Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

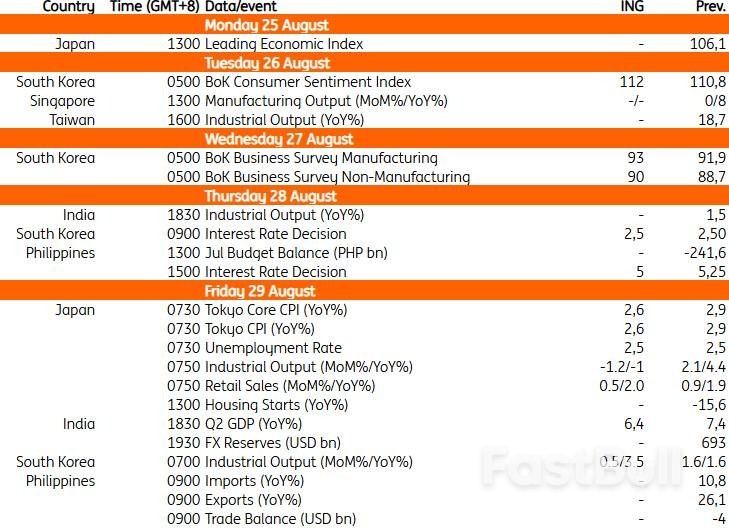

The Bank of Korea's meeting on Thursday will be a highlight of the week. The market widely expects no action, but it will pay close attention to the latest quarterly macro outlook report.

The Bank of Korea's meeting on Thursday will be a highlight of the week. The market widely expects no action, but it will pay close attention to the latest quarterly macro outlook report. With inflation anchored at 2% and growth projected to pick up in the second half of 2025, financial stability remains the priority. The BoK will probably wait for clearer signs of moderation in house prices before taking action. It may raise its 2025 GDP forecast from 0.8% year-on-year to 1.0%, and its 2026 GDP forecast from 1.6% to 1.7%. GDP in the second quarter was stronger than expected. On top of that, consumption is likely to soar in the third quarter, largely due to government cash payout programmes. This will be reflected in next week's consumer sentiment survey and retail sales, which should improve compared to the previous month. However, the fiscal outlook could be a drag unless more expansionary policies are implemented. Also, sluggish construction investment should weigh on overall growth. The BoK will remain cautious amid tariff-related uncertainty, even as the US–Korea trade deal should be welcomed by the central bank. The inflation outlook is expected to be revised up to 2.0% for 2025 (vs a 1.9% May outlook), with the 2026 outlook unchanged at 1.8%. A below-2% rate paves the way for further easing. Even if the BoK revises the growth outlook upwards, it would still be below potential GDP. With the negative output gap expected to persist, the BoK should ease monetary conditions -- most likely in October.

We continue to expect Bangko Sentral ng Pilipinas (BSP) to cut rates by 25bp to 5%. We don't believe that the relative strength in growth data will deter the central bank from cutting rates in August as CPI inflation remains firmly below the inflation target. While CPI readings should accelerate from here, contained domestic rice prices and a reversal in oil should keep inflation subdued. Additionally, recent comments by the BSP suggest more active steps to intervene in FX markets to contain currency volatility. This should keep imported inflation contained.

Tokyo's inflation data is widely anticipated, with headline prices set to slow to 2.6% year-on-year in August from 2.9% in July. This decline is mainly due to falling energy prices, while fresh food prices continue to rise. Core inflation, excluding fresh food and energy, is expected to remain above 3%, which would bolster the Bank of Japan’s confidence that underlying prices are approaching 2%. Meanwhile, industrial production is expected to decline by 1.2% month-on-month seasonally adjusted in July, partially offsetting the previous month's 2.1% gain. The temporary increase in output related to tariff-related front-loading might normalise in July. However, retail sales are expected to rise, supported by solid wage growth. The unemployment rate is expected to remain at 2.5%, signalling tight labour market conditions which will eventually lead to more sustainable wage growth.

