Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump announces preparations for "Putin-Zelenskyy Meeting," venue for trilateral summit undetermined; Zelenskyy says Ukraine no longer insists on a ceasefire as prerequisite......

Ukrainian President Volodymyr Zelenskiy said on Tuesday after his meeting with U.S. President Donald Trump and European leaders that security guarantees for Kyiv will likely be worked out within 10 days.

"Security guarantees will probably be 'unpacked' by our partners, and more and more details will emerge. All of this will somehow be formalised on paper within the next week to 10 days," Zelenskiy said at broadcast press briefing after his meetings.

Trump told Zelenskiy on Monday that the United States would help guarantee Ukraine's security in any deal to end Russia's war there, though the extent of any assistance was not immediately clear.

"It is important that the United States is sending a clear signal that it will be among the countries helping to coordinate and will also be a participant in the security guarantees for Ukraine," Zelenskiy said. "I believe this is a major step forward."

Although a peace deal appeared far from imminent after the meetings in Washington, Zelenskiy said his Monday meeting with Trump was his "best" so far.

He also said Ukraine was ready to meet with Russia in "any format" and that territorial issues would be discussed on a bilateral level with Russian President Vladimir Putin - but no dates for a possible meeting with Moscow have been scheduled yet.

"The question of territories is something we will leave between me and Putin," Zelenskiy said.

He added that a part of security guarantees for Ukraine is a package of U.S. weapons "which primarily includes aircraft, air defence systems," among others.

"There indeed is a package with our proposals worth $90 billion," Zelenskiy said.

"And we have agreements with the U.S. president that when our export opens, they will buy Ukrainian drones. This is important for us."

SoftBank Group Corp. agreed to buy $2 billion of Intel Corp. stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions.The Japanese company, which is adding Intel to an investment portfolio that includes AI linchpins Nvidia Corp. and Taiwan Semiconductor Manufacturing Co., will pay $23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which will issue new stock to SoftBank, surged more than 5% in after-hours trading. Shares of SoftBank fell as much as 5% Tuesday in Tokyo.

SoftBank, which owns Arm Holdings Plc, has for decades tried to become a central player in AI. Those ambitions sharpened this year with the announcement of Stargate, a $500 billion endeavor with OpenAI, Oracle Corp. and Abu Dhabi fund MGX to build essential data centers in the US. Prior to that, founder Masayoshi Son dreamed of competing with Nvidia in chip design through the “Izanagi” project.Its latest move also delivers a strong vote of confidence in a storied US chipmaker that’s struggled to remain relevant in the AI sphere.

Intel aims to prove it can be a technology leader again after falling behind TSMC in contract chipmaking and Nvidia in chip design. CEO Lip-Bu Tan met with US President Donald Trump at the White House last week, helping lay the groundwork for discussions around ways to rescue Intel.

The Santa Clara-based company held talks with the Trump administration about a deal that would potentially turn the US into its biggest backer. Officials have discussed taking a stake of about 10% in the chipmaker, Bloomberg News reported Monday.SoftBank has been expanding its US footprint. That includes a recent deal to buy Foxconn Technology Group’s electric vehicle plant in Ohio — a move that could kickstart Stargate.

In announcing its investment in Intel, SoftBank paid tribute to the chip pioneer’s history.“For more than 50 years, Intel has been a trusted leader in innovation,” Son said in a statement. “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role.”The timing of the announcement could be a boost for the Japanese government as it presses the US to follow through on a pledge to cut tariffs on its cars in exchange for setting up a $550 billion fund for investment into the US.

Intel CEO Tan, a chip industry veteran who took the helm this year, has worked with Son previously and spent years on SoftBank’s board as an independent director before resigning in 2022.“I appreciate the confidence he has placed in Intel with this investment,” Tan said.

Key Points:

On Monday, August 11, the US and China agreed to a second 90-day extension of the trade war truce, averting a full-blown trade war. Since the agreement, the US and China have been largely silent on trade developments. Both sides appear willing to let current tariffs remain, but the potential for an escalation in the trade war lingers.

