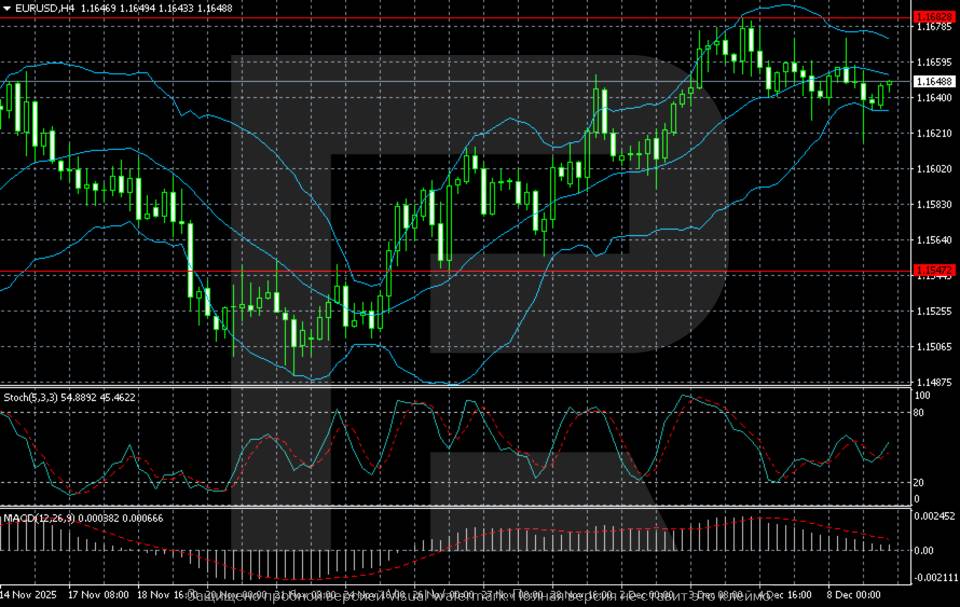

The EURUSD pair has risen to 1.1648. All eyes are on the Federal Reserve's December meeting.

The EURUSD rate is edging higher on Tuesday, reaching 1.1648. However, overall, the major currency pair continues to move sideways ahead of the two-day Federal Reserve meeting, where the market is nearly unanimous in expecting a rate cut.

The likelihood of a 25-basis-point rate reduction on Wednesday is estimated at about 87%, up from around 67% a month ago. Still, the outlook for 2026 remains uncertain. A hawkish cut is possible, in which Jerome Powell signals caution regarding further easing steps.

Investors are also awaiting key US macroeconomic releases. Today, the postponed JOLTS job openings report for October will be published, followed by initial jobless claims and the trade balance later in the week.

On the H4 chart, the EURUSD pair maintains a moderately bullish trajectory, but upward momentum has noticeably weakened. The price is consolidating below the 1.1682 resistance level, which has repeatedly capped attempts at growth. Quotes are currently moving along the middle Bollinger Band, indicating the absence of a strong trend. The upper band is slightly turning downwards, reflecting lower volatility.

The Stochastic Oscillator is in the mid-range around 45, giving no clear signals. The market is out of oversold territory but lacks a confident bullish trigger. MACD remains positive, yet its histogram is declining, underscoring weakening bullish momentum and a likely phase of sideways consolidation.

The nearest support level is located at 1.1547 – the level from which the previous strong recovery began. The resistance stands at 1.1682. A breakout above this level would open the path towards 1.1750. As long as the pair trades between these boundaries, the baseline scenario is consolidation within the range with a mild upward tilt.

The EURUSD pair is rising slightly, but very cautiously. The EURUSD forecast for today, 9 December 2025, suggests a mild upward move towards 1.1682.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold's recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

British American Tobacco on Tuesday reaffirmed its 2026 growth targets but said performance will likely come in at the lower end of its 3% to 5% revenue growth range, as the London-based tobacco company navigates a transition to nicotine alternatives amid regional headwinds.

The company expects approximately 2% revenue and adjusted profit growth for fiscal year 2025, with New Category products, encompassing heated tobacco, vapor and nicotine pouches, accelerating to double-digit growth in the second half.

Chief executive Tadeu Marroco said the company remains "focused on establishing glo Hilo as a premium offering in the largest Heated Products profit pools" with launches in Japan in September and Poland in October, with additional rollouts planned for 2026.

BAT's U.S. operations showed the strongest momentum, with value share rising 20 basis points while volume share remained flat.

The company's Velo Plus nicotine pouch drove Modern Oral volume share up 920 basis points in the U.S. market, where BAT said it is on track for full-year profitability in its New Category business.

The Velo brand achieved 15.9% volume share of Total Oral products and 31.8% of Modern Oral products globally, representing increases of 460 basis points and 590 basis points respectively.

BAT's Vuse vapor brand, which maintained global leadership in tracked channels with value share in top markets up 10 basis points, showed improved second-half performance despite ongoing challenges from illicit products.

The company expects full-year Vuse revenue to decline in the high-single digits, compared to a 13% drop in the first half.

Regional performance varied significantly. The Americas excluding the U.S., led by Brazil, Turkey and Mexico, delivered strong results. However, the Asia-Pacific, Middle East and Africa region faced material fiscal and regulatory headwinds in Bangladesh and Pakistan that will impact adjusted profit growth.

The company's glo heated tobacco product line saw volume share in top markets decline 1.2 percentage points, impacted by competition in Japan.

BAT's Americas excluding U.S. volume share for glo declined 60 basis points as the company made resource allocation decisions ahead of the glo Hilo rollout.

Globally, BAT's group value share in top cigarette markets remained flat while volume share declined 10 basis points. The company projects global tobacco industry volume will decline approximately 2% for 2025.

BAT announced £1.3 billion in share buybacks for fiscal year 2026, up from £1.1 billion in 2025. The company expects operating cash flow conversion to exceed 95% in 2025, with gross capital expenditure of approximately £1.2 billion.

For fiscal year 2025, BAT projects mid-single digit New Category revenue growth at constant rates, with approximately 2% adjusted profit from operations growth at constant rates.

The company anticipates a roughly 3% translational foreign exchange headwind on adjusted profit from operations and approximately 4% on adjusted earnings per share. Net finance costs are projected at approximately £1.8 billion.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up