We expect second-quarter Indian GDP growth to ease to 6.4% YoY, below market expectations. High-frequency indicators point to a moderation in both private consumption and investment. Additionally, higher-than-expected tariffs and rising uncertainty around India's trade policy with the US are emerging as downside risks to the 2025 growth outlook.

Industrial profits data for July, out on Wednesday, is likely to show continued downward pressure. Moving forward, “anti-involution” measures to combat deflationary price wars will be important in tackling the high proportion of loss-making enterprises and excess industrial capacity. But given the negative externalities of such a policy drive, this will likely be a very gradual process. Profits could remain under pressure this year.

Key events in Asia next week

The U.S. session was shaped by anticipation of Fed policy signals, softer labor market data, retail sector disappointments, and rising volatility impacting tech, retail equities, oil prices, and the dollar most noticeably. President Donald Trump renewed criticism of Powell and pressured another Fed governor, Lisa Cook, for alleged mortgage improprieties, raising uncertainty over Fed governance and policy direction.

Friday, August 22, 2025, is a critical day for Asian traders due to anticipated signals from U.S. Fed Chair Powell at the Jackson Hole Symposium, fresh inflation and retail data from Japan, Singapore, India, the UK, and Canada, and continued shifts in global risk sentiment and legislative headlines. Stay alert for volatility in USD, GBP, CAD, JPY, and SGD crosses, as well as for news impacting Asian tech and energy stocks. Emissions data show a 1% YoY decline in CO2 for the first half of 2025, signaling ongoing energy transitions that may affect commodity demand and regional market sentiment.

The US Dollar faces downside pressure ahead of Powell’s pivotal Jackson Hole speech, with volatility expected to spike as traders respond to Fed policy signals regarding interest rates. Markets are highly sensitive to Powell’s tone at Jackson Hole. If he signals dovishness (rate cut likely), expect further USD declines and rallies in risk assets. Hawkishness (holding rates) could provide brief USD support.Central Bank Notes:

Next 24 Hours Bias

Medium Bearish

Gold remains moderately bullish on August 22, 2025, supported by central bank expectations and risk-off sentiment. Watch for breakouts above $3,439–$3,575 for further rallies, while a drop below $3,225 signals deeper corrections. Domestic markets (e.g., India) have shown resilience, recovering recent losses and sustaining strong demand amid ongoing global volatility. The gold market reacted last week to softer US inflation data, increased odds of Fed rate cuts in September, and persistent geopolitical uncertainties, fueling demand for gold as a safe-haven asset.Next 24 Hours Bias

Medium Bullish

The Australian Dollar is under pressure as of August 22, 2025, with slight prospects for a technical rebound that remain dependent on key resistance levels and unfolding global economic events. Solid domestic data is being overshadowed by external factors, particularly US Dollar strength and upcoming Fed decisions.The Australian Dollar remains influenced by US monetary policy signals, including possible Fed rate moves. Persistent US Dollar strength and market jitters related to geopolitics and Federal Reserve independence are contributing to volatility for the AUD. Australia’s central bank, meanwhile, maintains a steady policy rate, citing resilience in demand and the labor market.Central Bank Notes:

Weak Bearish

NZD is under significant pressure due to the central bank’s dovish pivot, with further declines anticipated unless global sentiment shifts or economic data surprises. The NZD has sunk to its lowest levels since April 2025, primarily caused by the Reserve Bank of New Zealand (RBNZ) announcing a 25 basis point rate cut to 3.00%. The RBNZ further signaled more rate cuts ahead, targeting a trough near 2.5% by year-end. Markets are pricing in additional easing, pushing the NZD/USD down 1.2% and reaching multi-month lows versus both the US dollar and Australian dollar.