News broke on Friday, August 15, that Beijing warned companies against stockpiling rare earths, potentially undermining its earlier commitment under the truce agreement. China Beige Book reported:“China is telling companies they cannot go out & build huge inventories in rare earths, or they’ll face shortages… Authorities are deliberately limiting approved export volumes to prevent foreign stockpiling. This will be a leverage point from now on.”Notably, removing restrictions on rare earth exports to the US was part of the trade war truce agreement. While Chinese imports into the US face tariffs averaging 55%, US exports to China are subject to only a 10% levy. US tariffs on Chinese goods are seemingly having a greater impact on China’s economy early in the third quarter.

According to the Kobeissi Letter:

“The number of container ships departing from China to the US over the last 15 days has dropped to its lowest level since May. This is also the lowest reading in 2 years. Shipping volumes have declined by ~40% over the last month. This comes despite the ongoing US-China tariff truce, which was extended for another 90 days on Tuesday. In reality, average US tariff rates on Chinese goods still stand at ~55%, according to Bloomberg. US-China trade is slowing.”

The absence of trade talks and the silence of intentions to improve relations suggest both governments might be waiting to see who blinks first.Chinese economic indicators signaled a deteriorating macroeconomic backdrop in July after a resilient second quarter. Notably, industrial production rose 5.7% year-on-year in July, slowing from June’s 6.8% increase, aligning with July’s Manufacturing PMI trends.

The heavily scrutinized S&P Global China General Manufacturing PMI (formerly the Caixin Manufacturing PMI) dropped below the neutral 50 level to 49.4 in July (June: 50.4) as manufacturing output fell for just the second time since 2023. A fourth monthly contraction in new export orders and a weaker order book affected output across the sector.The effects of weakening external demand on the manufacturing sector are affecting the broader economy. Retail sales increased 3.7% year-on-year in July, down sharply from June’s 4.8% rise, despite Beijing’s efforts to boost domestic consumption.

China’s housing sector woes continue to dent consumer sentiment. Yet, increased competition across the industrial sector is fueling cost pressures, forcing manufacturers to cut staffing levels or reduce wages to bolster profit margins. The net effect could be a further weakening in consumer sentiment and spending, challenging Beijing’s 5% GDP growth target.

Leading economist Hao Hong remarked on consumer sentiment trends and Beijing’s efforts to boost consumption, stating:“There’s no quick fix to boosting household confidence except for a stock market rebound. This is a topic that we economists have been discussing in the closed-door meetings in Beijing.”

On Monday, August 18, Mainland China’s CSI 300 climbed to a 10-month high, while the Shanghai Composite Index struck a 10-year high. Despite reaching new 2025 highs, the CSI 300 and the Shanghai Composite Index continue to trade well below their all-time highs.In contrast, the Nasdaq Composite Index and the S&P 500 reached new record highs in August. US retail sales figures supported Hao Hong’s view on consumer sentiment and stock market trends. US retail sales rose 0.5% month-on-month in July after increasing 0.9% in June, reflecting robust demand.

However, a slowing economy may test demand for Mainland China-listed stocks, potentially leading to a reversal of year-to-date gains. Trade developments could be crucial since lower tariffs on Chinese goods may ease price pressures, bolster the labor market, and boost wages.Natixis Asia Pacific Chief Economist Alicia Garcia Herrero shared her views on China’s economic outlook, stating:“The economy’s outperformance in the first half makes the Chinese government’s 5% GDP growth target, which was set during the Two Sessions back in March, more realistic. More specifically, the third and fourth quarter will need an average GDP growth rate of 4.7%, which we believe is feasible under the current fiscal (and to a lesser extent monetary) stimuli.”

However, Garcia Herrero also warned that the economic momentum from the first half of the year could wane, adding:“Without stronger and more lasting stimulus measures, particularly the ones targeting service consumption, sustaining the momentum from first half will be challenging.”

Garcia Herrero concluded:

“All in all, while the Chinese economy has a greater likelihood of meeting the government’s growth target, there are significant uncertainties down the road. Despite foreseeable headwinds from trade friction and persisting deflation, the government does have more bullets for further stimulus if needed. Therefore, we have revised our forecast of China’s GDP growth to 5% for 2025 and 4.5% for 2026.”

Hang Seng Defies Gravity in 2025 Rally

Despite economic uncertainty, Chinese and Hong Kong equities have posted strong gains in 2025:

While trade developments will continue to dominate market sentiment, sentiment remains hinged to Beijing’s next stimulus measures. A delay, combined with weakening data, could derail the current rally.

US-China trade updates and Beijing’s stimulus plans will continue to influence risk assets in the coming weeks. However, upcoming economic indicators will also require consideration. Next week, July’s industrial profit data and August’s private sector PMI will offer further clues on whether Beijing can weather the tariff headwinds.Ahead of next week’s data, the People’s Bank of China (PBoC) will set the loan prime rates on August 20. Economists expect the PBoC to keep the one-year and five-year LPRs at 3% and 3.5%, respectively.

Air Canada and the union representing 10,000 striking flight attendants will hold discussions on Monday night with a mediator, the union said in a statement.The Canadian Union of Public Employees (CUPE), which represents the flight attendants, had remained on strike even after the Canada Industrial Relations Board declared its action unlawful.Air Canada's unionized flight attendants walked off the job on Saturday after contract talks with the carrier failed, in a move that disrupted travel plans for hundreds of thousands of passengers.

The union is currently in meetings with Air Canada, with the assistance of mediator William Kaplan, in Toronto, CUPE said in a statement on Facebook. The strike is still on, it said.The two sides had not spoken since before the start of the strike.Earlier, the two sides were holding talks. A source said there are discussions being held on whether to hold mediation, but with the condition that the flight attendants return to work.

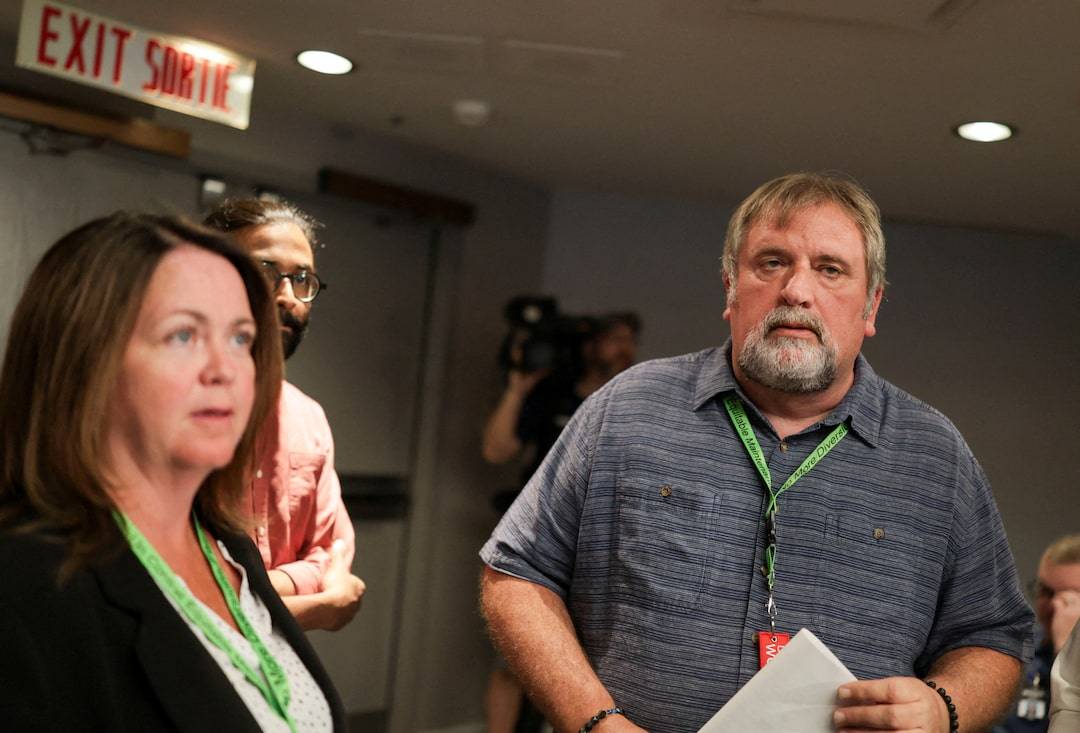

Item 1 of 5 Mark Hancock, National President of the Canadian Union of Public Employees (CUPE) which represents striking Air Canada flight attendants, speaks at a news conference in the hotel media room at Toronto Pearson International Airport in Mississauga, Ontario, Canada, August 18, 2025. Mark Hancock, National President of the Canadian Union of Public Employees (CUPE) which represents striking Air Canada flight attendants, speaks at a news conference in the hotel media room at Toronto Pearson International Airport in Mississauga, Ontario, Canada, August 18, 2025.