Central Bank Notes:

● The next meeting is on 22 October 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese yen is showing mixed trends with short-term bearish technicals, but expectations for BOJ rate hikes in the coming months and external factors could drive future volatility. According to a Reuters poll, nearly two-thirds of economists expect the Bank of Japan (BOJ) to raise its key interest rate by at least 25 basis points in Q4 2025, possibly in October. Most economists do not expect any changes at the mid-September policy meeting, but a sizable majority foresee increased borrowing costs next quarter.

Central Bank Notes:

Next 24 Hours BiasWeak Bullish

Oil prices on August 22, 2025, show stabilization after volatile movements, with a mild upward trend driven by bullish inventory news and hopes for a Fed rate cut. However, technical signals caution for further bearish pressure amid ongoing geopolitical uncertainty and evolving supply dynamics. The latest U.S. Energy Information Administration (EIA) report showed a larger-than-expected draw of 6 million barrels in crude inventories, with gasoline stocks falling 2.7 million barrels. This signals tightening supplies and resilient demand, supporting bullish sentiment.Next 24 Hours Bias

Medium Bullish

Nvidia has asked some of its component suppliers to stop production related to its made-for-China H20 general processing units, as Beijing cracks down on the American chip darling, The Information reported Friday.The directive comes weeks after the Chinese government told local tech companies to stop buying the chips due to alleged security concerns, the report said, citing people with knowledge of the matter.

Nvidia reportedly as asked Arizona-based Amkor Technology, which handles the advanced packaging of Nvidia's H20 chips, and South Korea's Samsung Electronics, which supplies memory for them to halt production. Samsung and Amkor did not immediately respond to CNBC's request for comment.A separate report from Reuters, citing sources, said that Nvidia had asked Foxconn to suspend work related to the H20s. Foxconn did not immediately respond to a request for comment.In response to an inquiry from CNBC, an Nvidia spokesperson said "We constantly manage our supply chain to address market conditions."

The news further throws the return of the H20s to the China market in doubt, after Washington said it would issue export licenses, allowing the chip's exports to China — whose shipment had effectively been banned in April.Last month, the Cyberspace Administration of China had summoned Nvidia regarding national security concerns with the H20s and had asked the company to provide information on the chips.

Beijing has raised concerns that the chips could be have certain tracking technology or "backdoors," allowing them to be operated remotely. U.S. lawmakers have proposed legislation that would require AI chips under export regulations to be equipped with location-tracking systems to avoid their illegal shipments.Speaking to reporters in Taiwan on Friday, Nvidia CEO Jensen Huang acknowledged that China had asked questions about security "backdoors," and that the company had made it clear they do not exist.

"Hopefully the response that we've given to the Chinese government will be sufficient. We're in discussions with them," he said, adding that Nvidia had been "surprised" by the queries."As you know, [Beijing] requested and urged us to secure licenses for the H20s, for some time and I've worked quite hard to help them secure the licenses, and so hopefully this will be resolved," he said.Nvidia in a statement on Friday said "The market can use the H20 with confidence."

It added: "As both governments recognize, the H20 is not a military product or for government infrastructure. China won't rely on American chips for government operations, just like the U.S. government would not rely on chips from China. However, allowing U.S. chips for beneficial commercial business use is good for everyone."

Last month, Nvidia had reportedly sent notices to major tech companies and AI developers urging them against the use of the H20s, in what first had appeared as a soft mandate. The Information later reported that Beijing had told some firms, including ByteDance, Alibaba and Tencent, to halt orders of the chips altogether, until the completion of a national security review.It had been seen as a major win for Nvidia when Huang announced last month that the U.S. government would allow sales of the company's H20 chips to China.

However, the national security scrutiny the H20s are now facing from the Chinese side, highlights the difficulties of navigating Nvidia's business through increasing tensions and shifting trade policy between Washington and Beijing.Chip industry analysts have also said Beijing's actions appear to reinforce its commitment to its own chip self-sufficiency campaigns and its intention to resist the Trump administration's plan to keep American AI hardware dominant in China.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up