Canadian Jobs Minister Patty Hajdu urged both parties to return to the negotiating table and reach a collective agreement for workers as soon as possible.Air Canada CEO Mike Rousseau on Monday defended the airline's offer of a 38% boost in compensation to striking flight attendants but said there was a big gap compared with the union's demand and did not offer a path to return to negotiations.Hours later, jobs minister Hajdu raised pressure on Air Canada, saying she was launching a probe into airline pay and that a negotiated agreement between workers and the company would produce "the best deal."

Hajdu and Rousseau's comments followed the union's refusal of a federal labor board's order to return to work. That refusal has created a three-way standoff between the company, workers and the government, and raised the stakes in a dispute that has disrupted flights for hundreds of thousands of travelers during tourist season.Flight attendants want higher wages and to be paid for time spent boarding passengers and other duties on the ground. They currently are not paid specifically for such work, and Hajdu in her comments on X voiced surprise at what she called allegations of unpaid work at the airline, which for months has been in on-and-off contract talks that prominently included the ground pay demands."I've ordered a probe into the allegation of unpaid work in the airline sector," said Hajdu, who on the weekend kicked off the effort to force binding arbitration that would end the strike, contrary to union wishes.

New Zealand’s population is growing at the slowest pace in almost three years as a sluggish economic recovery deters foreign immigrants and prompts more citizens to depart.

The estimated population grew by 37,400 in the 12 months through June, reaching almost 5.33 million, Statistics New Zealand said Tuesday in Wellington. That’s the weakest expansion since the third quarter of 2022.

Annual net immigration dropped to just 13,700 in the period — the lowest since 2022 — while there were 21,000 more births than deaths, the statistics agency said.

New Zealand’s economy has historically relied on population growth to stoke domestic demand and support growth, because productivity or output per worker is weaker than that of many comparable developed nations. Foreign workers also traditionally fill missing skills gaps across many industries and provide labor for major infrastructure projects.

Immigration has slowed as more New Zealand citizens look overseas for better-paying jobs as cooling economic growth pushes up the unemployment rate and caps wages. Some 71,851 citizens left in the 12 months through June — the most in 13 years.

At the same time, foreign workers are increasingly reluctant to head to New Zealand as job prospects dim. The annual number of non-resident arrivals has fallen by about 45,000 since June last year.

New Zealand’s economy has struggled to sustain a recovery from a deep recession in 2024 even as interest rates fall. The jobless rate has climbed to a five-year high of 5.2% and economists are predicting economic growth stalled in the second quarter.

The Reserve Bank has cut the Official Cash Rate by 225 basis points since August last year and is expected to ease the benchmark further tomorrow.

Australia’s consumer confidence surged in August after the Reserve Bank cut interest rates for the third time this year and signaled further easing is likely.

Sentiment advanced by 5.7% to 98.5 points, a 3-1/2 year high, a Westpac Banking Corp. survey showed Tuesday. While pessimists persist in outweighing optimists, with a dividing line of 100, the gap is narrowing.

It has been 42 months since Australian consumers last registered a sentiment reading above 100 – the second-longest period of continuous pessimism since the survey began in 1974, behind only the early 1990s recession, said Matthew Hassan, Westpac’s head of Australian macro forecasting.

The data suggest “this long run of consumer pessimism may finally be coming to an end,” Hassan said, adding that all components of the index posted gains. “Consumers appear much less anxious about their finances.”

The RBA has lowered borrowing costs by 75 basis points since the start of the year for a cash rate of 3.6%. Governor Michele Bullock last week signaled a “couple more” cuts will be required to achieve the bank’s latest forecasts.

Economists see another rate reduction in November and a final one early next year, taking the terminal rate to 3.1%.

The prospect of further easing “looks to have reinforced consumer expectations that mortgage interest rates are headed lower, giving a broad-based boost to sentiment,” Hassan said. “Consumer attitudes towards major purchases are starting to turn positive.”

In Australia, where consumption accounts for about half of the economy, households’ attitudes toward purchases are closely monitored by policymakers.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up